Pepperdine University Retirement Plan Committee Meeting 08/31/09

... The Committee reviewed the asset allocation by age group for the Diversified Plan and noted more than 50% of participants age 29 and under have allocated their accounts into the T. Rowe Price target date funds. It was noted the target dates funds are the default option which would likely lead to hig ...

... The Committee reviewed the asset allocation by age group for the Diversified Plan and noted more than 50% of participants age 29 and under have allocated their accounts into the T. Rowe Price target date funds. It was noted the target dates funds are the default option which would likely lead to hig ...

Paper

... The problematic is then usual, it deals with the problem of the introduction of a funded part in a pension scheme; the form of this funded part is particular: it consists in a reserve fund created with the surplus of the PAYG pension scheme that appears when increasing the retirement age. We increa ...

... The problematic is then usual, it deals with the problem of the introduction of a funded part in a pension scheme; the form of this funded part is particular: it consists in a reserve fund created with the surplus of the PAYG pension scheme that appears when increasing the retirement age. We increa ...

Statement of investment policies and procedures

... “DC Account” means the value of the Member’s contributions and the University’s matching contributions, accumulated with annual investment returns; “DC Pension” means the Member’s annual pension, as determined at retirement and adjusted from time to time, based on the Member’s DC Account; “Derivativ ...

... “DC Account” means the value of the Member’s contributions and the University’s matching contributions, accumulated with annual investment returns; “DC Pension” means the Member’s annual pension, as determined at retirement and adjusted from time to time, based on the Member’s DC Account; “Derivativ ...

Private Pensions/Les pensions privées

... this is the person(s) ultimately responsible for managing the pension fund with the overriding objective of providing a secure source of retirement income. In cases where operational and oversight responsibilities are split between different committees within an entity, the governing body is the exe ...

... this is the person(s) ultimately responsible for managing the pension fund with the overriding objective of providing a secure source of retirement income. In cases where operational and oversight responsibilities are split between different committees within an entity, the governing body is the exe ...

Section 529 College Savings Plans

... Custodial 529 Plan Another strategy to circumvent the problems created by the tax law changes is for the donor to liquidate the minor’s UTMA account and use the proceeds to fund a 529 plan, thus creating a “custodial” 529 plan. There are some important issues a donor should consider before taking t ...

... Custodial 529 Plan Another strategy to circumvent the problems created by the tax law changes is for the donor to liquidate the minor’s UTMA account and use the proceeds to fund a 529 plan, thus creating a “custodial” 529 plan. There are some important issues a donor should consider before taking t ...

Benefit corporation according to Italian law

... profitability and saves money. The Dow Jones Group Sustainability Index performed at an average of 36,1% better than the traditional Dow Jones Group Index (source: “The Business Case for Sustainability”, July 2012 issued by International Finance Corporation ”). However, the approved legislation has ...

... profitability and saves money. The Dow Jones Group Sustainability Index performed at an average of 36,1% better than the traditional Dow Jones Group Index (source: “The Business Case for Sustainability”, July 2012 issued by International Finance Corporation ”). However, the approved legislation has ...

Qualified Eligible Person ("QEP") Definition

... purpose of acquiring the securities offered, as to which the trustee or other person authorized to make decisions with respect to the trust, and each person who has contributed assets to the trust, is a person described in clause (i), (ii), or (iv); or iv. any person, acting for its own account or t ...

... purpose of acquiring the securities offered, as to which the trustee or other person authorized to make decisions with respect to the trust, and each person who has contributed assets to the trust, is a person described in clause (i), (ii), or (iv); or iv. any person, acting for its own account or t ...

NC Supplemental Retirement Plans JP Morgan Business Review

... JPMAM's value-oriented approach to investing is ideal for risk-averse core fixed income clients. The investment process, led by Swanson, thrives on identifying relative value in the CMO market with minimal option or event risk. In addition, the risk management function is well integrated with the in ...

... JPMAM's value-oriented approach to investing is ideal for risk-averse core fixed income clients. The investment process, led by Swanson, thrives on identifying relative value in the CMO market with minimal option or event risk. In addition, the risk management function is well integrated with the in ...

