inside moving beyond the basics of retirement planning s2 private

... funds, so it can enhance returns of these portfolios without materially changing the risk profile. And with daily valuations, it means that DC pension plans now have access to an asset class that was historically valued quarterly at best, and had limited liquidity. These funds change all that. It’s ...

... funds, so it can enhance returns of these portfolios without materially changing the risk profile. And with daily valuations, it means that DC pension plans now have access to an asset class that was historically valued quarterly at best, and had limited liquidity. These funds change all that. It’s ...

Flexible Working - Wiltshire Pension Fund

... pension benefits is to be waived. The decision to waive the actuarial reduction will only be applied in exceptional circumstances, at the discretion of the Headteacher and The Board of Trustees. Any costs associated with the granting of this discretion will be met from the relevant Academy budget. ...

... pension benefits is to be waived. The decision to waive the actuarial reduction will only be applied in exceptional circumstances, at the discretion of the Headteacher and The Board of Trustees. Any costs associated with the granting of this discretion will be met from the relevant Academy budget. ...

Letter to Department of Commerce Regarding Continuous Death

... employers sponsoring retirement plans in this country. On behalf of those plan sponsors, plan administrators and recordkeepers, and the millions of participants who rely on those plans for retirement security, we are writing with respect to an important issue arising under the Bipartisan Budget Act ...

... employers sponsoring retirement plans in this country. On behalf of those plan sponsors, plan administrators and recordkeepers, and the millions of participants who rely on those plans for retirement security, we are writing with respect to an important issue arising under the Bipartisan Budget Act ...

Agreement for Opting Out of the Ithaca College 403(b) Retirement Plan

... Agreement for Opting Out of the Ithaca College 403(b) Retirement Plan This form serves as notice to Ithaca College that you wish to opt-out or decline enrollment in the Ithaca College 403(b) Retirement Plan at this time. Please complete, sign, and return the form to the Office of Human Resources. If ...

... Agreement for Opting Out of the Ithaca College 403(b) Retirement Plan This form serves as notice to Ithaca College that you wish to opt-out or decline enrollment in the Ithaca College 403(b) Retirement Plan at this time. Please complete, sign, and return the form to the Office of Human Resources. If ...

EWGP: An Attractive Alternative to Retiree

... through your organiza on’s Pharmacy Benefit Manager (PBM). The PBM will also perform many of the ongoing administra ve du es associated with the plan, with pharma reimbursements and Medicare payments handled out of sight to the par cipants. To the re ree, there will be one Rx card and the program wi ...

... through your organiza on’s Pharmacy Benefit Manager (PBM). The PBM will also perform many of the ongoing administra ve du es associated with the plan, with pharma reimbursements and Medicare payments handled out of sight to the par cipants. To the re ree, there will be one Rx card and the program wi ...

salary reduction agreement

... Fidelity Investments Retirement Annuity (Note: there is no service requirement for eligible employees to participate in this Tax Deferred Annuity Arrangement; contributions to this annuity are not matched by Holy Family University; see Summary Plan Description for details.) ...

... Fidelity Investments Retirement Annuity (Note: there is no service requirement for eligible employees to participate in this Tax Deferred Annuity Arrangement; contributions to this annuity are not matched by Holy Family University; see Summary Plan Description for details.) ...

Funding Retiree Benefits - GASB

... FY 2008 OPERATING BUDGET Funding Retiree Benefits - GASB The Montgomery County Public Schools (MCPS) FY 2008 Operating Budget includes $16.1 million to begin pre-funding of Other Post-Employment health and life insurance Benefits (OPEB) for retired employees made necessary by the rulings of the Gove ...

... FY 2008 OPERATING BUDGET Funding Retiree Benefits - GASB The Montgomery County Public Schools (MCPS) FY 2008 Operating Budget includes $16.1 million to begin pre-funding of Other Post-Employment health and life insurance Benefits (OPEB) for retired employees made necessary by the rulings of the Gove ...

