Design Your Retiree Medical Plan for Maximum Flexibility

... accounts while the employee is active. For example, if the annual contribution is $2,000 per year of service and investment earnings average 6 percent, a retiree with 25 years of service at retirement will have an account balance of about $110,000 at retirement. For conversions, a transition benefit ...

... accounts while the employee is active. For example, if the annual contribution is $2,000 per year of service and investment earnings average 6 percent, a retiree with 25 years of service at retirement will have an account balance of about $110,000 at retirement. For conversions, a transition benefit ...

Earnings adjustments for corrective contributions

... Use of these guidelines to calculate allocable earnings will be deemed acceptable by the IRS. However, other earnings calculation methods may be used, if they are appropriate for the situation, bearing in mind that they have not been deemed as acceptable methods of calculating earnings by the IRS. I ...

... Use of these guidelines to calculate allocable earnings will be deemed acceptable by the IRS. However, other earnings calculation methods may be used, if they are appropriate for the situation, bearing in mind that they have not been deemed as acceptable methods of calculating earnings by the IRS. I ...

Cape Elizabeth School Department, ME 403(b) Salary Reduction

... Subject to the annual contribution limits and other requirements of the 403(b) Plan of the Employer, I authorize the Employer to reduce my cash compensation in exchange for the prompt payment of an equal amount for deposit to a qualified annuity contract or custodial account as a salary reduction co ...

... Subject to the annual contribution limits and other requirements of the 403(b) Plan of the Employer, I authorize the Employer to reduce my cash compensation in exchange for the prompt payment of an equal amount for deposit to a qualified annuity contract or custodial account as a salary reduction co ...

RETIREMENT FACT SHEET.qxp

... It wasn’t too long ago that most people could rely on Social Security and their employer’s pension plan to provide most of their retirement income. But times have changed, and it’s becoming increasingly important for individuals to take responsibility for their own retirements. ...

... It wasn’t too long ago that most people could rely on Social Security and their employer’s pension plan to provide most of their retirement income. But times have changed, and it’s becoming increasingly important for individuals to take responsibility for their own retirements. ...

Introduction to segregated funds - Client

... Any amount that is allocated to a segregated fund is invested at the risk of the contract owner and may increase or decrease in value. Sun Life GIFs are individual variable annuity contracts issued by Sun Life Assurance Company of Canada, a member of the Sun Life Financial group of companies. © Sun ...

... Any amount that is allocated to a segregated fund is invested at the risk of the contract owner and may increase or decrease in value. Sun Life GIFs are individual variable annuity contracts issued by Sun Life Assurance Company of Canada, a member of the Sun Life Financial group of companies. © Sun ...

Multiplier Effect The Public Pensions:

... Nonfederal public pension plan fiduciaries are bound by rules defined in state statutes, usually a variation of those found in the Employee Retirement Income Security Act (ERISA), the 1974 federal law governing private pension plans. These include cautions about prudence, diversification, and exclus ...

... Nonfederal public pension plan fiduciaries are bound by rules defined in state statutes, usually a variation of those found in the Employee Retirement Income Security Act (ERISA), the 1974 federal law governing private pension plans. These include cautions about prudence, diversification, and exclus ...

ACA * What is it?

... • Offering HSA contributions rather than insurance contribution increases. • Selecting higher deductible plans for employees to choose from. • Districts bringing in 3rd party administrators to discuss healthcare changes with employees. ...

... • Offering HSA contributions rather than insurance contribution increases. • Selecting higher deductible plans for employees to choose from. • Districts bringing in 3rd party administrators to discuss healthcare changes with employees. ...

Lance Wallach - CommPartners

... The information provided herein is not intended as legal, accounting, financial, or any other type of advice for any specific individual or other entity. You should contact an appropriate professional for any such advice. Notice Pursuant to IRS Circular 230 Any tax advice expressed in this communica ...

