Career Opportunities in Public Finance

... In short, investment bankers serve as advisors to, and intermediaries between, the issuer of securities (corporations and governments) and the public and private investor markets. Whether you are interested in investment banking, commercial banking, or financial services, you will find that many of ...

... In short, investment bankers serve as advisors to, and intermediaries between, the issuer of securities (corporations and governments) and the public and private investor markets. Whether you are interested in investment banking, commercial banking, or financial services, you will find that many of ...

Willis Owen | Industry Insight | Article Print |Investment grade bonds

... This article was written by John Pattullo, Co-Head of Strategic Fixed Income at Henderson Global Investors prior to today’s reduction in the UK’s interest rate: A few months ago I remarked to Jenna, my co-manager, how boring credit (corporate bond) markets were. Be wary of what you wish for, I hear ...

... This article was written by John Pattullo, Co-Head of Strategic Fixed Income at Henderson Global Investors prior to today’s reduction in the UK’s interest rate: A few months ago I remarked to Jenna, my co-manager, how boring credit (corporate bond) markets were. Be wary of what you wish for, I hear ...

Linkages between Planning and Budgeting

... In the earlier years, there was a lot of mismatch However, effort has now been made to harmonize, align and become result-oriented, and some effective progress has been made. Some results can be seen in the next slide ...

... In the earlier years, there was a lot of mismatch However, effort has now been made to harmonize, align and become result-oriented, and some effective progress has been made. Some results can be seen in the next slide ...

transcript for The Risk And Reward Of Investing (DOC: 27KB)

... investing before. And I'm really glad I did, because the first thing I learned about was the risks and rewards of investing. And that it's really important that I understand how I feel about risk. Just like starting my own business, really. Different investments carry different levels of risk. So wi ...

... investing before. And I'm really glad I did, because the first thing I learned about was the risks and rewards of investing. And that it's really important that I understand how I feel about risk. Just like starting my own business, really. Different investments carry different levels of risk. So wi ...

FCF New York Life Anchor IV

... ** Expense ratio (gross) does not include fee waivers or expense reimbursements which result in lower actual cost to the investor. ^ The portfolio composition, industry sectors, top ten holdings, and credit analysis are presented to illustrate examples of securities that the fund has bought and dive ...

... ** Expense ratio (gross) does not include fee waivers or expense reimbursements which result in lower actual cost to the investor. ^ The portfolio composition, industry sectors, top ten holdings, and credit analysis are presented to illustrate examples of securities that the fund has bought and dive ...

Press Release Brussels, 8 June 2017 `EU publicly quoted

... There are many diverging definitions of SMEs and often confusion between SMEs proper (corner shops, small businesses that do not have necessarily intention to grow) and small and mid-size quoted companies, which are aiming to expand and seek equity capital. For instance, the SME Growth Markets defin ...

... There are many diverging definitions of SMEs and often confusion between SMEs proper (corner shops, small businesses that do not have necessarily intention to grow) and small and mid-size quoted companies, which are aiming to expand and seek equity capital. For instance, the SME Growth Markets defin ...

I have been obsessed with investing ever since I can remember

... could ever think about was why the “market” was unable to see what I was seeing when I was losing. Sometimes I bought a SURE THING that dropped in value and sometimes I laughed at those who bought something that I thought was overvalued as it continued to soar. As I continued to study the great inve ...

... could ever think about was why the “market” was unable to see what I was seeing when I was losing. Sometimes I bought a SURE THING that dropped in value and sometimes I laughed at those who bought something that I thought was overvalued as it continued to soar. As I continued to study the great inve ...

What Is Diversification?

... diversifying. The value of stocks, bonds, and mutual funds fluctuate with market conditions. Shares, when sold, may be worth more or less than their original cost. Mutual funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. ...

... diversifying. The value of stocks, bonds, and mutual funds fluctuate with market conditions. Shares, when sold, may be worth more or less than their original cost. Mutual funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. ...

