Guide to Private Equity and Venture Capital for

... capital, making the first move may seem daunting, given that many characteristics are quite unlike those of more traditional types of investing. That’s why we have put together this guide. Containing practical information on why and how to invest in the asset class, plus an overview of the benefits ...

... capital, making the first move may seem daunting, given that many characteristics are quite unlike those of more traditional types of investing. That’s why we have put together this guide. Containing practical information on why and how to invest in the asset class, plus an overview of the benefits ...

Principles of Economics, Case and Fair,9e

... The Demand for New Capital and the Investment Decision Comparing Costs and Expected Return The Expected Rate of Return and the Marginal Revenue Product of Capital A perfectly competitive profit-maximizing firm will keep investing in new capital up to the point at which the expected rate of return is ...

... The Demand for New Capital and the Investment Decision Comparing Costs and Expected Return The Expected Rate of Return and the Marginal Revenue Product of Capital A perfectly competitive profit-maximizing firm will keep investing in new capital up to the point at which the expected rate of return is ...

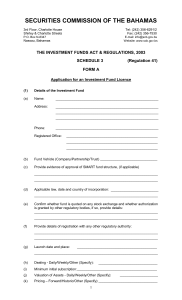

The Investment Funds Act, 2003 - Securities Commission of the

... Constitutive Documents (Certified copies of Memorandum & Articles of Association, including copies of all material agreements) Copies of certificates and other documents of proof for information contained in submitted resumes. Financial statements Prescribed Application Fee (non-refundable) ...

... Constitutive Documents (Certified copies of Memorandum & Articles of Association, including copies of all material agreements) Copies of certificates and other documents of proof for information contained in submitted resumes. Financial statements Prescribed Application Fee (non-refundable) ...

Scottish Equitable JPMorgan Mansart Risk Profile 10 Fund

... to other funds in our Full Fund Range. This is not the fund’s risk against industry benchmarks. We regularly review the risk ratings, so they can change. †The underlying fund gets its total return through a financial contract with JPMorgan Chase Bank, N.A. This contract is an asset of the underlying ...

... to other funds in our Full Fund Range. This is not the fund’s risk against industry benchmarks. We regularly review the risk ratings, so they can change. †The underlying fund gets its total return through a financial contract with JPMorgan Chase Bank, N.A. This contract is an asset of the underlying ...

position paper - SDA Bocconi School of Management

... Government is retreating or cannot cope with demand; or traditional nonprofit organizations haven’t been able to generate a meaningful impact in a sustainable way because of the lack of capacities and resources, which have hampered the scalability of their initiatives. Impact Investing is therefore ...

... Government is retreating or cannot cope with demand; or traditional nonprofit organizations haven’t been able to generate a meaningful impact in a sustainable way because of the lack of capacities and resources, which have hampered the scalability of their initiatives. Impact Investing is therefore ...

The Use of Financial Ratios in Predicting Corporate Failure in Sri

... That is, the financial ratios previously deployed are accrual accounting financial ratios that cannot reflect the ability of a firm to manage its future cash flows. Cash flow has been an important determinant of failure. Sharma (2001) was critical of Altman for not including cash flow as a factor an ...

... That is, the financial ratios previously deployed are accrual accounting financial ratios that cannot reflect the ability of a firm to manage its future cash flows. Cash flow has been an important determinant of failure. Sharma (2001) was critical of Altman for not including cash flow as a factor an ...

INVESTMENT POLICY The Kitsap Community Foundation (“the

... current market value, and summarizing values by asset class and within equities by economic sector. A statement of all purchases and sales (including matured or called fixed income securities) over the previous quarter. A statement of income received over the past quarter. A statement of realized ga ...

... current market value, and summarizing values by asset class and within equities by economic sector. A statement of all purchases and sales (including matured or called fixed income securities) over the previous quarter. A statement of income received over the past quarter. A statement of realized ga ...

Session 1 Investment Philosophies: Introduction Test 1. Which of the

... d. Invest on the belief that investors over react to big news and announcements and that markets correct themselves over time. e. All of the above Explanation: The remaining choices all represent strategies. ...

... d. Invest on the belief that investors over react to big news and announcements and that markets correct themselves over time. e. All of the above Explanation: The remaining choices all represent strategies. ...

Templeton Foreign Fund Fact Sheet

... All investments involve risks, including possible loss of principal. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments; investments in developing markets involve heightened risks related to the same factors. Currency ...

... All investments involve risks, including possible loss of principal. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments; investments in developing markets involve heightened risks related to the same factors. Currency ...

Diasporas: Exploring their Development Potential

... communities or by friends and family back in the countryof-origin. The social recognition a diasporan receives by investing in the origin country may also be a key motivating factor. ...

... communities or by friends and family back in the countryof-origin. The social recognition a diasporan receives by investing in the origin country may also be a key motivating factor. ...

Green Paper on Long-Term Financing of the European - EUR-Lex

... private investment. While governments will always play a key role in the provision of public goods and public infrastructure, greater spending efficiency through more systematic cost-benefit analysis and careful project screening has been a long-standing challenge. In addition, public resources in t ...

... private investment. While governments will always play a key role in the provision of public goods and public infrastructure, greater spending efficiency through more systematic cost-benefit analysis and careful project screening has been a long-standing challenge. In addition, public resources in t ...

Green Paper on Long-Term Financing of the European Economy

... private investment. While governments will always play a key role in the provision of public goods and public infrastructure, greater spending efficiency through more systematic cost-benefit analysis and careful project screening has been a long-standing challenge. In addition, public resources in t ...

... private investment. While governments will always play a key role in the provision of public goods and public infrastructure, greater spending efficiency through more systematic cost-benefit analysis and careful project screening has been a long-standing challenge. In addition, public resources in t ...

