Regional Conference on Factoring in Central East Europe

... Factoring continues to grow successfully both in mature markets and in emerging markets. Through their control methods and permanent monitoring of the receivables on their clients’ debtors, Factoring Companies are able to provide more financing than traditional lenders, and at the same time, limit ...

... Factoring continues to grow successfully both in mature markets and in emerging markets. Through their control methods and permanent monitoring of the receivables on their clients’ debtors, Factoring Companies are able to provide more financing than traditional lenders, and at the same time, limit ...

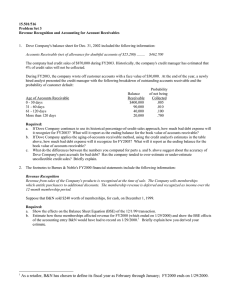

15.501/516 Problem Set 3 Revenue Recognition and Accounting for Account Receivables

... The company had credit sales of $870,000 during FY2003. Historically, the company's credit manager has estimated that 4% of credit sales will not be collected. During FY2003, the company wrote off customer accounts with a face value of $30,000. At the end of the year, a newly hired analyst presented ...

... The company had credit sales of $870,000 during FY2003. Historically, the company's credit manager has estimated that 4% of credit sales will not be collected. During FY2003, the company wrote off customer accounts with a face value of $30,000. At the end of the year, a newly hired analyst presented ...

THE EVOLVING FACE OF FACTORING By Harvey S. Gross There is

... rarely thought of as factoring, credit card programs are exactly that – the selling of accounts receivable at a discount to the credit card company, which then takes the risk of collection. Without these credit card “factors,” all but the largest retail establishments would be cash and carry. Today, ...

... rarely thought of as factoring, credit card programs are exactly that – the selling of accounts receivable at a discount to the credit card company, which then takes the risk of collection. Without these credit card “factors,” all but the largest retail establishments would be cash and carry. Today, ...

GROW... - Amerisource Funding

... Recently, there has been a significant buzz about the Cash Flow Lending product. While this product looks like an attractive quick solution, you should ask how much are they really charging? The answer is typically more than 100% APR – we’ve seen as high as 200% APR!! So in reality, the true cost is ...

... Recently, there has been a significant buzz about the Cash Flow Lending product. While this product looks like an attractive quick solution, you should ask how much are they really charging? The answer is typically more than 100% APR – we’ve seen as high as 200% APR!! So in reality, the true cost is ...