0538479736_265849

... Recourse is defined by the FASB as “the right of a transferee of receivables to receive payment from the transferor of those receivable for any of the following reasons: a) failure of the debtors to pay when due, b) the effects of prepayments, or c) adjustments resulting from defects in the eligibil ...

... Recourse is defined by the FASB as “the right of a transferee of receivables to receive payment from the transferor of those receivable for any of the following reasons: a) failure of the debtors to pay when due, b) the effects of prepayments, or c) adjustments resulting from defects in the eligibil ...

Survey_5e_Ch6_Lecture

... If payment is collected after the write-off, the write-off entry is reversed and the cash collection is recorded. • Assume a $5,000 account had been previously written off. ...

... If payment is collected after the write-off, the write-off entry is reversed and the cash collection is recorded. • Assume a $5,000 account had been previously written off. ...

3.01 part 2

... All cash payments are recorded in the cash payments journal A special journal used to record only cash payment transactions is called a cash payments journal Checks are the source documents for most cash payments The cash payments journal contains columns for general journal transactions, accou ...

... All cash payments are recorded in the cash payments journal A special journal used to record only cash payment transactions is called a cash payments journal Checks are the source documents for most cash payments The cash payments journal contains columns for general journal transactions, accou ...

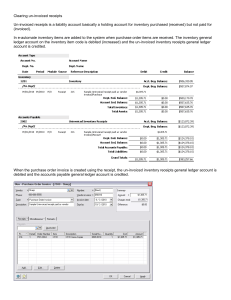

Understanding un-invoiced receipts

... If the invoice is recorded using a vendor invoice instead of a vendor purchase order invoice then the accounts payable account may appear correct but the charges used on the vendor invoice create double costs and the purchase order receipt does not get cleared out. Unfortunately, this may not be rec ...

... If the invoice is recorded using a vendor invoice instead of a vendor purchase order invoice then the accounts payable account may appear correct but the charges used on the vendor invoice create double costs and the purchase order receipt does not get cleared out. Unfortunately, this may not be rec ...

Cash Receipts Journal - McGraw Hill Higher Education

... structure is identical. Companies desire to apply accounting in an efficient manner. Accordingly, systems that employ special journals are applied worldwide. ...

... structure is identical. Companies desire to apply accounting in an efficient manner. Accordingly, systems that employ special journals are applied worldwide. ...

44)

... 1) Which of the following records the payment of the current month's rent bill for a business? A) debit to cash and a credit to rent expense B) debit to rent expense and a credit to cash C) debit to rent expense and a credit to accounts payable D) debit to accounts payable and a credit to cash 2) Re ...

... 1) Which of the following records the payment of the current month's rent bill for a business? A) debit to cash and a credit to rent expense B) debit to rent expense and a credit to cash C) debit to rent expense and a credit to accounts payable D) debit to accounts payable and a credit to cash 2) Re ...

Chapter 7 short version

... Pledge of Accounts Receivable - used as a guarantee in credit arrangements with financial institutions to receive loans-IFRS requires that pledge agreements should be disclosed in the notes to the financial statements Factoring Accounts Receivable- selling receivables to get cash before the maturity ...

... Pledge of Accounts Receivable - used as a guarantee in credit arrangements with financial institutions to receive loans-IFRS requires that pledge agreements should be disclosed in the notes to the financial statements Factoring Accounts Receivable- selling receivables to get cash before the maturity ...

Quiz Part A

... a. It is the only source in financial statements for learning about cash generation. b. Focusing on net income can be misleading if a company has a healthy profit, but cannot translate the profit into cash. c. The statement of cash flows reveals why a company was able to generate a profit. d. Both ( ...

... a. It is the only source in financial statements for learning about cash generation. b. Focusing on net income can be misleading if a company has a healthy profit, but cannot translate the profit into cash. c. The statement of cash flows reveals why a company was able to generate a profit. d. Both ( ...

Accounts and Notes Receivable

... At this point, we begin to study financial accounting topics not covered in Accounting 100. This chapter will be challenging because all material is new. Therefore, make certain to devote the proper amount of time to the course material. A receivable is an amount due from another party. Receivables ...

... At this point, we begin to study financial accounting topics not covered in Accounting 100. This chapter will be challenging because all material is new. Therefore, make certain to devote the proper amount of time to the course material. A receivable is an amount due from another party. Receivables ...

