Past and Present High-Risk Investments by States and Localities

... The Distribution of Pension Risk Measures to quantify states’ exposure to pension risks must be developed before the distribution of pension risks is analyzed. The assets and liabilities of defined benefit plans evolve over the course of the fiscal year as fund assets earn investment returns and gov ...

... The Distribution of Pension Risk Measures to quantify states’ exposure to pension risks must be developed before the distribution of pension risks is analyzed. The assets and liabilities of defined benefit plans evolve over the course of the fiscal year as fund assets earn investment returns and gov ...

PPA 419 – Aging Service Administration

... Workers can voluntarily redirect 4 percent of their payroll taxes up to $1000 annually to a personal account (the maximum contribution is indexed annually to wage growth). No additional contribution from the worker would be required. In exchange for the account, traditional Social Security benef ...

... Workers can voluntarily redirect 4 percent of their payroll taxes up to $1000 annually to a personal account (the maximum contribution is indexed annually to wage growth). No additional contribution from the worker would be required. In exchange for the account, traditional Social Security benef ...

Click here to full press release.

... this week backed the ‘divestment’ movement by supporting calls for pension fund investments on behalf of UNISON members to ‘divest’. ...

... this week backed the ‘divestment’ movement by supporting calls for pension fund investments on behalf of UNISON members to ‘divest’. ...

5vcforum - Attica Ventures

... Unclear which apply and which have been repealed It is possible to interpret that pension funds can invest in PE based on Article 13 of Law 1902/1990: ΄΄.....Likewise they are permitted to purchase and sell all types of shares with a prior joint decision of the Ministers of National Economy and Soci ...

... Unclear which apply and which have been repealed It is possible to interpret that pension funds can invest in PE based on Article 13 of Law 1902/1990: ΄΄.....Likewise they are permitted to purchase and sell all types of shares with a prior joint decision of the Ministers of National Economy and Soci ...

2011-01-27 Presentation to IAPF Trustee Forum

... • That’s all they ever do • The Golden Rule of Pension Communication: Nobody Ever reads the small print Retirement Age, when failures of earlier communication will come back to haunt trustees and finish up as complaints in my Office ...

... • That’s all they ever do • The Golden Rule of Pension Communication: Nobody Ever reads the small print Retirement Age, when failures of earlier communication will come back to haunt trustees and finish up as complaints in my Office ...

sprIng 2010

... principal and on any money earned on that principal. For example, if you earn 6% annually on a $10,000 initial investment, you could have $10,600 at the end of the first year. If you earn the same 6% during the next year, the interest is applied to the new amount in your account and you could have $ ...

... principal and on any money earned on that principal. For example, if you earn 6% annually on a $10,000 initial investment, you could have $10,600 at the end of the first year. If you earn the same 6% during the next year, the interest is applied to the new amount in your account and you could have $ ...

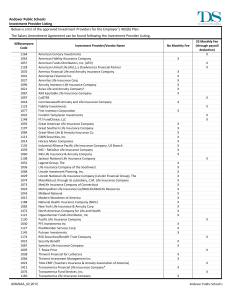

SALARY REDUCTION AGREEMENT (SRA) 403(b)

... the annuity and/or custodial account; it’s terms; the selection of Investment Provider; the solvency of, operation of, or benefits provided by said Investment Provider; or his/her selection and purchase of annuity contracts and/or shares of regulated investments from an Investment Provider. It is un ...

... the annuity and/or custodial account; it’s terms; the selection of Investment Provider; the solvency of, operation of, or benefits provided by said Investment Provider; or his/her selection and purchase of annuity contracts and/or shares of regulated investments from an Investment Provider. It is un ...

AXA Social Security presentation

... Accordingly, any tax information provided in this document is not intended or written to be used, and cannot be used by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transaction(s) ...

... Accordingly, any tax information provided in this document is not intended or written to be used, and cannot be used by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transaction(s) ...

Now you can get real world financial education…in real time

... You should consider the investment objectives, risks, charges and expenses carefully before investing. Please call 877-518-9161 or log on to tiaa.org for current product and fund prospectuses that contain this and other information. Please read the prospectuses carefully before investing. TIAA-CREF ...

... You should consider the investment objectives, risks, charges and expenses carefully before investing. Please call 877-518-9161 or log on to tiaa.org for current product and fund prospectuses that contain this and other information. Please read the prospectuses carefully before investing. TIAA-CREF ...

Fully Insured Plans: A Viable Retirement Plan Solution

... to $2,500 per month. The cash value of her existing contract would buy an annuity of $400 per month at retirement. That existing contract is placed on “paidup” status. The plan purchases another contract for Crystal of $2,100 ($2,500 new benefit minus $400 paid up benefit). The drawback is that the ...

... to $2,500 per month. The cash value of her existing contract would buy an annuity of $400 per month at retirement. That existing contract is placed on “paidup” status. The plan purchases another contract for Crystal of $2,100 ($2,500 new benefit minus $400 paid up benefit). The drawback is that the ...

Key Changes Ahead

... reforming the rules for money market funds. This will have an impact on retirement plans. Money market funds (MMFs) have been used by 401(k) and 403(b) plans to provide a simple, stable and liquid source of income, despite their low returns. The new rules will require committees to re-examine the ro ...

... reforming the rules for money market funds. This will have an impact on retirement plans. Money market funds (MMFs) have been used by 401(k) and 403(b) plans to provide a simple, stable and liquid source of income, despite their low returns. The new rules will require committees to re-examine the ro ...

Now you can get real world financial education

... interested, discover more about how to invest in one of the 529 college savings plans managed by TIAA-CREF Tuition Financing, Inc. for a child, grandchild, yourself or other loved one. ...

