Invesco Core Plus Bond Fund investment philosophy and process

... are in alignment with IFI’s overall view on risks. Additionally, IFI leverages Invesco’s independent group risk function which uses leading thirdparty risk and performance systems to facilitate this continuous oversight function. Risk management guidelines are firmly set within the investment proces ...

... are in alignment with IFI’s overall view on risks. Additionally, IFI leverages Invesco’s independent group risk function which uses leading thirdparty risk and performance systems to facilitate this continuous oversight function. Risk management guidelines are firmly set within the investment proces ...

File - Skagit Community Foundation

... the Board of Directors for approval regarding changes to asset allocation target and range percentages. The Committee may terminate investment advisors who do not adequately discharge their duties, including, but not limited to, failure to meet the investment objectives, failure to adhere to the ...

... the Board of Directors for approval regarding changes to asset allocation target and range percentages. The Committee may terminate investment advisors who do not adequately discharge their duties, including, but not limited to, failure to meet the investment objectives, failure to adhere to the ...

Econ-Growth-for-Development

... • Gov’ts or firms may borrow from other countries or aid agencies – pay back interest from future growth Investment must be balanced between human, physical, and technological resources ...

... • Gov’ts or firms may borrow from other countries or aid agencies – pay back interest from future growth Investment must be balanced between human, physical, and technological resources ...

Energy Access Ventures Fund launched: boost for access to energy

... Manufacturing & Machine Tooling, Utilities & Infrastructures, and Data Centres & Networks. Focused on making energy safe, reliable, efficient, productive and green, the Group’s 170,000-plus employees achieved sales of 25 billion euros in 2014, through an active commitment to helping individuals and ...

... Manufacturing & Machine Tooling, Utilities & Infrastructures, and Data Centres & Networks. Focused on making energy safe, reliable, efficient, productive and green, the Group’s 170,000-plus employees achieved sales of 25 billion euros in 2014, through an active commitment to helping individuals and ...

Click to download IMVA Opportunity March 2014

... This document is for information purposes and internal use only. It is neither an advice nor a recommendation to enter into any investment. Investment suitability must be determined individually for each investor, and the financial instruments described above may not be suitable for all investors. T ...

... This document is for information purposes and internal use only. It is neither an advice nor a recommendation to enter into any investment. Investment suitability must be determined individually for each investor, and the financial instruments described above may not be suitable for all investors. T ...

PPT

... How to Really Pick Stocks, Seriously 1. Diversify–choose a large number of stocks. Lowers risk by limiting exposure to things going wrong in any particular company, industry or country. Diversification has no downside—it reduces risk without reducing your expected return. ...

... How to Really Pick Stocks, Seriously 1. Diversify–choose a large number of stocks. Lowers risk by limiting exposure to things going wrong in any particular company, industry or country. Diversification has no downside—it reduces risk without reducing your expected return. ...

Systems Objectives

... • With no direct connection between contributions and benefits, the financing method is specified by law and may rely on earmarked taxes, contributions based on wages paid by workers and/or employers, or by any other method that raises sufficient funds. • Monthly pensions are paid out of the social ...

... • With no direct connection between contributions and benefits, the financing method is specified by law and may rely on earmarked taxes, contributions based on wages paid by workers and/or employers, or by any other method that raises sufficient funds. • Monthly pensions are paid out of the social ...

High Conviction, High Concentration A CONCENTRATED

... Companies undergoing Positive Dynamic Change are those experiencing High Unit Volume Growth (including growing demand, having a strong business model, enjoying market dominance, or generating free cash flow) or Positive Life Cycle Change (companies benefitting from a positive catalyst, such as new m ...

... Companies undergoing Positive Dynamic Change are those experiencing High Unit Volume Growth (including growing demand, having a strong business model, enjoying market dominance, or generating free cash flow) or Positive Life Cycle Change (companies benefitting from a positive catalyst, such as new m ...

United Emerging Markets Bond Fund

... future or likely performance of the Fund(s) or the Manager. Any extraordinary performance may be due to exceptional circumstances which may not be sustainable. The value of Units and any income from the Fund(s) may fall as well as rise. The above information is strictly for general information only ...

... future or likely performance of the Fund(s) or the Manager. Any extraordinary performance may be due to exceptional circumstances which may not be sustainable. The value of Units and any income from the Fund(s) may fall as well as rise. The above information is strictly for general information only ...

California`s Economic Payoff: Investing in

... Methodology & Method for Calculating the Return on Investment Estimates for this report are based on a variety of data sources, and modelled using a synthetic worklife model. Summaries of the characteristics associated with education in California were estimated by age, ethnicity, and education for ...

... Methodology & Method for Calculating the Return on Investment Estimates for this report are based on a variety of data sources, and modelled using a synthetic worklife model. Summaries of the characteristics associated with education in California were estimated by age, ethnicity, and education for ...

Order Number: 41512 Running Head: A JOB AT EAST COAST

... Question 1 The mutual funds are more advantageous that the companies stocks. The mutual stocks have a low level of risk as compared to the stocks. The mutual funds offer divergent options. These options include the dividend payout, growth and dividend reinvestment, (Kirk, 2011). The mutual funds off ...

... Question 1 The mutual funds are more advantageous that the companies stocks. The mutual stocks have a low level of risk as compared to the stocks. The mutual funds offer divergent options. These options include the dividend payout, growth and dividend reinvestment, (Kirk, 2011). The mutual funds off ...

Key Changes Ahead

... • How do you explain the different types of funds to participants? For retail funds, the redemption fees and gates should be explained. For institutional funds, the f loating NAV should be explained. And, for government funds, perhaps the choice and the likely lower returns should be explained. • Wh ...

