Decomposition of technical reserves of pension funds in price

... average pay plan. They guarantee nominal future benefits and may index these if the financial condition of the fund allows it. Pension funds have to maintain sufficient own funds as a buffer cushion to absorb financial shocks. If stock prices suddenly fall, then a buffer may prevent that the pension ...

... average pay plan. They guarantee nominal future benefits and may index these if the financial condition of the fund allows it. Pension funds have to maintain sufficient own funds as a buffer cushion to absorb financial shocks. If stock prices suddenly fall, then a buffer may prevent that the pension ...

Conventional annuity solution

... Source: DataStream, BlackRock. Data is based on back-tested, simulated volatility until inception and then is based on realised allocations (inception date 10/02/2012, shown approximately on chart by dashed line). Data correct as of 31/05/2013. Simulated performance shown is calculated net of a TER ...

... Source: DataStream, BlackRock. Data is based on back-tested, simulated volatility until inception and then is based on realised allocations (inception date 10/02/2012, shown approximately on chart by dashed line). Data correct as of 31/05/2013. Simulated performance shown is calculated net of a TER ...

Setting the Discount Rate for Valuing Pension Liabilities

... 2 Gold, J. & Latter, G. “The Case for Marking Public Plan Liabilities to Market.” The Future of Public Employee Retirement Systems, pages 34-35. ...

... 2 Gold, J. & Latter, G. “The Case for Marking Public Plan Liabilities to Market.” The Future of Public Employee Retirement Systems, pages 34-35. ...

Mascaro Company 401(k) Plan

... Statement”. Fill out the form and mail it back. The Social Security Administration will send you a report (in three to four weeks) that shows your employment history and an estimate of your benefits. ...

... Statement”. Fill out the form and mail it back. The Social Security Administration will send you a report (in three to four weeks) that shows your employment history and an estimate of your benefits. ...

Gora - Solidarity versus Free Market ENG

... participation. This is a strong argument. However, it is the argument leading to reduction of choice for participants which is somehow against non-universal participation. This does not lead to any simple conclusion, however, this contradiction should be kept in mind. Different features of schemes o ...

... participation. This is a strong argument. However, it is the argument leading to reduction of choice for participants which is somehow against non-universal participation. This does not lead to any simple conclusion, however, this contradiction should be kept in mind. Different features of schemes o ...

impact of flex contributions and opt

... Penalties under the ACA’s Employer Mandate may apply to an employer when a full-time employee qualifies for and receives financial assistance to purchase coverage on the marketplace, and the coverage offered by the employer to that full-time employee is not affordable because the employee’s require ...

... Penalties under the ACA’s Employer Mandate may apply to an employer when a full-time employee qualifies for and receives financial assistance to purchase coverage on the marketplace, and the coverage offered by the employer to that full-time employee is not affordable because the employee’s require ...

This PDF is a selection from a published volume from... Economic Research Volume Title: Research Findings in the Economics of Aging

... is 48 percent (as compared to a probability of 73 percent based on historical data) and that they believe the variability of returns is also larger than the historical record shows (Kézdi and Willis 2007). Indeed, the professors themselves may not believe that the future will be like the past. For e ...

... is 48 percent (as compared to a probability of 73 percent based on historical data) and that they believe the variability of returns is also larger than the historical record shows (Kézdi and Willis 2007). Indeed, the professors themselves may not believe that the future will be like the past. For e ...

The Origins and Severity of the Public Pension Crisis

... Table 1 below. The first column shows the projected capitalization of the U.S. market assuming that stock prices rise on average in step with corporate profits (i.e. the PE ratio remains constant) and that corporate profits increase at the same rate as the economy. The second column shows the annual ...

... Table 1 below. The first column shows the projected capitalization of the U.S. market assuming that stock prices rise on average in step with corporate profits (i.e. the PE ratio remains constant) and that corporate profits increase at the same rate as the economy. The second column shows the annual ...

Media Release

... “With a compulsory annuity the annuity rate, or monthly pension, is determined by the life insurer and is dependent on the current interest rate. But with a living annuity, investors can choose a suitable mix of underlying market linked investments.” Benefit payments The life industry settled claims ...

... “With a compulsory annuity the annuity rate, or monthly pension, is determined by the life insurer and is dependent on the current interest rate. But with a living annuity, investors can choose a suitable mix of underlying market linked investments.” Benefit payments The life industry settled claims ...

