A Closer Look

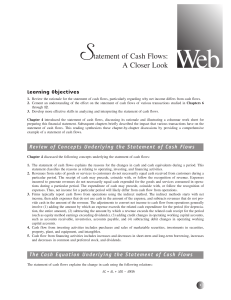

... 1. The statement of cash flows explains the reasons for the changes in cash and cash equivalents during a period. This statement classifies the reasons as relating to operating, investing, and financing activities. 2. Revenues from sales of goods or services to customers do not necessarily equal cas ...

... 1. The statement of cash flows explains the reasons for the changes in cash and cash equivalents during a period. This statement classifies the reasons as relating to operating, investing, and financing activities. 2. Revenues from sales of goods or services to customers do not necessarily equal cas ...

download

... If payment is made by March 22, SolusiNet records the discount as a reduction in cost. Notice that Merchandise Inventory is credited because NetSolutions maintains a perpetual inventory. ...

... If payment is made by March 22, SolusiNet records the discount as a reduction in cost. Notice that Merchandise Inventory is credited because NetSolutions maintains a perpetual inventory. ...

accounting process - ICAI Knowledge Gateway

... or liability. On the other hand, if the loan is repayable within 4 or 5 years or more, it would be termed as long term loan or liability. Some other short-term liabilities relating to credit purchase of merchandise are popularly called as trade payables, and for other purchases and services received ...

... or liability. On the other hand, if the loan is repayable within 4 or 5 years or more, it would be termed as long term loan or liability. Some other short-term liabilities relating to credit purchase of merchandise are popularly called as trade payables, and for other purchases and services received ...

Equity $10000 Land $84000 Notes Payable $10000

... – Each asset, liability and equity item is represented by an account – Flexibility in the names given to accounts. – Each account has two sides • just like the Balance Sheet • Left-hand side is the debit side • Right-hand side is the credit side ...

... – Each asset, liability and equity item is represented by an account – Flexibility in the names given to accounts. – Each account has two sides • just like the Balance Sheet • Left-hand side is the debit side • Right-hand side is the credit side ...

Download attachment

... assessing the amounts, timing, and uncertainty of prospective cash receipts from dividends or interest and the proceeds from the sale, redemption, or maturity of securities or loans. The prospects for those cash receipts are affected by an enterprise's ability to generate enough cash to meet its obl ...

... assessing the amounts, timing, and uncertainty of prospective cash receipts from dividends or interest and the proceeds from the sale, redemption, or maturity of securities or loans. The prospects for those cash receipts are affected by an enterprise's ability to generate enough cash to meet its obl ...

chapter 10—statement of cash flows

... 11. Cash flow per share is a better indication of a firm's ability to make capital expenditure decisions and pay dividends than is earnings per share. ANS: T 12. Cash flow per share can be viewed as a substitute for earnings per share in terms of a firm's profitability. ANS: F 13. The statement of c ...

... 11. Cash flow per share is a better indication of a firm's ability to make capital expenditure decisions and pay dividends than is earnings per share. ANS: T 12. Cash flow per share can be viewed as a substitute for earnings per share in terms of a firm's profitability. ANS: F 13. The statement of c ...

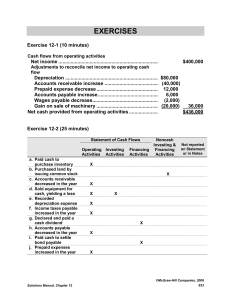

Net Cash Flow from Operating Activities

... Statement of Cash Flows / Cash Flow Statement A statement of cash flows is a financial statement which summarizes cash transactions of a business during a given accounting period and classifies them under three heads, namely, cash flows from operating, investing and financing activities. It shows ho ...

... Statement of Cash Flows / Cash Flow Statement A statement of cash flows is a financial statement which summarizes cash transactions of a business during a given accounting period and classifies them under three heads, namely, cash flows from operating, investing and financing activities. It shows ho ...

TRUE/FALSE. Write `T` if the statement is true and `F` if the statement

... and a $1,020 credit to Cash. B) The accounting entry would be a $1,000 debit to Accounts Payable, a $20 credit to Inventory and a $980 credit to Cash. C) The accounting entry would be a $980 debit to Accounts Payable, a $20 debit to Inventory and a $1,000 credit to Cash. D) The accounting entry woul ...

... and a $1,020 credit to Cash. B) The accounting entry would be a $1,000 debit to Accounts Payable, a $20 credit to Inventory and a $980 credit to Cash. C) The accounting entry would be a $980 debit to Accounts Payable, a $20 debit to Inventory and a $1,000 credit to Cash. D) The accounting entry woul ...

CASH MANAGEMENT PROCEDURES FOR NED GRANTEES

... reimbursements to employees for expenses. Expenditures are summarized in NED quarterly financial reports. For organizations performing currency exchanges (for example, transferring dollars into local currency), procedures detailed in Attachment E, Currency Exchange and Reporting Procedures, should b ...

... reimbursements to employees for expenses. Expenditures are summarized in NED quarterly financial reports. For organizations performing currency exchanges (for example, transferring dollars into local currency), procedures detailed in Attachment E, Currency Exchange and Reporting Procedures, should b ...

cash flows

... Flows: Classifying Inflows and Outflows of Cash The statement of cash flows essentially summarizes the inflows and outflows of cash during a given period as shown in the following slide (Table 3.3) 1- Decrease/increase in any asset: (difficult for many to grasp (focus on the movement of funds in and ...

... Flows: Classifying Inflows and Outflows of Cash The statement of cash flows essentially summarizes the inflows and outflows of cash during a given period as shown in the following slide (Table 3.3) 1- Decrease/increase in any asset: (difficult for many to grasp (focus on the movement of funds in and ...