Contractual Savings and Financial Markets

... charged, per cent of contributions / accumulation Source: Whitehouse (2000) ...

... charged, per cent of contributions / accumulation Source: Whitehouse (2000) ...

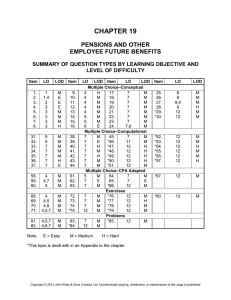

chapter study objectives

... 8. Account for defined benefit plans with benefits that vest or accumulate other than pension plans. Under ASPE, any non-pension defined benefit plans with benefits that vest or accumulate are accounted for in the same way as defined benefit pension plans. Under IFRS, short-term employee benefits ar ...

... 8. Account for defined benefit plans with benefits that vest or accumulate other than pension plans. Under ASPE, any non-pension defined benefit plans with benefits that vest or accumulate are accounted for in the same way as defined benefit pension plans. Under IFRS, short-term employee benefits ar ...

print - MFS Investment Management

... 13 years in 1970 to 20 years in 2014, according to the OECD’s Pensions at a Glance 2015. • OECD projections indicate room for improvement in developed market income replacement rates. In the OECD’s Pensions at a Glance 2015, projected income replacement in the United Kingdom, Australia, Canada and ...

... 13 years in 1970 to 20 years in 2014, according to the OECD’s Pensions at a Glance 2015. • OECD projections indicate room for improvement in developed market income replacement rates. In the OECD’s Pensions at a Glance 2015, projected income replacement in the United Kingdom, Australia, Canada and ...

Private Equity`s Place in Defined Contribution Schemes

... or terminate their DB plans and replace them with DC options. Nor should we conclude that the buoyant public markets performance of recent years is going to save the day via retirement plan investments in equity mutual funds. Fundraising in the private equity industry is going through a period of ch ...

... or terminate their DB plans and replace them with DC options. Nor should we conclude that the buoyant public markets performance of recent years is going to save the day via retirement plan investments in equity mutual funds. Fundraising in the private equity industry is going through a period of ch ...

Setting up a secure retirement income

... forward looking statements, forecasts or predictions based on current expectations about future events and results (see, for example, Figure 1). Actual results may be materially different from those shown. This is because outcomes reflect the assumptions made and may be affected by known or unknown ...

... forward looking statements, forecasts or predictions based on current expectations about future events and results (see, for example, Figure 1). Actual results may be materially different from those shown. This is because outcomes reflect the assumptions made and may be affected by known or unknown ...

The Sec. 401 (k) Retirement Plan: ... and a Simplified Illustration of the ...

... Effective October 18, 1989, all loans must satisfy five criteria. The criteria have been set by the Department of Labor. The first criterion is that "all loans must be available to all participants and beneficiaries on a reasonably equivalent basis" (Charles D. Spencer & Assoc., Inc., 1989b). This m ...

... Effective October 18, 1989, all loans must satisfy five criteria. The criteria have been set by the Department of Labor. The first criterion is that "all loans must be available to all participants and beneficiaries on a reasonably equivalent basis" (Charles D. Spencer & Assoc., Inc., 1989b). This m ...

Annual Report - PEBA - Government of Saskatchewan

... retirement and secondarily in the event of termination of employment. The Plan also provides benefits to the dependents of deceased employees and superannuates in the event of death either prior, or subsequent to retirement. ...

... retirement and secondarily in the event of termination of employment. The Plan also provides benefits to the dependents of deceased employees and superannuates in the event of death either prior, or subsequent to retirement. ...

Operating Leases

... Consequences for the lessee: 1. The lease asset is not reported on the balance sheet - net operating asset turnover (NOAT) is higher. 2. The lease liability is not reported on the balance sheet - financial leverage is improved. 3. Without analytical adjustments (see later section on capitalization o ...

