Transaction cost changes

... Transaction costs will be incurred when buying and selling investment fund assets. A transaction cost factor (buy spread), if applicable, will be included in the unit price used to buy units in an investment fund to allow for some or all of the costs of buying assets. Similarly, a transaction cost f ...

... Transaction costs will be incurred when buying and selling investment fund assets. A transaction cost factor (buy spread), if applicable, will be included in the unit price used to buy units in an investment fund to allow for some or all of the costs of buying assets. Similarly, a transaction cost f ...

How to get income from your pension

... ne of the great benefits of the new pension freedoms is that they make it easier for savers to take an income from their retirement fund without buying an annuity. While an annuity pays a guaranteed income for life, it does so at the cost of surrendering your savings at the outset; when you die, ther ...

... ne of the great benefits of the new pension freedoms is that they make it easier for savers to take an income from their retirement fund without buying an annuity. While an annuity pays a guaranteed income for life, it does so at the cost of surrendering your savings at the outset; when you die, ther ...

Spending your pension as you wish

... necessarily real in the same way deficits may not be real today. No one knows. That’s the point with pensions, they are paid out a very long time in the future. “These were young schemes started in the Fifties and Sixties. They didn’t begin to pay out in any serious way, until decades later, when all ...

... necessarily real in the same way deficits may not be real today. No one knows. That’s the point with pensions, they are paid out a very long time in the future. “These were young schemes started in the Fifties and Sixties. They didn’t begin to pay out in any serious way, until decades later, when all ...

The role of financial literacy and pensions knowledge on the

... countries workers are allowed to split their savings among two or more different funds. A common practice among countries is to offer a default fund for workers who do not actively choose how they would like to have their retirement savings invested. Given the array of choices available to workers, ...

... countries workers are allowed to split their savings among two or more different funds. A common practice among countries is to offer a default fund for workers who do not actively choose how they would like to have their retirement savings invested. Given the array of choices available to workers, ...

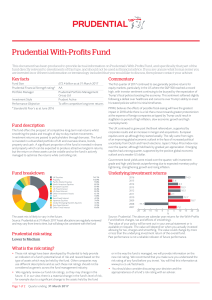

Prudential With

... The performance figures shown are overall annualised returns for contributions made on the dates specified. The returns include both regular and final bonuses added to a benefit paid at normal retirement date, but make no allowance for any applicable initial charges, allocation rates or early cash i ...

... The performance figures shown are overall annualised returns for contributions made on the dates specified. The returns include both regular and final bonuses added to a benefit paid at normal retirement date, but make no allowance for any applicable initial charges, allocation rates or early cash i ...

New Employee Welcome Guide

... Youare immediately 100% vested in your own contributions and any earnings accumulated on those contributions. Your years of service with the State determine how much you are vested in contributions made by the State to your account. The chart below details the vesting schedule for the 4% mandatory c ...

... Youare immediately 100% vested in your own contributions and any earnings accumulated on those contributions. Your years of service with the State determine how much you are vested in contributions made by the State to your account. The chart below details the vesting schedule for the 4% mandatory c ...

Fiduciary Assure - Workplace Benefits

... employees. Who’s looking out for you? You want your employees to succeed, not only at work but also in preparing for their retirement. You provide them with the resources and tools they need, while you make available to them a group of diversified investments. It’s a job that comes with great respon ...

... employees. Who’s looking out for you? You want your employees to succeed, not only at work but also in preparing for their retirement. You provide them with the resources and tools they need, while you make available to them a group of diversified investments. It’s a job that comes with great respon ...

Predictors of Pension Finance Literacy: A Survey of Members of

... 1997 RBA Act that brought about regulation, protection and structure to the pension fund industry. RBA continues work to develop the industry and advise the government on pension policy reforms. Kenya’s pension system embraces four components namely the NSSF, Civil Servants Pension Scheme (CSPS), Oc ...

... 1997 RBA Act that brought about regulation, protection and structure to the pension fund industry. RBA continues work to develop the industry and advise the government on pension policy reforms. Kenya’s pension system embraces four components namely the NSSF, Civil Servants Pension Scheme (CSPS), Oc ...

The 4% Withdrawal Rule—Have Planners Been Wrong?