... The information provided herein is not intended as legal, accounting, financial, or any other type of advice for any specific individual or other entity. You should contact an appropriate professional for any such advice. Notice Pursuant to IRS Circular 230 Any tax advice expressed in this communica ...

The ABCs of Hardships and Loans

... You will only find hardship distributions in defined contribution plans, such as 401(k), 403(b) and 457 plans. What are the requirements for hardship distributions? The regulations require that there has to be an “immediate and heavy financial need.” A distribution is deemed to be for an immediate a ...

... You will only find hardship distributions in defined contribution plans, such as 401(k), 403(b) and 457 plans. What are the requirements for hardship distributions? The regulations require that there has to be an “immediate and heavy financial need.” A distribution is deemed to be for an immediate a ...

68 KB - Financial System Inquiry

... The Interim report highlights total life expectancy and the need for increased financial literacy and education. I agree but would suggest that even so the Committee understates the issue. Recently one major fund manager announced their new retirement structure being the “three bucket approach”-a th ...

... The Interim report highlights total life expectancy and the need for increased financial literacy and education. I agree but would suggest that even so the Committee understates the issue. Recently one major fund manager announced their new retirement structure being the “three bucket approach”-a th ...

IRA Rollover Considerations

... Employer-sponsored plan participants should check with their plan’s administrator to verify the options available in their plan. Decisions to roll over or transfer retirement plan or IRA assets should be made with careful consideration of the advantages and disadvantages as discussed above. Stifel d ...

... Employer-sponsored plan participants should check with their plan’s administrator to verify the options available in their plan. Decisions to roll over or transfer retirement plan or IRA assets should be made with careful consideration of the advantages and disadvantages as discussed above. Stifel d ...

Here is the powerpoint presentation.

... • Demographic reproduction of the next generation is shaped by social institutions and populations may expand or decline. • Economies also require a processes of succession and vary in their ability to sustain themselves and yield economic benefits to their members. • There are boom and bust generat ...

... • Demographic reproduction of the next generation is shaped by social institutions and populations may expand or decline. • Economies also require a processes of succession and vary in their ability to sustain themselves and yield economic benefits to their members. • There are boom and bust generat ...

When investing for any large financial objective, it`s best to start early

... When investing for any large financial objective, it's best to start early and invest often. First, set your goal: Estimate how much you will need to accumulate for each child based on his or her age. Then, develop a plan and stick with it. Consider discussing the following guidelines with your fina ...

... When investing for any large financial objective, it's best to start early and invest often. First, set your goal: Estimate how much you will need to accumulate for each child based on his or her age. Then, develop a plan and stick with it. Consider discussing the following guidelines with your fina ...

ICMA

... a basic misunderstanding about the function and operation of state and local governments. The mechanics of bankruptcy are inapplicable to a sovereign entity. Bankruptcy is not a legal option for states, as constitutionally recognized sovereigns, because states have taxing authority and constitutiona ...

... a basic misunderstanding about the function and operation of state and local governments. The mechanics of bankruptcy are inapplicable to a sovereign entity. Bankruptcy is not a legal option for states, as constitutionally recognized sovereigns, because states have taxing authority and constitutiona ...

TP - Proposal template - Canadian Federation of Pensioners

... equitable pension security • Members are retirees from major corporations including: ...

... equitable pension security • Members are retirees from major corporations including: ...

Demographic Change and Europe`s Pensions Crisis Key Note Speech

... In order to encourage individuals to save even more for their retirement, automatic enrolment in an occupational pension plan was introduced in 2012. Employers are required to automatically enrol all employees who are not already covered by a private pension. People can choose to opt out within one ...

... In order to encourage individuals to save even more for their retirement, automatic enrolment in an occupational pension plan was introduced in 2012. Employers are required to automatically enrol all employees who are not already covered by a private pension. People can choose to opt out within one ...

