Staying Ahead of the Curve: Nine Hot Trends for Defined

... marketplaces. This trend is carrying over to the governmental marketplace, as well. Over the past several years, many states and municipalities have considered utilizing enhanced defined contribution plans for new and/or existing employees. States like Tennessee and Rhode Island have led the way in ...

... marketplaces. This trend is carrying over to the governmental marketplace, as well. Over the past several years, many states and municipalities have considered utilizing enhanced defined contribution plans for new and/or existing employees. States like Tennessee and Rhode Island have led the way in ...

Would Poland Benefit From a Fiscal Responsibility Law?

... Figure 5. Slippages Since the 1999 Pension Reform: (Projected balance of the first pillar relative to GDP) ...

... Figure 5. Slippages Since the 1999 Pension Reform: (Projected balance of the first pillar relative to GDP) ...

Transition to Retirement Pensions

... Benefit payments are split into taxable and tax free components. The taxable component will generally be taxed at the recipient’s marginal rate less a 15% pension tax offset. The tax-free component is not subject to any tax. ...

... Benefit payments are split into taxable and tax free components. The taxable component will generally be taxed at the recipient’s marginal rate less a 15% pension tax offset. The tax-free component is not subject to any tax. ...

The Spectre of Mortgage Fraud: A PRIMER

... based on her pension, then she has a retirement that is somewhat unfunded. That is, as of now, her pension plan has only about 50¢ for every $1 of promised benefits. Social Security and Medicare also are unfunded. Their trust funds consist of government bonds. If I took care of my own retirement the ...

... based on her pension, then she has a retirement that is somewhat unfunded. That is, as of now, her pension plan has only about 50¢ for every $1 of promised benefits. Social Security and Medicare also are unfunded. Their trust funds consist of government bonds. If I took care of my own retirement the ...

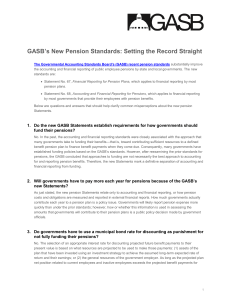

GASB`s New Pension Standards: Setting the Record Straight

... Yes. The comparability of the pension information that will result from the new Statements has been significantly improved. One of the features of the prior standards that many financial statement users have criticized is the variety of choices that employers could make when attributing the present ...

... Yes. The comparability of the pension information that will result from the new Statements has been significantly improved. One of the features of the prior standards that many financial statement users have criticized is the variety of choices that employers could make when attributing the present ...

Prezentácia

... with a non-stop access to their individual retirement accounts and disclosure requirements, they see the performance of their DSS and/or pension fund may „vote“ and change their pension fund, even leave their DSS and switch to a rival company ...

... with a non-stop access to their individual retirement accounts and disclosure requirements, they see the performance of their DSS and/or pension fund may „vote“ and change their pension fund, even leave their DSS and switch to a rival company ...

Chapter 3

... The focus on superannuation and encouraging individuals to save and invest for their future, and particularly their retirement years, has been increasingly emphasised in the past two decades in Australia. The Australian Government has been especially pro-active in this regard, mandating minimum cont ...

... The focus on superannuation and encouraging individuals to save and invest for their future, and particularly their retirement years, has been increasingly emphasised in the past two decades in Australia. The Australian Government has been especially pro-active in this regard, mandating minimum cont ...

210115 The Dutch Pension System Chris Driessen

... the short term blunt Pension premium also too volatile in relation with the interest Pension premiums are very high [15-20% of the ...

... the short term blunt Pension premium also too volatile in relation with the interest Pension premiums are very high [15-20% of the ...

Municipal Pension Plan AGM

... Historically, bcIMC has been a conservative, long-term investor Invests in all major asset classes ...

... Historically, bcIMC has been a conservative, long-term investor Invests in all major asset classes ...

Chapter 29

... Actuarial rate of return: The rate of return: used to find the PV of expected benefits (discount rate). at which the fund’s assets are assumed to be invested. Employee Retirement Income Security Act (ERISA): The federal law governing the administration and structure of corporate pension plans. ( ...

... Actuarial rate of return: The rate of return: used to find the PV of expected benefits (discount rate). at which the fund’s assets are assumed to be invested. Employee Retirement Income Security Act (ERISA): The federal law governing the administration and structure of corporate pension plans. ( ...

Detroit default exposes lie of phantom returns

... the electoral cycle. Think of it this way: what are the chances that the contestants in the next congressional or presidential elections would ask the voters to decide if pension and healthcare promises made by governments are super-priority debts? Because that is what “Detroit” is all about. The pe ...

... the electoral cycle. Think of it this way: what are the chances that the contestants in the next congressional or presidential elections would ask the voters to decide if pension and healthcare promises made by governments are super-priority debts? Because that is what “Detroit” is all about. The pe ...

