Special Journals and Vouchers

... Relatively large organizations ordinarily provide for the control of purchases and cash disbursements through adoption of some form of a voucher system. With the use of a voucher system, checks may be drawn only upon a written authorization in the form of a voucher approved by some responsible offic ...

... Relatively large organizations ordinarily provide for the control of purchases and cash disbursements through adoption of some form of a voucher system. With the use of a voucher system, checks may be drawn only upon a written authorization in the form of a voucher approved by some responsible offic ...

Opening vignette

... transaction processing, rather than on using the information for decisions. b. Use EDGAR to find the Form 10-K that VISA Inc. filed with the SEC on 21 November 2008. What AIS outputs are included in that filing? The 10-K itself could be considered an output of the AIS. It includes the following item ...

... transaction processing, rather than on using the information for decisions. b. Use EDGAR to find the Form 10-K that VISA Inc. filed with the SEC on 21 November 2008. What AIS outputs are included in that filing? The 10-K itself could be considered an output of the AIS. It includes the following item ...

English Glossary

... the original amount of a note; sometimes referred to as face amount of a a written and signed promise to pay a sum of money at a specified time. ...

... the original amount of a note; sometimes referred to as face amount of a a written and signed promise to pay a sum of money at a specified time. ...

Financial Accounting

... A sole proprietor’s owner’s equity balance was $10,000 at the beginning of the year and was $22,000 at the end of the year. During the year the owner invested $5,000 in the business and had withdrawn $24,000 for personal use. The sole proprietorship’s net income for the year was $ ...

... A sole proprietor’s owner’s equity balance was $10,000 at the beginning of the year and was $22,000 at the end of the year. During the year the owner invested $5,000 in the business and had withdrawn $24,000 for personal use. The sole proprietorship’s net income for the year was $ ...

Basics Of Accounting

... 2. Trading Account –Is an account which gives you the result that is(Gross Profit or Gross Loss) from buying & selling of goods. 3. Profit & Loss A/c –Is an account which gives you the result that is (Net Profit or Net Loss)from the transaction during certain. 4. Balance Sheet -It is a statement whi ...

... 2. Trading Account –Is an account which gives you the result that is(Gross Profit or Gross Loss) from buying & selling of goods. 3. Profit & Loss A/c –Is an account which gives you the result that is (Net Profit or Net Loss)from the transaction during certain. 4. Balance Sheet -It is a statement whi ...

Document

... books by crediting accounts receivable and reducing the amount we have set aside as an allowance by debiting the allowance for doubtful accounts. The effect – assuming that the uncollected accounts receivable is not larger than the allowance for doubtful accounts – is that net accounts receivable do ...

... books by crediting accounts receivable and reducing the amount we have set aside as an allowance by debiting the allowance for doubtful accounts. The effect – assuming that the uncollected accounts receivable is not larger than the allowance for doubtful accounts – is that net accounts receivable do ...

BRIEF EXERCISE 8-1 (a) Other receivables. (b) Notes receivable. (c

... Receivables are claims that are expected to be collected in cash. Receivables represent one of a company’s most liquid assets. Receivables are frequently classified as: Accounts receivable: Are amounts customers owe on account. Result from the sale of goods and services (often called tra ...

... Receivables are claims that are expected to be collected in cash. Receivables represent one of a company’s most liquid assets. Receivables are frequently classified as: Accounts receivable: Are amounts customers owe on account. Result from the sale of goods and services (often called tra ...

Cash discount

... A buys goods from B, on the understanding that A will be allowed a period of credit before having to pay for the goods. The terms of the transaction are as follows. • Date of sale: 1 July 20X6 • Credit period allowed: 30 days • Invoice price of the goods: $2,000 • Discount offered: 4% for prompt pay ...

... A buys goods from B, on the understanding that A will be allowed a period of credit before having to pay for the goods. The terms of the transaction are as follows. • Date of sale: 1 July 20X6 • Credit period allowed: 30 days • Invoice price of the goods: $2,000 • Discount offered: 4% for prompt pay ...

Q2) sea company had the following transactions :

... 1. ( ) Reliability of information means that the information is free of error and bias. 2. ( ) The economic entity assumption states that the economic life of a business can be divided into artificial time periods 3. ( ) The full disclosure principle requires that circumstances and events that make ...

... 1. ( ) Reliability of information means that the information is free of error and bias. 2. ( ) The economic entity assumption states that the economic life of a business can be divided into artificial time periods 3. ( ) The full disclosure principle requires that circumstances and events that make ...

Internal Controls - Trans

... Management should require regular monthly reports on the financial status of the organization. ...

... Management should require regular monthly reports on the financial status of the organization. ...

BUS 203 Business Financial Mgt_Spring 2006_1st Part

... credit sales less returns, discounts and rebates. • COGS - Cost of Goods Sold - the total cost of products sold (retail) plus the cost of delivery. For manufacturing it is everything that it costs to make and deliver it. • Gross Profit - Profit before expenses and ...

... credit sales less returns, discounts and rebates. • COGS - Cost of Goods Sold - the total cost of products sold (retail) plus the cost of delivery. For manufacturing it is everything that it costs to make and deliver it. • Gross Profit - Profit before expenses and ...

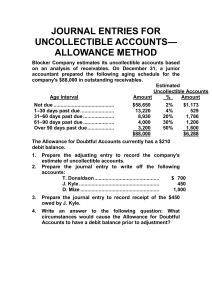

download

... circumstances would cause the Allowance for Doubtful Accounts to have a debit balance prior to adjustment? The actual amount of uncollectible accounts written off in the prior accounting period was greater than the estimate used to record the adjusting entry for bad debts. ...

