Endowment Investment Policy

... preservation of principal in the overall portfolio. The risk of loss shall be controlled by investing only in authorized securities as defined in this Policy, by qualifying the financial institutions with whom Texas Southern University will transact, and by portfolio diversification. Safety is defin ...

... preservation of principal in the overall portfolio. The risk of loss shall be controlled by investing only in authorized securities as defined in this Policy, by qualifying the financial institutions with whom Texas Southern University will transact, and by portfolio diversification. Safety is defin ...

Foreign Direct Investment and Transnational Corporations in the

... significant institutional support for foreign investors. Under the care of SARIO there were many investment projects in automotive sector, in electronics, in chemistry, rubber and plastics and in machinery implemented [3]. The stimulation of the FDI inflow was prioritized as a one of the main goals. ...

... significant institutional support for foreign investors. Under the care of SARIO there were many investment projects in automotive sector, in electronics, in chemistry, rubber and plastics and in machinery implemented [3]. The stimulation of the FDI inflow was prioritized as a one of the main goals. ...

Results of DNB investment surveys into alternative investments by

... of alternative investments.2 In this letter we inform you in greater detail about the generic results of those surveys. The purpose of this information is to provide guidance to the pensions sector and to promote the development of good practices. In recent years the share of alternative investments ...

... of alternative investments.2 In this letter we inform you in greater detail about the generic results of those surveys. The purpose of this information is to provide guidance to the pensions sector and to promote the development of good practices. In recent years the share of alternative investments ...

Public Capital: Investment Stocks and Depreciation

... cyclical unemployment expenditure and government expenditure co-financing EU funding from total expenditure in a given year. The adjusted GFCF value is constructed by subtracting a backward-looking 4-year average of GFCF from the current year GFCF. This adjustment affords some flexibility as it allo ...

... cyclical unemployment expenditure and government expenditure co-financing EU funding from total expenditure in a given year. The adjusted GFCF value is constructed by subtracting a backward-looking 4-year average of GFCF from the current year GFCF. This adjustment affords some flexibility as it allo ...

Comparative Analysis of Blue Chip Fund

... Fund accounting systems are sophisticated computerized systems used to account for investor capital flows in and out of a fund, purchases and sales of investments and related investment income, gains, losses and operating expenses of the fund. The fund's investments and other assets are valued regul ...

... Fund accounting systems are sophisticated computerized systems used to account for investor capital flows in and out of a fund, purchases and sales of investments and related investment income, gains, losses and operating expenses of the fund. The fund's investments and other assets are valued regul ...

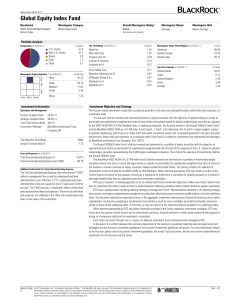

Global Equity Index Fund

... practicable the capitalization weighted total rate of return of the entire global market for publicly traded equity securities as captured by the MSCI ACWI IMI US $ Net Dividend Index. In seeking its objective, the Account invests in the Russell 3000[rt] Index Fund E and the BlackRock MSCI ACWI ex-U ...

... practicable the capitalization weighted total rate of return of the entire global market for publicly traded equity securities as captured by the MSCI ACWI IMI US $ Net Dividend Index. In seeking its objective, the Account invests in the Russell 3000[rt] Index Fund E and the BlackRock MSCI ACWI ex-U ...

DOCUMENTOS DE TRABAJO Serie Economía CAPITAL CONTROLS AND THE COST OF DEBT

... We construct our data set for capital account restrictions by using the methodology introduced by Schindler (2009), which is based on information provided in the IMF’s Annual Report on Exchange Arrangements and Exchange Restrictions (AREAER). To reduce the potential for errors in the coding of the ...

... We construct our data set for capital account restrictions by using the methodology introduced by Schindler (2009), which is based on information provided in the IMF’s Annual Report on Exchange Arrangements and Exchange Restrictions (AREAER). To reduce the potential for errors in the coding of the ...

Document

... your time at Accelerator participating in the decisions regarding scientific, business, intellectual property, and management aspects of potential start-up companies. The fellow has the opportunity to work and interact with the Accelerator team as well as experienced scientists and investors from th ...