Credit Union-Owned Life Insurance

... benefits. CUOLI can also provide the credit union with the ability to offset expenses from existing benefit programs. Many credit unions utilize CUOLI as an investment strategy to fund, or cost-offset, benefit programs designed to reward and retain key employees. However, CUOLI is very flexible and ...

... benefits. CUOLI can also provide the credit union with the ability to offset expenses from existing benefit programs. Many credit unions utilize CUOLI as an investment strategy to fund, or cost-offset, benefit programs designed to reward and retain key employees. However, CUOLI is very flexible and ...

More Cash Balance Plan Sponsors Choosing ash

... Kravitz has already assisted many clients in setting up Actual Rate of Return plans, and has worked with others to convert from a traditional safe harbor rate to Actual Rate of Return. This option is typically best suited for larger plans, since in smaller plans the fluctuation in market returns may ...

... Kravitz has already assisted many clients in setting up Actual Rate of Return plans, and has worked with others to convert from a traditional safe harbor rate to Actual Rate of Return. This option is typically best suited for larger plans, since in smaller plans the fluctuation in market returns may ...

PDF Download

... rather substantially from many other systems in that a substantial part of total pension provision comes from occupational pension funds operating in the private sector. The significant pension savings that have accumulated in these funds in recent decades will help to overcome the burden that popul ...

... rather substantially from many other systems in that a substantial part of total pension provision comes from occupational pension funds operating in the private sector. The significant pension savings that have accumulated in these funds in recent decades will help to overcome the burden that popul ...

The Lender`s View of Debt and Equity: The Case

... contributions and investment earnings of the accumulation in the account. Defined contribution plans are in effect tax-deferred retirement savings accounts held in trust for the employees. Contributions usually are specified as a predetermined fraction of salary, although that fraction need not be c ...

... contributions and investment earnings of the accumulation in the account. Defined contribution plans are in effect tax-deferred retirement savings accounts held in trust for the employees. Contributions usually are specified as a predetermined fraction of salary, although that fraction need not be c ...

New rules for money market funds

... preservation fund is a fiduciary action that must be made in accordance with ERISA’s fiduciary duty requirements (i.e., through a procedurally prudent process). ERISA Section 404(c) does provide a special rule for individual account plans in which the participant exercises independent control over t ...

... preservation fund is a fiduciary action that must be made in accordance with ERISA’s fiduciary duty requirements (i.e., through a procedurally prudent process). ERISA Section 404(c) does provide a special rule for individual account plans in which the participant exercises independent control over t ...

Agreement between NSITF and NECA on the

... Act, excluding pension contributions, bonuses (performance-related payments), overtime payments, and irregular one-off payments (such as driver’s allowance, medicals, 13th month payment, etc.). Section 73 of the ECA defines “remuneration” as ”basic wages, salaries or earnings designated or calculate ...

... Act, excluding pension contributions, bonuses (performance-related payments), overtime payments, and irregular one-off payments (such as driver’s allowance, medicals, 13th month payment, etc.). Section 73 of the ECA defines “remuneration” as ”basic wages, salaries or earnings designated or calculate ...

Note on the methodology for developing a more precise

... funds, which are risk free, does not raise any particular problems. On the other hand, the dividing line between Equity funds and Bond funds is probably harder to define. Moreover, one can maintain that Bond funds also bear not inconsiderable risks (not only exchange rate risk, but also risk of defa ...

... funds, which are risk free, does not raise any particular problems. On the other hand, the dividing line between Equity funds and Bond funds is probably harder to define. Moreover, one can maintain that Bond funds also bear not inconsiderable risks (not only exchange rate risk, but also risk of defa ...

Appendix: Regression Analysis for the Deloitte/ICI Defined

... Department of Labor Form 5500 data for plan-year 2006 indicate that the micro plan segment (plans with less than $1 million in assets ) represent 62% of all 401(k) plans, 4% of all 401(k) plan assets, and 10% of active 401(k) plan participants. The small plan segment (plans with $1 million to less ...

... Department of Labor Form 5500 data for plan-year 2006 indicate that the micro plan segment (plans with less than $1 million in assets ) represent 62% of all 401(k) plans, 4% of all 401(k) plan assets, and 10% of active 401(k) plan participants. The small plan segment (plans with $1 million to less ...