... to be a function of the degree of longevity risk aversion. The risk-averse retiree is one who wants to make provision for a longer-than-expected life, so as risk aversion increases, initial withdrawal rates go down and the slope by age gets flatter. For example, the optimal initial withdrawal rate f ...

... to be a function of the degree of longevity risk aversion. The risk-averse retiree is one who wants to make provision for a longer-than-expected life, so as risk aversion increases, initial withdrawal rates go down and the slope by age gets flatter. For example, the optimal initial withdrawal rate f ...

North Carolina Large Cap Value Fund

... Performance Risks. Before investing, investors should carefully consider the investment objectives, risks, charges and expenses of this Fund and other plan investment options. The performance quoted represents past performance as described herein. The investment value and return will fluctuate so th ...

... Performance Risks. Before investing, investors should carefully consider the investment objectives, risks, charges and expenses of this Fund and other plan investment options. The performance quoted represents past performance as described herein. The investment value and return will fluctuate so th ...

Public Pension Funds and Assumed Rates of Return

... The goal of this research is to add to an emerging body of literature that suggests that the adoption of these relatively high investment return assumptions may partly be explained by political incentives aimed at reducing the amount of annual plan contributions and obscuring the magnitude of unfund ...

... The goal of this research is to add to an emerging body of literature that suggests that the adoption of these relatively high investment return assumptions may partly be explained by political incentives aimed at reducing the amount of annual plan contributions and obscuring the magnitude of unfund ...

Longevity Insurance Benefits for Social Security

... reventing people from falling into poverty as they age is a key goal of Social Security. Longevity insurance is one way to address the income needs of those who have lived longer than they expected and have used up their retirement savings, with only their Social Security benefit remaining. While al ...

... reventing people from falling into poverty as they age is a key goal of Social Security. Longevity insurance is one way to address the income needs of those who have lived longer than they expected and have used up their retirement savings, with only their Social Security benefit remaining. While al ...

North Carolina Fixed Income Fund

... Performance Risks. Before investing, investors should carefully consider the investment objectives, risks, charges and expenses of this Fund and other plan investment options. The performance quoted represents past performance as described herein. The investment value and return will fluctuate so th ...

... Performance Risks. Before investing, investors should carefully consider the investment objectives, risks, charges and expenses of this Fund and other plan investment options. The performance quoted represents past performance as described herein. The investment value and return will fluctuate so th ...

How to get a £1 million pension

... A Many company pensions contracted out of S2P and Serps. The employer took responsibility for paying this top-up. Such employees will automatically have a deduction, to take their company Serps equivalent into account. Q When will I get my state pension? ATo pay for the increase in the state pension ...

... A Many company pensions contracted out of S2P and Serps. The employer took responsibility for paying this top-up. Such employees will automatically have a deduction, to take their company Serps equivalent into account. Q When will I get my state pension? ATo pay for the increase in the state pension ...

pension funds and the u

... Long-term equity projections using asset and liability models often simply rediscover a fallacy amply explained, for example, by Samuelson (1979) and are in any event irrelevant in the face of the above arbitrage argument. The sophistication of the basic indifference proposition is often lost in po ...

... Long-term equity projections using asset and liability models often simply rediscover a fallacy amply explained, for example, by Samuelson (1979) and are in any event irrelevant in the face of the above arbitrage argument. The sophistication of the basic indifference proposition is often lost in po ...

Mixed Use Property Purchase

... For Financial Adviser use only and not for use by retail clients. All statements concerning the tax treatment of products and their benefits are based on our understanding of the current law and HM Revenue & Customs (HMRC) practice. These are for general guidance only and do not constitute professio ...

... For Financial Adviser use only and not for use by retail clients. All statements concerning the tax treatment of products and their benefits are based on our understanding of the current law and HM Revenue & Customs (HMRC) practice. These are for general guidance only and do not constitute professio ...

Launches HDFC Life Cancer Care

... provider today announced the launch of HDFC Life Cancer Care, a health plan that provides financial support on diagnosis of early or major stages of cancer. HDFC Life is the only private life insurance company to offer such a product. The plan is distinct from standard critical illness policies as i ...

