List of supporting documents

... - In case of external travels – travel report approved by the Head of the beneficiary organisation; - Invoice for accommodation; - Proof for the collection of the daily allowance; - Proof for the payment of the participation fee (if applicable); - Proof for the payment of the medical insurance; - St ...

... - In case of external travels – travel report approved by the Head of the beneficiary organisation; - Invoice for accommodation; - Proof for the collection of the daily allowance; - Proof for the payment of the participation fee (if applicable); - Proof for the payment of the medical insurance; - St ...

U3.3 Working Capital

... party, i.e. a financial lender. The finance company pays the retailer (and charges the retailer a small fee for the service) and charges the customer at a later date. Since credit improves flexibility (customers do not need to carry so much cash with them) and allows customers to buy now but to post ...

... party, i.e. a financial lender. The finance company pays the retailer (and charges the retailer a small fee for the service) and charges the customer at a later date. Since credit improves flexibility (customers do not need to carry so much cash with them) and allows customers to buy now but to post ...

Chapter 7

... A subsidiary ledger is a group of accounts with a common characteristic, such as customer accounts. The subsidiary ledger is assembled to facilitate the recording process by freeing the general ledger from details concerning individual balances. Two common subsidiary ledgers are the Accounts Receiva ...

... A subsidiary ledger is a group of accounts with a common characteristic, such as customer accounts. The subsidiary ledger is assembled to facilitate the recording process by freeing the general ledger from details concerning individual balances. Two common subsidiary ledgers are the Accounts Receiva ...

Financial Statements Basics - Duke`s Fuqua School of Business

... decrease in a liability or equity account. A credit implies the opposite: a decrease to an asset account and an increase in a liability or equity account. So, for example, if you debit Cash and credit Bank borrowings, what does this mean you did? Journal entry: Cash (Dr) Bank borrowings (Cr) ...

... decrease in a liability or equity account. A credit implies the opposite: a decrease to an asset account and an increase in a liability or equity account. So, for example, if you debit Cash and credit Bank borrowings, what does this mean you did? Journal entry: Cash (Dr) Bank borrowings (Cr) ...

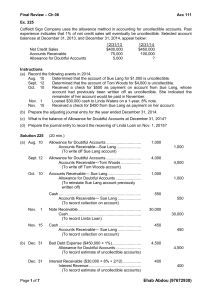

Final Review – Ch 08 Acc 111 Ex. 225 Coffeldt Sign Company uses

... Kosko Furniture Store has credit sales of $400,000 in 2014 and a debit balance of $600 in the Allowance for Doubtful Accounts at year end. As of December 31, 2014, $130,000 of accounts receivable remain uncollected. The credit manager prepared an aging schedule of accounts receivable and estimates t ...

... Kosko Furniture Store has credit sales of $400,000 in 2014 and a debit balance of $600 in the Allowance for Doubtful Accounts at year end. As of December 31, 2014, $130,000 of accounts receivable remain uncollected. The credit manager prepared an aging schedule of accounts receivable and estimates t ...

Apollo Revenue Cycle Flowchart

... balances and other credit file information using a computer-based inquiry system. If credit is approved, the credit manager signs the sales order. If credit is not approved, the customer is asked to pay in advance, and the sales order is held until notification of payment is received from the cashie ...

... balances and other credit file information using a computer-based inquiry system. If credit is approved, the credit manager signs the sales order. If credit is not approved, the customer is asked to pay in advance, and the sales order is held until notification of payment is received from the cashie ...

PART A - Chabot College

... Capital represents the owner's investment, or equity, in a business. ...

... Capital represents the owner's investment, or equity, in a business. ...

Chapter 4 Instructor

... sold for more or less than the amounts at which they are carried on the balance sheet. In such cases a gain (if a credit) or loss (if a debit) must be recognized. Ex: Land that cost $10,000 is sold for $11,000 cash. Prepare the GJE: Cash ...

... sold for more or less than the amounts at which they are carried on the balance sheet. In such cases a gain (if a credit) or loss (if a debit) must be recognized. Ex: Land that cost $10,000 is sold for $11,000 cash. Prepare the GJE: Cash ...

Appendix 1 Job Description

... Maintain documented processes on all aspects of the Sales Ledger function; Train staff on the Sales Ledger processes that they are required to carry out; ...

... Maintain documented processes on all aspects of the Sales Ledger function; Train staff on the Sales Ledger processes that they are required to carry out; ...

Cash Flow Forecast Worksheet - 4

... involves looking ahead to when you believe cash is flowing into your business, and when it needs to flow out. Review your cash flow forecast once a week. This worksheet is a template to help you determine the cash flow for your business. ...

... involves looking ahead to when you believe cash is flowing into your business, and when it needs to flow out. Review your cash flow forecast once a week. This worksheet is a template to help you determine the cash flow for your business. ...

Bad debt - Get Through Guides

... income statement and how the closing balance of the allowance should appear in the SOFP. Account for contras between trade receivables and payables. Prepare ,reconcile and understand the purpose of supplier statements. Classify items as current or non-current liabilities in the SOFP. ...

... income statement and how the closing balance of the allowance should appear in the SOFP. Account for contras between trade receivables and payables. Prepare ,reconcile and understand the purpose of supplier statements. Classify items as current or non-current liabilities in the SOFP. ...

Week 5 Horngren, Chapter 8, Accounting Information

... people to whom they have given credit. This is done in the Accounts Receivable Subsidiary Ledger. So when entries are made in the sales journal the individual accounts are updated in the subsidiary ledger on a daily basis. Note the posting references and entries in the subsidiary ledger in Exhibit 8 ...

