Neuberger Berman NVIT Socially Responsible Fund

... Investment Strategy from investment’s prospectus The investment seeks long-term growth of capital by investing primarily in securities of companies that meet the fund's financial criteria and social policy. The fund invests primarily in equity securities of mid- to large-cap companies that the subad ...

... Investment Strategy from investment’s prospectus The investment seeks long-term growth of capital by investing primarily in securities of companies that meet the fund's financial criteria and social policy. The fund invests primarily in equity securities of mid- to large-cap companies that the subad ...

Investment Letter: 8th May 2014 A cursory glance at the financial

... spades in 2013 have been less conductive this year. The bits that have hurt have been exposures to concept growth areas: biotechnology and the internet part of technology. High duration equities, where the earnings are parked out in the distance, have underperformed low duration equities (more commo ...

... spades in 2013 have been less conductive this year. The bits that have hurt have been exposures to concept growth areas: biotechnology and the internet part of technology. High duration equities, where the earnings are parked out in the distance, have underperformed low duration equities (more commo ...

Socially Responsible Investing Comes of Age

... Social positioning. Companies that lead with ethical business practice set a standard that can lead to competitive advantage. Fair treatment of employees, the environment, suppliers, customers, and shareholders is rewarded by the market and influences vendors and partners. Just as important, those t ...

... Social positioning. Companies that lead with ethical business practice set a standard that can lead to competitive advantage. Fair treatment of employees, the environment, suppliers, customers, and shareholders is rewarded by the market and influences vendors and partners. Just as important, those t ...

New Fund Manager for Bioventures

... The Bioventures Management team of Heather Sherwin and Paul Miot are pleased to announce new shareholders of the Fund Management Company. This company, whose sole responsibility is the management of the Bioventures Fund, was previously owned by Gensec Bank and Real Africa Holdings (RAH). RAH maintai ...

... The Bioventures Management team of Heather Sherwin and Paul Miot are pleased to announce new shareholders of the Fund Management Company. This company, whose sole responsibility is the management of the Bioventures Fund, was previously owned by Gensec Bank and Real Africa Holdings (RAH). RAH maintai ...

An-Investment-Plan-f.. - Bob

... Train your children to invest a. When they earn their first income (Babysitting – Mowing lawns) help open an index account b. Match each dollar they add to the account for encouragement i. Help them understand the broker statement c. Help them develop an interest in investing i. Evaluate companies u ...

... Train your children to invest a. When they earn their first income (Babysitting – Mowing lawns) help open an index account b. Match each dollar they add to the account for encouragement i. Help them understand the broker statement c. Help them develop an interest in investing i. Evaluate companies u ...

THE MOTIVATIONS OF THE TRANSNATIONAL ... TO EFFECT FOREIGN CAPITAL INVESTMENTS

... The technologic progress and the reputation of the brands make the conquest of new markets easier and easier. Generally, we have aimed at countries in course of development from Asia, Latin America, and South-East Europe. For the companies that have effected such investments the advantages have bee ...

... The technologic progress and the reputation of the brands make the conquest of new markets easier and easier. Generally, we have aimed at countries in course of development from Asia, Latin America, and South-East Europe. For the companies that have effected such investments the advantages have bee ...

What annual returns do investors expect?

... of those primarily investing in stocks in the future, over two thirds (69%) plan to invest in Canadian stocks ...

... of those primarily investing in stocks in the future, over two thirds (69%) plan to invest in Canadian stocks ...

Wells Fargo Securities_Sales and Trading Analystx

... Whether you’re at the beginning of your career or looking to make your next move, you want to work for a company that values your individual talents, skills and experience. Wells Fargo was named Among the World’s 50 Most Respected Companies by Barron’s magazine in 2010. Learn about the many exciting ...

... Whether you’re at the beginning of your career or looking to make your next move, you want to work for a company that values your individual talents, skills and experience. Wells Fargo was named Among the World’s 50 Most Respected Companies by Barron’s magazine in 2010. Learn about the many exciting ...