How to Maximize Your Funding Opportunities

... How John can reach the 2.3m Standard Fund Threshold For John to take full advantage of the 2.3m Standard Fund Threshold, he could increase his salary which would increase his current Revenue maximum funding limit from 2m up to 2.3m. How would this work in practice? If John increases his salary from ...

... How John can reach the 2.3m Standard Fund Threshold For John to take full advantage of the 2.3m Standard Fund Threshold, he could increase his salary which would increase his current Revenue maximum funding limit from 2m up to 2.3m. How would this work in practice? If John increases his salary from ...

Ralph`s Pension Analysis Ralph recognizes defined

... grows to $2,000/year times 25 years = $50,000 at the end of 25 years.] (iv) Contrast the accounting in (iii) with (standard) economic valuation. B. Ralph’s pension disclosures. Ralph is considering alternative employment and is concerned about the soundness of the organization’s pension plan so he d ...

... grows to $2,000/year times 25 years = $50,000 at the end of 25 years.] (iv) Contrast the accounting in (iii) with (standard) economic valuation. B. Ralph’s pension disclosures. Ralph is considering alternative employment and is concerned about the soundness of the organization’s pension plan so he d ...

184 kb PowerPoint presentation

... a. Limit (eliminate?) ability to lower contributions through advance funding 2. Vary with: a. Degree of individual choice b. Degree of centralization of administration c. Level of service offered 3. May serve as insurance against certain forms of political risk ...

... a. Limit (eliminate?) ability to lower contributions through advance funding 2. Vary with: a. Degree of individual choice b. Degree of centralization of administration c. Level of service offered 3. May serve as insurance against certain forms of political risk ...

Pooled Registered Pension Plans

... contributions to one but they may do so. • Enrolment - Where employers do offer such a plan, employees are automatically enrolled, subject to an opting-out right. • Eligibility - Employers may select to offer a Pooled Registered Pension Plan to a class of employees. Part-time employees can partici ...

... contributions to one but they may do so. • Enrolment - Where employers do offer such a plan, employees are automatically enrolled, subject to an opting-out right. • Eligibility - Employers may select to offer a Pooled Registered Pension Plan to a class of employees. Part-time employees can partici ...

recent developments in occupational pension plan accounting

... recorded, as a general rule, as liabilities in the balance sheet of the sponsoring employer. The International Accounting Standards Board (IASB) clearly distinguishes two categories: defined contribution plans and defined benefits plans. In this paper, we focus only plans that are not defined contri ...

... recorded, as a general rule, as liabilities in the balance sheet of the sponsoring employer. The International Accounting Standards Board (IASB) clearly distinguishes two categories: defined contribution plans and defined benefits plans. In this paper, we focus only plans that are not defined contri ...

403(b) - ADMIN Partners

... 403(b) Retirement Plan [Insert Employer Name] offers a 403(b) Retirement Plan for eligible employees. Most W-2 employees are eligible to participate in this plan by making voluntary contributions to a 403(b) investment. A 403(b) plan is a tax-deferred retirement program that permits you to reduce yo ...

... 403(b) Retirement Plan [Insert Employer Name] offers a 403(b) Retirement Plan for eligible employees. Most W-2 employees are eligible to participate in this plan by making voluntary contributions to a 403(b) investment. A 403(b) plan is a tax-deferred retirement program that permits you to reduce yo ...

BUSINESS SUCCESSION PLANNING * Measuring the Opportunities

... retain highly qualified employees ...

... retain highly qualified employees ...

resolution no - Village of Schaumburg

... Establish minimum standards for investment, actuarial and other professional services utilized by the pension funds. ...

... Establish minimum standards for investment, actuarial and other professional services utilized by the pension funds. ...

Not every retirement plan is as special as your New York State

... Learn more about planning for your retirement with the New York State Deferred Compensation Plan! ...

... Learn more about planning for your retirement with the New York State Deferred Compensation Plan! ...

the Research Summary

... public pension plans in order to calculate the probability that each fund will be able to meet its obligations in the future. Given that Ohio’s pensions are less than fully funded, they will almost certainly not be able to pay their future liabilities and will need additional resources. Although the ...

... public pension plans in order to calculate the probability that each fund will be able to meet its obligations in the future. Given that Ohio’s pensions are less than fully funded, they will almost certainly not be able to pay their future liabilities and will need additional resources. Although the ...

Saving - London Chamber of Commerce and Industry

... 1997, and therefore, pensions have proved to be less. By taking £5 billion out of pension funds every year, the Chancellor increased the Exchequer’s funds in a way that cost wage earners far more in the long-term than a rise in income tax. London Chamber at the time denounced the abolition as a hidd ...

... 1997, and therefore, pensions have proved to be less. By taking £5 billion out of pension funds every year, the Chancellor increased the Exchequer’s funds in a way that cost wage earners far more in the long-term than a rise in income tax. London Chamber at the time denounced the abolition as a hidd ...