Labor market impacts

... savings to annuity in competitive market: – Pension is automatically lower for early retirees – Annual benefit decreases as longevity increases – This encourages more years of work, helps economy and fund ...

... savings to annuity in competitive market: – Pension is automatically lower for early retirees – Annual benefit decreases as longevity increases – This encourages more years of work, helps economy and fund ...

West Thames HR Exchange Club 11th April 2002

... What about the State Pension? • Basic Pension - £3770 pa • SERPS – Income related (eg earned average earnings SERPS is worth Approx £3700pa) • SSP (State Second Pension ) from April 2002 (Same as SERPS but better for low earners under £24600pa) • Opting out gave a better deal, but no more, for same ...

... What about the State Pension? • Basic Pension - £3770 pa • SERPS – Income related (eg earned average earnings SERPS is worth Approx £3700pa) • SSP (State Second Pension ) from April 2002 (Same as SERPS but better for low earners under £24600pa) • Opting out gave a better deal, but no more, for same ...

Slide 1

... • Retirees with Inadequate Income will fall back on Welfare Transfers (e.g., GIS and Provincial Plans) • Also has Impact on Cost of OAS (Clawback) • Government Responsible for Protecting Future Taxpayers from Workers not Saving Enough for ...

... • Retirees with Inadequate Income will fall back on Welfare Transfers (e.g., GIS and Provincial Plans) • Also has Impact on Cost of OAS (Clawback) • Government Responsible for Protecting Future Taxpayers from Workers not Saving Enough for ...

85 Weighted average assumptions used to determine net periodic

... Weighted average assumptions used to determine net periodic pension cost (benefit) at date of measurement: U.S. Plans ...

... Weighted average assumptions used to determine net periodic pension cost (benefit) at date of measurement: U.S. Plans ...

powerpoint on pensions and inter

... • In 1960 not a single Tokiwadaira resident was aged over 65, but its demographics, like Japan's, are changing fast. Now, almost a third of the 5,360 residents are elderly; in 10 years they will make up around 40%. • "It has changed beyond recognition," says Yutaka Sakai, head of a local group that ...

... • In 1960 not a single Tokiwadaira resident was aged over 65, but its demographics, like Japan's, are changing fast. Now, almost a third of the 5,360 residents are elderly; in 10 years they will make up around 40%. • "It has changed beyond recognition," says Yutaka Sakai, head of a local group that ...

Next year will see the start of a huge revolution in

... requirements or participating in the new ‘industry wide occupational scheme’, the National Employment Savings Trust (NEST). Either way the employer will face significant costs hence the key strategy for businesses is to plan for this anticipated cost. Employers can address some of the problems prese ...

... requirements or participating in the new ‘industry wide occupational scheme’, the National Employment Savings Trust (NEST). Either way the employer will face significant costs hence the key strategy for businesses is to plan for this anticipated cost. Employers can address some of the problems prese ...

EXPATRIATE MANAGEMENT COMMITTEE

... Employee Pension Plan Most popular plans still are career pay plan with a lump sum payout (which is tax-favored). The QPP and EPF are funded; problem relates to many underfunded QPF’s. After 2005 the tax preference for RAPs will be eliminated. Some recent changes include: 1) new accounting standards ...

... Employee Pension Plan Most popular plans still are career pay plan with a lump sum payout (which is tax-favored). The QPP and EPF are funded; problem relates to many underfunded QPF’s. After 2005 the tax preference for RAPs will be eliminated. Some recent changes include: 1) new accounting standards ...

The Political Economy of Pension Reform in Transformation

... Financial imbalance in national pension scheme Flattening and lowering of pension benefits Shift of power for pension policy making from Labour/Welfare Ministry to Finance Ministry • Neoliberal economist links with World Bank • Pension privatization ...

... Financial imbalance in national pension scheme Flattening and lowering of pension benefits Shift of power for pension policy making from Labour/Welfare Ministry to Finance Ministry • Neoliberal economist links with World Bank • Pension privatization ...

