Chapter Outline Notes

... both unrecorded and not yet received in cash (or other assets). 2. Accrued revenues commonly result from services, products, interest, and rent. 3. Adjusting entries for recording accrued revenues involve increasing (debit) assets and increasing (credit) revenues. (The asset is a receivable.) 4. Acc ...

... both unrecorded and not yet received in cash (or other assets). 2. Accrued revenues commonly result from services, products, interest, and rent. 3. Adjusting entries for recording accrued revenues involve increasing (debit) assets and increasing (credit) revenues. (The asset is a receivable.) 4. Acc ...

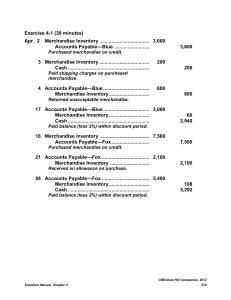

Exercise 4-1 (30 minutes) Apr. 2 Merchandise Inventory 3,600

... In today’s competitive world, organizations must concentrate on meeting their customers’ needs and avoiding dissatisfaction. If these needs are not met and dissatisfaction grows, the customers will deal with other companies or entities. One measure of dissatisfaction of customers is the amount of so ...

... In today’s competitive world, organizations must concentrate on meeting their customers’ needs and avoiding dissatisfaction. If these needs are not met and dissatisfaction grows, the customers will deal with other companies or entities. One measure of dissatisfaction of customers is the amount of so ...

PowerPoint for Chapter 19

... 10,000 × 1.01 = $10,100 for February ** It is assumed that the borrowing is done for one month at 1.5 percent interest (18﹪/12 months = 1.5﹪/ month) 2,469 × 1.015 = $2,506 for April ...

... 10,000 × 1.01 = $10,100 for February ** It is assumed that the borrowing is done for one month at 1.5 percent interest (18﹪/12 months = 1.5﹪/ month) 2,469 × 1.015 = $2,506 for April ...

Accounts Receivable

... Illustration: Assume that Higley Co. on November 1 indicates that it cannot pay at the present time. If Wolder Co. does expect eventual collection, it would make the following entry at the time the note is dishonored (assuming no previous accrual of interest). Nov. 1 Accounts receivable ...

... Illustration: Assume that Higley Co. on November 1 indicates that it cannot pay at the present time. If Wolder Co. does expect eventual collection, it would make the following entry at the time the note is dishonored (assuming no previous accrual of interest). Nov. 1 Accounts receivable ...

Accounting for Receivables

... Tasanee was the accounts receivable clerk for a large non-profit foundation that provided performance and exhibition space for the performing and visual arts. Her responsibilities included activities normally assigned to an accounts receivable clerk, such as recording revenues from various sources t ...

... Tasanee was the accounts receivable clerk for a large non-profit foundation that provided performance and exhibition space for the performing and visual arts. Her responsibilities included activities normally assigned to an accounts receivable clerk, such as recording revenues from various sources t ...

Financial Accounting and Accounting Standards

... long-term debt, and (3) compensating balances. ...

... long-term debt, and (3) compensating balances. ...

CHAPTER 02 AA Accounting for Business

... The four financial statements and their purposes are: 1. Income statement — describes a company’s revenues and expenses along with the resulting net income or loss over a period of time due to earnings activities. 2. Statement of retained earnings— explains changes in equity from net income (or loss ...

... The four financial statements and their purposes are: 1. Income statement — describes a company’s revenues and expenses along with the resulting net income or loss over a period of time due to earnings activities. 2. Statement of retained earnings— explains changes in equity from net income (or loss ...

Chapter 2 Review of the Accounting Process

... STEP 1: Obtain information about external transactions from source documents. The first objective of an accounting system is to identify the economic events that directly affect the financial position of the company. Events, or transactions, can be classified as either external events or internal ev ...

... STEP 1: Obtain information about external transactions from source documents. The first objective of an accounting system is to identify the economic events that directly affect the financial position of the company. Events, or transactions, can be classified as either external events or internal ev ...

Paper Bookkeeping - Navajo Business, Navajo Nation

... all financial transactions undertaken by a business (or an individual). A bookkeeper (or book-keeper), sometimes called an accounting clerk in the US, is a person who keeps the books of an organization. The organization might be a business, a charity or even a local sports club. Two methods are wide ...

... all financial transactions undertaken by a business (or an individual). A bookkeeper (or book-keeper), sometimes called an accounting clerk in the US, is a person who keeps the books of an organization. The organization might be a business, a charity or even a local sports club. Two methods are wide ...