Kirk Corporation purchased $5000 worth of merchandise, terms 2/10

... Kirk Corporation purchased $5,000 worth of merchandise, terms 2/10 n/30, FOB shipping points, from the Spock Corporation on June 4. The cost of merchandise to Spock was $3,600. On June 10, Kirk returned $700 worth of goods to Spock for full credit. The goods had a cost of $450 to Spock. Kirk paid sh ...

... Kirk Corporation purchased $5,000 worth of merchandise, terms 2/10 n/30, FOB shipping points, from the Spock Corporation on June 4. The cost of merchandise to Spock was $3,600. On June 10, Kirk returned $700 worth of goods to Spock for full credit. The goods had a cost of $450 to Spock. Kirk paid sh ...

Cash Flow for Manufacturing and Wholesale Companies

... selling expenses or variable costs may even require more cash. Understanding the cash cycle of your company may assist you in making sound business decisions. Increasing inventory or accounts receivable may improve your balance sheet, but it does not generate cash to pay bills. The chairman of Citib ...

... selling expenses or variable costs may even require more cash. Understanding the cash cycle of your company may assist you in making sound business decisions. Increasing inventory or accounts receivable may improve your balance sheet, but it does not generate cash to pay bills. The chairman of Citib ...

Receivables

... This is also called the income statement approach. It is based on prior experience of the business. It is computed as a percentage of credit sales. It ignores the current balance of the allowance ...

... This is also called the income statement approach. It is based on prior experience of the business. It is computed as a percentage of credit sales. It ignores the current balance of the allowance ...

CHAPTER 7

... Interest-bearing notes have a stated rate of interest that is to be paid in addition to the face amount of the note. Zero-interest-bearing notes include interest as a part of the face amount instead of stating it explicitly. (Short-term notes are usually recorded at face value and long-term notes at ...

... Interest-bearing notes have a stated rate of interest that is to be paid in addition to the face amount of the note. Zero-interest-bearing notes include interest as a part of the face amount instead of stating it explicitly. (Short-term notes are usually recorded at face value and long-term notes at ...

Accounting for Notes Receivable

... Promissory Note-a written promise to pay a specified amount of money either on demand or at a definite future date. Promissory Notes may be used in exchange for goods or services, in exchange for loaned funds, or in exchange for an outstanding account receivable. Principal-amount stated on the face ...

... Promissory Note-a written promise to pay a specified amount of money either on demand or at a definite future date. Promissory Notes may be used in exchange for goods or services, in exchange for loaned funds, or in exchange for an outstanding account receivable. Principal-amount stated on the face ...

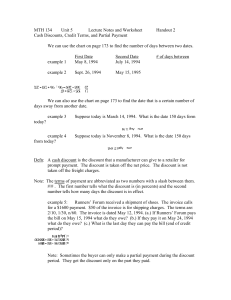

MTH 134 Unit 5 Lecture Notes and Worksheet

... Defn: A cash discount is the discount that a manufacturer can give to a retailer for prompt payment. The discount is taken off the net price. The discount is not taken off the freight charges. Note: The terms of payment are abbreviated as two numbers with a slash between them. #/# . The first number ...

... Defn: A cash discount is the discount that a manufacturer can give to a retailer for prompt payment. The discount is taken off the net price. The discount is not taken off the freight charges. Note: The terms of payment are abbreviated as two numbers with a slash between them. #/# . The first number ...

Chapter 5 The Time Value of Money

... Trade credit provides companies with many advantages: It is generally readily available, convenient, and flexible, and it usually does not entail any restrictive covenants or pledges of security. In addition, it is usually inexpensive. ...

... Trade credit provides companies with many advantages: It is generally readily available, convenient, and flexible, and it usually does not entail any restrictive covenants or pledges of security. In addition, it is usually inexpensive. ...

2138 Exam 2

... 2013, Blondie Fixtures was considering alternatives to bolster its cash position. Option One called for transferring $400,000 in accounts receivable to Dogwood Finance Company without recourse for a 5% fee. Option Two calls for Blondie to transfer the $400,000 in receivables to Dogwood with recourse ...