... your time at Accelerator participating in the decisions regarding scientific, business, intellectual property, and management aspects of potential start-up companies. The fellow has the opportunity to work and interact with the Accelerator team as well as experienced scientists and investors from th ...

Working Capital Management versus Dr. Mohammed Abdul Raffey

... capital decisions since current assets are short-lived short lived investments that are continually being converted into other asset types (Rao, 1989). In the case of current liabilities, the firm is responsible for paying ng obligations mentioned under current liabilities on a timely basis. Liquidi ...

... capital decisions since current assets are short-lived short lived investments that are continually being converted into other asset types (Rao, 1989). In the case of current liabilities, the firm is responsible for paying ng obligations mentioned under current liabilities on a timely basis. Liquidi ...

How to Establish an Alternative Investment Fund in

... 1. “Marketing” means for this purpose marketing (as defined in AIFMD) in the EEA without a passport. 2. All of AIFMD will apply where an AIF is marketed with a passport (not currently expected to be available before 2017). Provisions permitting marketing without a passport may be terminated from a d ...

... 1. “Marketing” means for this purpose marketing (as defined in AIFMD) in the EEA without a passport. 2. All of AIFMD will apply where an AIF is marketed with a passport (not currently expected to be available before 2017). Provisions permitting marketing without a passport may be terminated from a d ...

Impact of Corporate Social Responsibility on Financial

... H01. There is no significant relationship between corporate social responsibility and Return on Capital employed of listed banks in Nigeria. H02. There is no significant relationship between corporate social responsibility and earnings per share of listed banks in Nigeria. H03. There is no significa ...

... H01. There is no significant relationship between corporate social responsibility and Return on Capital employed of listed banks in Nigeria. H02. There is no significant relationship between corporate social responsibility and earnings per share of listed banks in Nigeria. H03. There is no significa ...

AVI Goodhart Press Announcement 30 SEP 2015

... succeed John Pennink as Chief Investment Officer (“CIO”). Joe joined AVI in 2002 and will now lead the global equity team, which has over 43 years of combined investment experience. John Pennink will remain CEO of AVI, providing strong support for Joe and the rest of the investment team. The Board o ...

... succeed John Pennink as Chief Investment Officer (“CIO”). Joe joined AVI in 2002 and will now lead the global equity team, which has over 43 years of combined investment experience. John Pennink will remain CEO of AVI, providing strong support for Joe and the rest of the investment team. The Board o ...

UK Angola Investment Forum

... Investing Investment regulations Objectives of the investment law • Grow the economy in all provinces • Increase national productive capacity and efficiency • Promote partnerships with Angolans • Increase employment and capacity of Angolans • Increase exports and reduce imports • Rehabilitate, expa ...

... Investing Investment regulations Objectives of the investment law • Grow the economy in all provinces • Increase national productive capacity and efficiency • Promote partnerships with Angolans • Increase employment and capacity of Angolans • Increase exports and reduce imports • Rehabilitate, expa ...

Investment Risk Report The Trustees of the A Sample Will Trust

... inflation adjusted growth rate) and the volatility (standard deviation, a measure of the riskiness of the growth rate). The current values are shown in the chart below. These are estimated based on both historical returns and on an in house analysis of market data at the review date, including bond ...

... inflation adjusted growth rate) and the volatility (standard deviation, a measure of the riskiness of the growth rate). The current values are shown in the chart below. These are estimated based on both historical returns and on an in house analysis of market data at the review date, including bond ...

CAPITAL ONE INVESTING, LLC Statement of Financial Condition

... accounted for 22% of the margin loans. Margin Risk By permitting customers to purchase on margin, the Company is subject to risks inherent in extending credit, especially during periods of rapidly declining markets in which the value of the collateral held by the Company could fall below the amount ...

... accounted for 22% of the margin loans. Margin Risk By permitting customers to purchase on margin, the Company is subject to risks inherent in extending credit, especially during periods of rapidly declining markets in which the value of the collateral held by the Company could fall below the amount ...

the Building Capital Markets progress report

... one of the key priorities the Prime Minister has laid out for this Government to achieve. The Business Growth Agenda will drive this by ensuring the Government stays focused on what matters to business, to create jobs and encourage confidence and further investment. There are six key ingredients tha ...

