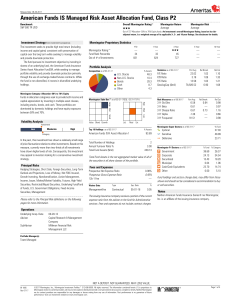

American Funds IS Managed Risk Asset Allocation Fund

... allocation and investment strategies do not perform as expected, which may cause the portfolio to underperform its benchmark, other investments with similar objectives, or the market in general. The investment is subject to the risk of loss of income and capital invested, and the advisor does not gu ...

... allocation and investment strategies do not perform as expected, which may cause the portfolio to underperform its benchmark, other investments with similar objectives, or the market in general. The investment is subject to the risk of loss of income and capital invested, and the advisor does not gu ...

Disclaimer CAVENDISH IMPACT CAPITAL: IMPORTANT NOTICES

... or sell, or a solicitation of an offer to buy or sell, any security, product, service or investment, save that certain applications accessible through the Portal allow registered users to enter into transactions and different applications accessible through the Portal may be subject to further usage ...

... or sell, or a solicitation of an offer to buy or sell, any security, product, service or investment, save that certain applications accessible through the Portal allow registered users to enter into transactions and different applications accessible through the Portal may be subject to further usage ...

Official PDF , 19 pages

... and United Kingdom, widely held firms are prone to other people’s money agency problems while firms with dominant insider shareholders are prone to entrenchment agency problems. The firms in pyramids are vulnerable to both at the same time. Furthermore, pyramid member firms are vulnerable to a third ...

... and United Kingdom, widely held firms are prone to other people’s money agency problems while firms with dominant insider shareholders are prone to entrenchment agency problems. The firms in pyramids are vulnerable to both at the same time. Furthermore, pyramid member firms are vulnerable to a third ...

Working Capital Management impact on Profitability

... professionals about empirical evidences (Garcia-Teruel, 2006) (Nazir and Afza, 2003) and others studies just base their conclusions on past theories (Shin and Soenen, 1998). Many managers search for information about the value creation and how to do it. I will refer to current versus non-current man ...

... professionals about empirical evidences (Garcia-Teruel, 2006) (Nazir and Afza, 2003) and others studies just base their conclusions on past theories (Shin and Soenen, 1998). Many managers search for information about the value creation and how to do it. I will refer to current versus non-current man ...

Investment Preferences and Patient Capital: Financing, Governance

... meetings and governing boards (Carroll, 2012). Although there is no broadly agreed definition of impatience in the scholarship on pension funds, it can be defined as the opposite of the four strategies: financing for firms for other than long-term operations; investment in targets seeking short-term ...

... meetings and governing boards (Carroll, 2012). Although there is no broadly agreed definition of impatience in the scholarship on pension funds, it can be defined as the opposite of the four strategies: financing for firms for other than long-term operations; investment in targets seeking short-term ...

MANAGING VOLATILITY: A STRATEGIC FRAMEWORK

... market decline of 20%, and so forth? This kind of scenario analysis is very helpful in coming up with a dollar impact on the company’s P&L or balance sheet. It also allows for better worst-case planning, as very specific outcomes can be examined in detail. In general, scenario analysis allows one to ...

... market decline of 20%, and so forth? This kind of scenario analysis is very helpful in coming up with a dollar impact on the company’s P&L or balance sheet. It also allows for better worst-case planning, as very specific outcomes can be examined in detail. In general, scenario analysis allows one to ...

Investment Financing and Financial Development: Firm Level Evidence from Vietnam

... 1998, 1999; Huang, 2010, 2011). The focus of this paper is to investigate how finance can facilitate investment activity. In this area, the current research can be split into two categories: first, research on the issue of financial development, investment and economic growth in a single or cross-co ...

... 1998, 1999; Huang, 2010, 2011). The focus of this paper is to investigate how finance can facilitate investment activity. In this area, the current research can be split into two categories: first, research on the issue of financial development, investment and economic growth in a single or cross-co ...

