Investment Companies Entities Expert Panel

... Peggy McCaffrey, Cohen & Company During her 25-year career, Peggy has enjoyed serving a variety of clients. Prior to the founding of Cohen Fund Audit Services in 2004, Peggy spent 13 years at Cohen & Company working with the firm’s broker-dealers, investment companies, broadcasting companies and oth ...

... Peggy McCaffrey, Cohen & Company During her 25-year career, Peggy has enjoyed serving a variety of clients. Prior to the founding of Cohen Fund Audit Services in 2004, Peggy spent 13 years at Cohen & Company working with the firm’s broker-dealers, investment companies, broadcasting companies and oth ...

403(b) - ADMIN Partners

... Should you choose to take advantage of this retirement savings opportunity, you will need to complete enrollment paperwork provided by the investment provider and a salary reduction agreement that authorizes us to deduct money from your paycheck. A salary reduction agreement is available [INSERT]. W ...

... Should you choose to take advantage of this retirement savings opportunity, you will need to complete enrollment paperwork provided by the investment provider and a salary reduction agreement that authorizes us to deduct money from your paycheck. A salary reduction agreement is available [INSERT]. W ...

November 2013 - Dana Investment Advisors

... increased additions to stock funds and by reading comments in the press that small investors are feeling comfortable owning stocks again. Many of these same people until recently vowed never to own stocks again. Does that mean it’s time to head for the exits? Have we reached extreme levels in stock ...

... increased additions to stock funds and by reading comments in the press that small investors are feeling comfortable owning stocks again. Many of these same people until recently vowed never to own stocks again. Does that mean it’s time to head for the exits? Have we reached extreme levels in stock ...

EXPANDING PHILANTHROPY IN BRAZIL

... There are many challenges for organizations in raising funds from private donors in Brazil. Perhaps the most crucial is that most social investors are linked to corporations, which imposes a set of additional obstacles: Negative perceptions of the capacity of CSOs to carry out their missions: CSO ...

... There are many challenges for organizations in raising funds from private donors in Brazil. Perhaps the most crucial is that most social investors are linked to corporations, which imposes a set of additional obstacles: Negative perceptions of the capacity of CSOs to carry out their missions: CSO ...

Joint-stock Company supporting the capitalization and

... The Guarantee guarantees investments in the Company’s share capital and ensures recovery of 80 per cent of the difference between (i) capital injected to the Company for any reason plus investment costs and (ii) the amount received by the relevant investor, for any reason, during each fiscal year, ...

... The Guarantee guarantees investments in the Company’s share capital and ensures recovery of 80 per cent of the difference between (i) capital injected to the Company for any reason plus investment costs and (ii) the amount received by the relevant investor, for any reason, during each fiscal year, ...

Sustainable Investment Research International Group Local

... campaigns. At the same time, there has been a growing understanding of the potential benefits for investment returns of companies adopting higher corporate social responsibility standards as a way of both managing risk and identifying ways of enhancing future performance. With increasing pressure on ...

... campaigns. At the same time, there has been a growing understanding of the potential benefits for investment returns of companies adopting higher corporate social responsibility standards as a way of both managing risk and identifying ways of enhancing future performance. With increasing pressure on ...

What strategies should I consider to retire in a low/zero interest

... Investors retiring may need to rethink their investment strategy—but, at the same time, avoid several temptations. vehicles. This shift, though, should be carefully calibrated and correlated to mitigate additional risk and make sure you have the proper liquidity. Two strategies you may consider are ...

... Investors retiring may need to rethink their investment strategy—but, at the same time, avoid several temptations. vehicles. This shift, though, should be carefully calibrated and correlated to mitigate additional risk and make sure you have the proper liquidity. Two strategies you may consider are ...

Raising capital is often a grueling, time

... circulate, many an entrepreneur’s thoughts turn to raising capital. Perhaps you are one of those. As part of your conversations with people in the financial industry you may have heard the term “the cost of capital,” a reference to the return on the capital being deployed, whether it is debt or equi ...

