Tax-Deferred Annuities: Are They Right for You?

... to pay taxes on all of the earnings that have built up over the years. If you take gradual distributions, you pay taxes a little at a time, allowing the rest of the money to continue growing tax deferred. In addition, if the annuity is nonqualified and you elect to receive an annuity payout, you wil ...

... to pay taxes on all of the earnings that have built up over the years. If you take gradual distributions, you pay taxes a little at a time, allowing the rest of the money to continue growing tax deferred. In addition, if the annuity is nonqualified and you elect to receive an annuity payout, you wil ...

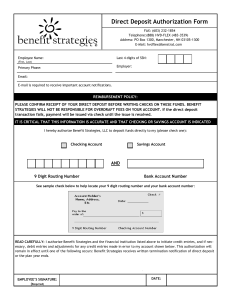

Direct Deposit Authorization Form

... I hereby authorize Benefit Strategies, LLC to deposit funds directly to my (please check one): ...

... I hereby authorize Benefit Strategies, LLC to deposit funds directly to my (please check one): ...

(6990) without criminal background check

... [only for new hires] On or before your first day of employment, please bring proof of identity and eligibility to work in the United States to the Office of Human Resource Services. This information is required for I-9 purposes. For a complete list of eligible documents see http://www.uscis.gov/file ...

... [only for new hires] On or before your first day of employment, please bring proof of identity and eligibility to work in the United States to the Office of Human Resource Services. This information is required for I-9 purposes. For a complete list of eligible documents see http://www.uscis.gov/file ...

RAs and medical expenses

... including medical aid scheme contributions are fully tax-deductible. The new flexibility of retirement annuity funds allows a person to retire from the retirement annuity any time after age 55 – you no longer have to exit by age 70. Therefore you can continue funding the retirement annuity fund unti ...

... including medical aid scheme contributions are fully tax-deductible. The new flexibility of retirement annuity funds allows a person to retire from the retirement annuity any time after age 55 – you no longer have to exit by age 70. Therefore you can continue funding the retirement annuity fund unti ...

Heads I win, tails I win

... These anomalously low real yields are not a source of joy, except for those who can borrow at them. Conventional assessments of defined-benefit pension fund solvency will produce staggering shortfalls when future real pension commitments are discounted at such extremely low rates, driving many of th ...

... These anomalously low real yields are not a source of joy, except for those who can borrow at them. Conventional assessments of defined-benefit pension fund solvency will produce staggering shortfalls when future real pension commitments are discounted at such extremely low rates, driving many of th ...

(Pre-tax salary reduction contributions) ROTH 403(b)

... • Pre-tax contributions are deducted before you pay current income taxes. Pre-tax investments grow tax-deferred and the contributions and any earnings are taxed when you take a distribution from this plan. • Post-tax Roth contributions are deducted after you pay current income taxes. Earnings on pos ...

... • Pre-tax contributions are deducted before you pay current income taxes. Pre-tax investments grow tax-deferred and the contributions and any earnings are taxed when you take a distribution from this plan. • Post-tax Roth contributions are deducted after you pay current income taxes. Earnings on pos ...

This PDF is a selection from a published volume from... Research Volume Title: Demography and the Economy

... The demographic transition to an older population has enormous implications for the well-being of future workers and retirees. In this chapter, Sylvester Schieber shows how this transition will affect economic growth, how it will stress pension systems, and how countries with different pension systems ...

... The demographic transition to an older population has enormous implications for the well-being of future workers and retirees. In this chapter, Sylvester Schieber shows how this transition will affect economic growth, how it will stress pension systems, and how countries with different pension systems ...

1 The Essence of Social Security: Debunked Myths Robert L. Brown

... your life expectancy is not enough. One would be wise to cover at least one’s life expectancy plus one standard deviation. So, if workers want to be sure that they will not outlive their assets, they make conservative withdrawals. That means they live at a lower standard of living than is necessary. ...

... your life expectancy is not enough. One would be wise to cover at least one’s life expectancy plus one standard deviation. So, if workers want to be sure that they will not outlive their assets, they make conservative withdrawals. That means they live at a lower standard of living than is necessary. ...

