PBO - GRN027 - Securing the Future of Farming

... $25 million (including administration costs) per year over the period 2017-18 to 2020-21 to improve research and investment in soil quality through a National Soil Health Strategy. ...

... $25 million (including administration costs) per year over the period 2017-18 to 2020-21 to improve research and investment in soil quality through a National Soil Health Strategy. ...

CF Heartwood Growth Multi Asset Fund

... The fund has the discretion to invest in the investments as described above with no need to adhere to a particular ...

... The fund has the discretion to invest in the investments as described above with no need to adhere to a particular ...

a critical review of modigliani and miller`s theorem of capital structure

... The First Proposition without the Effect of Taxes In their study, Modigliani and Miller take into consideration and discuss two firms with different structures of capital, one including debt in its structure of capital whereas the other one without debt in its structure of capital. Modigliani and Mi ...

... The First Proposition without the Effect of Taxes In their study, Modigliani and Miller take into consideration and discuss two firms with different structures of capital, one including debt in its structure of capital whereas the other one without debt in its structure of capital. Modigliani and Mi ...

Taiwan 2015 - 2016.docx

... 5.12 Restrictions eased on the acquisition and post-acquisition selling of stocks for securities investment trust and consulting professionals On May 25th, 2015, the FSC loosened the restrictions on employee and their spouses involved in securities investment trust companies or discretionary investm ...

... 5.12 Restrictions eased on the acquisition and post-acquisition selling of stocks for securities investment trust and consulting professionals On May 25th, 2015, the FSC loosened the restrictions on employee and their spouses involved in securities investment trust companies or discretionary investm ...

Mankiw 6e PowerPoints

... Efficient Markets Hypothesis (EMH): The market price of a company’s stock is the fully rational valuation of the company, given current information about the company’s ...

... Efficient Markets Hypothesis (EMH): The market price of a company’s stock is the fully rational valuation of the company, given current information about the company’s ...

Key Investor Information This document provides you

... Prospectus and Reports: Copies of the Prospectus (including the Fund Information Card) and the annual and half-yearly reports of ANIMA Funds plc may be obtained from the Administrator, free of charge, or by visiting www.animafunds.ie. These documents are available in English. NAV / Pricing: The Net ...

... Prospectus and Reports: Copies of the Prospectus (including the Fund Information Card) and the annual and half-yearly reports of ANIMA Funds plc may be obtained from the Administrator, free of charge, or by visiting www.animafunds.ie. These documents are available in English. NAV / Pricing: The Net ...

... replace worn capital. Corporations divide this bonus between accumulating more capital at a rate of 6.0 percent per year and paying their owners 3.8 percent of the current value of the capital. It is an interesting implication of this view that U.S. corporations are generally self-perpetuating. At t ...

November 16, 2009

... Commonwealth of Virginia, Virginia Polytechnic Institute and State University, the Virginia Community College System, Rolls-Royce North America (USA) Holdings Co., and related parties as set forth in the Memorandum of Understanding dated November 20, 2007; and, WHEREAS, one of the initiatives of the ...

... Commonwealth of Virginia, Virginia Polytechnic Institute and State University, the Virginia Community College System, Rolls-Royce North America (USA) Holdings Co., and related parties as set forth in the Memorandum of Understanding dated November 20, 2007; and, WHEREAS, one of the initiatives of the ...

Investment

... in the gross capital stock is gross investment minus scrapping. Figures for these two measures of the change in the capital stock are shown in figure 3.2. The main pattern revealed by figure 3.2 is that investment, according to all three definitions, rose substantially for most of the 1960s, but tha ...

... in the gross capital stock is gross investment minus scrapping. Figures for these two measures of the change in the capital stock are shown in figure 3.2. The main pattern revealed by figure 3.2 is that investment, according to all three definitions, rose substantially for most of the 1960s, but tha ...

agenda for a new strategy of equity financing by the islamic

... in companies that are likely to do so is not the way to promote development. It translates its development objectives by promoting private sector development in countries where considerable work is required to fund, create and structure projects. Although operating in these countries is often less p ...

... in companies that are likely to do so is not the way to promote development. It translates its development objectives by promoting private sector development in countries where considerable work is required to fund, create and structure projects. Although operating in these countries is often less p ...

NBER WORKING PAPER SERIES RESTRICTION OF INTERNATIONAL PRODUCTION: David G. Hartman

... U.S. multinational firms have a much broader role than transferring abundant ...

... U.S. multinational firms have a much broader role than transferring abundant ...

Determinants of capital structure

... In the last two decades, after the collapse of the socialist system and the emergence of a new economic reality in Eastern Europe, considerably different from the existing economic paradigms, a new field for exploration emerged in the economic science. Namely, contemporary corporate finance is mostl ...

... In the last two decades, after the collapse of the socialist system and the emergence of a new economic reality in Eastern Europe, considerably different from the existing economic paradigms, a new field for exploration emerged in the economic science. Namely, contemporary corporate finance is mostl ...

Real Estate and Unconventional Securities under the Arkansas

... represents that after a given period of time, five years for example, he would buy back the property for twenty thousand dollars. The promoter could retain control with his contribution accounting for only a small portion of the entire venture. The risk of loss in case of whole or partial failure of ...

... represents that after a given period of time, five years for example, he would buy back the property for twenty thousand dollars. The promoter could retain control with his contribution accounting for only a small portion of the entire venture. The risk of loss in case of whole or partial failure of ...