... circumstances would cause the Allowance for Doubtful Accounts to have a debit balance prior to adjustment? The actual amount of uncollectible accounts written off in the prior accounting period was greater than the estimate used to record the adjusting entry for bad debts. ...

Is the accounting equation in balance?

... transactions and will be paid with assets or services. Entities that a company owes money to are called creditors. ...

... transactions and will be paid with assets or services. Entities that a company owes money to are called creditors. ...

Chapter 8 Working Capital Management

... • Liquidity is the ability of the company to satisfy its short-term obligations using assets that are readily converted into cash. • Liquidity management is the ability of the company to generate cash when and where needed. • Liquidity management requires addressing drags and pulls on liquidity. - D ...

... • Liquidity is the ability of the company to satisfy its short-term obligations using assets that are readily converted into cash. • Liquidity management is the ability of the company to generate cash when and where needed. • Liquidity management requires addressing drags and pulls on liquidity. - D ...

information bulletin

... The role is based out of the EHF Office in Brussels, but involves extensive travel across Europe. ...

... The role is based out of the EHF Office in Brussels, but involves extensive travel across Europe. ...

Chapter 19

... • Trading or order costs • Costs related to safety reserves, i.e., lost sales and customers and production stoppages ...

... • Trading or order costs • Costs related to safety reserves, i.e., lost sales and customers and production stoppages ...

Baseline Assessment Date

... 2. To determine that the ledger is in balance and to reduce the balances of the revenue, expense, and withdrawal accounts to zero. 3. To update the balance of the owner's capital account and to return the balances of the revenue, expense, and withdrawal accounts to zero. 4. To update the balances of ...

... 2. To determine that the ledger is in balance and to reduce the balances of the revenue, expense, and withdrawal accounts to zero. 3. To update the balance of the owner's capital account and to return the balances of the revenue, expense, and withdrawal accounts to zero. 4. To update the balances of ...

Glosarry of Business Terms

... Accrued expenses, accruals ‐‐ an expense which has been incurred but not yet paid for. Salaries are a good example. Employees earn or accrue salaries each hour they work. The salaries continue to accrue until payday when the accrued expense of the salaries is eliminated. Aging ‐‐ a process where acc ...

... Accrued expenses, accruals ‐‐ an expense which has been incurred but not yet paid for. Salaries are a good example. Employees earn or accrue salaries each hour they work. The salaries continue to accrue until payday when the accrued expense of the salaries is eliminated. Aging ‐‐ a process where acc ...

Chapter Four

... BRIEF EXERCISE 4-3 PG 193 EXERCISE 4-4 PG 197 E4-6, 4-7 4-8 PG 197 INTERNAL CONTROL ...

... BRIEF EXERCISE 4-3 PG 193 EXERCISE 4-4 PG 197 E4-6, 4-7 4-8 PG 197 INTERNAL CONTROL ...

1. Recognizing accounts receivable. 2. Valuing accounts receivable

... • The required balance in the allowance account is determined by applying the percentage to the accounts receivable balance at the end of the current period. • The amount of the adjusting entry to record expected bad debt losses for the current period is the difference between the required balance a ...

... • The required balance in the allowance account is determined by applying the percentage to the accounts receivable balance at the end of the current period. • The amount of the adjusting entry to record expected bad debt losses for the current period is the difference between the required balance a ...

Valuing Accounts Receivable

... Valuing receivables involves reporting them at their net realizable value. Net realizable value is the amount expected to be received in cash. Credit losses are considered a normal and necessary risk of doing business on a credit basis. Credit losses are debited to Bad Debts Expense. The key i ...

... Valuing receivables involves reporting them at their net realizable value. Net realizable value is the amount expected to be received in cash. Credit losses are considered a normal and necessary risk of doing business on a credit basis. Credit losses are debited to Bad Debts Expense. The key i ...

Chapter Outline Notes

... the fee), credit Sales (for the full invoice amount). f. Entry if company must remit the credit card sales receipts to the credit card company and wait for the cash payment: debit Accounts Receivable (for full invoice less the fee), debit Credit Card Expense (for the fee), credit Sales. Entry when p ...

... the fee), credit Sales (for the full invoice amount). f. Entry if company must remit the credit card sales receipts to the credit card company and wait for the cash payment: debit Accounts Receivable (for full invoice less the fee), debit Credit Card Expense (for the fee), credit Sales. Entry when p ...

1.00

... During 2015, Omega Company had net sales of $11,400,000. Most of the sales were on credit. At the end of 2015, the balance of Accounts Receivable was $1,400,000, and Allowance for Uncollectible Accounts had a debit balance of $48,000. • Omega Company's management uses two methods of estimating uncol ...

... During 2015, Omega Company had net sales of $11,400,000. Most of the sales were on credit. At the end of 2015, the balance of Accounts Receivable was $1,400,000, and Allowance for Uncollectible Accounts had a debit balance of $48,000. • Omega Company's management uses two methods of estimating uncol ...

BUSA 101 – MR

... 25. The process of transferring data in an entry to the appropriate accounts is called .................................................................................................... 25. ____________________________ ______ 26. ____________________________ ______ 26. Revenue received in advance ...

... 25. The process of transferring data in an entry to the appropriate accounts is called .................................................................................................... 25. ____________________________ ______ 26. ____________________________ ______ 26. Revenue received in advance ...

ADVANCED ACCOUNTING (02)

... 13. The total of the balances in the creditor’s accounts should agree with the balance of _______. A. purchase account in general ledger B. accounts Receivable account in general ledger C. accounts Payable account in general ledger D. should not agree with any general ledger accounts 14. Long lived ...

... 13. The total of the balances in the creditor’s accounts should agree with the balance of _______. A. purchase account in general ledger B. accounts Receivable account in general ledger C. accounts Payable account in general ledger D. should not agree with any general ledger accounts 14. Long lived ...