Declaration of Eligibility for Institutional Share Classes

... This form is the document evidencing proof of eligibility for an institutional investor. By signing this form you confirm that you are an institutional investor within the meaning of Article 174 of Luxembourg Law of December 2010. This form must be completed by new and existing JPMorgan clients befo ...

... This form is the document evidencing proof of eligibility for an institutional investor. By signing this form you confirm that you are an institutional investor within the meaning of Article 174 of Luxembourg Law of December 2010. This form must be completed by new and existing JPMorgan clients befo ...

Review Your Strategy

... to your investment options. Your recommended asset mix is derived from various factors such as your years to retirement, your projected salary growth, and results from an "asset-liability analysis.” The "asset-liability analysis" is an economic concept that is helpful in understanding your ability t ...

... to your investment options. Your recommended asset mix is derived from various factors such as your years to retirement, your projected salary growth, and results from an "asset-liability analysis.” The "asset-liability analysis" is an economic concept that is helpful in understanding your ability t ...

Western Balkans Investment Framework (WBIF) – Call for Projects

... projects by the European Commission through funding from the Multi-IPA and the International Financial Institutions (IFIs) within the candidate countries and potential candidates. It was founded by the European Commission, the European Bank for Reconstruction and Development, European Investment Ban ...

... projects by the European Commission through funding from the Multi-IPA and the International Financial Institutions (IFIs) within the candidate countries and potential candidates. It was founded by the European Commission, the European Bank for Reconstruction and Development, European Investment Ban ...

Investing In Canadian Dividend Stocks

... of new shares at no cost). These plans are bargains and should be employed by investors. Individual investors require the personal attributes of courage and patience in order to succeed. For example, the recent (and perhaps ongoing) “Great Recession” has caused great upheaval in the investing commun ...

... of new shares at no cost). These plans are bargains and should be employed by investors. Individual investors require the personal attributes of courage and patience in order to succeed. For example, the recent (and perhaps ongoing) “Great Recession” has caused great upheaval in the investing commun ...

Topic 3 – Why diversification is important

... Note: The NZSX All Gross Index is a gross index and from 1 October 2005 assumes the reinvestment of cash dividends. Prior to this date, the NZX gross indices assumed the reinvestment of gross dividends (ie including imputation credits). The Australian All Ords Index is an accumulation (or gross) ind ...

... Note: The NZSX All Gross Index is a gross index and from 1 October 2005 assumes the reinvestment of cash dividends. Prior to this date, the NZX gross indices assumed the reinvestment of gross dividends (ie including imputation credits). The Australian All Ords Index is an accumulation (or gross) ind ...

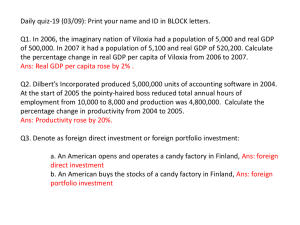

03/09

... Daily quiz-19 (03/09): Print your name and ID in BLOCK letters. Q1. In 2006, the imaginary nation of Viloxia had a population of 5,000 and real GDP of 500,000. In 2007 it had a population of 5,100 and real GDP of 520,200. Calculate the percentage change in real GDP per capita of Viloxia from 2006 to ...

... Daily quiz-19 (03/09): Print your name and ID in BLOCK letters. Q1. In 2006, the imaginary nation of Viloxia had a population of 5,000 and real GDP of 500,000. In 2007 it had a population of 5,100 and real GDP of 520,200. Calculate the percentage change in real GDP per capita of Viloxia from 2006 to ...

Not So Fast - Columbia Center on Sustainable Investment

... multinational companies are increasingly and dangerously using the Investor-State Dispute Settlement mechanism to challenge the ability of governments to regulate businesses. What was once just a relatively little used procedure is now becoming a serious problem for governments that are attempting t ...

... multinational companies are increasingly and dangerously using the Investor-State Dispute Settlement mechanism to challenge the ability of governments to regulate businesses. What was once just a relatively little used procedure is now becoming a serious problem for governments that are attempting t ...

Media release - Insync Funds Management

... Australian-based international equities fund generated a positive return in January while broad MSCI index was down -3.3% in January Insync Global Titans Fund deploys downside protection in the form of buying out-of- the-money index puts (with 60% net asset value covered using index puts for Jan.) T ...

... Australian-based international equities fund generated a positive return in January while broad MSCI index was down -3.3% in January Insync Global Titans Fund deploys downside protection in the form of buying out-of- the-money index puts (with 60% net asset value covered using index puts for Jan.) T ...

25 November 2005 - Lancashire County Council

... The allocation of the Fund, at 30 September, over asset classes and investment managers is shown below and reflects the move to a predominantly specialist investment management structure from December 2004. Each manager is measured against a specific benchmark allocation for each asset class agreed ...

... The allocation of the Fund, at 30 September, over asset classes and investment managers is shown below and reflects the move to a predominantly specialist investment management structure from December 2004. Each manager is measured against a specific benchmark allocation for each asset class agreed ...

Declaration of hedge fund business as a Collective Investment

... of which members of the public are invited or permitted to invest money or other assets and which uses any strategy or takes any position which could result in the arrangement incurring losses greater than its aggregate market value at any point in time, and which strategies or positions include but ...

... of which members of the public are invited or permitted to invest money or other assets and which uses any strategy or takes any position which could result in the arrangement incurring losses greater than its aggregate market value at any point in time, and which strategies or positions include but ...

