Assets = Liabilities + Owner`s Equity

... On August 25, Bengkel Agung Jaya extended an offer of Rp125,000,000 for land that had been priced for sale at Rp150,000,000. On September 3, Bengkel Agung Jaya accepted the seller’s counteroffer of Rp137,000,000. On October 20, the land was assessed at a value of Rp98,000,000 for property tax purpos ...

... On August 25, Bengkel Agung Jaya extended an offer of Rp125,000,000 for land that had been priced for sale at Rp150,000,000. On September 3, Bengkel Agung Jaya accepted the seller’s counteroffer of Rp137,000,000. On October 20, the land was assessed at a value of Rp98,000,000 for property tax purpos ...

L5-Inventories and Receivables - masif-emba-fais-s12

... Inventory errors affect the computation of cost of goods sold and net income in two periods. An error in ending inventory of the current period will have a reverse effect on net income of the next accounting period. Over the two years, the total net income is correct because the errors offset each o ...

... Inventory errors affect the computation of cost of goods sold and net income in two periods. An error in ending inventory of the current period will have a reverse effect on net income of the next accounting period. Over the two years, the total net income is correct because the errors offset each o ...

Slices - personal.kent.edu

... allows the firm to borrow up to a certain amount on a short-term basis Committed – formal legal arrangement that may require a commitment fee and generally has a floating interest rate Non-committed – informal agreement with a bank that is similar to credit card debt for individuals Revolving cr ...

... allows the firm to borrow up to a certain amount on a short-term basis Committed – formal legal arrangement that may require a commitment fee and generally has a floating interest rate Non-committed – informal agreement with a bank that is similar to credit card debt for individuals Revolving cr ...

Understanding Cooperative Bookkeeping and Financial Statements

... cash does not always occur at the same time as the business transaction. This can affect the liquidity of the cooperative or its ability to meet cash obligations. The amount of cash received by a cooperative during a given month often does not equal the amount paid, especially for seasonal businesse ...

... cash does not always occur at the same time as the business transaction. This can affect the liquidity of the cooperative or its ability to meet cash obligations. The amount of cash received by a cooperative during a given month often does not equal the amount paid, especially for seasonal businesse ...

Controlling Cash

... • D. Since source documents serve as documentation of business transactions, from time to time the validity of these documents should be checked. • E. For added protection, a company should carry both casualty insurance on assets and fidelity bonds on employees. ...

... • D. Since source documents serve as documentation of business transactions, from time to time the validity of these documents should be checked. • E. For added protection, a company should carry both casualty insurance on assets and fidelity bonds on employees. ...

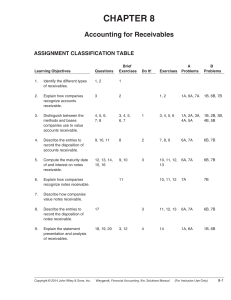

CHAPTER 8 Accounting for Receivables

... When Jana Company has dishonored a note, the ledger can set up a receivable equal to the face amount of the note plus the interest due. It will then try to collect the balance due, or as much as possible. If there is no hope of collection it will write-off the receivable. ...

... When Jana Company has dishonored a note, the ledger can set up a receivable equal to the face amount of the note plus the interest due. It will then try to collect the balance due, or as much as possible. If there is no hope of collection it will write-off the receivable. ...

Asset section of the balance sheet

... during the period of time. Expenses reports in one accounting period may actually be paid for in another accounting period. o Net income (or net earnings): the excess of total revenues over total expenses. If total expenses exceed total revenues, a net loss is reported. Net income normally does not ...

... during the period of time. Expenses reports in one accounting period may actually be paid for in another accounting period. o Net income (or net earnings): the excess of total revenues over total expenses. If total expenses exceed total revenues, a net loss is reported. Net income normally does not ...

Principles of Accounting I

... internal decision makers), tax, auditing, cost, and so forth. The importance of accounting is that it is the language of business and a basic understanding of it is necessary for almost any job in the business world. Bookkeeping should be distinguished from accounting. Bookkeeping refers to the reco ...

