Money Laundering Using New Payment Methods

... In October 2006, the FATF published its first report on New Payment Methods (NPMs). The report was an initial look at the potential money laundering (ML) and terrorist financing (TF) implications of payment innovations that gave customers the opportunity to carry out payments directly through techni ...

... In October 2006, the FATF published its first report on New Payment Methods (NPMs). The report was an initial look at the potential money laundering (ML) and terrorist financing (TF) implications of payment innovations that gave customers the opportunity to carry out payments directly through techni ...

The Interplay Between Student Loans and Credit Cards: Implications for Default ∗

... of the recent trends in borrowing and default behavior. Data show that young U.S. households have the second highest rate of bankruptcy (just after those aged 35 to 44) and the rate among 25to 34-year-olds increased between 1991 and 2001; this fact indicates that the current generation is more likel ...

... of the recent trends in borrowing and default behavior. Data show that young U.S. households have the second highest rate of bankruptcy (just after those aged 35 to 44) and the rate among 25to 34-year-olds increased between 1991 and 2001; this fact indicates that the current generation is more likel ...

COLLEGE STUDENTS AND CREDIT CARD USE: THE EFFECT OF

... card is even higher; 92 percent of households with income in excess of $30,000 report holding at least one card (Gould, 2004). Although these estimates indicate that credit card ownership has increased substantially over the past thirty years, they do not tell the whole story. Households that have c ...

... card is even higher; 92 percent of households with income in excess of $30,000 report holding at least one card (Gould, 2004). Although these estimates indicate that credit card ownership has increased substantially over the past thirty years, they do not tell the whole story. Households that have c ...

ACCT 2301 PP Ch 7

... (expense recognition) principle requires expenses to be reported in the same accounting period as the sales they help produce. ...

... (expense recognition) principle requires expenses to be reported in the same accounting period as the sales they help produce. ...

and Accounts Receivable Methods Percent of

... On September 9, Martin decides to pay $200 that was previously written off. ...

... On September 9, Martin decides to pay $200 that was previously written off. ...

The Democratization of Credit and the Rise in Consumer Bankruptcies

... ceiving a high endowment realization in the second period. To offer a lending contract, which specifies an interest rate, a borrowing limit and a set of eligible borrowers, an intermediary incurs a fixed cost. When designing loan contracts, lenders face an asymmetric information problem, as they ob ...

... ceiving a high endowment realization in the second period. To offer a lending contract, which specifies an interest rate, a borrowing limit and a set of eligible borrowers, an intermediary incurs a fixed cost. When designing loan contracts, lenders face an asymmetric information problem, as they ob ...

open-end credit under -truth-in- lending

... credit card plans could be held responsible for making disclosures at the time of each "transaction." Further, each merchant could be required to make the disclosures in question, simply by belonging to a particular bank credit card plan.24 20. For most open-end credit plans, this means that a discl ...

... credit card plans could be held responsible for making disclosures at the time of each "transaction." Further, each merchant could be required to make the disclosures in question, simply by belonging to a particular bank credit card plan.24 20. For most open-end credit plans, this means that a discl ...

1. Recognizing accounts receivable. 2. Valuing accounts receivable

... Reproduction or translation of this work beyond that permitted by CANCOPY (Canadian Reprography Collective) is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons Canada, Ltd. The purchaser may make back-up copies for his / her own use only ...

... Reproduction or translation of this work beyond that permitted by CANCOPY (Canadian Reprography Collective) is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons Canada, Ltd. The purchaser may make back-up copies for his / her own use only ...

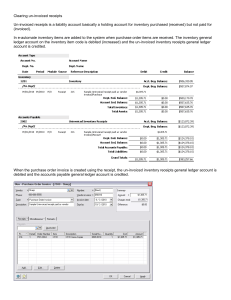

Understanding un-invoiced receipts

... If the invoice is recorded using a vendor invoice instead of a vendor purchase order invoice then the accounts payable account may appear correct but the charges used on the vendor invoice create double costs and the purchase order receipt does not get cleared out. Unfortunately, this may not be rec ...

... If the invoice is recorded using a vendor invoice instead of a vendor purchase order invoice then the accounts payable account may appear correct but the charges used on the vendor invoice create double costs and the purchase order receipt does not get cleared out. Unfortunately, this may not be rec ...

Download paper (PDF)

... financial crisis leads to a rise in the cost of capital, this may worsen informational frictions through the mechanisms described above. We seek to quantify the importance of such effects in determining the profitability of bank lending to consumers during the recent financial crisis. To identify t ...

... financial crisis leads to a rise in the cost of capital, this may worsen informational frictions through the mechanisms described above. We seek to quantify the importance of such effects in determining the profitability of bank lending to consumers during the recent financial crisis. To identify t ...

Credit Card Debt and Consumption

... See Dunn, et. al (2006) for sample characteristics. The Survey of Consumer Finances (SCF) has been widely used in this literature, but the SCF appears only once in three years and is thus not suitable for this research. ...

... See Dunn, et. al (2006) for sample characteristics. The Survey of Consumer Finances (SCF) has been widely used in this literature, but the SCF appears only once in three years and is thus not suitable for this research. ...

Microsoft Word - AP 5700 - Intercollegiate Athletics

... valid state-issued driver’s license, valid state-issued identification card, current passport, a Social Security Card, current residential lease, or copy of a deed to the person’s home or invoice/statement for property taxes. 2) Persons with covered accounts who request a change in their personal in ...