... circulate, many an entrepreneur’s thoughts turn to raising capital. Perhaps you are one of those. As part of your conversations with people in the financial industry you may have heard the term “the cost of capital,” a reference to the return on the capital being deployed, whether it is debt or equi ...

Yield Uganda - Pearl Capital Partners

... PCP Uganda team has been operating since 2005, and has unparalleled experience of investing in Ugandan agriculture-related businesses zz PCP Uganda has in-depth experience of tailoring investment structures to the needs of the individual investee, including both equity and medium/long term ...

... PCP Uganda team has been operating since 2005, and has unparalleled experience of investing in Ugandan agriculture-related businesses zz PCP Uganda has in-depth experience of tailoring investment structures to the needs of the individual investee, including both equity and medium/long term ...

CBRE Hotel European Investment figures Q2 2016

... demand for leased hotel assets. The hotel development pipeline expects that over £2 billion of fixed-income stock is due to enter the regional UK market in the next three years. France recorded 25% Y-o-Y growth in the second quarter of 2016 with deal volume totalling €508 million in the first six mo ...

... demand for leased hotel assets. The hotel development pipeline expects that over £2 billion of fixed-income stock is due to enter the regional UK market in the next three years. France recorded 25% Y-o-Y growth in the second quarter of 2016 with deal volume totalling €508 million in the first six mo ...

simplified prospectus

... may use various instruments to reduce the global risk of the portfolio or improve its return. The Fund may use various derivatives such as options, forwards, futures contracts or swaps for hedging purposes against losses incurred by variations in securities values or exchange rates. The Fund may als ...

... may use various instruments to reduce the global risk of the portfolio or improve its return. The Fund may use various derivatives such as options, forwards, futures contracts or swaps for hedging purposes against losses incurred by variations in securities values or exchange rates. The Fund may als ...

European SRI Transparency Code

... Describe the main characteristics of the fund(s): geographical focus, asset class, SRI strategy used (use the classification provided by Eurosif/EFAMA). What is (are) this (these) fund(s) trying to achieve through taking into account ESG criteria? • For instance, financing a specific sector, reducin ...

... Describe the main characteristics of the fund(s): geographical focus, asset class, SRI strategy used (use the classification provided by Eurosif/EFAMA). What is (are) this (these) fund(s) trying to achieve through taking into account ESG criteria? • For instance, financing a specific sector, reducin ...

Debunking some myths and misconceptions about

... We often hear that a benefit of active management is that the manager can move into cash or defensive positions to curb portfolio losses during market downturns or bear markets. In reality, the probability that these managers will move fund assets at just the right time is very low. Most events that ...

... We often hear that a benefit of active management is that the manager can move into cash or defensive positions to curb portfolio losses during market downturns or bear markets. In reality, the probability that these managers will move fund assets at just the right time is very low. Most events that ...

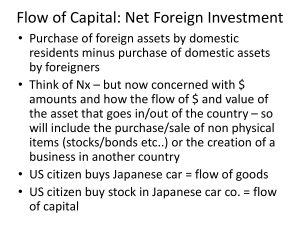

5. CH 29 NFI and B O P notes

... • Think of Nx – but now concerned with $ amounts and how the flow of $ and value of the asset that goes in/out of the country – so will include the purchase/sale of non physical items (stocks/bonds etc..) or the creation of a business in another country • US citizen buys Japanese car = flow of goods ...

... • Think of Nx – but now concerned with $ amounts and how the flow of $ and value of the asset that goes in/out of the country – so will include the purchase/sale of non physical items (stocks/bonds etc..) or the creation of a business in another country • US citizen buys Japanese car = flow of goods ...

here - International Economic Law and Policy Blog

... governance. Moreover, the premise regarding changes in governance rests on questionable assumptions about state behavior, especially in the developing world, where regulatory capacity is often limited. Indeed, the few studies which have examined this question suggest that developing states’ awarenes ...

... governance. Moreover, the premise regarding changes in governance rests on questionable assumptions about state behavior, especially in the developing world, where regulatory capacity is often limited. Indeed, the few studies which have examined this question suggest that developing states’ awarenes ...