Glossary - Salvus Master Trust

... The Lifetime Allowance reduced from £1.8 million to £1.5 million on 6 April 2012 and reduced further to £1.25 million on 6 April 2014, and to £1.0 million on 6 April 2016. An individual can elect for fixed protection to retain the preceding Lifetime Allowance. It is not possible to accrue any additi ...

... The Lifetime Allowance reduced from £1.8 million to £1.5 million on 6 April 2012 and reduced further to £1.25 million on 6 April 2014, and to £1.0 million on 6 April 2016. An individual can elect for fixed protection to retain the preceding Lifetime Allowance. It is not possible to accrue any additi ...

Estimating future costs at public pension plans: Setting the discount

... estimated liabilities of a pension plan are nei- mon stocks) will yield higher levels of returns. They also agree that higher-risk portfolios generther bank loans nor are they bonds. Unlike banks, plan members do not lend ally have greater volatility in returns. For many money to their pension plan ...

... estimated liabilities of a pension plan are nei- mon stocks) will yield higher levels of returns. They also agree that higher-risk portfolios generther bank loans nor are they bonds. Unlike banks, plan members do not lend ally have greater volatility in returns. For many money to their pension plan ...

Is Stock Market Volatility Bad For Your Pension

... in the run up to someone's retirement. So you may not be as exposed to these riskier, more volatile areas, as you thought. If you are about five years from retirement, there are some things to do now to make sure that when you come to retirement you are not as negatively affected as you might be. On ...

... in the run up to someone's retirement. So you may not be as exposed to these riskier, more volatile areas, as you thought. If you are about five years from retirement, there are some things to do now to make sure that when you come to retirement you are not as negatively affected as you might be. On ...

13.6 million uk adults without a pension

... Women are more dependent on property than men with 14% saying their property is their pension compared to 12% of men. In fact, women are increasingly relying on their properties as only 9% said it was their pension in 2010. Furthermore, 16% of those aged 65+ that are still in employment will rely on ...

... Women are more dependent on property than men with 14% saying their property is their pension compared to 12% of men. In fact, women are increasingly relying on their properties as only 9% said it was their pension in 2010. Furthermore, 16% of those aged 65+ that are still in employment will rely on ...

Document

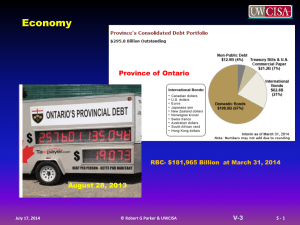

... Impact on Business and Society Canada and the Provinces are engaged in pension plans that are massively underfunded and ultimately unsustainable Funding expensive public sector pension plans when many Canadians do not have a plan will generate increased public backlash With a significant portion of ...

... Impact on Business and Society Canada and the Provinces are engaged in pension plans that are massively underfunded and ultimately unsustainable Funding expensive public sector pension plans when many Canadians do not have a plan will generate increased public backlash With a significant portion of ...

Myth 4: Funding reduces public spending on pensions.

... pension plans—public and private alike—encourage early retirement by increasing pensions for work beyond the normal age of retirement by less than the actuarial amount. Many employer plans encourage labor immobility (public schemes, being universal, do not have this problem). Thus, labor supply depe ...

... pension plans—public and private alike—encourage early retirement by increasing pensions for work beyond the normal age of retirement by less than the actuarial amount. Many employer plans encourage labor immobility (public schemes, being universal, do not have this problem). Thus, labor supply depe ...

06042015-Minutes-kl

... Estate which has been the Non-Core Private Real Estate money manager for all three Pension Funds since 2010. Mr. Taylor stated that Metropolitan has been purchased by The Carlyle Group. He added that they will remain independent in their investment decisions but will have access to all of Carlyle’s ...

... Estate which has been the Non-Core Private Real Estate money manager for all three Pension Funds since 2010. Mr. Taylor stated that Metropolitan has been purchased by The Carlyle Group. He added that they will remain independent in their investment decisions but will have access to all of Carlyle’s ...

Topic No. D-36 Topic: Selection of Discount Rates Used for

... the assumed discount rates shall change in a similar manner. Interest rates have been declining and are at their lowest levels in more than a decade. At each measurement date, the SEC staff expects registrants to use discount rates to measure obligations for pension benefits and postretirement benef ...