... • How do you explain the different types of funds to participants? For retail funds, the redemption fees and gates should be explained. For institutional funds, the f loating NAV should be explained. And, for government funds, perhaps the choice and the likely lower returns should be explained. • Wh ...

Becoming a Millionaire - Frederick H. Willeboordse

... In a mutual fund or unit trust, the money of thousands of individuals is pooled and then invested by the fund manager according to the nature of the fund. Since ‘shares’ only indicate how much is contributed to the pool, it is not necessary to buy entire shares and one can buy e.g. 0.1234 shares. In ...

... In a mutual fund or unit trust, the money of thousands of individuals is pooled and then invested by the fund manager according to the nature of the fund. Since ‘shares’ only indicate how much is contributed to the pool, it is not necessary to buy entire shares and one can buy e.g. 0.1234 shares. In ...

Chap021-Investors and the Investment Process

... • Advice from the mutual fund industry: • Don’t try to outguess the market by moving your money in and out. Buy and hold instead. • Diversify to reduce risk. • Put money in stocks, bonds, and money market mutual funds. • Avoid keeping 401(k) money in a company’s lowrisk default investment scheme. • ...

... • Advice from the mutual fund industry: • Don’t try to outguess the market by moving your money in and out. Buy and hold instead. • Diversify to reduce risk. • Put money in stocks, bonds, and money market mutual funds. • Avoid keeping 401(k) money in a company’s lowrisk default investment scheme. • ...

Lecture 1 Chapter 1PPT

... would like to earn capital income • Borrowers: need more funds than they currently have; willing and able to repay with interest in the future. ...

... would like to earn capital income • Borrowers: need more funds than they currently have; willing and able to repay with interest in the future. ...

The Benefits of Diversification with Real Estate

... assurance that a recurring income stream will be generated or will continue, and there can be no guarantee that these objectives can be met. Potential Hedge Against Inflation: As prices of goods and services increase in the broader economy, real estate can benefit. Rental increases are generally bui ...

... assurance that a recurring income stream will be generated or will continue, and there can be no guarantee that these objectives can be met. Potential Hedge Against Inflation: As prices of goods and services increase in the broader economy, real estate can benefit. Rental increases are generally bui ...

CF CANLIFE GLOBAL INFRASTRUCTURE FUND DRAFT

... Infrastructure assets encompass the basic facilities, services and installations needed for the functioning of a community or society, such as transportation, utilities, energy and communications. Anything from roads and ports to oil and gas storage facilities can fall under the umbrella of infrastr ...

... Infrastructure assets encompass the basic facilities, services and installations needed for the functioning of a community or society, such as transportation, utilities, energy and communications. Anything from roads and ports to oil and gas storage facilities can fall under the umbrella of infrastr ...

Common Mistakes in Investment Portfolios

... • Time weighted Rate of Return calculations have never been performed and reported, and there is no method for evaluating performance relative to risk. • The portfolio’s risk is high given its potential return. • An Investment Policy Statement setting forth objectives and asset class ranges has n ...

... • Time weighted Rate of Return calculations have never been performed and reported, and there is no method for evaluating performance relative to risk. • The portfolio’s risk is high given its potential return. • An Investment Policy Statement setting forth objectives and asset class ranges has n ...

Stable Value Fund

... Are there any limitations on contributions, withdrawals, or transfers from my plan’s stable value option? Generally, there are no limitations on contributions to or withdrawals from the Fund as a result of retirement, death, disability, unforeseen hardship, separation from service, or attainment of ...

... Are there any limitations on contributions, withdrawals, or transfers from my plan’s stable value option? Generally, there are no limitations on contributions to or withdrawals from the Fund as a result of retirement, death, disability, unforeseen hardship, separation from service, or attainment of ...

Poof

... It's one of the largest types of instruments in the world, with a total of about $60 trillion in nominal value, but also the least regulated. It will take days for owners of CDSs bought through Lehman to determine how much they have, much less to create a paper trail to present at bankruptcy court a ...

... It's one of the largest types of instruments in the world, with a total of about $60 trillion in nominal value, but also the least regulated. It will take days for owners of CDSs bought through Lehman to determine how much they have, much less to create a paper trail to present at bankruptcy court a ...

Enterprise Capital Funds

... industries to more general portfolios Range of stages - seed to later stage venture ...

... industries to more general portfolios Range of stages - seed to later stage venture ...

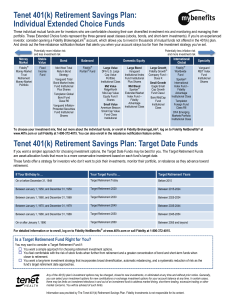

Tenet 401(k) Retirement Savings Plan: Individual Extended Choice

... You feel comfortable with the risk of stock funds when further from retirement and a greater concentration of bond and short-term funds when closer to retirement. You want a long-term investment strategy that incorporates broad diversification, automatic rebalancing, and a systematic reduction o ...

... You feel comfortable with the risk of stock funds when further from retirement and a greater concentration of bond and short-term funds when closer to retirement. You want a long-term investment strategy that incorporates broad diversification, automatic rebalancing, and a systematic reduction o ...

DOC - Europa.eu

... concrete projects that enhance cooperation between schools and companies. And investments in health care will further develop the strength of the workforce and improve living conditions in Poland. Poland will also significantly benefit from the Youth Employment Initiative (we speak about an additi ...

... concrete projects that enhance cooperation between schools and companies. And investments in health care will further develop the strength of the workforce and improve living conditions in Poland. Poland will also significantly benefit from the Youth Employment Initiative (we speak about an additi ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.