Infrastructure Investment Trust

... CMB contributed to the topic by issuing the draft “Infrastructure Investment Trust” in order to enhance the investment climate. The purpose of this regulation is to arrange the principals and procedures of the responsibilities which are related to the establishers of Infrastructure Investment Trust, ...

... CMB contributed to the topic by issuing the draft “Infrastructure Investment Trust” in order to enhance the investment climate. The purpose of this regulation is to arrange the principals and procedures of the responsibilities which are related to the establishers of Infrastructure Investment Trust, ...

Chapter 1 PPP

... Move toward less risky investments to preserve capital Transition to higher-quality securities with lower risk ...

... Move toward less risky investments to preserve capital Transition to higher-quality securities with lower risk ...

Investment Proposal - Morgan Stanley Sustainable Investing

... 1) Diversifying investments across geographies and product types 2) Focusing on one region at a time to fully develop deep networks and local expertise to support our portfolio companies before expanding 3) Putting in place investment and risk committees and processes to understand, evaluate and res ...

... 1) Diversifying investments across geographies and product types 2) Focusing on one region at a time to fully develop deep networks and local expertise to support our portfolio companies before expanding 3) Putting in place investment and risk committees and processes to understand, evaluate and res ...

Pension Fund Management Private Client Investment Portfolios

... investments, fixed income investments and equity based investments. We are targeted at individuals and institutions who intend to have their own portfolios were they can track the fixed income investments placed on their behalf, property structures done for them, equity counters held and the transac ...

... investments, fixed income investments and equity based investments. We are targeted at individuals and institutions who intend to have their own portfolios were they can track the fixed income investments placed on their behalf, property structures done for them, equity counters held and the transac ...

Private Equity Briefing - Center for Economic and Policy Research

... • Compare employment dynamics in “targets” acquired by PE in LBO 1/1980 – 12/2005 with “controls” • Same data sets and methodology used in both, but • Results in 2008 far less favorable to PE • But even in 2011, no support: “employment grows a tad more slowly in PE than in non-PE owned companies” • ...

... • Compare employment dynamics in “targets” acquired by PE in LBO 1/1980 – 12/2005 with “controls” • Same data sets and methodology used in both, but • Results in 2008 far less favorable to PE • But even in 2011, no support: “employment grows a tad more slowly in PE than in non-PE owned companies” • ...

presentation - European Corporate Governance Institute

... In addition, EVCA has a series of task forces and working groups on specific issues ...

... In addition, EVCA has a series of task forces and working groups on specific issues ...

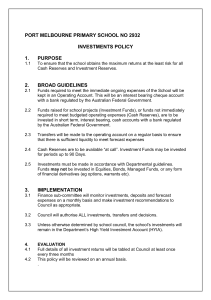

PORT MELBOURNE PRIMARY SCHOOL NO 3932

... Transfers will be made to the operating account on a regular basis to ensure that there is sufficient liquidity to meet forecast expenses ...

... Transfers will be made to the operating account on a regular basis to ensure that there is sufficient liquidity to meet forecast expenses ...

Slide 1

... “…Americans created the phrase ‘to make money.’ No other language or nation had ever used these words before... Americans were the first to understand that wealth has to be created.” Ayn Rand (1905-1982) Russian-American philosopher ...

... “…Americans created the phrase ‘to make money.’ No other language or nation had ever used these words before... Americans were the first to understand that wealth has to be created.” Ayn Rand (1905-1982) Russian-American philosopher ...

SEB Företagsinvest

... KTH Seed Capital invests in early stage high-tech companies relating Research and Development at Royal Institute of Technology (KTH). Develops and sells a software platform to telecom operators to help in their process of trading, pricing and ...

... KTH Seed Capital invests in early stage high-tech companies relating Research and Development at Royal Institute of Technology (KTH). Develops and sells a software platform to telecom operators to help in their process of trading, pricing and ...