Plan summary in word format

... Please see the brochure for a full explanation of the calculation. The securities will be issued by The Royal Bank of Scotland plc, a major financial institution with a credit rating as at 18th August 2011 of ‘A+’ by Standard and Poor’s. If the financial institution were to fail to meet the repaymen ...

... Please see the brochure for a full explanation of the calculation. The securities will be issued by The Royal Bank of Scotland plc, a major financial institution with a credit rating as at 18th August 2011 of ‘A+’ by Standard and Poor’s. If the financial institution were to fail to meet the repaymen ...

Payment of Dividends out of Capital

... her investment and (2) there is a danger that returns which include distributions out of capital are potentially misleading. There has been a recent increase in investor demand globally (and in particular in Asian markets) for investment products that can provide a consistent income with a certain t ...

... her investment and (2) there is a danger that returns which include distributions out of capital are potentially misleading. There has been a recent increase in investor demand globally (and in particular in Asian markets) for investment products that can provide a consistent income with a certain t ...

Investment

... — in reality, human capital investment is hugely important. • But physical capital is obviously important too (just look around you). • Most of the business cycle is accounted for by swings in investment. ...

... — in reality, human capital investment is hugely important. • But physical capital is obviously important too (just look around you). • Most of the business cycle is accounted for by swings in investment. ...

Click to download DGHM ACV SEPTEMBER 2010

... The investment objective of the ACV sub fund is to provide capital appreciation over a multi-year investment horizon by investing primarily in a diversified portfolio of publicly traded equity securities of US based companies, which the Investment Manager believes to be undervalued. The companies wi ...

... The investment objective of the ACV sub fund is to provide capital appreciation over a multi-year investment horizon by investing primarily in a diversified portfolio of publicly traded equity securities of US based companies, which the Investment Manager believes to be undervalued. The companies wi ...

RBC Multi-Strategy Alpha Fund

... prospectus-offered mutual funds. In assessing the suitability of these investments, investors should carefully consider their personal circumstances, including time horizon, liquidity needs, portfolio size, income, investment knowledge and attitude toward price fluctuations. Investors should consult ...

... prospectus-offered mutual funds. In assessing the suitability of these investments, investors should carefully consider their personal circumstances, including time horizon, liquidity needs, portfolio size, income, investment knowledge and attitude toward price fluctuations. Investors should consult ...

Templeton Latin America Fund

... value of shares in the Fund and income received from it can go down as well as up, and investors may not get back the full amount invested. Past performance is no guarantee of future performance. Currency fluctuations may affect the value of overseas investments. When investing in a fund denominated ...

... value of shares in the Fund and income received from it can go down as well as up, and investors may not get back the full amount invested. Past performance is no guarantee of future performance. Currency fluctuations may affect the value of overseas investments. When investing in a fund denominated ...

Investment demand curve Investment demand curve

... Interest rates changes – Movements along the investment demand curve. Expected Rate of Return changes – Shifts of the curve. ...

... Interest rates changes – Movements along the investment demand curve. Expected Rate of Return changes – Shifts of the curve. ...

Click to download DGHM ACV December 2015

... advice. Please consult your own professional advisers in order to evaluate and judge the matters referred to herein. An investment should be made only on the basis of the prospectus, the annual and any subsequent semi-annual-reports of HEREFORD FUNDS (the "Fund"), a société d'investissement à capita ...

... advice. Please consult your own professional advisers in order to evaluate and judge the matters referred to herein. An investment should be made only on the basis of the prospectus, the annual and any subsequent semi-annual-reports of HEREFORD FUNDS (the "Fund"), a société d'investissement à capita ...

University Of Ottawa Presentation

... Jean-François Leprince -Managing Partner Accomplished leader with 30 years of multi-products, multifunctional, multi-geographical experience in the pharmaceutical industry Richard Meadows-Managing Partner VC experience in two multi-billion dollar private equity funds along with 15+ years Business De ...

... Jean-François Leprince -Managing Partner Accomplished leader with 30 years of multi-products, multifunctional, multi-geographical experience in the pharmaceutical industry Richard Meadows-Managing Partner VC experience in two multi-billion dollar private equity funds along with 15+ years Business De ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.