Slide 1

... accumulation phase and annuitization in the payout phase. The new system remains a part of social security irrespective to public or private management of its parts. The new system is similar to the new Swedish system (launched on the same day as the Polish one). ...

... accumulation phase and annuitization in the payout phase. The new system remains a part of social security irrespective to public or private management of its parts. The new system is similar to the new Swedish system (launched on the same day as the Polish one). ...

Live now, pay later – but how much?

... account when setting premiums, which will increase costs for some people. A ruling by the European Court of Justice means premiums for new insurance policies or renewals of existing cover must be set without regard to gender. The Directive has implications for insurers’ long-held principle of settin ...

... account when setting premiums, which will increase costs for some people. A ruling by the European Court of Justice means premiums for new insurance policies or renewals of existing cover must be set without regard to gender. The Directive has implications for insurers’ long-held principle of settin ...

All findings, interpretations, and conclusions of this presentation

... by the Papers • Moving from pay-as-you-go pensions to funded pensions ...

... by the Papers • Moving from pay-as-you-go pensions to funded pensions ...

Presentation by the Delegation of Kosovo 1

... Currently KPST administers a phased withdrawal scheme 9 of 18 ...

... Currently KPST administers a phased withdrawal scheme 9 of 18 ...

I. Legal Limitations on Public Pension Plan

... For example, from 2000 to 2007, public employees saw a 16 percent increased in compensation after adjusting for inflation, compared with just 11 percent for private workers. Dennis Cauchon, State, local government workers see pay gains, USA TODAY, February 1, 2008, http://www.usatoday.com/news/natio ...

... For example, from 2000 to 2007, public employees saw a 16 percent increased in compensation after adjusting for inflation, compared with just 11 percent for private workers. Dennis Cauchon, State, local government workers see pay gains, USA TODAY, February 1, 2008, http://www.usatoday.com/news/natio ...

December 2013 Update - Mackintosh Cunningham Consulting Ltd

... The DWP is proposing a new type of pension scheme. At present pension schemes can be broadly divided into two types: Defined Benefit (DB) Schemes which typically offer a retirement income, or a specific level of pension savings, based on a formula related to an employee’s salary and/or the length of ...

... The DWP is proposing a new type of pension scheme. At present pension schemes can be broadly divided into two types: Defined Benefit (DB) Schemes which typically offer a retirement income, or a specific level of pension savings, based on a formula related to an employee’s salary and/or the length of ...

Download attachment

... But countries with no exchange controls showed “huge” home bias in the allocation of their assets, with only 25%-35% of their portfolios invested offshore, so the question was whether exchange controls played any role at all in the decision to invest offshore, said Totaram. Much of the evidence, tak ...

... But countries with no exchange controls showed “huge” home bias in the allocation of their assets, with only 25%-35% of their portfolios invested offshore, so the question was whether exchange controls played any role at all in the decision to invest offshore, said Totaram. Much of the evidence, tak ...

NIRS Sample Presentation

... management tool, old-age poverty insurance, and stabilizing factor in the economy. • As a stable employer, government is well-suited to sponsor pensions. • Core elements of pension promote retirement security: ...

... management tool, old-age poverty insurance, and stabilizing factor in the economy. • As a stable employer, government is well-suited to sponsor pensions. • Core elements of pension promote retirement security: ...

OTTAWA`S PUBLIC-SECTOR PENSION BUBBLE GROWS TO $227

... billion, far more than reported, according to a report released today by the C.D. Howe Institute. In “Ottawa’s Pension Gap: The Growing and Under-reported Cost of Federal Employee Pensions,” authors Alexandre Laurin and William Robson find that, using fair-value accounting like private-sector plans ...

... billion, far more than reported, according to a report released today by the C.D. Howe Institute. In “Ottawa’s Pension Gap: The Growing and Under-reported Cost of Federal Employee Pensions,” authors Alexandre Laurin and William Robson find that, using fair-value accounting like private-sector plans ...