... one of the key priorities the Prime Minister has laid out for this Government to achieve. The Business Growth Agenda will drive this by ensuring the Government stays focused on what matters to business, to create jobs and encourage confidence and further investment. There are six key ingredients tha ...

CF Prudential Managed Defensive Fund

... greater clarity about the path of the eurozone economy. However, he recognises the trading bloc’s vulnerability, given its current lacklustre economic growth. Policymakers have done their best in the recent past to support economic activity by keeping interest rates down and the subdued pace of grow ...

... greater clarity about the path of the eurozone economy. However, he recognises the trading bloc’s vulnerability, given its current lacklustre economic growth. Policymakers have done their best in the recent past to support economic activity by keeping interest rates down and the subdued pace of grow ...

Schroder Real Estate Investment Management Limited

... billion) under management as at 30 September 2015. Our clients are major financial institutions including pension funds, banks and insurance companies, local and public authorities, governments, charities, high net worth individuals and retail investors. With one of the largest networks of offices o ...

... billion) under management as at 30 September 2015. Our clients are major financial institutions including pension funds, banks and insurance companies, local and public authorities, governments, charities, high net worth individuals and retail investors. With one of the largest networks of offices o ...

Capital Entity Procedures

... operating activity. Unrestricted funds are funds from various sources that can be used in any manner by the parish in accordance with its tax exempt purpose. Designated funds are unrestricted funds that the Pastor has agreed to set aside for a specific purpose, for example a capital building project ...

... operating activity. Unrestricted funds are funds from various sources that can be used in any manner by the parish in accordance with its tax exempt purpose. Designated funds are unrestricted funds that the Pastor has agreed to set aside for a specific purpose, for example a capital building project ...

PRIVATE EQUITY IN REAL ESTATE

... The term private equity refers to equity investment in growth oriented businesses, majority of which are unlisted. The capital is provided for medium to long term to enable such businesses to grow and expand. Private equity investors assume the role of active investors and work closely with their po ...

... The term private equity refers to equity investment in growth oriented businesses, majority of which are unlisted. The capital is provided for medium to long term to enable such businesses to grow and expand. Private equity investors assume the role of active investors and work closely with their po ...

Steady State Investment per worker

... Simplifying, Investment = (d+n)K or investment per worker = (d+n)k ...

... Simplifying, Investment = (d+n)K or investment per worker = (d+n)k ...

File ch21 Type: Multiple Choice 1. Which of the following is NOT one

... a) No loss. Every down year is followed by an up year. b) 10%. The investor will still have 90% of his investment. c) 20%. The long run standard deviation of the S&P 500 is about 20%. d) 40%. The bear markets of 1973-4 and 2000-2 both resulted in losses of about 40%. Ans: D ...

... a) No loss. Every down year is followed by an up year. b) 10%. The investor will still have 90% of his investment. c) 20%. The long run standard deviation of the S&P 500 is about 20%. d) 40%. The bear markets of 1973-4 and 2000-2 both resulted in losses of about 40%. Ans: D ...

Global Unconstrained Bond a sub-fund of Schroder

... This document provides you with key investor information about this fund. It is not marketing material. The information is required by law to help you understand the nature and the risks of investing in this fund. You are advised to read it so you can make an informed decision about whether to inves ...

... This document provides you with key investor information about this fund. It is not marketing material. The information is required by law to help you understand the nature and the risks of investing in this fund. You are advised to read it so you can make an informed decision about whether to inves ...

Mirae Asset Trigger Investment Plan (TRIP)

... How does the facility work? Suppose you prefer to invest in a mutual fund when markets are at specic levels, you would need to keep track of markets and invest on the day markets reach their desired level. With the TRIP facility, you need not keep track of market movements. You can simply set four ...

... How does the facility work? Suppose you prefer to invest in a mutual fund when markets are at specic levels, you would need to keep track of markets and invest on the day markets reach their desired level. With the TRIP facility, you need not keep track of market movements. You can simply set four ...

The Decentering of the Global Firm Working Paper

... national identity no longer guaranteed that it would advance the economic interests of a particular country. For example, a foreign firm with substantial investments in the United States may well be better for America than an American firm with most of its operations abroad. Reich’s question provoke ...

... national identity no longer guaranteed that it would advance the economic interests of a particular country. For example, a foreign firm with substantial investments in the United States may well be better for America than an American firm with most of its operations abroad. Reich’s question provoke ...