WV Fish Health Certification: Results of Year 1

... Affiliate of The Conservation Fund, national land and water conservation organization based in Alexandria, VA ~ $2 M invested to date in 18 businesses in West Virginia; 0% losses Expanded to North Carolina, Virginia, and NE Tennessee in 2007 ...

... Affiliate of The Conservation Fund, national land and water conservation organization based in Alexandria, VA ~ $2 M invested to date in 18 businesses in West Virginia; 0% losses Expanded to North Carolina, Virginia, and NE Tennessee in 2007 ...

TEST 1 IBM422S 20 AUGUST 2015

... C. It is easier and less risky for a firm to build strategic assets than acquire similar assets. D. Mergers and acquisitions are quicker to execute than greenfield investments. 4. A French wind power company gives an Indonesian company the right to produce and sell wind turbines in return for a roya ...

... C. It is easier and less risky for a firm to build strategic assets than acquire similar assets. D. Mergers and acquisitions are quicker to execute than greenfield investments. 4. A French wind power company gives an Indonesian company the right to produce and sell wind turbines in return for a roya ...

Corporate Finance

... Growing perpetuity: Stream of periodic cash flows that grows at a constant rate forever (dividend discount model used to value equity is one example of a growing perpetuity) ...

... Growing perpetuity: Stream of periodic cash flows that grows at a constant rate forever (dividend discount model used to value equity is one example of a growing perpetuity) ...

Executive Project Director

... Service Orientation implies a desire to identify and serve customers/clients, who may include the public, colleagues, partners (e.g. educational institutes, non-government organizations, etc.), coworkers, peers, branches, ministries / agencies and other government organizations. It means focusing on ...

... Service Orientation implies a desire to identify and serve customers/clients, who may include the public, colleagues, partners (e.g. educational institutes, non-government organizations, etc.), coworkers, peers, branches, ministries / agencies and other government organizations. It means focusing on ...

Socially Responsive Investment Fund

... they are a part--locally and globally--through programs such as innovative charitable giving, community outreach, and promoting volunteerism. Diversity and Employee Relations The Fund will invest in companies that have a superior record in areas such as: innovative benefits (child care, profit shari ...

... they are a part--locally and globally--through programs such as innovative charitable giving, community outreach, and promoting volunteerism. Diversity and Employee Relations The Fund will invest in companies that have a superior record in areas such as: innovative benefits (child care, profit shari ...

Can someone please provide some assistance with responding to the

... excluded. A certain degree of permanency is employed when dealing with the exclusion of financing from short-term sources. The structure involves the following pattern: First, cost minimization. When the firm determines the proper way to arrange its sources of funds, then cost can be kept at the low ...

... excluded. A certain degree of permanency is employed when dealing with the exclusion of financing from short-term sources. The structure involves the following pattern: First, cost minimization. When the firm determines the proper way to arrange its sources of funds, then cost can be kept at the low ...

Key Trends Shaping the Rapid Growth of the Venture Capital

... 74% of telecommunications jobs 81% of software jobs 55% of semiconductor revenue 67% of electronics/instrumentation revenue ...

... 74% of telecommunications jobs 81% of software jobs 55% of semiconductor revenue 67% of electronics/instrumentation revenue ...

The Merciless Math of Loss - CMG AdvisorCentral

... makes investing extremely inefficient. It is for that reason that active investment management is critically important. Especially in more uncertain environments, successful active investing can help preserve and grow capital more efficiently than passive investing. We believe tactical investing can ...

... makes investing extremely inefficient. It is for that reason that active investment management is critically important. Especially in more uncertain environments, successful active investing can help preserve and grow capital more efficiently than passive investing. We believe tactical investing can ...

Updates to the HealthEquity investment lineup

... Beginning April 1, 2017, you will not be able to add new investments to certain mutual funds. You can still keep any current investments you have in these funds, but HealthEquity will no longer monitor their performance. Investment fees in the new lineup are typically lower than before. However, in ...

