* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Mascaro Company 401(k) Plan

Survey

Document related concepts

Systemic risk wikipedia , lookup

Private equity wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Fund governance wikipedia , lookup

Stock trader wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Private equity secondary market wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Negative gearing wikipedia , lookup

Private money investing wikipedia , lookup

Investment banking wikipedia , lookup

Early history of private equity wikipedia , lookup

Transcript

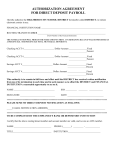

American Management Technologies, Inc. 401k Profit Sharing Retirement Plan Executive Benefit Plans, Inc. and Transamerica Retirement Services www.401kport.com/payroll/ Your Social Security Benefit The Social Security Administration will give you a benefit estimate at your request. Call (800) 772-1213 and ask for a “Request for Earnings & Benefit Estimate Statement”. Fill out the form and mail it back. The Social Security Administration will send you a report (in three to four weeks) that shows your employment history and an estimate of your benefits. WHAT IS A 401(k)? • IRS regulations allowing for employee income deferral before income taxes are withheld. • An employee benefit. • A vehicle available to employees which provides for long-term growth of retirement income. WHAT DOES IT DO FOR ME? • Accumulative savings for retirement. • Current year income tax reduction. • No tax on earnings as they grow. • Future tax advantages when you receive your income. • Competitive investment yields with Transamerica. HOW DOES IT WORK? • You elect a deferral of your income in the form of a percentage of pay (1%100%). • Your company may match a percentage of the salary you defer on a discretionary basis. • Your annual taxable income reported to the IRS is reduced by your elected deferral. • Your deferred income is owned by you and will accrue at a competitive current rate of interest, tax-deferred, with Transamerica. AMT 401(k) Plan Highlights 1) Plan Effective Date: January 1, 2000 2) Maximum Deferral: 100% of Salary to $14,000 in 2005 3) Company Contribution: Discretionary 4) Eligibility Requirements: Age 21 and 12 Months of Service 5) Entry Dates: 1st Day of Each Month 6) Change in Investment Mix: Daily 7) Normal Retirement Date: Age 65 8) Early Retirement Date: Age 55 and 10 Years of Service 9) Vesting of -Elective Contributions: -Employer Contributions: Years of Service Less than 2 2 but less than 3 3 but less than 4 4 but less than 5 5 but less than 6 6 or more 100% Immediate Begins from Date of Hire Vested Percentage 0% 20% 40% 60% 80% 100% 10) Death/Total Disability: 100% Vesting 11) Hardship Withdrawals: of Your Vested Benefits 12) Loans: Permitted with a Minimum of $1,000 13) 24-Hour Fund Performance Hotline: 800-401-8726 14) Transamerica Fund Performance: www.ta-retirement.com 15) Transamerica Voice Response Unit: 800-401-8726 16) AMT Employee Account Website: www.401kport.com/payroll Does 401(k) Cut my Pay? Assuming you are saving now on an after tax basis; your net take home pay will actually increase. Here’s how: Assumes a $20,000 Annual Salary Without 401(k) With 401(k) Current Pay $20,000 $20,000 401(k) Deferral (6%) ______ 1,200 Taxable Income $20,000 $18,800 4,000 3,760 $16,000 $15,040 960 _______ $15,040 $15,040 $ -0- $ 240 Plus your 401(k) Savings -0- 1,200 Plus Employer Match -0- 0 Tax (20%) Net Pay Personal Savings Net Take Home Pay Tax Savings TOTAL SAVINGS $ 960 $ 1,440 The Benefit of Investing Early Age Annual # of years Total Accumulative Contribution in plan Contribution value @ 65 Participant A 20 $2,000 9 $18,000 $465,168 Participant B 30 $2,000 36 $72,000 $404,141 Part. A Part. B $0 $100,000 $200,000 $300,000 $400,000 $500,000 Acc. Value Ttl. Contribution Assumes an 8% Annual Rate of Return How Should I Invest My Plan Contributions? That’s a good question! Especially when you consider the difference just a few percentage points of additional investment return can make on your accumulated balance, as this chart shows: Investment of $100 per Month Years 10 20 30 40 6% $16,470 46,435 100,954 200,145 Assumed Investment Return 8% 10% 12% 18,417 59,295 150,030 351,428 20,655 76,570 227,933 637,428 23,234 99,915 352,991 1,188,242 The right