... 2013, Blondie Fixtures was considering alternatives to bolster its cash position. Option One called for transferring $400,000 in accounts receivable to Dogwood Finance Company without recourse for a 5% fee. Option Two calls for Blondie to transfer the $400,000 in receivables to Dogwood with recourse ...

Lecture 09 Practical Issues in Cash and Receivables: Disposition

... with unrealized holding gains or losses reported as part of net income. An unrealized holding gain or loss is the net change in the fair value of the receivable from one period to another, exclusive of interest revenue. Secured Borrowing 6. Receivables are often used as collateral in a borrowing tra ...

... with unrealized holding gains or losses reported as part of net income. An unrealized holding gain or loss is the net change in the fair value of the receivable from one period to another, exclusive of interest revenue. Secured Borrowing 6. Receivables are often used as collateral in a borrowing tra ...

Accounting for Receivables

... S.O. #1: Types of Receivables Receivables refer to ____________ due from individuals and other companies that are expected to be collected ______________. Receivables are classified as either: ___________ receivable, are amounts owed by __________ on account. These receivables are expected to be col ...

... S.O. #1: Types of Receivables Receivables refer to ____________ due from individuals and other companies that are expected to be collected ______________. Receivables are classified as either: ___________ receivable, are amounts owed by __________ on account. These receivables are expected to be col ...

LESSON 13: FACTORING – THEORETICAL FRAMEWORK

... 1. between the exporter (client) and the export factor. 2. export factor and import factor. The import factor acts as a link between export factor and the importer helps in solving the problem of legal formalities and of language. He also assumes customer trade credit risk, and agrees to collect rec ...

... 1. between the exporter (client) and the export factor. 2. export factor and import factor. The import factor acts as a link between export factor and the importer helps in solving the problem of legal formalities and of language. He also assumes customer trade credit risk, and agrees to collect rec ...

Off-Balance Sheet Financing Off-balance sheet

... Leases often require much less equity investment than bank financing. That is, banks may only lend a portion of the asset’s cost and require the borrower to make up the difference form its available cash. Leases, on the other hand, usually only require that the first lease payment be made at the i ...

... Leases often require much less equity investment than bank financing. That is, banks may only lend a portion of the asset’s cost and require the borrower to make up the difference form its available cash. Leases, on the other hand, usually only require that the first lease payment be made at the i ...

9 Ways to Increase Available Cash - Multi-SWAC

... Have a system in place to chase up slow payers. This involves ringing requesting the funds, sending statements, adding interest (see 3 above) and other ways to ensure the funds are received in terms of the credit terms applied. 5. Sell off obsolete stock at any price Obsolete stock takes up space th ...

... Have a system in place to chase up slow payers. This involves ringing requesting the funds, sending statements, adding interest (see 3 above) and other ways to ensure the funds are received in terms of the credit terms applied. 5. Sell off obsolete stock at any price Obsolete stock takes up space th ...

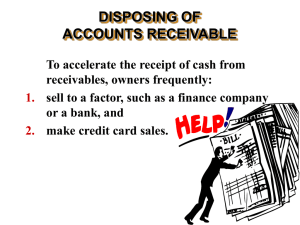

To accelerate the receipt of cash from receivables, owners frequently

... • A factor buys receivables from businesses for a fee and collects the payments directly from customers. • Credit cards are frequently used by retailers who wish to avoid the paperwork of issuing credit. • Retailers can receive cash more quickly from the credit card issuer. ...

... • A factor buys receivables from businesses for a fee and collects the payments directly from customers. • Credit cards are frequently used by retailers who wish to avoid the paperwork of issuing credit. • Retailers can receive cash more quickly from the credit card issuer. ...

answers to questions - ORU Accounting Information

... When Cain Company dishonors a note, it may: (1) issue a new note for the maturity value of the dishonored note, or (2) refuse to make any settlement, or (3) it might make partial payment and issue a new note for the unpaid balance. ...

... When Cain Company dishonors a note, it may: (1) issue a new note for the maturity value of the dishonored note, or (2) refuse to make any settlement, or (3) it might make partial payment and issue a new note for the unpaid balance. ...

Chapter 5

... The primary issues in accounting for accounts receivable are when and how to measure bad debts (i.e., accounts that will not be paid). ...

... The primary issues in accounting for accounts receivable are when and how to measure bad debts (i.e., accounts that will not be paid). ...