... Beginning April 1, 2017, you will not be able to add new investments to certain mutual funds. You can still keep any current investments you have in these funds, but HealthEquity will no longer monitor their performance. Investment fees in the new lineup are typically lower than before. However, in ...

*Securities offered through American Portfolio Financial Services

... This presentation contains certain “forward” looking statements”, which may be identified by the use of such words as “believe”, “expect”, “anticipate”, “should”, “planned”, “estimated”, “potential”, and other similar terms. Examples of forward looking statements include, but are not limited to esti ...

... This presentation contains certain “forward” looking statements”, which may be identified by the use of such words as “believe”, “expect”, “anticipate”, “should”, “planned”, “estimated”, “potential”, and other similar terms. Examples of forward looking statements include, but are not limited to esti ...

Venture Capital Market in Poland and Polish government activities

... At the same time (in 2005) total investments made by private equity (PE) including venture capital investments in Poland amounted to EUR 154 million, increased by 20% compared to 2004. The average seize of PE/VC investment grew from EUR 3 million to EUR 4,8 million in 2005. It shows that the number ...

... At the same time (in 2005) total investments made by private equity (PE) including venture capital investments in Poland amounted to EUR 154 million, increased by 20% compared to 2004. The average seize of PE/VC investment grew from EUR 3 million to EUR 4,8 million in 2005. It shows that the number ...

US High Yield Fund

... The Fund seeks both high current income and capital appreciation by investing in a diversified portfolio of high-yield bonds from U.S. corporate issuers. The Philosophy The Fund is managed according to a disciplined philosophy, which emphasizes diversification and extensive proprietary and public cr ...

... The Fund seeks both high current income and capital appreciation by investing in a diversified portfolio of high-yield bonds from U.S. corporate issuers. The Philosophy The Fund is managed according to a disciplined philosophy, which emphasizes diversification and extensive proprietary and public cr ...

Industry Comparison by GDP and Percentage of the

... Sustainable Capital Formation The innovation is here, but the risk capital required to sustain R&D in the long-run is lacking. Canada’s biotechnology industry requires $1 billion annually to sustain itself. This is capital from all sources: ...

... Sustainable Capital Formation The innovation is here, but the risk capital required to sustain R&D in the long-run is lacking. Canada’s biotechnology industry requires $1 billion annually to sustain itself. This is capital from all sources: ...

lventure group`s international investor day: portfolio startups go to

... European VC scene at the event”, said Luigi Capello, LVenture Group CEO, “It has been a great occasion to foster synergies across the European startup scene”. LVenture Group is a holding company listed on the MTA of the Italian Stock Exchange operating in the field of Venture Capital with an interna ...

... European VC scene at the event”, said Luigi Capello, LVenture Group CEO, “It has been a great occasion to foster synergies across the European startup scene”. LVenture Group is a holding company listed on the MTA of the Italian Stock Exchange operating in the field of Venture Capital with an interna ...

MedTech ”Made in Germany”

... many institutional investors reluctant to invest. Nonetheless, alternative investments such as venture capital could prove prosperous again in the future. To begin with, investors are increasingly running out of alternatives at times when money is cheaply available. Second, buy-out funds are losing ...

... many institutional investors reluctant to invest. Nonetheless, alternative investments such as venture capital could prove prosperous again in the future. To begin with, investors are increasingly running out of alternatives at times when money is cheaply available. Second, buy-out funds are losing ...

Slide 1 - Acionista.com.br

... Origin of Investors as % of Committed Capital 2009: high concentration in Brazil, U.S. and E.U ...

... Origin of Investors as % of Committed Capital 2009: high concentration in Brazil, U.S. and E.U ...

Main Message

... Business growth for existing Greek portfolio companies or New, local investment opportunities, in a high growth environment with lower (than in recent past) risk profile ...