... the assumed discount rates shall change in a similar manner. Interest rates have been declining and are at their lowest levels in more than a decade. At each measurement date, the SEC staff expects registrants to use discount rates to measure obligations for pension benefits and postretirement benef ...

IRS further extends effective date of normal

... In 2007, the IRS published final regulations confirming that pension plans may make payments to participants who have reached normal retirement age and have not separated from service with the employer. These regulations also provided guidance on how low a plan’s normal retirement age may be and est ...

... In 2007, the IRS published final regulations confirming that pension plans may make payments to participants who have reached normal retirement age and have not separated from service with the employer. These regulations also provided guidance on how low a plan’s normal retirement age may be and est ...

Plan Health Statement - Deerfield Beach Pension

... were no employer and employee contributions or state funding but members are still allowed to accrue benefits. This will not happen as long as the required contributions are paid. Florida law requires that the contributions be made, and everyone involved recognizes their solemn responsibility to kee ...

... were no employer and employee contributions or state funding but members are still allowed to accrue benefits. This will not happen as long as the required contributions are paid. Florida law requires that the contributions be made, and everyone involved recognizes their solemn responsibility to kee ...

PPT

... The measurement of neutral and real holding gains and losses Income arising from (financial) assets Income from activities undertaken on an informal basis (exhaustiveness) ...

... The measurement of neutral and real holding gains and losses Income arising from (financial) assets Income from activities undertaken on an informal basis (exhaustiveness) ...

Building Blocks of Personal Finance

... a. When developing a financial plan, a person must have long and short term goals, organized financial records, a spending plan, and an emergency savings fund. 4. Manage a. Solid financial management includes properly managing large expenses including housing, transportation, insurance, and income t ...

... a. When developing a financial plan, a person must have long and short term goals, organized financial records, a spending plan, and an emergency savings fund. 4. Manage a. Solid financial management includes properly managing large expenses including housing, transportation, insurance, and income t ...

For immediate distribution 4 August 2009 HFM Columbus warns on

... Hoyland Financial Management was established in 1986 by Jeremy Hoyland to provide indepth, independent financial advice primarily to high net worth individuals and business owners. It has dedicated departments for high net worth financial planning, including investment, pensions and tax advice, mort ...

... Hoyland Financial Management was established in 1986 by Jeremy Hoyland to provide indepth, independent financial advice primarily to high net worth individuals and business owners. It has dedicated departments for high net worth financial planning, including investment, pensions and tax advice, mort ...

BBB Benefits Plan - Meritage Financial Group

... has been the preferred provider of BBB Benefits Plans since 1999, providing Accredited Businesses with sound, comprehensive financial advice while practicing full disclosure throughout every step of the process. In addition, we offer a full spectrum of financial products and services for both indivi ...

... has been the preferred provider of BBB Benefits Plans since 1999, providing Accredited Businesses with sound, comprehensive financial advice while practicing full disclosure throughout every step of the process. In addition, we offer a full spectrum of financial products and services for both indivi ...

Ken Peasnell - Lancaster University

... Impact on pension schemes • Employer DC schemes – The contribution rate is determined by the labour market – Pension managers therefore focus on balancing risks and returns • Resource constraints will affect these decisions through their impact on yields on equities, bonds and other investment asse ...

... Impact on pension schemes • Employer DC schemes – The contribution rate is determined by the labour market – Pension managers therefore focus on balancing risks and returns • Resource constraints will affect these decisions through their impact on yields on equities, bonds and other investment asse ...

Brief Summary of GASB 68

... pension contribution amounts. Many plans that used GASB 27’s ARC for financial reporting and calculating contributions may now apply different methods and assumptions for those separate purposes. A summary of GASB 68’s requirements follows: ...

... pension contribution amounts. Many plans that used GASB 27’s ARC for financial reporting and calculating contributions may now apply different methods and assumptions for those separate purposes. A summary of GASB 68’s requirements follows: ...