MedTech ”Made in Germany”

... opportunities for investors and strategic buyers to act countercyclically. The high demand for and the low supply of (risk) capital in the life sciences field make Germany a buyer‘s market at the moment. But negative past experiences with venture capital investments make many institutional investors ...

... opportunities for investors and strategic buyers to act countercyclically. The high demand for and the low supply of (risk) capital in the life sciences field make Germany a buyer‘s market at the moment. But negative past experiences with venture capital investments make many institutional investors ...

responsAbility - CSR

... responsAbility investments AG – a global leader • 3,1 bln USD AuM -> invested in 546 companies in 96 countries • Investors; Fin.Institutions, Pension Funds, DFI’s and small savers ...

... responsAbility investments AG – a global leader • 3,1 bln USD AuM -> invested in 546 companies in 96 countries • Investors; Fin.Institutions, Pension Funds, DFI’s and small savers ...

Transaction cost changes

... Any questions? If you have any questions or would like further information, please: > speak with your ANZ Financial Planner > email us at [email protected] or [email protected] for ANZ OneAnswer > call Customer Services on 13 38 63 weekdays 8am to 8pm (Sydney time). This information is cu ...

... Any questions? If you have any questions or would like further information, please: > speak with your ANZ Financial Planner > email us at [email protected] or [email protected] for ANZ OneAnswer > call Customer Services on 13 38 63 weekdays 8am to 8pm (Sydney time). This information is cu ...

Turmoil and Opportunities in Brazil Infographic

... increased when investing in emerging markets. Additional risks associated with emerging markets investing include smaller-sized markets, liquidity risks, and less established legal, political, social, and business systems to support securities markets. Some emerging markets countries may have fixed ...

... increased when investing in emerging markets. Additional risks associated with emerging markets investing include smaller-sized markets, liquidity risks, and less established legal, political, social, and business systems to support securities markets. Some emerging markets countries may have fixed ...

Edition 2 - 2017 - VZD Capital Management

... while looking out the back window.” As recent political and economic surprises have demonstrated, one simply cannot predict the future. One of the biggest surprises this year may be how staid the markets have remained regardless of news, global events and economic data. Many feared that the presiden ...

... while looking out the back window.” As recent political and economic surprises have demonstrated, one simply cannot predict the future. One of the biggest surprises this year may be how staid the markets have remained regardless of news, global events and economic data. Many feared that the presiden ...

The Swedish AP Funds` co-ordination of carbon footprint reporting

... national pension system, comprising income-based and premium pension contributions. Currently, there are six AP Funds: the First, Second, Third, Fourth, Sixth and Seventh AP Funds. These AP Funds have different responsibilities within the national pension system. They apply different investment stra ...

... national pension system, comprising income-based and premium pension contributions. Currently, there are six AP Funds: the First, Second, Third, Fourth, Sixth and Seventh AP Funds. These AP Funds have different responsibilities within the national pension system. They apply different investment stra ...

VictoryShares US Multi-Factor Minimum Volatility ETF

... visit www.victorysharesliterature.com, call your Financial Advisor, or call shareholder services at 1.866.376.7890. Read the prospectus carefully before investing. Investing involves risk, including the potential loss of principal. There is no guarantee that the Fund will achieve its investment obje ...

... visit www.victorysharesliterature.com, call your Financial Advisor, or call shareholder services at 1.866.376.7890. Read the prospectus carefully before investing. Investing involves risk, including the potential loss of principal. There is no guarantee that the Fund will achieve its investment obje ...

pax small cap fund

... Small Cap Core Funds Average is a total return performance average of the mutual funds tracked by Lipper, Inc. that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a threeyear weighted basis) below Lipper’s USDE small-cap ceiling. Small ...

... Small Cap Core Funds Average is a total return performance average of the mutual funds tracked by Lipper, Inc. that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a threeyear weighted basis) below Lipper’s USDE small-cap ceiling. Small ...

Investment policy statement - Giving to CU

... 2. International Equities: Equity investment opportunities outside of the United States shall be used as a portfolio diversification strategy. Exposure to international equities in developed and emerging markets provide opportunities to participate in growing economies outside of the United States, ...

... 2. International Equities: Equity investment opportunities outside of the United States shall be used as a portfolio diversification strategy. Exposure to international equities in developed and emerging markets provide opportunities to participate in growing economies outside of the United States, ...

HSBC Property Investment Fund

... HSBC Global Asset Management (Malta) Limited is pleased to offer the HSBC Property Investment Fund. Property should be part of a well-balanced investment portfolio. The HSBC Property Investment Fund will provide you with an exciting opportunity to invest in property the easy way. You need not worry ...

... HSBC Global Asset Management (Malta) Limited is pleased to offer the HSBC Property Investment Fund. Property should be part of a well-balanced investment portfolio. The HSBC Property Investment Fund will provide you with an exciting opportunity to invest in property the easy way. You need not worry ...

Grabel Slides 9-8-14 - The University of New Mexico

... • Agenda – Investment experience – Business strategy – Investment Philosophy (time permitting) ...

... • Agenda – Investment experience – Business strategy – Investment Philosophy (time permitting) ...

Robo-advisors have yet to be tested

... in 2008/09 and the client holds on and adds to diminished positions, they would be handsomely rewarded. The person invested with the robo-advisor would be discouraged and likely unwilling to re-enter the market at an opportune time. This is the problem with how the public perceives what an advisor i ...

... in 2008/09 and the client holds on and adds to diminished positions, they would be handsomely rewarded. The person invested with the robo-advisor would be discouraged and likely unwilling to re-enter the market at an opportune time. This is the problem with how the public perceives what an advisor i ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.