... provider today announced the launch of HDFC Life Cancer Care, a health plan that provides financial support on diagnosis of early or major stages of cancer. HDFC Life is the only private life insurance company to offer such a product. The plan is distinct from standard critical illness policies as i ...

OBRA Information Guide

... As an OBRA employee, you must contribute at least 7.5% of your gross compensation per pay period to the SMART Plan. This contribution is deducted on a pre-tax basis, reducing your current taxable income. This means that you will not pay any tax on this money until it is distributed from your account ...

... As an OBRA employee, you must contribute at least 7.5% of your gross compensation per pay period to the SMART Plan. This contribution is deducted on a pre-tax basis, reducing your current taxable income. This means that you will not pay any tax on this money until it is distributed from your account ...

3(38) Investment Policy Statement

... designed to provide eligible employees with the ability to save for retirement over the long-term through a combination of employee [and employer] contributions to individual participant accounts and the earnings thereon. The Plan is a qualified employee benefit plan intended to comply with all appl ...

... designed to provide eligible employees with the ability to save for retirement over the long-term through a combination of employee [and employer] contributions to individual participant accounts and the earnings thereon. The Plan is a qualified employee benefit plan intended to comply with all appl ...

Introduction - Corporate and Professional Pensions Ltd

... The maximum level of pension is set by reference to the Government Actuary’s Department’s (GAD) rates which are based on age and the value of the unsecured pension fund at the date the funds are first designated. The maximum limit is recalculated every five years when the new limit for the next peri ...

... The maximum level of pension is set by reference to the Government Actuary’s Department’s (GAD) rates which are based on age and the value of the unsecured pension fund at the date the funds are first designated. The maximum limit is recalculated every five years when the new limit for the next peri ...

full press release. - Punter Southall Transaction Services

... Palisades Capital Advisors provides solutions to complex corporate finance and US pension issues with a particular focus on merger and acquisitions, restructurings and industry-wide pension arrangements. Palisades Capital Advisors and Punter Southall Transaction Services have worked together since 2 ...

... Palisades Capital Advisors provides solutions to complex corporate finance and US pension issues with a particular focus on merger and acquisitions, restructurings and industry-wide pension arrangements. Palisades Capital Advisors and Punter Southall Transaction Services have worked together since 2 ...

Graystone Consulting Contact List

... GRAYSTONE CONSULTING Graystone Consultant has been contracted to provide retirement counseling services to members on the 403(b) Retirement Plan here at St. Norbert College. Some of the services are: o Investment Fund Monitoring o Benchmark Plan Fees & Costs o On-Site Group Employee Meetings o One ...

... GRAYSTONE CONSULTING Graystone Consultant has been contracted to provide retirement counseling services to members on the 403(b) Retirement Plan here at St. Norbert College. Some of the services are: o Investment Fund Monitoring o Benchmark Plan Fees & Costs o On-Site Group Employee Meetings o One ...

IRA PROVISIONS IN BIPARTISAN RETIREMENT SAVINGS BILLS

... have been introduced in the House (H.R.10) by Representatives Rob Portman (R-OH) and Ben Cardin (DMD) and in the Senate (S. 742) by Senate Finance Committee Chairman Charles Grassley (R-IA) and Ranking Member Max Baucus (D-MT) include provisions that would increase retirement savings by updating and ...

... have been introduced in the House (H.R.10) by Representatives Rob Portman (R-OH) and Ben Cardin (DMD) and in the Senate (S. 742) by Senate Finance Committee Chairman Charles Grassley (R-IA) and Ranking Member Max Baucus (D-MT) include provisions that would increase retirement savings by updating and ...

GENERAL Retirement Plan Enrollment Form *088004*

... As a new employee covered by the Florida Retirement System (FRS), you have an opportunity to enroll in the FRS retirement plan of your choice. See Section 1 for your enrollment deadline. You must be actively employed earning salary and service credit when your form is received by the FRS Plan Choice ...

... As a new employee covered by the Florida Retirement System (FRS), you have an opportunity to enroll in the FRS retirement plan of your choice. See Section 1 for your enrollment deadline. You must be actively employed earning salary and service credit when your form is received by the FRS Plan Choice ...