* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Linkages between Planning and Budgeting

Socially responsible investing wikipedia , lookup

International investment agreement wikipedia , lookup

Corporate venture capital wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Investment banking wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Investment management wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

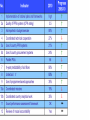

+ Linkages between Planning and Budgeting Case of Cambodia + Planning in Cambodia – background Cambodia is a planned economy, operating in a market framework Development targets, hence capital expenditures, are planned through 5-year plans Each 5-yr plan sets growth targets at the sectoral and sub-sectoral levels. It also sets institutional targets, trade targets, targets for capacities, etc. While the government makes investments in most of infrastructure and social sectors; industry, agriculture and services sectors are under the investment domain of the private sector + Some overlaps in domain There is some overlap, though: Both, the government and private sector invest and operate in the social sectors The government investments in large irrigation projects, though private sector also invests in irrigation Almost all public investment projects are implemented through private contracting agencies + The modus operandi of planning 1 The planning authorities set aggregate and sectoral annual growth rates. These are based on a political consensus and the extant capacities in the country For each sector, there is a set incremental capital-output ratio and capital-labour ratio These ratios help forecast resources and labour deployment needs in the years to come The government has a medium-term expenditure framework (MTEF), which links the real and financial sectors through pre-determined fixed coefficients (between inputs and outputs) and prevalent prices + The modus operandi of planning 2 Other than the political consensus: Economic growth rates in the private sector are determined based the investment rates – these data are available through investment approvals that the government makes Public investments are determined, based on allocation of resources and commitments made by Finance Ministry (own resources) and ODA + Financial planning Finances for capital expenditure under the plans are forecast, based on the requirements of the real economy described above Based on the MTEF, a 3-year forecast on financial requirements is made, by sectors and sub-sectors (3-year rolling plans) There is a revision of the 3-year forecast each year, based the exact progress, changing prices and resources available + Actual allocation Actual allocations are made at two levels: The Finance Ministry makes allocations to the implementing ministries/agencies, from both, the government’s own revenues, and donor finances routed through the finance ministry Some donor commitments are disbursed directly to the line ministries + Harmonization of planning and finances There are at least three levels of harmonization required: Between private (both FDI and national) investment and public sector investment (both ODI and own) Between the government’s scheduling of investments and donor commitments Intra-donor coordination + Current approaches In the earlier years, there was a lot of mismatch However, effort has now been made to harmonize, align and become result-oriented, and some effective progress has been made. Some results can be seen in the next slide + Concluding remarks – the way ahead Financial Sector Planning needs strengthening in the sense that ODA funding cycles and national needs must be matched. Programme-based approaches need universal application to harmonize financial and real sector planning Greater use of country systems can make planning easier