... internal decision makers), tax, auditing, cost, and so forth. The importance of accounting is that it is the language of business and a basic understanding of it is necessary for almost any job in the business world. Bookkeeping should be distinguished from accounting. Bookkeeping refers to the reco ...

Financial Accounting and Accounting Standards

... designers who frequently traveled together came up with a fraud scheme: They submitted claims for the same expenses. For example, if they had a meal together that cost $200, one person submitted the detailed meal bill, another submitted the credit card receipt, and a third submitted a monthly credit ...

... designers who frequently traveled together came up with a fraud scheme: They submitted claims for the same expenses. For example, if they had a meal together that cost $200, one person submitted the detailed meal bill, another submitted the credit card receipt, and a third submitted a monthly credit ...

FAP 20e Chapter 9 SM

... a. Both U.S. GAAP and IFRS have similar asset criteria that apply to recognition of receivables. Further, receivables that arise from revenuegenerating activities are subject to broadly similar criteria for U.S. GAAP and IFRS. Specifically, both refer to the realization principle and an earnings pro ...

... a. Both U.S. GAAP and IFRS have similar asset criteria that apply to recognition of receivables. Further, receivables that arise from revenuegenerating activities are subject to broadly similar criteria for U.S. GAAP and IFRS. Specifically, both refer to the realization principle and an earnings pro ...

Chap007

... Interpretation: An accounts receivable turnover of 6.2 implies that the company’s average accounts receivable balance is converted into cash 6.2 times per year. The 6.2 turnover is about 17% lower than the average turnover of 7.5 for its competitors. The company needs to identify the cause of this p ...

... Interpretation: An accounts receivable turnover of 6.2 implies that the company’s average accounts receivable balance is converted into cash 6.2 times per year. The 6.2 turnover is about 17% lower than the average turnover of 7.5 for its competitors. The company needs to identify the cause of this p ...

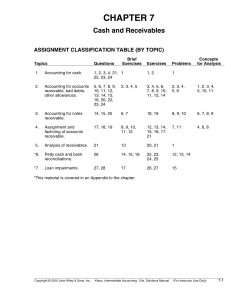

CHAPTER 7 Cash and Receivables

... Allowance for Doubtful Accounts is credited with a percentage of the current year’s credit or total sales. The rate is determined by reference to the relationship between prior years’ credit or total sales and actual bad debts arising therefrom. Consideration should also be given to changes in credi ...

... Allowance for Doubtful Accounts is credited with a percentage of the current year’s credit or total sales. The rate is determined by reference to the relationship between prior years’ credit or total sales and actual bad debts arising therefrom. Consideration should also be given to changes in credi ...

Chapter 18 Notes File - National Trail Local School District

... **Only purchases of merchandise on account are journalized in the purchases journal. --Items not recorded in the Purchases Journal: supplies, equipment, services. STEPS: Recording an entry in a purchases journal. 1. Write the date 2. Write the vendor name in the Account Credited column 3. Write the ...

... **Only purchases of merchandise on account are journalized in the purchases journal. --Items not recorded in the Purchases Journal: supplies, equipment, services. STEPS: Recording an entry in a purchases journal. 1. Write the date 2. Write the vendor name in the Account Credited column 3. Write the ...

Unit 3 – Journals and Ledgers, Keeping track of it all

... evidence of a purchase of assets or services on account 2. Sales Invoice – a source document issued by the seller when a sale is made on account Example of purchase invoice for the buyer and a sale invoice for the seller 3. Cash Sales Slip – a source document completed by the seller when the sale wa ...

... evidence of a purchase of assets or services on account 2. Sales Invoice – a source document issued by the seller when a sale is made on account Example of purchase invoice for the buyer and a sale invoice for the seller 3. Cash Sales Slip – a source document completed by the seller when the sale wa ...

notes07

... Managing and Monitoring Cash A business needs to have enough cash on hand to meet its cash needs on time (e.g., make payments when required). It is better if the cash needs are met from the company’s operations (no cost) rather than borrowing (interest cost). Company treasurers or chief financial of ...