... Business growth for existing Greek portfolio companies or New, local investment opportunities, in a high growth environment with lower (than in recent past) risk profile ...

SEBI (Venture Capital Funds) Regulations, 1996

... ARDC credited with the first major venture capital success story when its 1957 investment of $70,000 in Digital Equipment Corporation (DEC) would be valued at over $355 million after the company's IPO in 1968 ARDC made an annualized return of 101% on the transaction ...

... ARDC credited with the first major venture capital success story when its 1957 investment of $70,000 in Digital Equipment Corporation (DEC) would be valued at over $355 million after the company's IPO in 1968 ARDC made an annualized return of 101% on the transaction ...

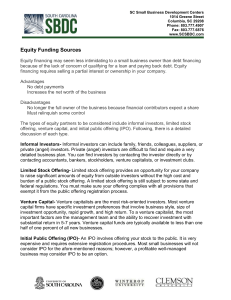

doc - South Carolina Small Business Development Centers

... capital firms have specific investment preferences that involve business style, size of investment opportunity, rapid growth, and high return. To a venture capitalist, the most important factors are the management team and the ability to recover investment with substantial return in 5-7 years. Ventu ...

... capital firms have specific investment preferences that involve business style, size of investment opportunity, rapid growth, and high return. To a venture capitalist, the most important factors are the management team and the ability to recover investment with substantial return in 5-7 years. Ventu ...

Long_Tail_PE.112134455

... investments that result in singles and doubles. Just like the 100-million copy selling album ‘Thriller’ released in 1982 has devolved into 2008’s biggest grossing album by ‘Lil Wayne (selling less than 3 million copies), so to will the outsized returns of many 90s vintage IPOs be replaced by the mor ...

... investments that result in singles and doubles. Just like the 100-million copy selling album ‘Thriller’ released in 1982 has devolved into 2008’s biggest grossing album by ‘Lil Wayne (selling less than 3 million copies), so to will the outsized returns of many 90s vintage IPOs be replaced by the mor ...

Aescap invests invests € 4 M in TO

... Alzheimer’s Disease, Stroke, Lysosomal Storage Diseases and brain tumors. toBBB’s lead product is fighting lethal viral infections of the brain using a broadspectrum antiviral drug. The 2B-Trans™ technology is unique in that it delivers drugs to the brain by an intravenous administration using a wel ...

... Alzheimer’s Disease, Stroke, Lysosomal Storage Diseases and brain tumors. toBBB’s lead product is fighting lethal viral infections of the brain using a broadspectrum antiviral drug. The 2B-Trans™ technology is unique in that it delivers drugs to the brain by an intravenous administration using a wel ...

`It can be difficult to achieve harmony`

... The main challenge we see is the clash of corporate culture that happens after an M&A transaction completes. Foreign investors – whether they are strategic or financial – partner with the founding Turkish shareholder through a majority or minority stake, or through a joint venture. In the vital six- ...

... The main challenge we see is the clash of corporate culture that happens after an M&A transaction completes. Foreign investors – whether they are strategic or financial – partner with the founding Turkish shareholder through a majority or minority stake, or through a joint venture. In the vital six- ...

PPT

... • Examples: Intel, Cisco, Siemens, AT&T • Corporate funding for strategic investment • Help companies whose success may spur revenue growth of VC corporation • Not exclusively or primarily concerned with return on investment • May provide investees with valuable connections and partnerships • Typica ...

... • Examples: Intel, Cisco, Siemens, AT&T • Corporate funding for strategic investment • Help companies whose success may spur revenue growth of VC corporation • Not exclusively or primarily concerned with return on investment • May provide investees with valuable connections and partnerships • Typica ...

read ARTICLE - California Capital Partners

... "We've been able to make a compelling case to defer the equity round until they get better traction and are at a better point to negotiate dilution or valuation." ...

... "We've been able to make a compelling case to defer the equity round until they get better traction and are at a better point to negotiate dilution or valuation." ...