The Value of Early Investing

... • The securities and Exchange Commission is the federal agency that protects the interest of investors by regulating companies that sell stock. The SEC requires these companies to publicly disclose dishonest practices. The SEC is the final authority over their activities. ...

... • The securities and Exchange Commission is the federal agency that protects the interest of investors by regulating companies that sell stock. The SEC requires these companies to publicly disclose dishonest practices. The SEC is the final authority over their activities. ...

Clinton Vs. Trump

... investments... at all. And two in five are without any long-term assets, such as property or a pension, to fall back on in the future. While alarming enough on their own, these figures become all the more concerning when considering ...

... investments... at all. And two in five are without any long-term assets, such as property or a pension, to fall back on in the future. While alarming enough on their own, these figures become all the more concerning when considering ...

Long Term Disability

... Successive periods of disability after the member returns to work for the City, separated by less than 180 calendar days due to causes related to the earlier disability, will result in the immediate re-commencement of LTD benefits. The benefit will be based on the regular rate of pay on the date the ...

... Successive periods of disability after the member returns to work for the City, separated by less than 180 calendar days due to causes related to the earlier disability, will result in the immediate re-commencement of LTD benefits. The benefit will be based on the regular rate of pay on the date the ...

How the Income Tax Treatment of Saving and Social Security

... • Baseline uses observed median DC contributions for 30-39-year-olds from 2007 to 2010. • Assume 3 percent real growth on accumulations • Assume workers increase annual real contributions by 1 percent each year after 2010. ...

... • Baseline uses observed median DC contributions for 30-39-year-olds from 2007 to 2010. • Assume 3 percent real growth on accumulations • Assume workers increase annual real contributions by 1 percent each year after 2010. ...

REF-PAYT 05-11 - Florida Administrative Code

... This Section is for ROLLOVERS, and must be filled out by a REPRESENTATIVE of the ELIGIBLE PLAN or IRA Please select the type of account the rollover is being deposited in (as defined in s. 402(c)(8)(B) of the Internal Revenue Code) and provide the address to where the check should be mailed. This co ...

... This Section is for ROLLOVERS, and must be filled out by a REPRESENTATIVE of the ELIGIBLE PLAN or IRA Please select the type of account the rollover is being deposited in (as defined in s. 402(c)(8)(B) of the Internal Revenue Code) and provide the address to where the check should be mailed. This co ...

winfield police pension fund

... the loss of money due to gold being lower in the last few months. Gary explained that gold is in our portfolio as a “catastrophic insurance policy.” As a “non-correlating asset”, gold typically moves lower when most other financial investment assets are moving higher and gold moves significantly hig ...

... the loss of money due to gold being lower in the last few months. Gary explained that gold is in our portfolio as a “catastrophic insurance policy.” As a “non-correlating asset”, gold typically moves lower when most other financial investment assets are moving higher and gold moves significantly hig ...

Pension Reform and Financial Markets: Encouraging Household

... Unsustainable pension system and public finances in the long run Introduction of funded pensions system with mandatory private individual account and voluntary supplemental accounts, including in the region. ...

... Unsustainable pension system and public finances in the long run Introduction of funded pensions system with mandatory private individual account and voluntary supplemental accounts, including in the region. ...

Performance Based Pay

... • Strategic implications of pay for performance • Assumptions of incentive plans • Individual and group incentive ...

... • Strategic implications of pay for performance • Assumptions of incentive plans • Individual and group incentive ...

Seeking a Stable Retirement

... effectively pays tax on that $2,000 in dividends to the host countries, and pays tax again, to the IRS this time, when the foreign stock fund reports the dividend income generated by the foreign stocks. ...

... effectively pays tax on that $2,000 in dividends to the host countries, and pays tax again, to the IRS this time, when the foreign stock fund reports the dividend income generated by the foreign stocks. ...

investors choice letter to shareholders

... To the shareholders of Paychex, Inc.: Paychex, Inc. has established an Investors Choice Dividend Reinvestment and Direct Stock Purchase and Sale Plan (the “Plan”) for the convenience to our investors and shareholders. The Plan offers you an affordable alternative for buying and selling common stock ...