Venture Capital financing of innovation patents

... – 2000 – 2004 external investment funds used in formation of about 1/3 of spin-outs in the U.K. – Recent research on the supply of entrepreneurial finance for business growth has focused on the venture capital industry – Definition has changed over the years and varies from firm to firm and country ...

... – 2000 – 2004 external investment funds used in formation of about 1/3 of spin-outs in the U.K. – Recent research on the supply of entrepreneurial finance for business growth has focused on the venture capital industry – Definition has changed over the years and varies from firm to firm and country ...

June - sibstc

... indicating that the factor obtains all of the rights and risks associated with the receivables. Accordingly, the factor obtains the right to receive the payments made by the debtor (customer) for the invoice amount. Usually, the account debtor is notified of the sale of the receivable, and the facto ...

... indicating that the factor obtains all of the rights and risks associated with the receivables. Accordingly, the factor obtains the right to receive the payments made by the debtor (customer) for the invoice amount. Usually, the account debtor is notified of the sale of the receivable, and the facto ...

Introduction to Social Finance: reusing money for financial and

... Social Finance is authorised and regulated by the Financial Service Authority FSA No: 497568 ...

... Social Finance is authorised and regulated by the Financial Service Authority FSA No: 497568 ...

The New Landscape for Business Startups and Their Investors

... employees who hold shares) or 2,000 total shareholders generally will no longer be required to register with the Securities and Exchange Commission (SEC). By exempting smaller companies from registration requirements, the Act enables them to bypass many SEC regulations that are designed to increase ...

... employees who hold shares) or 2,000 total shareholders generally will no longer be required to register with the Securities and Exchange Commission (SEC). By exempting smaller companies from registration requirements, the Act enables them to bypass many SEC regulations that are designed to increase ...

Actis Content - Rural Finance and Investment Learning Centre

... Clear and realistic exit route with investment horizon of 3-7 years Align interests of all major stakeholders (other shareholders, management, regulators, etc.) Investment range, US$10m to US$75m and stakes from 25% to 100% Expansion capital (organic/M&A) Change of control transactions (MBOs, MBIs, ...

... Clear and realistic exit route with investment horizon of 3-7 years Align interests of all major stakeholders (other shareholders, management, regulators, etc.) Investment range, US$10m to US$75m and stakes from 25% to 100% Expansion capital (organic/M&A) Change of control transactions (MBOs, MBIs, ...

PDF

... 2002. After owning Wythe-Will for approximately five years, Hunt Private Equity decided to seek liquidity for the investors in Lafayette. Advisory Role: VRA Partners was engaged by Wythe-Will to serve as its exclusive financial advisor in the sale of the Company. VRA Partners executed a broad market ...

... 2002. After owning Wythe-Will for approximately five years, Hunt Private Equity decided to seek liquidity for the investors in Lafayette. Advisory Role: VRA Partners was engaged by Wythe-Will to serve as its exclusive financial advisor in the sale of the Company. VRA Partners executed a broad market ...

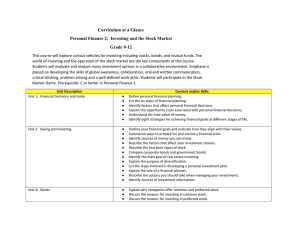

Curriculum at a Glance Personal Finance 2: Investing and the Stock

... Identify factors that affect personal financial decisions. Explain the opportunity costs associated with personal financial decisions. Understand the time value of money. Identify eight strategies for achieving financial goals at different stages of life. ...

... Identify factors that affect personal financial decisions. Explain the opportunity costs associated with personal financial decisions. Understand the time value of money. Identify eight strategies for achieving financial goals at different stages of life. ...

Increasing EU industries, challenges and opportunities

... Recommendations for an industrial compact Industrial competitiveness throughout all policy areas ...

... Recommendations for an industrial compact Industrial competitiveness throughout all policy areas ...