Document

... 1. Determine whether an asset, a liability, owner’s equity, revenue, or expense account is affected by the transaction. 2. For each account affected by the transaction, determine whether the account increases or ...

... 1. Determine whether an asset, a liability, owner’s equity, revenue, or expense account is affected by the transaction. 2. For each account affected by the transaction, determine whether the account increases or ...

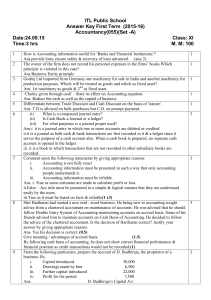

Ans key First term Acc XI

... How is Accounting information useful for ‘Banks and Financial Institutions’? Ans.provide loan; ensure safety & recovery of loan advanced. (any 2) The owner of the firm does not record his personal expenses in the firms’ books.Which principle is violated in this case? Ans.Business Entity principle Go ...

... How is Accounting information useful for ‘Banks and Financial Institutions’? Ans.provide loan; ensure safety & recovery of loan advanced. (any 2) The owner of the firm does not record his personal expenses in the firms’ books.Which principle is violated in this case? Ans.Business Entity principle Go ...

A Assets Owners Equity - Duplin County Schools

... information regarding their clients. • Accountants are expected to protect personal and private information regarding their clients. • An accountant should not use information learned for personal gain. ...

... information regarding their clients. • Accountants are expected to protect personal and private information regarding their clients. • An accountant should not use information learned for personal gain. ...

theme: cash flow - Real Life Accounting

... more detail as to the cash flow of the Operating activities. Learning how to prepare a manual Statement of Cash Flows can be a challenge, yet, once learned, will solve the mystery of where your money went. TIP: A Quick And Dirty Cash Flow Analysis Let’s face it, if you are a small business operator ...

... more detail as to the cash flow of the Operating activities. Learning how to prepare a manual Statement of Cash Flows can be a challenge, yet, once learned, will solve the mystery of where your money went. TIP: A Quick And Dirty Cash Flow Analysis Let’s face it, if you are a small business operator ...

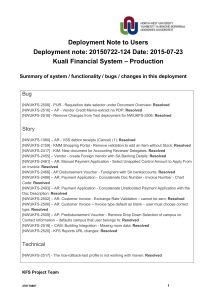

Deployment procedure

... [NWUKFS-1060] – AR - VSS debtor receipts (Cancel) (1): Resolved [NWUKFS-2159] - KMM Shopping Portal - Remove validation to add an Item without Stock: Resolved [NWUKFS-2417] - KIM: New document for Accounting Reviewer Delegates: Resolved [NWUKFS-2455] – Vendor - create Foreign Vendor with SA Banking ...

... [NWUKFS-1060] – AR - VSS debtor receipts (Cancel) (1): Resolved [NWUKFS-2159] - KMM Shopping Portal - Remove validation to add an Item without Stock: Resolved [NWUKFS-2417] - KIM: New document for Accounting Reviewer Delegates: Resolved [NWUKFS-2455] – Vendor - create Foreign Vendor with SA Banking ...

Chapter 3 Adjusting the Accounts

... At each statement date, there are adjustment entries: (1) to record the expenses that apply to the current accounting period (2) to show the unexpired costs in the assets account Example: On Jan. 1st, Phoenix Consulting paid $12,000 for 12 months of insurance coverage. Show the adjusting journal ent ...

... At each statement date, there are adjustment entries: (1) to record the expenses that apply to the current accounting period (2) to show the unexpired costs in the assets account Example: On Jan. 1st, Phoenix Consulting paid $12,000 for 12 months of insurance coverage. Show the adjusting journal ent ...

Write-off of Accounts Receivable

... Proper Cash Management • Restrictions placed on a company’s access to its cash are typically imposed by creditors to help ensure future interest and principal payments, i.e., loan or debt covenants. • Compensating balances are sometimes required • Control Record over cash, i.e., bank reconciliation ...

... Proper Cash Management • Restrictions placed on a company’s access to its cash are typically imposed by creditors to help ensure future interest and principal payments, i.e., loan or debt covenants. • Compensating balances are sometimes required • Control Record over cash, i.e., bank reconciliation ...