... To the shareholders of Paychex, Inc.: Paychex, Inc. has established an Investors Choice Dividend Reinvestment and Direct Stock Purchase and Sale Plan (the “Plan”) for the convenience to our investors and shareholders. The Plan offers you an affordable alternative for buying and selling common stock ...

MFIN5600 Practice questions Chapter 1 1. Characterize each of the

... have a great risk/return profile. We should definitely plan a major investment in hedge funds.’’ DiMarco responds: ‘‘There are several reasons that the Sharpe ratio may be misleading.’’ i. Discuss the situations that could cause an upward bias in the calculation of the Sharpe ratio. ii. Evaluate the ...

... have a great risk/return profile. We should definitely plan a major investment in hedge funds.’’ DiMarco responds: ‘‘There are several reasons that the Sharpe ratio may be misleading.’’ i. Discuss the situations that could cause an upward bias in the calculation of the Sharpe ratio. ii. Evaluate the ...

529 College Savings Plans

... qualified education expenses. (The earnings portion of any withdrawal not used for college expenses is taxed at the recipient's rate and subject to a 10% penalty.) • State tax advantages: Many states offer income tax incentives for state residents, such as a tax deduction for contributions or a tax ...

... qualified education expenses. (The earnings portion of any withdrawal not used for college expenses is taxed at the recipient's rate and subject to a 10% penalty.) • State tax advantages: Many states offer income tax incentives for state residents, such as a tax deduction for contributions or a tax ...

PENCOM ALTERNATE ASSETS SEMINAR

... Very positive results to date but still in early stages Compliance still low – less than 25% of quoted companies registered Pension funds are +/-1% of GDP with potential to grow rapidly (25% by 2020?) Conservative and highly professional regulation which will need to liberalize over time ...

... Very positive results to date but still in early stages Compliance still low – less than 25% of quoted companies registered Pension funds are +/-1% of GDP with potential to grow rapidly (25% by 2020?) Conservative and highly professional regulation which will need to liberalize over time ...

sample letter

... amended (“ERISA”), which includes: (a) an “employee benefit plan” that is subject to the provisions of Title I of ERISA; (b) a “plan” that is not subject to the provisions of Title I of ERISA, but that is subject to the prohibited transaction provisions of Section 4975 of the U.S. Internal Revenue C ...

... amended (“ERISA”), which includes: (a) an “employee benefit plan” that is subject to the provisions of Title I of ERISA; (b) a “plan” that is not subject to the provisions of Title I of ERISA, but that is subject to the prohibited transaction provisions of Section 4975 of the U.S. Internal Revenue C ...

Pop 125 Enrollment Form

... marriage, divorce, death of a spouse or child, birth or adoption of a child, termination or commencement of employment of a spouse, change in my or my spouse’s employment status from full-time to part-time or from part-time to full-time, my spouse or I taking an unpaid leave of absence, a substantia ...

... marriage, divorce, death of a spouse or child, birth or adoption of a child, termination or commencement of employment of a spouse, change in my or my spouse’s employment status from full-time to part-time or from part-time to full-time, my spouse or I taking an unpaid leave of absence, a substantia ...

UK Total Rewards Overview

... Keysight uses a classification model based on the complexity of different positions. Jobs are grouped into Individual Contributor A, Individual Contributor B and People Managers, each with a Generic Factor chart outlining a level definition and the skills and knowledge required. Jobs that involve wo ...

... Keysight uses a classification model based on the complexity of different positions. Jobs are grouped into Individual Contributor A, Individual Contributor B and People Managers, each with a Generic Factor chart outlining a level definition and the skills and knowledge required. Jobs that involve wo ...

2010 Contribution Limits

... You can be more effective in investing for your retirement if you understand what to expect from different types of investments, including their potential returns and risks. Traditionally, investors have looked to stocks for long-term growth, bonds for current income, and cash for short-term protect ...

... You can be more effective in investing for your retirement if you understand what to expect from different types of investments, including their potential returns and risks. Traditionally, investors have looked to stocks for long-term growth, bonds for current income, and cash for short-term protect ...