... Consequences for the lessee: 1. The lease asset is not reported on the balance sheet - net operating asset turnover (NOAT) is higher. 2. The lease liability is not reported on the balance sheet - financial leverage is improved. 3. Without analytical adjustments (see later section on capitalization o ...

Download attachment

... Closed and open funds also differ in governance structures. In the case of closed pension funds set up in the trust form, the administration of the fund is the responsibility of a board of trustees that represent the interests of the beneficiaries. The composition and responsibilities of the board v ...

... Closed and open funds also differ in governance structures. In the case of closed pension funds set up in the trust form, the administration of the fund is the responsibility of a board of trustees that represent the interests of the beneficiaries. The composition and responsibilities of the board v ...

NBER WORKING PAPER SERIES PRIVATE PENSIONS INFLATION Martin Feldstein

... 1 The inflation-induced growth of the assets of pension funds would also be reduced to the extent that households save less in response to the lower real yield on saving or divert saving into nonportfolio assets like housing and land. 2 Joseph Stiglitz (1973) develops an analysis which shows that un ...

... 1 The inflation-induced growth of the assets of pension funds would also be reduced to the extent that households save less in response to the lower real yield on saving or divert saving into nonportfolio assets like housing and land. 2 Joseph Stiglitz (1973) develops an analysis which shows that un ...

Saving early for retirement

... invest in domestic or international assets. Mutual funds have annual management fees, called the expense ratio. These fees vary by the fund’s provider and type. (See table 2.) Index funds. Index funds are a simple, inexpensive way to invest in a financial market. An index fund replicates a market in ...

... invest in domestic or international assets. Mutual funds have annual management fees, called the expense ratio. These fees vary by the fund’s provider and type. (See table 2.) Index funds. Index funds are a simple, inexpensive way to invest in a financial market. An index fund replicates a market in ...

Minutes 08-02-12 - The Resource Centers, LLC

... Mr. Lozen discussed the Foster & Foster Memorandum Regarding Funding Requirements. He advised that the State of Florida permits the annual required contributions to be calculated as a percentage of payroll, or in actual dollars. It was a consensus of the Trustees and Finance Director Vickie Bateman ...

... Mr. Lozen discussed the Foster & Foster Memorandum Regarding Funding Requirements. He advised that the State of Florida permits the annual required contributions to be calculated as a percentage of payroll, or in actual dollars. It was a consensus of the Trustees and Finance Director Vickie Bateman ...

Guaranteed Capital Fund

... The information contained in this document does not constitute advice by Sanlam Life. Whilst every attempt has been made to ensure the accuracy of the information contained herein, Sanlam cannot be held responsible for any errors that may occur. Past performance cannot be relied on as an indicator o ...

... The information contained in this document does not constitute advice by Sanlam Life. Whilst every attempt has been made to ensure the accuracy of the information contained herein, Sanlam cannot be held responsible for any errors that may occur. Past performance cannot be relied on as an indicator o ...

Tax-Free Savings Accounts

... RRSP or Registered Retirement Income Fund, which is included when calculating these benefits, withdrawals from a TFSA do not affect the level of benefits received. It should be kept in mind that every individual faces different circumstances and financial needs. ...

... RRSP or Registered Retirement Income Fund, which is included when calculating these benefits, withdrawals from a TFSA do not affect the level of benefits received. It should be kept in mind that every individual faces different circumstances and financial needs. ...

|

... The interests of large sponsors and their pension scheme trustees have become increasingly aligned as the need to control balance sheets and scheme liabilities becomes evermore pressing. The use of liability-driven investment has typically only been employed by these large schemes. However, medium-s ...

... The interests of large sponsors and their pension scheme trustees have become increasingly aligned as the need to control balance sheets and scheme liabilities becomes evermore pressing. The use of liability-driven investment has typically only been employed by these large schemes. However, medium-s ...

2017 Benefits

... FOR INSTITUTIONAL INVESTOR USE ONLY. NOT FOR USE WITH OR DISTRIBUTION TO THE PUBLIC. ...

... FOR INSTITUTIONAL INVESTOR USE ONLY. NOT FOR USE WITH OR DISTRIBUTION TO THE PUBLIC. ...