Revenue recognition: determinants of the accounts receivable and

... The recognition of economic events in accounting revenues tends to lag that of the market. An informed market recognizes the effects of economic events when they occur, but revenue recognition must await compliance with formal accounting recognition criteria. The application of these criteria involv ...

... The recognition of economic events in accounting revenues tends to lag that of the market. An informed market recognizes the effects of economic events when they occur, but revenue recognition must await compliance with formal accounting recognition criteria. The application of these criteria involv ...

Introduction to Accounting

... services are rendered it is immaterial whether cash is received or not. • Same with the expenses i.e. they are recorded in the accounting period in which they assist in earning the revenues whether the cash is paid for them or not. ...

... services are rendered it is immaterial whether cash is received or not. • Same with the expenses i.e. they are recorded in the accounting period in which they assist in earning the revenues whether the cash is paid for them or not. ...

JOURNAL

... If you match the first two simple entries with the converted compound entry, you will find that there is no difference between them so far as the accounting effect is concerned. The compound entries save time and space. Such compound entries are made in the following cases: (a) When two or more tran ...

... If you match the first two simple entries with the converted compound entry, you will find that there is no difference between them so far as the accounting effect is concerned. The compound entries save time and space. Such compound entries are made in the following cases: (a) When two or more tran ...

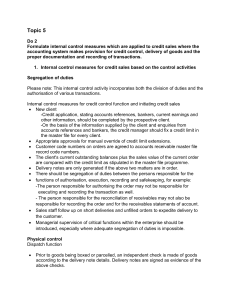

Do 3 - Together We Pass

... use of cash registers for handling cash sales. 1. Internal control measures that normally exist when cash registers are used in the handling of cash sales (1) Cash registers must display the amount of the cash sales on a screen which is visible to the client and/or print out an invoice (slip) showin ...

... use of cash registers for handling cash sales. 1. Internal control measures that normally exist when cash registers are used in the handling of cash sales (1) Cash registers must display the amount of the cash sales on a screen which is visible to the client and/or print out an invoice (slip) showin ...

Step 1: Determine what the current account

... For each separate case below, follow the three-step process for adjusting the unearned revenue liability account. Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record an adjusting entry to get from step 1 to step 2 ...

... For each separate case below, follow the three-step process for adjusting the unearned revenue liability account. Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record an adjusting entry to get from step 1 to step 2 ...

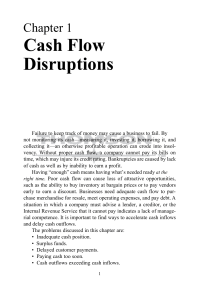

Cash Flow Disruptions

... sum of the fixed costs of transactions and the opportunity cost of holding cash balances. ...

... sum of the fixed costs of transactions and the opportunity cost of holding cash balances. ...

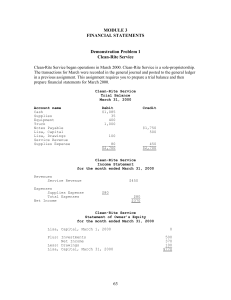

Homework Disk: Assignment 9

... Hoffman Consulting Inc. started operations in October 2000. The transactions for October were recorded in the general journal and posted to the general ledger in a previous assignment. Hoffman Consulting Inc. is organized as a corporation. This assignment requires you to prepare a trial balance and ...

... Hoffman Consulting Inc. started operations in October 2000. The transactions for October were recorded in the general journal and posted to the general ledger in a previous assignment. Hoffman Consulting Inc. is organized as a corporation. This assignment requires you to prepare a trial balance and ...

Accounting 20 Module 4 Lesson 17 Lesson 17

... This method of estimating the bad debts expense determines the amount required in the Allowance for Bad Debts. As well, this method is a process of analyzing accounts receivable by classifying the amounts owed according to the length of time they are overdue. When the schedule is prepared, the amoun ...

... This method of estimating the bad debts expense determines the amount required in the Allowance for Bad Debts. As well, this method is a process of analyzing accounts receivable by classifying the amounts owed according to the length of time they are overdue. When the schedule is prepared, the amoun ...

forms of business organization

... How is internal control used to secure cash receipts? How is internal control used to prevent theft when issuing cash disbursements? List the steps in preparing a bank ...

... How is internal control used to secure cash receipts? How is internal control used to prevent theft when issuing cash disbursements? List the steps in preparing a bank ...

Cash flows from operating activities

... Cash flows from financing activities Cash received from issuing stock.............................. Cash received from borrowing ................................... Cash paid for note payable ......................................... Cash paid for dividends .......................................... ...

... Cash flows from financing activities Cash received from issuing stock.............................. Cash received from borrowing ................................... Cash paid for note payable ......................................... Cash paid for dividends .......................................... ...

cash flow statement

... • Profit represents the increase in net assets in a business during an accounting period. • This increase can be in : ---Cash ---Non-current assets ---Receivables ---Inventory ...

... • Profit represents the increase in net assets in a business during an accounting period. • This increase can be in : ---Cash ---Non-current assets ---Receivables ---Inventory ...

Debits and Credits: Analyzing and Recording Business Transactions

... Mia Wong, Capital. These account titles come from the chart of accounts. Step 2 Which categories do these accounts belong to? Cash and Office Equipment are assets. Mia Wong, Capital, is capital. Step 3 Are the accounts increasing or decreasing? The Cash and Office Equipment, both assets, are increas ...

... Mia Wong, Capital. These account titles come from the chart of accounts. Step 2 Which categories do these accounts belong to? Cash and Office Equipment are assets. Mia Wong, Capital, is capital. Step 3 Are the accounts increasing or decreasing? The Cash and Office Equipment, both assets, are increas ...