... Managing and Monitoring Cash A business needs to have enough cash on hand to meet its cash needs on time (e.g., make payments when required). It is better if the cash needs are met from the company’s operations (no cost) rather than borrowing (interest cost). Company treasurers or chief financial of ...

1. Paid rent for the next three months. 2. Paid property taxes that

... 8. Account does not appear in either the balance sheet or the income statement. ...

... 8. Account does not appear in either the balance sheet or the income statement. ...

chapter 6 solutions version 1

... handling of cash from the accounting function, (d) deposit all cash receipts daily and make all cash payments by check, (e) require separate approval of all checks and electronic funds transfers, and (f) require monthly reconciliation of bank accounts. ...

... handling of cash from the accounting function, (d) deposit all cash receipts daily and make all cash payments by check, (e) require separate approval of all checks and electronic funds transfers, and (f) require monthly reconciliation of bank accounts. ...

Chapter 7

... translation of this work beyond that permitted in Section 117 of the 1976 United States Copyright Act without the express written consent of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. The purchaser may m ...

... translation of this work beyond that permitted in Section 117 of the 1976 United States Copyright Act without the express written consent of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. The purchaser may m ...

CHAPTER 7

... On 31 May 2003 the following information appeared in the books of Nessel and Rode: Balance of Accounts Receivable Control account$5478 Total of schedule of debtors$2896 Balance of Accounts Payable Control account$7368 Total of schedule of creditors$4034 Because the schedules and control account bala ...

... On 31 May 2003 the following information appeared in the books of Nessel and Rode: Balance of Accounts Receivable Control account$5478 Total of schedule of debtors$2896 Balance of Accounts Payable Control account$7368 Total of schedule of creditors$4034 Because the schedules and control account bala ...

Statement of Cash Flows Statement of Cash Flows

... If cash is not involved in a significant change in the Land account (such as purchase of land for a long-term note payable), this information can be reported in an accompanying schedule or report or at the end of the statement of cash flows in a section called ‘Significant noncash transactions.’ ...

... If cash is not involved in a significant change in the Land account (such as purchase of land for a long-term note payable), this information can be reported in an accompanying schedule or report or at the end of the statement of cash flows in a section called ‘Significant noncash transactions.’ ...

11.1 Subsidiary Ledger Systems

... 9. What types of accounts are found in the main ledger? All types except for individual customers'’ or creditors’ accounts 10. Give the names of the two accounts in the main ledger that replace the accounts of customers and trade creditors. Accounts Receivable Control account and Accounts Payable C ...

... 9. What types of accounts are found in the main ledger? All types except for individual customers'’ or creditors’ accounts 10. Give the names of the two accounts in the main ledger that replace the accounts of customers and trade creditors. Accounts Receivable Control account and Accounts Payable C ...

UNIVERSITY OF WATERLOO School of Accounting and Finance

... Provide the journal entries required to record the following transactions that occurred in October 2008. You do not need to include explanations. Answers must appear in the space provided. A) The company sold an old truck which had an original cost of $45,000. The accumulated amortization on the tru ...

... Provide the journal entries required to record the following transactions that occurred in October 2008. You do not need to include explanations. Answers must appear in the space provided. A) The company sold an old truck which had an original cost of $45,000. The accumulated amortization on the tru ...

Principles-of-Financial-Accounting-11th-Edition

... what they have learned about debits and credits. Finally, explain the beauty of the double-entry system. Students need to know that transactions are not recorded in T accounts in practice, but T accounts are used by accountants to analyze complex transactions. Memorization and repetition are the key ...

... what they have learned about debits and credits. Finally, explain the beauty of the double-entry system. Students need to know that transactions are not recorded in T accounts in practice, but T accounts are used by accountants to analyze complex transactions. Memorization and repetition are the key ...