Course 4: Managing Cash Flow

... For large corporations with financially sound operations, cash can be obtained on the credit worthiness of the corporation; i.e. unsecured financing. Smaller organizations can sometimes obtain unsecured financing, but costs are often much higher than secured financing. For large corporations in the ...

... For large corporations with financially sound operations, cash can be obtained on the credit worthiness of the corporation; i.e. unsecured financing. Smaller organizations can sometimes obtain unsecured financing, but costs are often much higher than secured financing. For large corporations in the ...

Sales Transaction Assertions

... recording cash receipts from one customer and covers the shortage with receipts from another customer. It can be detected by comparing the name, amount, and dates shown on remittance advices with cash receipts journal entries and related duplicate deposit slips. Dishonest Employee ...

... recording cash receipts from one customer and covers the shortage with receipts from another customer. It can be detected by comparing the name, amount, and dates shown on remittance advices with cash receipts journal entries and related duplicate deposit slips. Dishonest Employee ...

Chapter 3

... Section 117 of the 1976 United States Copyright Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. The purchaser may make back-up copies for his/her own use only and ...

... Section 117 of the 1976 United States Copyright Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. The purchaser may make back-up copies for his/her own use only and ...

LO 2 - Wiley

... Tasanee was the accounts receivable clerk for a large non-profit foundation that provided performance and exhibition space for the performing and visual arts. Her responsibilities included activities normally assigned to an accounts receivable clerk, such as recording revenues from various sources t ...

... Tasanee was the accounts receivable clerk for a large non-profit foundation that provided performance and exhibition space for the performing and visual arts. Her responsibilities included activities normally assigned to an accounts receivable clerk, such as recording revenues from various sources t ...

answers to questions - ORU Accounting Information

... indicate how assets, liabilities, and equities have changed during the period. A current income statement provides information about the amount of cash provided or used by operations. Certain transactions provide additional detailed information needed to determine how cash was provided or used durin ...

... indicate how assets, liabilities, and equities have changed during the period. A current income statement provides information about the amount of cash provided or used by operations. Certain transactions provide additional detailed information needed to determine how cash was provided or used durin ...

Financial Accounting and Accounting Standards

... IFRS and GAAP differ in the criteria used to derecognize (generally through a sale or factoring) a receivable. IFRS is a combination of an approach focused on risks and rewards and loss of control. GAAP uses loss of control as the primary criterion. In addition, IFRS permits partial derecognition; G ...

... IFRS and GAAP differ in the criteria used to derecognize (generally through a sale or factoring) a receivable. IFRS is a combination of an approach focused on risks and rewards and loss of control. GAAP uses loss of control as the primary criterion. In addition, IFRS permits partial derecognition; G ...

Top of Form Week 4: Internal Control, Cash and Receivables

... Receivables are amounts due from customers of the company. They are located in a balance sheet account called accounts and notes receivable. The uncollected accounts create a need for funding that business can be conducted to cover a loan from a bank if its cash flow projections were too optimistic. ...

... Receivables are amounts due from customers of the company. They are located in a balance sheet account called accounts and notes receivable. The uncollected accounts create a need for funding that business can be conducted to cover a loan from a bank if its cash flow projections were too optimistic. ...

Financial Accounting and Accounting Standards

... IFRS and GAAP differ in the criteria used to derecognize (generally through a sale or factoring) a receivable. IFRS is a combination of an approach focused on risks and rewards and loss of control. GAAP uses loss of control as the primary criterion. In addition, IFRS permits partial derecognition; G ...

... IFRS and GAAP differ in the criteria used to derecognize (generally through a sale or factoring) a receivable. IFRS is a combination of an approach focused on risks and rewards and loss of control. GAAP uses loss of control as the primary criterion. In addition, IFRS permits partial derecognition; G ...

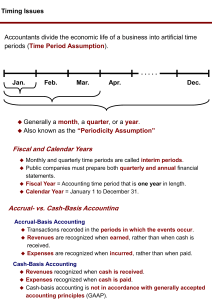

Fiscal and Calendar Years Accrual- vs. Cash

... Buildings, equipment, and vehicles (assets with long lives) are recorded as assets, rather than an expense, in the year acquired. Companies report a portion of the cost of the asset as an expense (depreciation expense) during each period of the asset’s useful life. Depreciation does not attemp ...

... Buildings, equipment, and vehicles (assets with long lives) are recorded as assets, rather than an expense, in the year acquired. Companies report a portion of the cost of the asset as an expense (depreciation expense) during each period of the asset’s useful life. Depreciation does not attemp ...