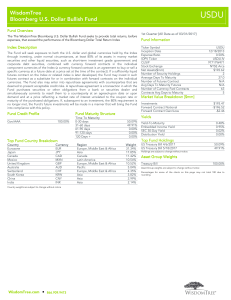

WisdomTree Bloomberg U.S. Dollar Bullish Fund

... the collateral securing the repurchase agreements and may decline prior to the expiration of the repurchase agreement term. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting such issuers. Unlike typical exchange-traded Funds, there ar ...

... the collateral securing the repurchase agreements and may decline prior to the expiration of the repurchase agreement term. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting such issuers. Unlike typical exchange-traded Funds, there ar ...

( +381(11)2627-612

... 1. Full name of the Company _____________________________________________________________ 2. Location and address ________________________________________________________________ 3. Managing director _____________________________________Tel: __________________________ 4. Financial director _________ ...

... 1. Full name of the Company _____________________________________________________________ 2. Location and address ________________________________________________________________ 3. Managing director _____________________________________Tel: __________________________ 4. Financial director _________ ...

April 24, 2017 JNL/American Funds Blue Chip

... earnings growth expectations are not met, their stock prices will likely fall, which may reduce the value of a Fund’s investment in those stocks. Over market cycles, different investment styles may sometimes outperform other investment styles (for example, growth investing may outperform value inves ...

... earnings growth expectations are not met, their stock prices will likely fall, which may reduce the value of a Fund’s investment in those stocks. Over market cycles, different investment styles may sometimes outperform other investment styles (for example, growth investing may outperform value inves ...

PDF - BAM Advisor Services

... willing to buy at 10 and sell at 10.5). The stock has typically been trading just 30,000 shares a day, but the active fund wants to immediately sell 100,000 shares. However, selling such a large number of shares relative to the stock’s typical trading level will drive the price much lower … even bef ...

... willing to buy at 10 and sell at 10.5). The stock has typically been trading just 30,000 shares a day, but the active fund wants to immediately sell 100,000 shares. However, selling such a large number of shares relative to the stock’s typical trading level will drive the price much lower … even bef ...

Stock Exchange Markets for New Ventures

... seeking exposure to VC would have been better off investing in the public rather than in the conventional market. Simple screening rules applied at the initial listing time would have allowed such an investor to earn an average annual return of 24.45%; interestingly, during the 1995-2005 subperiod, ...

... seeking exposure to VC would have been better off investing in the public rather than in the conventional market. Simple screening rules applied at the initial listing time would have allowed such an investor to earn an average annual return of 24.45%; interestingly, during the 1995-2005 subperiod, ...

Principles of Economics, Case and Fair,9e

... The Demand for New Capital and the Investment Decision Comparing Costs and Expected Return The Expected Rate of Return and the Marginal Revenue Product of Capital A perfectly competitive profit-maximizing firm will keep investing in new capital up to the point at which the expected rate of return is ...

... The Demand for New Capital and the Investment Decision Comparing Costs and Expected Return The Expected Rate of Return and the Marginal Revenue Product of Capital A perfectly competitive profit-maximizing firm will keep investing in new capital up to the point at which the expected rate of return is ...

Financial Services Guaranteed Investment

... visiting www.acadie.com/mlgi-return. Information on returns is provided for information purposes only. The return on your investment is also shown on your monthly account statement, for information purposes. Return on the investment can only be known at maturity. The following information is ava ...

... visiting www.acadie.com/mlgi-return. Information on returns is provided for information purposes only. The return on your investment is also shown on your monthly account statement, for information purposes. Return on the investment can only be known at maturity. The following information is ava ...

Annual Financial Report as at December 31, 2010

... > Company Buyouts and Technological Innovations to cover major investments such as company buyouts and their related employee-shareholder cooperatives, and investments in information technologies; > Venture Capital – Health to consolidate the Company’s few investments in life sciences managed in h ...

... > Company Buyouts and Technological Innovations to cover major investments such as company buyouts and their related employee-shareholder cooperatives, and investments in information technologies; > Venture Capital – Health to consolidate the Company’s few investments in life sciences managed in h ...

words

... identify these and other forward-looking statements by the use of words such as “becoming,” “may,” “will,” “should,” "could," "would," “predict,” “potential,” “continue,” “anticipate,” “believe,” “estimate,” “seek,” “expect,” “plan,” “intend,” the negative of such words, or comparable terminology. A ...

... identify these and other forward-looking statements by the use of words such as “becoming,” “may,” “will,” “should,” "could," "would," “predict,” “potential,” “continue,” “anticipate,” “believe,” “estimate,” “seek,” “expect,” “plan,” “intend,” the negative of such words, or comparable terminology. A ...

Kurzinformation Simplified Prospectus iShares eb

... The unit value can fluctuate. Investors may not recover the full value of their investment. If the index falls in value, causing the value of the Investment Fund to fall, the Company’s fund management will not attempt to limit losses through hedging transactions or sales of equities (i.e. the fund i ...

... The unit value can fluctuate. Investors may not recover the full value of their investment. If the index falls in value, causing the value of the Investment Fund to fall, the Company’s fund management will not attempt to limit losses through hedging transactions or sales of equities (i.e. the fund i ...

Koovs plc Koovs plc closes current round of capital raising at £26.2

... The New Ordinary Shares have not been and will not be registered under the US Securities Act 1933 (as amended) (the "US Securities Act") or with any securities regulatory authority of any state or other jurisdiction of the United States and, accordingly, may not be offered, sold, resold, taken up, t ...

... The New Ordinary Shares have not been and will not be registered under the US Securities Act 1933 (as amended) (the "US Securities Act") or with any securities regulatory authority of any state or other jurisdiction of the United States and, accordingly, may not be offered, sold, resold, taken up, t ...