Living Annuity 3.4MB

... At retirement, you may need your living annuity to last for 20 years or longer. Therefore, contrary to popular belief, most retirees are still long term investors and need to have a long term approach when managing their investments. Investment risk is linked to the term of your investments. The lon ...

... At retirement, you may need your living annuity to last for 20 years or longer. Therefore, contrary to popular belief, most retirees are still long term investors and need to have a long term approach when managing their investments. Investment risk is linked to the term of your investments. The lon ...

Conference Program

... the roundtables give you the opportunity to interact directly with a mix of traditional, alternative and OCIO consulting professionals. Enjoy direct dialogue with experienced individuals as they provide organizational updates, discuss strategic research themes, and share search activity specific to ...

... the roundtables give you the opportunity to interact directly with a mix of traditional, alternative and OCIO consulting professionals. Enjoy direct dialogue with experienced individuals as they provide organizational updates, discuss strategic research themes, and share search activity specific to ...

Policies and Procedures

... Program policies and procedures contained in this document are established to ensure the MOA manages and allocates the funds committed to it under the SSBCI Act of 2010 to establish the 49SAF. The policies and procedures conform to SSBCI guidelines (www.treasury.gov/ssbci); the MOA’s agreement with ...

... Program policies and procedures contained in this document are established to ensure the MOA manages and allocates the funds committed to it under the SSBCI Act of 2010 to establish the 49SAF. The policies and procedures conform to SSBCI guidelines (www.treasury.gov/ssbci); the MOA’s agreement with ...

Indian Private Equity: Route to Resurgence

... survey, private equity firms emphasised their key challenges were with management capabilities, corporate governance and capital discipline, all of which impact value creation. ...

... survey, private equity firms emphasised their key challenges were with management capabilities, corporate governance and capital discipline, all of which impact value creation. ...

Community Investment

... Community investment is about community engagement. It is about ordinary people investing their own money – sometimes small sums, sometimes larger amounts – to support the development of something they care about. These ventures may be a local service – a shop or pub- or an enterprise with regional, ...

... Community investment is about community engagement. It is about ordinary people investing their own money – sometimes small sums, sometimes larger amounts – to support the development of something they care about. These ventures may be a local service – a shop or pub- or an enterprise with regional, ...

Venture Capita Report

... but recent years have seen a shift towards the later stages as a means of mitigating risk. The study found that during 2003 and 2004 more than a third of specialists had been investing predominantly at the growth capital stage, meaning the companies were likely to be cash flow positive rather than e ...

... but recent years have seen a shift towards the later stages as a means of mitigating risk. The study found that during 2003 and 2004 more than a third of specialists had been investing predominantly at the growth capital stage, meaning the companies were likely to be cash flow positive rather than e ...

Final - Chapter 10-1

... • Social entrepreneurship: Entrepreneurial actions where both economic and social value creation occur • Corporate social performance (CSP): The degree to which a firm's actions honor ethical values that respect individuals, communities, and the natural environment • Kinder, Lydenberg and Domini & C ...

... • Social entrepreneurship: Entrepreneurial actions where both economic and social value creation occur • Corporate social performance (CSP): The degree to which a firm's actions honor ethical values that respect individuals, communities, and the natural environment • Kinder, Lydenberg and Domini & C ...

THEME: THE CHANGING ECONOMIC LANDSCAPE WITHIN EAC

... international debt. It is not always possible or desirable to hold this excess liquidity as money or to channel it into immediate consumption. This is especially the case when a nation depends on raw material exports like oil, copper or diamonds. In such countries, the main reason for creating a SWF ...

... international debt. It is not always possible or desirable to hold this excess liquidity as money or to channel it into immediate consumption. This is especially the case when a nation depends on raw material exports like oil, copper or diamonds. In such countries, the main reason for creating a SWF ...