Investment climate and opportunities for investment in the

... consideration and the following are being considered through public-private consultation – All sectors to be opened up, provided 51% owned by locals – 100% FI to be allowed for large capital investments – Automatic approval for FI – Streamlining the royalty regime to remove current inconsistencies – ...

... consideration and the following are being considered through public-private consultation – All sectors to be opened up, provided 51% owned by locals – 100% FI to be allowed for large capital investments – Automatic approval for FI – Streamlining the royalty regime to remove current inconsistencies – ...

“Games are won by players who focus on the playing field — not by

... Hopefully we have successfully illustrated that a stock’s return is based on two things: capital allocation, and the difference in its price-to-earnings (P/E) ratio at the time of sale versus the time of purchase. Since the company’s P/E ratio in the future cannot be known, figuring out how a compan ...

... Hopefully we have successfully illustrated that a stock’s return is based on two things: capital allocation, and the difference in its price-to-earnings (P/E) ratio at the time of sale versus the time of purchase. Since the company’s P/E ratio in the future cannot be known, figuring out how a compan ...

Epoch Global Equity Shareholder Yield Fund Institutional Class

... was the largest detractor to relative returns. Technology was the best-performing sector during the period, as it reported strong results. Stock selection in consumer staples, driven mainly by our tobacco holdings, which rose on the news of further industry consolidation and continued strong pricing ...

... was the largest detractor to relative returns. Technology was the best-performing sector during the period, as it reported strong results. Stock selection in consumer staples, driven mainly by our tobacco holdings, which rose on the news of further industry consolidation and continued strong pricing ...

TCP Capital Corp. Receives Investment Grade Ratings from

... This press release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on estimates, projections, beliefs and assumptions of management of the company at the time of such statements and are not guaran ...

... This press release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on estimates, projections, beliefs and assumptions of management of the company at the time of such statements and are not guaran ...

Investment

... — in reality, human capital investment is hugely important. • But physical capital is obviously important too (just look around you). • Most of the business cycle is accounted for by swings in investment. ...

... — in reality, human capital investment is hugely important. • But physical capital is obviously important too (just look around you). • Most of the business cycle is accounted for by swings in investment. ...

Managing Partner

... investments she originated in China, Ms. Xu has managed to exit from 4 of them and realized a total return of over US$100 million on a cost of US$28 million for an average holding period of 3 years. These investments include Vanda System (10x realized return), Netease (7x partially realized return), ...

... investments she originated in China, Ms. Xu has managed to exit from 4 of them and realized a total return of over US$100 million on a cost of US$28 million for an average holding period of 3 years. These investments include Vanda System (10x realized return), Netease (7x partially realized return), ...

2 - CUTS International

... study on the relationship of economic policy and small business. He said that on a number of fields FDI brought spectacular positive results. An improvement of production structure, quick development of the telephone system, the end of strong geopolitical dependence from the East were especially imp ...

... study on the relationship of economic policy and small business. He said that on a number of fields FDI brought spectacular positive results. An improvement of production structure, quick development of the telephone system, the end of strong geopolitical dependence from the East were especially imp ...

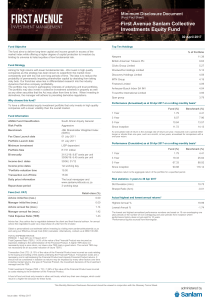

First Avenue Sanlam Collective Investments Equity Fund

... growth over the long term (greater than 5 years). It is designed to substantially outperform the markets and therefore carries a long-term investment horizon (5 years and upwards). The portfolio will be diversified across all major asset classes with significant exposure to equities, and may include ...

... growth over the long term (greater than 5 years). It is designed to substantially outperform the markets and therefore carries a long-term investment horizon (5 years and upwards). The portfolio will be diversified across all major asset classes with significant exposure to equities, and may include ...