Chapter 1

... to the highest bidder, and they can be traded as often as is desirable before they mature. In negotiated markets, the instruments are sold to one or a few buyers under private contract. Financial capital is raised when newly issued securities are sold in the primary markets. Security trading in th ...

... to the highest bidder, and they can be traded as often as is desirable before they mature. In negotiated markets, the instruments are sold to one or a few buyers under private contract. Financial capital is raised when newly issued securities are sold in the primary markets. Security trading in th ...

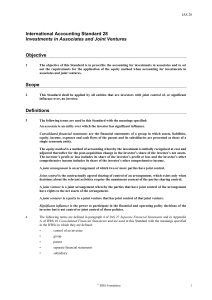

International Accounting Standard 28 Investments in Associates and

... IFRS 9 Financial Instruments does not apply to interests in associates and joint ventures that are accounted for using the equity method. When instruments containing potential voting rights in substance currently give access to the returns associated with an ownership interest in an associate or a j ...

... IFRS 9 Financial Instruments does not apply to interests in associates and joint ventures that are accounted for using the equity method. When instruments containing potential voting rights in substance currently give access to the returns associated with an ownership interest in an associate or a j ...

802.4R2 Capital Assests Management Systems Definitions

... Back trending/standard costing - an estimate of the historical original cost using a known average installed cost for like units as of the estimated addition/ acquisition date. This cost is only applied to the capital assets initially counted upon implementation of the capital assets management syst ...

... Back trending/standard costing - an estimate of the historical original cost using a known average installed cost for like units as of the estimated addition/ acquisition date. This cost is only applied to the capital assets initially counted upon implementation of the capital assets management syst ...

Methodological note to the table 1.4

... III.Other indicators This third group contains certain indicators that influence the stocks of physical, technological and human capital described in the previous section. These variables include R&D expenditure, use of patents, gross fixed capital formation, public expenditure on education and vent ...

... III.Other indicators This third group contains certain indicators that influence the stocks of physical, technological and human capital described in the previous section. These variables include R&D expenditure, use of patents, gross fixed capital formation, public expenditure on education and vent ...

DFS-J3-1541 rev0413(Investment Policy).

... Deferred Compensation Program and agrees to all terms and conditions that apply. Passively Managed Product (Index Fund) – An investment strategy that produces the same level and pattern of financial returns generated by a market benchmark index. Performance Benchmark – A market benchmark index that ...

... Deferred Compensation Program and agrees to all terms and conditions that apply. Passively Managed Product (Index Fund) – An investment strategy that produces the same level and pattern of financial returns generated by a market benchmark index. Performance Benchmark – A market benchmark index that ...

The key stages of financial planning

... adjust some of your current patterns of behaviour such as spending and saving. A very important issue is clarity about priorities – what might have seemed to be a high priority at the start of the process might have to be replaced by another need. Once these needs and wants have been identified, ana ...

... adjust some of your current patterns of behaviour such as spending and saving. A very important issue is clarity about priorities – what might have seemed to be a high priority at the start of the process might have to be replaced by another need. Once these needs and wants have been identified, ana ...

CMU Briefing Paper - For Print

... EU citizens as individual investors need positive incentives (“carrots”), and not “sticks”, to channel savings into long term investments for the real economy, since they are already suffering from the “financial repression” which – together with excessively high fees from financial institutions – c ...

... EU citizens as individual investors need positive incentives (“carrots”), and not “sticks”, to channel savings into long term investments for the real economy, since they are already suffering from the “financial repression” which – together with excessively high fees from financial institutions – c ...

Stock Descriptions - directinvestingclub.com

... Aberdeen Asia-Pacific Income Fund, Inc. (FAX) Aberdeen Asia-Pacific Income Fund, Inc. (the Fund) is a closed-end, non-diversified management investment company. The Fund's investment objective is to seek current income. The Fund seeks to achieve its investment objective, through investment in Austra ...

... Aberdeen Asia-Pacific Income Fund, Inc. (FAX) Aberdeen Asia-Pacific Income Fund, Inc. (the Fund) is a closed-end, non-diversified management investment company. The Fund's investment objective is to seek current income. The Fund seeks to achieve its investment objective, through investment in Austra ...

Agency Costs and the Performance Implications of International

... interests coincide. Wild (1994) observed that IIV formations also create more wealth for parent fIrm shareholders when parent fIrms have low levels of free cash flow or have high fInancial leverage for a given level of free cash flow. Cordeiro (1993) reponed that parent fIrm abnormal returns from IV ...

... interests coincide. Wild (1994) observed that IIV formations also create more wealth for parent fIrm shareholders when parent fIrms have low levels of free cash flow or have high fInancial leverage for a given level of free cash flow. Cordeiro (1993) reponed that parent fIrm abnormal returns from IV ...

Book Review of "Who Needs to Open the Capital Account?"

... aftermath of capital account liberalization, the cost of capital falls, investment rises as does economic growth and the effects are economically meaningful and statistically significant. However, while the impact on the standard of living or per capita incomes is permanent, the growth impact is temp ...

... aftermath of capital account liberalization, the cost of capital falls, investment rises as does economic growth and the effects are economically meaningful and statistically significant. However, while the impact on the standard of living or per capita incomes is permanent, the growth impact is temp ...

PBO - GRN027 - Securing the Future of Farming

... $25 million (including administration costs) per year over the period 2017-18 to 2020-21 to improve research and investment in soil quality through a National Soil Health Strategy. ...

... $25 million (including administration costs) per year over the period 2017-18 to 2020-21 to improve research and investment in soil quality through a National Soil Health Strategy. ...