... people to whom they have given credit. This is done in the Accounts Receivable Subsidiary Ledger. So when entries are made in the sales journal the individual accounts are updated in the subsidiary ledger on a daily basis. Note the posting references and entries in the subsidiary ledger in Exhibit 8 ...

ACCT 2301 PP Ch 7

... Expense Recording Bad Debts Expense (under the allowance method) At the end of its first year of operations, Barton Co. estimates that $3,000 of its accounts receivable will prove uncollectible. The total accounts receivable balance at December 31, 2013, is $278,000. We report our Accounts Receivabl ...

... Expense Recording Bad Debts Expense (under the allowance method) At the end of its first year of operations, Barton Co. estimates that $3,000 of its accounts receivable will prove uncollectible. The total accounts receivable balance at December 31, 2013, is $278,000. We report our Accounts Receivabl ...

Preview Sample 3

... Problem A - VI — Multiple-Step Income Statement (15 points) Below is a partial listing of the adjusted account balances of Larson Department Store at yearend on December 31, 2017. ...

... Problem A - VI — Multiple-Step Income Statement (15 points) Below is a partial listing of the adjusted account balances of Larson Department Store at yearend on December 31, 2017. ...

Adjusting Entries

... before they are used – When the cost is incurred, an asset (prepaid) is increased (debited) to show the future service or benefit, and cash is decreased ...

... before they are used – When the cost is incurred, an asset (prepaid) is increased (debited) to show the future service or benefit, and cash is decreased ...

Chapter 6: Highlights

... Under the accrual basis of measuring income, firms recognize revenue when (a) all, or a substantial portion, of the services expected to be provided have been performed, and (b) cash, or another asset whose cash equivalent value a firm can measure objectively, has been received. Satisfying the first ...

... Under the accrual basis of measuring income, firms recognize revenue when (a) all, or a substantial portion, of the services expected to be provided have been performed, and (b) cash, or another asset whose cash equivalent value a firm can measure objectively, has been received. Satisfying the first ...

bookkeeping: flow of information

... Correct any discrepancies in the trial balance. If the columns are not in balance, look for the math errors. While unbalancing columns indicate a recording error, note that balanced columns do not guarantee that there are no errors. For example, not recording a transaction or recording it in the wro ...

... Correct any discrepancies in the trial balance. If the columns are not in balance, look for the math errors. While unbalancing columns indicate a recording error, note that balanced columns do not guarantee that there are no errors. For example, not recording a transaction or recording it in the wro ...

Year 12 accounting term 2 internal controls

... adjustment/credit note certifies that a sales return or allowance has occurred. As well, statements of account should be sent at regular intervals to accounts receivable so that cash from these credit sales is collected as soon as possible. A statement of account is simply a list of the transactions ...

... adjustment/credit note certifies that a sales return or allowance has occurred. As well, statements of account should be sent at regular intervals to accounts receivable so that cash from these credit sales is collected as soon as possible. A statement of account is simply a list of the transactions ...

download

... Consumer Receivable factoring is the sale of accounts receivables (where services were delivered or goods were sold to consumers) for cash at a discount, without credit insurance. Define Factoring of Accounts Receivable - Full Recourse Full-Recourse factoring is the sale of accounts receivables for ...

... Consumer Receivable factoring is the sale of accounts receivables (where services were delivered or goods were sold to consumers) for cash at a discount, without credit insurance. Define Factoring of Accounts Receivable - Full Recourse Full-Recourse factoring is the sale of accounts receivables for ...

Test 1 Answers

... c. capital stock account d. revenue 5. A debit may signify a(n): a. decrease in asset accounts b. decrease in liability accounts c. increase in the capital stock account d. decrease in dividends account 6. Which of the following applications of the rules of debit and credit is true? a. decrease Prep ...

... c. capital stock account d. revenue 5. A debit may signify a(n): a. decrease in asset accounts b. decrease in liability accounts c. increase in the capital stock account d. decrease in dividends account 6. Which of the following applications of the rules of debit and credit is true? a. decrease Prep ...

[COURSE NAME] [~~~]

... examination booklet by giving the number of your choice. For example, if (1) is the best answer for item (a), write (a)(1) in your examination booklet. If more than one answer is given for an item, that item will not be marked. Incorrect answers will be marked as zero. No account will be taken of an ...

... examination booklet by giving the number of your choice. For example, if (1) is the best answer for item (a), write (a)(1) in your examination booklet. If more than one answer is given for an item, that item will not be marked. Incorrect answers will be marked as zero. No account will be taken of an ...

and Accounts Receivable Methods Percent of

... sale to the credit card company and waits for the payment that is received on July 28. Jul. 16 Accounts Receivable - Credit Card Co. Credit Card Expense Sales ...

... sale to the credit card company and waits for the payment that is received on July 28. Jul. 16 Accounts Receivable - Credit Card Co. Credit Card Expense Sales ...

SHORT TERM FINANCIAL MANAGEMENT

... Short-term financial decisions generally involve short-lived assets and liabilities, and are usually easily reversed. Most of short-term financial planning focuses on variation in working capital. Working capital policy involves the management of the current assets of the firm and the acquisition of ...

... Short-term financial decisions generally involve short-lived assets and liabilities, and are usually easily reversed. Most of short-term financial planning focuses on variation in working capital. Working capital policy involves the management of the current assets of the firm and the acquisition of ...

![[COURSE NAME] [~~~]](http://s1.studyres.com/store/data/016690036_1-a0e3386a320b08f14eef7bebe0343d5c-300x300.png)