Chapter 10, Liabilities

... + Actual earnings on pension fund investments + Contributions from employer - Payments to retirees = Fund assets at end of the period ...

... + Actual earnings on pension fund investments + Contributions from employer - Payments to retirees = Fund assets at end of the period ...

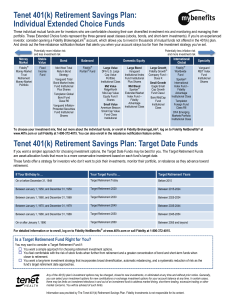

Tenet 401(k) Retirement Savings Plan: Individual Extended Choice

... You want a simple approach for choosing retirement investment options. You feel comfortable with the risk of stock funds when further from retirement and a greater concentration of bond and short-term funds when closer to retirement. You want a long-term investment strategy that incorporates b ...

... You want a simple approach for choosing retirement investment options. You feel comfortable with the risk of stock funds when further from retirement and a greater concentration of bond and short-term funds when closer to retirement. You want a long-term investment strategy that incorporates b ...

Delay SocialSecurity :Funding the Incom e Gap with a Rev ers e M

... The client’s pension alone puts her in a Federal 25% tax bracket before any Social Security or IRA withdrawals are added on top, and her California tax rate is 9%+. Her investments are only in an IRA. (A taxable account was used if there were extra dollars left after RMDs in any years and was avai ...

... The client’s pension alone puts her in a Federal 25% tax bracket before any Social Security or IRA withdrawals are added on top, and her California tax rate is 9%+. Her investments are only in an IRA. (A taxable account was used if there were extra dollars left after RMDs in any years and was avai ...

Pensions in Crisis: Europe and Central Asia Regional

... leaving expenditures constant or even higher. The crisis also resulted in a sharp drop in financial asset values which affects pensions provided by funded pillars. Consequently, no pension system, however structured, has been immune to the crisis. Despite the severity of the financial crisis, it pal ...

... leaving expenditures constant or even higher. The crisis also resulted in a sharp drop in financial asset values which affects pensions provided by funded pillars. Consequently, no pension system, however structured, has been immune to the crisis. Despite the severity of the financial crisis, it pal ...

Determining Fee Reasonableness of a Retirement Plan Recordkeeper

... As many institutional investment advisors know, Collective Investment Trusts have been in existence since the 1970s. Yet today’s collective funds are becoming increasingly popular as plan sponsors and institutional investment advisors seek more efficient ways to provide plan participants with high q ...

... As many institutional investment advisors know, Collective Investment Trusts have been in existence since the 1970s. Yet today’s collective funds are becoming increasingly popular as plan sponsors and institutional investment advisors seek more efficient ways to provide plan participants with high q ...

naic blanks (e) working group - National Association of Insurance

... life insurer’s obligation to make periodic payments for the annuitant’s lifetime at the time designated investments, which are not owned or held by the insurer, are depleted to a contractually-defined amount due to contractually-permitted withdrawals, market performance, fees and/or other charges. I ...

... life insurer’s obligation to make periodic payments for the annuitant’s lifetime at the time designated investments, which are not owned or held by the insurer, are depleted to a contractually-defined amount due to contractually-permitted withdrawals, market performance, fees and/or other charges. I ...

Investment Choice by Plan Members in OECD Countries with

... • But there are additional tasks because of multiplicity: • Definition of complementing portfolios with different strategies • Maintaining a default fund • Support plan members’ decision making • Information provision • Changing and termination of a portfolio, internal transfers • Complex administra ...

... • But there are additional tasks because of multiplicity: • Definition of complementing portfolios with different strategies • Maintaining a default fund • Support plan members’ decision making • Information provision • Changing and termination of a portfolio, internal transfers • Complex administra ...

Economics of Pensions

... pay all outstanding financial liabilities (or, equivalently, liabilities are defined by available funds). If there is no redistribution across generations, a generation is constrained by its own past savings and a representative individual gets out of a funded scheme no more than he has put in.3 If, ...

... pay all outstanding financial liabilities (or, equivalently, liabilities are defined by available funds). If there is no redistribution across generations, a generation is constrained by its own past savings and a representative individual gets out of a funded scheme no more than he has put in.3 If, ...