... interested, discover more about how to invest in one of the 529 college savings plans managed by TIAA-CREF Tuition Financing, Inc. for a child, grandchild, yourself or other loved one. ...

Is Smart Beta a Smart Strategy for You?

... The "funded status" is a measure of plan assets associated with investment performance and and liabilities that must be reported annually; a longevity from the pension plan sponsor to the plan funded at 80% or less may be struggling. participant. The lump-sum amount is the Most corporate pensions ar ...

... The "funded status" is a measure of plan assets associated with investment performance and and liabilities that must be reported annually; a longevity from the pension plan sponsor to the plan funded at 80% or less may be struggling. participant. The lump-sum amount is the Most corporate pensions ar ...

Private Pensions and Policy Responses to the Financial

... provinces (such as Alberta) and between the Swedish Financial Supervisory Authority, industry and with policy makers. In Spain, meetings between supervisors and industry participants (e.g. INVERCO, the Spanish Association of Investment and Pension Funds) have been held to discuss problems faced, inc ...

... provinces (such as Alberta) and between the Swedish Financial Supervisory Authority, industry and with policy makers. In Spain, meetings between supervisors and industry participants (e.g. INVERCO, the Spanish Association of Investment and Pension Funds) have been held to discuss problems faced, inc ...

Guidelines for Transfers of Registered Plans

... Chartered banks will endeavour to process transfers of deposit type registered plans in a maximum of seven (7) business days normally and twelve (12) business days during peak time (February 15 - March 31) from the date the bank receives the complete and accurate documentation (whether at the branch ...

... Chartered banks will endeavour to process transfers of deposit type registered plans in a maximum of seven (7) business days normally and twelve (12) business days during peak time (February 15 - March 31) from the date the bank receives the complete and accurate documentation (whether at the branch ...

Qualified Default Investment Alternatives

... notice must be provided no less than 30 days prior to the beginning of each subsequent plan year that contributions continue to be invested in the QDIA. Both the initial and annual notices must be written in a manner that can be understood by the average participant and include the following informa ...

... notice must be provided no less than 30 days prior to the beginning of each subsequent plan year that contributions continue to be invested in the QDIA. Both the initial and annual notices must be written in a manner that can be understood by the average participant and include the following informa ...

Minnesota Secure Choice Retirement Savings Act

... stocks, bonds, real estate, etc., professionally managed by the State Board of Investment, will generally generate a higher risk-adjusted long-term rate of return than any low-cost private retirement option, while, on average, outperforming individual investors by 1% or more per annum. Professionall ...

... stocks, bonds, real estate, etc., professionally managed by the State Board of Investment, will generally generate a higher risk-adjusted long-term rate of return than any low-cost private retirement option, while, on average, outperforming individual investors by 1% or more per annum. Professionall ...

PBGC Paper - Quantria Strategies

... annuity contracts and consistently earns a higher rate of return on its assets than the interest rate used to calculate its deficit. Different schools of thought proffer what the appropriate interest rate assumption should be for purposes of calculating the PBGC’s deficit. The PBGC uses the most con ...

... annuity contracts and consistently earns a higher rate of return on its assets than the interest rate used to calculate its deficit. Different schools of thought proffer what the appropriate interest rate assumption should be for purposes of calculating the PBGC’s deficit. The PBGC uses the most con ...

Session 11, Financial Economics Principles Applied to Public

... • For a fixed amount of collateral, which investment makes the promise most secure? • To make the promise secure, which investment requires the least amount of collateral? ...

... • For a fixed amount of collateral, which investment makes the promise most secure? • To make the promise secure, which investment requires the least amount of collateral? ...

xx - T. Rowe Price

... for investors of certain age ranges. The longer the time frame for investing, the higher the allocation is to stocks (and the higher the volatility) versus bonds or cash. Limitations: While the models have been designed with reasonable assumptions and methods, each model is hypothetical only and has ...

... for investors of certain age ranges. The longer the time frame for investing, the higher the allocation is to stocks (and the higher the volatility) versus bonds or cash. Limitations: While the models have been designed with reasonable assumptions and methods, each model is hypothetical only and has ...

(Attachment: 2)COMISAGENDA ITEM 4

... sector scheme. Members are not strictly trustees, as the Local Government Pension Scheme (LGPS) does not have a Trust Deed and is regulated by Statute. Although those entrusted to make statutory decisions under the LGPS are, in many ways, required to act in the same way as trustees in terms of their ...

... sector scheme. Members are not strictly trustees, as the Local Government Pension Scheme (LGPS) does not have a Trust Deed and is regulated by Statute. Although those entrusted to make statutory decisions under the LGPS are, in many ways, required to act in the same way as trustees in terms of their ...

Four things we learned from the Wealth and Assets Survey

... pension (that includes pensions that people are paying into as well as those that they are not) was £46,900. According to the Legal and General annuity calculator, this could provide an annual income of £2,659 over the course of retirement1. In effect then, this would only provide enough income to t ...

... pension (that includes pensions that people are paying into as well as those that they are not) was £46,900. According to the Legal and General annuity calculator, this could provide an annual income of £2,659 over the course of retirement1. In effect then, this would only provide enough income to t ...

Investments

... Ease (speed) with which an asset can be sold and created into cash Investment horizon - planned liquidation date of the investment Regulations Prudent man law Tax considerations Unique needs ...

... Ease (speed) with which an asset can be sold and created into cash Investment horizon - planned liquidation date of the investment Regulations Prudent man law Tax considerations Unique needs ...