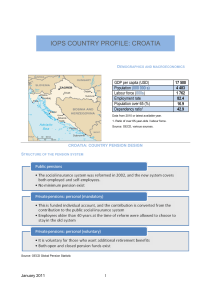

IOPS COUNTRY PROFILE: CROATIA

... (OMFs), which can only manage one mandatory fund each. By law, these funds must invest at least 50% of their assets in conservative government securities issued by the Republic of Croatia or the Croatian National Bank. In addition, no more than 45% of pension fund assets may be invested outside Croa ...

... (OMFs), which can only manage one mandatory fund each. By law, these funds must invest at least 50% of their assets in conservative government securities issued by the Republic of Croatia or the Croatian National Bank. In addition, no more than 45% of pension fund assets may be invested outside Croa ...

Netspar basic sheets

... years a 50bp (100 bp) decrease in annual costs improves pension income by 15% (30%) ...

... years a 50bp (100 bp) decrease in annual costs improves pension income by 15% (30%) ...

Life Insurance Retirement Plan (LIRP)

... Roth IRA, coupled with powerful additional benefits. Most Fortune 500 companies provide their senior executives with a retirement plan that contains the exact same investment vehicle as the LIRP. These are powerful plans and there is no reason a client cannot create one of these plans on their own. ...

... Roth IRA, coupled with powerful additional benefits. Most Fortune 500 companies provide their senior executives with a retirement plan that contains the exact same investment vehicle as the LIRP. These are powerful plans and there is no reason a client cannot create one of these plans on their own. ...

Revolutionizing DC Plan Design

... f or employees, the “DB-if ication” of DC plans shif t started with institutional f eatures such as autoenrollment and auto-escalation, which provide a pension-like contribution method f or participants, especially if there also is a company match or prof it-sharing contribution. Once participants ...

... f or employees, the “DB-if ication” of DC plans shif t started with institutional f eatures such as autoenrollment and auto-escalation, which provide a pension-like contribution method f or participants, especially if there also is a company match or prof it-sharing contribution. Once participants ...

Frequently Asked Questions

... demanding targeted climate action plans from our pension providers, and calling for government policies that enable the low carbon transition. How can I find out what my pension provider is investing in? Some pension providers publish a list of their ‘equity holdings’ (the companies that they hold s ...

... demanding targeted climate action plans from our pension providers, and calling for government policies that enable the low carbon transition. How can I find out what my pension provider is investing in? Some pension providers publish a list of their ‘equity holdings’ (the companies that they hold s ...

Canada`s top 10 pension funds: Helping drive national

... plans collected more than $70 billion in contributions, or 45% of all retirement contributions made by Canadians. That same year, they paid out $74 billion in retirement benefits to Canadians, or 49% of all nonOAS retirement benefits. While the Top Ten pension funds seek the best risk-adjusted retur ...

... plans collected more than $70 billion in contributions, or 45% of all retirement contributions made by Canadians. That same year, they paid out $74 billion in retirement benefits to Canadians, or 49% of all nonOAS retirement benefits. While the Top Ten pension funds seek the best risk-adjusted retur ...

Study summary

... plans collected more than $70 billion in contributions, or 45% of all retirement contributions made by Canadians. That same year, they paid out $74 billion in retirement benefits to Canadians, or 49% of all nonOAS retirement benefits. While the Top Ten pension funds seek the best risk-adjusted retur ...

... plans collected more than $70 billion in contributions, or 45% of all retirement contributions made by Canadians. That same year, they paid out $74 billion in retirement benefits to Canadians, or 49% of all nonOAS retirement benefits. While the Top Ten pension funds seek the best risk-adjusted retur ...

risk management

... Pension plans from employers/labor unions; Social insurance programs run by governments; Personal saving (e.g. real & financial assets including equity in one’s home or business, saving accounts, insurance contracts, etc). ...

... Pension plans from employers/labor unions; Social insurance programs run by governments; Personal saving (e.g. real & financial assets including equity in one’s home or business, saving accounts, insurance contracts, etc). ...