* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Understanding un-invoiced receipts

Survey

Document related concepts

Transcript

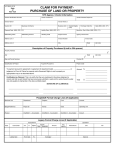

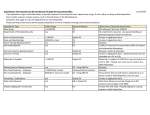

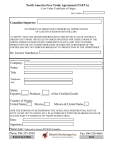

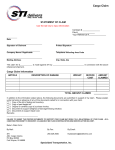

Clearing un-invoiced receipts Un-invoiced receipts is a liability account basically a holding account for inventory purchased (received) but not paid for (invoiced). In e-automate inventory items are added to the system when purchase order items are received. The inventory general ledger account on the inventory item code is debited (increased) and the un-invoiced inventory receipts general ledger account is credited. When the purchase order invoice is created using the receipt, the un-invoiced inventory receipts general ledger account is debited and the accounts payable general ledger account is credited. When the inventory item is sold on an invoice the inventory general ledger account on the item code is credited (decreased) and the accounts receivable account is debited (increased). The revenue is credited and cost of goods sold debited. (This process recognizes the revenue and cost in the same financial reporting period.) If the invoice is recorded using a vendor invoice instead of a vendor purchase order invoice then the accounts payable account may appear correct but the charges used on the vendor invoice create double costs and the purchase order receipt does not get cleared out. Unfortunately, this may not be recognized before the vendor invoice has been paid. To correct this and clear the purchase order receipt account, create a vendor purchase order invoice from the open receipt. Then input a vendor credit memo using the same charge account that was used when the vendor invoice was input. Apply the credit memo to the purchase order invoice. This will clear the double costing and keep the vendor account in balance. If the vendor invoice has not been paid it can be voided and replaced with the purchase order invoice. Sometimes the inventory items are paid for in the system with a credit card or instant check transaction. If you have an open receipt and do not show that the vendor has an open accounts payable balance then search for other ways the inventory was paid for and correct according to how it was paid. If a cashbook transaction was used then research what general ledger charge account was used and use that same charge account when clearing the purchase order invoice with a vendor credit memo. Sample vendor invoice using cost of goods sold account for inventory purchases. Sample of double costing of inventory from vendor invoice. To obtain a list of the open purchase order receipts from the purchasing pull down menu select purchasing purchase receipts and returns. Using the QuickSearch filter select UnInvoiced Not Equal to $0.00. This will provide a list of all the un-invoiced purchases. The purchase receipts e-view could also be used. Use the QuickSearch filter and select UnInvoiced not equal to 0. This total should match the current balance for un-invoiced receipts on your balance sheet. Sample purchase receipts e-view list.