Aust Superannuation Law Bulletin - The Trio debacle

... that have suffered loss as a result of fraudulent conduct or theft.71 An application for compensation, on behalf of those investors, was made to the Minister for Financial Services and Superannuation. In April 2011, the government announced that it would provide approximately $55 million in compensa ...

... that have suffered loss as a result of fraudulent conduct or theft.71 An application for compensation, on behalf of those investors, was made to the Minister for Financial Services and Superannuation. In April 2011, the government announced that it would provide approximately $55 million in compensa ...

Babson Capital Management presentation

... Source: Barclays Capital as of March 6, 2013. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. It is not possible to invest directly in an index. ...

... Source: Barclays Capital as of March 6, 2013. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. It is not possible to invest directly in an index. ...

For What IT`s Worth: Insights into the True Business Value of IT

... all the strategy and goals of the business have to be considered. After all, it is this strategy IT should align with. In modern business strategy literature, three dominant strategies are identified: Product Leadership, Customer Intimacy and Price Leadership (Treacey en Wiersema, 1997). In a Price ...

... all the strategy and goals of the business have to be considered. After all, it is this strategy IT should align with. In modern business strategy literature, three dominant strategies are identified: Product Leadership, Customer Intimacy and Price Leadership (Treacey en Wiersema, 1997). In a Price ...

Market Penetration and Investment Pattern: A Study

... endeavor to look at the potential of their products in the existing and new markets. These strategies are technically labeled as ‗market penetration‘ (Armstrong & Kotler, 2009). This strategy (market penetration) increases the product sales through an aggressive marketing mix. Such approach is, usua ...

... endeavor to look at the potential of their products in the existing and new markets. These strategies are technically labeled as ‗market penetration‘ (Armstrong & Kotler, 2009). This strategy (market penetration) increases the product sales through an aggressive marketing mix. Such approach is, usua ...

getting_certified_june_2013

... details about the project implementation schedule other financial and workforce data ...

... details about the project implementation schedule other financial and workforce data ...

The SEI Strategic Portfolios We have prepared the following

... Asset allocation is the precise division of a portfolio between multiple asset classes, such as equities, fixed interest, liquidity and interest linked. SEI considers this to be the most crucial step in the investment process. SEI’s asset allocation process is designed to build well-diversified port ...

... Asset allocation is the precise division of a portfolio between multiple asset classes, such as equities, fixed interest, liquidity and interest linked. SEI considers this to be the most crucial step in the investment process. SEI’s asset allocation process is designed to build well-diversified port ...

Challenges of Financing Infrastructure

... Government has a view on how it wants infrastructure investments to operate and investors have a view on how infrastructure investments will fit in their portfolio. An independent national centre for excellence, perhaps housed in our universities would create a place where best practice can be explo ...

... Government has a view on how it wants infrastructure investments to operate and investors have a view on how infrastructure investments will fit in their portfolio. An independent national centre for excellence, perhaps housed in our universities would create a place where best practice can be explo ...

Hedge Fund Vs Mutual Fund

... already rich. Hedge funds are open only to 'accredited investors' defined as those with net worth of more than $1.5 million, or income in excess of $200,000 in each of the past two years. The good ones demand $1 million or more of investment. ...

... already rich. Hedge funds are open only to 'accredited investors' defined as those with net worth of more than $1.5 million, or income in excess of $200,000 in each of the past two years. The good ones demand $1 million or more of investment. ...

Balance of Competencies 17.01.14

... structure of EU legislation, based much more on principle rather than prescription, should be used. We provide more detail in our response to Question 6 below. Even when legislation is effected via Regulations, there are sometimes issues as to how different Member States implement them. Such differe ...

... structure of EU legislation, based much more on principle rather than prescription, should be used. We provide more detail in our response to Question 6 below. Even when legislation is effected via Regulations, there are sometimes issues as to how different Member States implement them. Such differe ...