answer for you depends on a number of factors in your own personal situation. These include: How many years until you need to liquidate your account? What other investments do you have? What is your investment goal? What level of risk are you willing to take? Before you try to analyze your answers to these questions, remember a basic theory of investing: over time, you should be rewarded for taking greater risk. For example, despite its ups and downs, over any ten year period in the last 70 years- the stock market has outperformed any other investment category. This is not to say that everyone should invest in the stock market. Every individual is different and has different risk tolerance levels. One way to lower your risk but still participate in the market is to diversify your investments... the old “don’t put your eggs in one basket” theory. With this strategy, even if one type of investment does poorly, the other types are likely to do better. Asset Classifications CASH Investing money in very short term securities such as T-Bills BONDS Lending Money to Governments or Corporations STOCKS Owning a piece of a company Types of Risk • Market Risk -Short Term -Risk of losing money due to market fluctuations • Inflation Risk -Long Term -Risk that your investments won’t earn enough to maintain purchasing power Risk Classifications Examples of Three Investment Strategies Conservative 5% Cash 55% Bonds 40% Stocks Moderate 5% Cash 30% Bonds 65% Stocks Aggressive 15% Bonds 85% Stocks Whatever strategy is right for you, remember, you have the flexibility to change it if your situation or goals change. The keys to successful investing are knowing your risk tolerance, planning a long-term strategy and diversification. Where Do You Fit In? Your Investment Options A broad range of investment funds! Your Investment Options Investment Funds Summary Cash Equivalents Transamerica Stable Value Account Bond Transamerica Bond Ret Acct Hybrid American Funds Balanced Inv Acct Vanguard Target Retirement 2005 Ret Acct Vanguard Target Retirement 2015 Ret Acct Vanguard Target Retirement 2025 Ret Acct Vanguard Target Retirement 2035 Ret Acct Vanguard Target Retirement 2045 Ret Acct Vanguard Target Retirement 2010 Ret Acct Vanguard Target Retirement 2020 Ret Acct Vanguard Target Retirement 2030 Ret Acct Vanguard Target Retirement 2040 Ret Acct Vanguard Target Retirement 2050 Ret Acct Large/Mid Value Equity Columbia Mid Cap Value Fund Large/Mid Blend Equity Transamerica Core Equity Ret Acct Transamerica Partners Stock Index Ret Acct Oppenheimer Main Street Fund AIM Mid Cap Core Equity Fund Large/Mid Growth Equity Transamerica Aggressive Growth Fund Transamerica Equity Fund Transamerica Putnam Vista Fund AIM Capital Appreciation Ret Acct Small Company Equity Fidelity Advisor Small Cap Fund Transamerica SSgA Dow Jones Small Cap Value Fund Global Equity Transamerica Oppenheimer Global Fund International Equity TR Transamerica Templeton Foreign Fund Examples of Three Investment Strategies Conservative 5% Cash 55% Bonds 40% Stocks Moderate 5% Cash 30% Bonds 65% Stocks Aggressive 15% Bonds 85% Stocks Whatever strategy is right for you, remember, you have the flexibility to change it if your situation or goals change. The keys to successful investing are knowing your risk tolerance, planning a long-term strategy and diversification. Assess Your Financial Picture • How Much Have I Saved? • How Much Money Will I Need? • Risk Tolerance Market & Inflation Risk • Time Horizon How many years until I retire? Your Game Plan • Assess your Financial Picture • Save Early on a Pre-tax Basis • Save Regularly - Dollar Cost Averaging • Understand Basic Investment Concepts • Expect Years With Losses! • Develop a Long Term Game Plan • Review that Plan Periodically Questions & Contacts 401k Participant Accounting Contact: 800-401-8726 Telephone VRU (voice response unit) www.ta-retirement.com AMT Benefits Administrator: Tracie Ayers 180 AMT Tech Drive Rocky mount, VA 24151 540-366-8229 [email protected] AMT Primary Contact: A.G. Nichols 180 AMT Tech Drive Rocky mount, VA 24151 540-366-8229 Broker/Transamerica Contact: Mark L. Shaffer RHU, REBC Pension Specialist Executive Benefit Plans, Inc. 800-622-2411 [email protected] www.401kport.com/payroll/ Coordinating Your Retirement Plan For Your Future www.401kport.com/payroll/