Three Trends in Middle Market Private Equity

... Gone are the days when returns could be generated primarily through deal sourcing. Today's private equity investors must complement effective deal sourcing with post-transaction strategic and operational improvements in order to meet return expectations. ...

... Gone are the days when returns could be generated primarily through deal sourcing. Today's private equity investors must complement effective deal sourcing with post-transaction strategic and operational improvements in order to meet return expectations. ...

Risk Capital Financing for SMEs

... Facilitate entrepreneurship promoting access to risk capital financing Facilitate the establishment and development of new venture capital funds, motivate them invest in SME`s by offering state aid to private investors ...

... Facilitate entrepreneurship promoting access to risk capital financing Facilitate the establishment and development of new venture capital funds, motivate them invest in SME`s by offering state aid to private investors ...

Class Outline - Villanova University

... -- Analyze different valuation and analytic techniques for equities -- Examine investments techniques for equity portfolios -- Look at mutual funds and other investment companies as vehicles for investment strategies. ...

... -- Analyze different valuation and analytic techniques for equities -- Examine investments techniques for equity portfolios -- Look at mutual funds and other investment companies as vehicles for investment strategies. ...

Every investor, whether conservative or aggressive, wants to see

... with years of experience in investing. So your risk of losing money through investments is also lower compared to if you decide to invest directly in the market ...

... with years of experience in investing. So your risk of losing money through investments is also lower compared to if you decide to invest directly in the market ...

and what can you invest in?

... investment advice (what should they invest their money in? • You need to have a sample of investments that you actively track and can refer to when clients ask you for investment advice (note: it is NOT a list of items that pays you the biggest commission). • You have decided to track 10 items ...

... investment advice (what should they invest their money in? • You need to have a sample of investments that you actively track and can refer to when clients ask you for investment advice (note: it is NOT a list of items that pays you the biggest commission). • You have decided to track 10 items ...

- Liontrust

... to see dividends rising over time as companies increase payouts to shareholders as earnings grow. Since dividends are paid out in cash, companies with increasing payouts will need to produce high-quality cash earnings, with less scope for artificial inflation through financial manipulation or lower ...

... to see dividends rising over time as companies increase payouts to shareholders as earnings grow. Since dividends are paid out in cash, companies with increasing payouts will need to produce high-quality cash earnings, with less scope for artificial inflation through financial manipulation or lower ...

Emerging Markets Equity Corporate Class

... advisors and the strong partnership we have developed with them to create wealth and prosperity for Canadian families who entrust us with their affairs. CI Investments Inc. and Assante Wealth Management are wholly owned subsidiaries of CI Financial Corp., which is listed on the Toronto Stock Exchang ...

... advisors and the strong partnership we have developed with them to create wealth and prosperity for Canadian families who entrust us with their affairs. CI Investments Inc. and Assante Wealth Management are wholly owned subsidiaries of CI Financial Corp., which is listed on the Toronto Stock Exchang ...

the three stages of raising money

... famous Sand Hill Road in Silicon Valley, typically create investment funds with money from wealthy investors and institutions such as state pension funds. Investors are limited partners in the fund and often commit for five or ten years and are given a share of the yearly profits that the fund gener ...

... famous Sand Hill Road in Silicon Valley, typically create investment funds with money from wealthy investors and institutions such as state pension funds. Investors are limited partners in the fund and often commit for five or ten years and are given a share of the yearly profits that the fund gener ...

Discussion on Theoretical Basis and Practical Condition of Venture

... lease is another market-based financing model for enterprises, under which the company can obtain use right of required equipment by paying a small amount of money, however, its long lease period, almost covering two-thirds of the entire device lifetime, makes it not conductive to flexible technolog ...

... lease is another market-based financing model for enterprises, under which the company can obtain use right of required equipment by paying a small amount of money, however, its long lease period, almost covering two-thirds of the entire device lifetime, makes it not conductive to flexible technolog ...