... valid state-issued driver’s license, valid state-issued identification card, current passport, a Social Security Card, current residential lease, or copy of a deed to the person’s home or invoice/statement for property taxes. 2) Persons with covered accounts who request a change in their personal in ...

No compromise to NSW TrainLink reservation system data

... compromise to any customer information, including credit card details. On Friday NSW TrainLink announced the possible security compromise so that customers were alerted to a possible risk to their credit card and other personal details. NSW TrainLink is pleased to report that all available evidence ...

... compromise to any customer information, including credit card details. On Friday NSW TrainLink announced the possible security compromise so that customers were alerted to a possible risk to their credit card and other personal details. NSW TrainLink is pleased to report that all available evidence ...

The Changing Face of the Payments System

... Beyond cards, the payments market is more dynamic than ever. In some stores, consumers can now pay by simply tapping their phones on the retailer’s payment terminal or by showing a barcode on their smart phone’s screen. Similarly, as e-commerce expands, so do the number of ways to pay online. ...

... Beyond cards, the payments market is more dynamic than ever. In some stores, consumers can now pay by simply tapping their phones on the retailer’s payment terminal or by showing a barcode on their smart phone’s screen. Similarly, as e-commerce expands, so do the number of ways to pay online. ...

Electronic Payment System

... Detects fraud by comparing the verification number printed on the signature strip on the back of the card with the information on file with the cardholder’s issuing bank ...

... Detects fraud by comparing the verification number printed on the signature strip on the back of the card with the information on file with the cardholder’s issuing bank ...

Are Loyalty Programs Bad for Consumers?

... In 2010, the American authorities adopted rules leading to an interchange fee reduction of nearly 50% on payment cards,16 with the same kind of perverse effect. The regulation of interchange fees provoked the temporary disappearance of numerous loyalty programs there. Whereas in 2010, before the law ...

... In 2010, the American authorities adopted rules leading to an interchange fee reduction of nearly 50% on payment cards,16 with the same kind of perverse effect. The regulation of interchange fees provoked the temporary disappearance of numerous loyalty programs there. Whereas in 2010, before the law ...

ConsumerMan Video for LifeSmarts 3: YOUR CREDIT REPORT

... Credit is so much more than a little piece of plastic. Good credit lets you buy things on time at a lower Page | 1 interest rate. If your credit is bad, you could be denied a credit card or forced to make a big deposit when you sign up for cable TV. This lesson explores the basic facts about credit ...

... Credit is so much more than a little piece of plastic. Good credit lets you buy things on time at a lower Page | 1 interest rate. If your credit is bad, you could be denied a credit card or forced to make a big deposit when you sign up for cable TV. This lesson explores the basic facts about credit ...

Spring 2004 Dr. Tsai

... units in that particular store. The minimum level of inventory for each item is set by the inventory manager and the department managers. The inventory level of each item carried by each department is checked weekly against the reorder information carried in the master inventory book. When the inven ...

... units in that particular store. The minimum level of inventory for each item is set by the inventory manager and the department managers. The inventory level of each item carried by each department is checked weekly against the reorder information carried in the master inventory book. When the inven ...

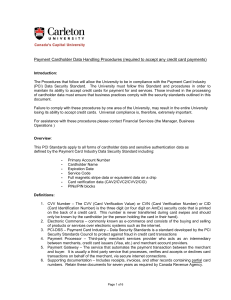

Payment Cardholder Data Handling Procedures (required to accept

... Account Number should be displayed. All other elements of the card number must be masked. Any cardholder data in physical hardcopy will be physically secured in a locked drawer, locked room, or locked filing cabinet. The merchant must collect keys from any individual who leaves the University or who ...

... Account Number should be displayed. All other elements of the card number must be masked. Any cardholder data in physical hardcopy will be physically secured in a locked drawer, locked room, or locked filing cabinet. The merchant must collect keys from any individual who leaves the University or who ...

Frequently Asked Questions

... • There is no requirement of minimum balance. • The services available include deposit and withdrawal of cash at bank branch as well as ATMs; receipt/credit of money through electronic payment channels or by means of collection/deposit of cheques. • Maximum of 4 withdrawals a month including ATM wit ...

... • There is no requirement of minimum balance. • The services available include deposit and withdrawal of cash at bank branch as well as ATMs; receipt/credit of money through electronic payment channels or by means of collection/deposit of cheques. • Maximum of 4 withdrawals a month including ATM wit ...

Personal Financial Literacy

... – Some service creditors require a deposit until they are familiar with your credit history. Personal Finance ...

... – Some service creditors require a deposit until they are familiar with your credit history. Personal Finance ...

CHAPTER 16, CREDIT IN AMERICA CREDIT

... Consumers can choose from a multitude of credit cards. Car manufacturers give credit for new cars. Airlines give bonus air miles when travel is charged. Telephone companies give discounts on calls. 1990’s brought lower interest rates which stimulated growth in the credit industry. Credit is tight in ...

... Consumers can choose from a multitude of credit cards. Car manufacturers give credit for new cars. Airlines give bonus air miles when travel is charged. Telephone companies give discounts on calls. 1990’s brought lower interest rates which stimulated growth in the credit industry. Credit is tight in ...

PF Pretest

... A. Property taxes are assessed at the same rate for all types of property, including homes, land and building, regardless of location or whether they are used for business or personal use. B. Property taxes are usually charged by state and local governments to pay for local schools and other service ...

... A. Property taxes are assessed at the same rate for all types of property, including homes, land and building, regardless of location or whether they are used for business or personal use. B. Property taxes are usually charged by state and local governments to pay for local schools and other service ...