The European Pension Crisis

... • + (quasi) mandatory funded private 2d pillar – group plan with investment manager chosen by employer and/or union in (1)--historical reasons; – but movement toward individual accounts in some cases (UK, Switzerland) – individual accounts with worker choice in (2) ...

... • + (quasi) mandatory funded private 2d pillar – group plan with investment manager chosen by employer and/or union in (1)--historical reasons; – but movement toward individual accounts in some cases (UK, Switzerland) – individual accounts with worker choice in (2) ...

trAnSition to 401(k) PLAnS - Sonoma County Association of Retired

... investments, anticipated employer contributions, retirement age, Social Security interface, life expectancy, and on and on. Most of us can’t predict what the stock market will do tomorrow, nor do we have ready access to the kind of regular periodic professional actuarial assistance needed to help so ...

... investments, anticipated employer contributions, retirement age, Social Security interface, life expectancy, and on and on. Most of us can’t predict what the stock market will do tomorrow, nor do we have ready access to the kind of regular periodic professional actuarial assistance needed to help so ...

Changes to Financial Statement Notes 10

... The Board changed its method of accounting for the following items in order to comply with accounting principles generally accepted in the United States of America: GASB 16 - For the fiscal year ended June 30, 2008, the Board included in compensated absences an estimate amount for accrued personal l ...

... The Board changed its method of accounting for the following items in order to comply with accounting principles generally accepted in the United States of America: GASB 16 - For the fiscal year ended June 30, 2008, the Board included in compensated absences an estimate amount for accrued personal l ...

Employee Benefits

... This type of cover gives your employees access to private medical diagnosis and treatment. Rather than waiting to be referred to a NHS consultant or practitioner their GP will be able to refer them to a private practitioner instead. This usually means your employee is treated sooner which therefore ...

... This type of cover gives your employees access to private medical diagnosis and treatment. Rather than waiting to be referred to a NHS consultant or practitioner their GP will be able to refer them to a private practitioner instead. This usually means your employee is treated sooner which therefore ...

Outlined below is a summary of the meeting

... Spain: Update on Corporate Benefit Plans Arturo Fisher of Hewitt Associates described Spain’s progress during the last ten years in catching up economically with other European countries. In Spain, a major challenge is how low birth rates will affect the future financing of pension benefits. He revi ...

... Spain: Update on Corporate Benefit Plans Arturo Fisher of Hewitt Associates described Spain’s progress during the last ten years in catching up economically with other European countries. In Spain, a major challenge is how low birth rates will affect the future financing of pension benefits. He revi ...

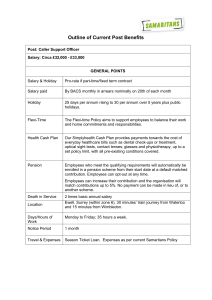

Outline of Current Post Benefits

... Employees who meet the qualifying requirements will automatically be enrolled in a pension scheme from their start date at a default matched contribution. Employees can opt-out at any time. Employees can increase their contribution and the organisation will match contributions up to 5%. No payment c ...

... Employees who meet the qualifying requirements will automatically be enrolled in a pension scheme from their start date at a default matched contribution. Employees can opt-out at any time. Employees can increase their contribution and the organisation will match contributions up to 5%. No payment c ...

Retirement Benefits Study Findings

... Establishing an alternative retirement plan could fulfill specific workforce needs; however, it does not erase the unfunded liabilities in the existing Defined Benefit (DB) plan and could cost more. • An alternative retirement plan—such as a defined contribution (DC) plan (like a 401(K), cash balanc ...

... Establishing an alternative retirement plan could fulfill specific workforce needs; however, it does not erase the unfunded liabilities in the existing Defined Benefit (DB) plan and could cost more. • An alternative retirement plan—such as a defined contribution (DC) plan (like a 401(K), cash balanc ...

4-1

... Defined Contribution Plans • Types – Cash Balance – Target Benefit – Money Purchase – Age Weighted Profits Sharing ...

... Defined Contribution Plans • Types – Cash Balance – Target Benefit – Money Purchase – Age Weighted Profits Sharing ...