CLOs, CDOs and the Search for High Yield

... a portfolio of loans, receiving loan interest while being exposed to loan defaults. However, via tranching of a CLO an investor can also choose to be exposed, for example to the first 10% of defaults on the underlying loans (high risk) or only be impacted should defaults reach 11%-20% (low risk), or ...

... a portfolio of loans, receiving loan interest while being exposed to loan defaults. However, via tranching of a CLO an investor can also choose to be exposed, for example to the first 10% of defaults on the underlying loans (high risk) or only be impacted should defaults reach 11%-20% (low risk), or ...

Large Cap Growth Fund FAQ - Westfield Capital Management

... within a disciplined investment process that is designed to enable its team of career analysts to impact portfolios. Westfield believes constant analysis and measurement of its investment process permits continual improvement to its approach to asset management. What are Fund’s investment objectives ...

... within a disciplined investment process that is designed to enable its team of career analysts to impact portfolios. Westfield believes constant analysis and measurement of its investment process permits continual improvement to its approach to asset management. What are Fund’s investment objectives ...

Testimony Of James Goulka Managing Director Arizona Technology

... I want to focus my comments today on a subset of American small business: startups. These are the creation of one, two, or three individuals, who take the exceptional risk of taking something that doesn’t exist--an idea—and making it into a reality that solves a problem in a new way, causes new ways ...

... I want to focus my comments today on a subset of American small business: startups. These are the creation of one, two, or three individuals, who take the exceptional risk of taking something that doesn’t exist--an idea—and making it into a reality that solves a problem in a new way, causes new ways ...

CMAA Investment Policy - Construction Management Association of

... The CMAA Investment Committee will provide oversight of this investment policy. CMAA management will provide a quarterly report to the CMAA Investment Committee on the investments, presenting such information as the inventory of investments, net income earned, percentage share of each category of in ...

... The CMAA Investment Committee will provide oversight of this investment policy. CMAA management will provide a quarterly report to the CMAA Investment Committee on the investments, presenting such information as the inventory of investments, net income earned, percentage share of each category of in ...

Turkish Capital Markets - Capital Markets Board of Turkey

... One of very few countries during the crisis, where there was ...

... One of very few countries during the crisis, where there was ...

PowerPoint Presentation - Module 1

... these steps to solve your problem: • Talk to your financial professional and explain the problem. Where is the fault? Were communications clear? Refer to your notes. What did the financial professional tell you? What do your notes say? • If your financial professional can't resolve your problem, the ...

... these steps to solve your problem: • Talk to your financial professional and explain the problem. Where is the fault? Were communications clear? Refer to your notes. What did the financial professional tell you? What do your notes say? • If your financial professional can't resolve your problem, the ...

Dynamic Power Canadian Growth Fund Series A

... The indicated rates of return are the historical annual compounded total returns including changes in units [share] value and reinvestment of all distributions [dividends] and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder ...

... The indicated rates of return are the historical annual compounded total returns including changes in units [share] value and reinvestment of all distributions [dividends] and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder ...

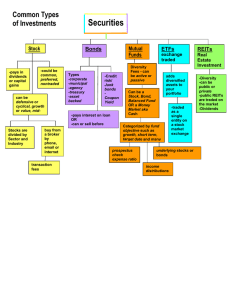

Securities

... money is pooled and invested it in a portfolio of stocks, bonds, short-term money-market instruments and other securities or assets chosen by the mutual fund management. The investor does not own the stock and bonds, they own a share in the company that owns the stocks and bonds. The fund is not tra ...

... money is pooled and invested it in a portfolio of stocks, bonds, short-term money-market instruments and other securities or assets chosen by the mutual fund management. The investor does not own the stock and bonds, they own a share in the company that owns the stocks and bonds. The fund is not tra ...

Real I.S. acquires office building in Brussels for BGV VI

... Jewgrafow, Chief Executive Officer of Real I.S AG. “As the seat of the European Commission, of the European Parliament and NATO, Brussels is especially characterised by its public and business-related service sector, which is also reflected in the strong demand for office space,” Jewgrafow explains. ...

... Jewgrafow, Chief Executive Officer of Real I.S AG. “As the seat of the European Commission, of the European Parliament and NATO, Brussels is especially characterised by its public and business-related service sector, which is also reflected in the strong demand for office space,” Jewgrafow explains. ...

The hidden risks of going passive

... or that it offers a ‘set-and-forget’ approach. We would argue that the most important investment decisions are unavoidably active and that there are hidden risks to index-based investment approaches. Moreover, there is evidence that some active managers can add value. This article looks at these and ...

... or that it offers a ‘set-and-forget’ approach. We would argue that the most important investment decisions are unavoidably active and that there are hidden risks to index-based investment approaches. Moreover, there is evidence that some active managers can add value. This article looks at these and ...

JPMorgan Market Overview

... should carefully consider the investment objectives and risk as well as charges and expenses of the mutual fund before investing. The prospectus contains this and other information about the mutual fund. Read the prospectus carefully before investing. Opinions and estimates offered constitute our ju ...

... should carefully consider the investment objectives and risk as well as charges and expenses of the mutual fund before investing. The prospectus contains this and other information about the mutual fund. Read the prospectus carefully before investing. Opinions and estimates offered constitute our ju ...

Paul Hayden presentation

... • 1st RFCC rolling 10 year Strategic Plan by April 2017 RFCC Stakeholder meeting via Suffolk Costal Forum • Tremendous support within RFCC for local groups and initiatives – we just need help finding ways of getting small amounts of money to where it will be of most use and deliver best value • We k ...

... • 1st RFCC rolling 10 year Strategic Plan by April 2017 RFCC Stakeholder meeting via Suffolk Costal Forum • Tremendous support within RFCC for local groups and initiatives – we just need help finding ways of getting small amounts of money to where it will be of most use and deliver best value • We k ...

January 5, 2016 Dear Friends, The Lerner Group believes that 2016

... The Lerner Group believes that 2016 should be a great year because many new and attractive investment opportunities are likely to arise. The stock market today is at a relatively low level. The S&P Index ended 2015 in the red. As the economy continues to recover, both the profits and stock prices ha ...

... The Lerner Group believes that 2016 should be a great year because many new and attractive investment opportunities are likely to arise. The stock market today is at a relatively low level. The S&P Index ended 2015 in the red. As the economy continues to recover, both the profits and stock prices ha ...

Slide 1 - Prudent Investor Advisors

... drive the long-run performance of these markets. Many participants in 401(k) plans as well as other investors lack the time or interest to research advanced investment principles. In the absence of such expertise, they may take unintended investment risks. Even experienced investors can find themsel ...

... drive the long-run performance of these markets. Many participants in 401(k) plans as well as other investors lack the time or interest to research advanced investment principles. In the absence of such expertise, they may take unintended investment risks. Even experienced investors can find themsel ...

Margin Agreement - RBC Direct Investing

... a) reduce or cancel any margin facility made available to me or refuse to grant any additional margin facility to me; or b) require that I provide margin in addition to the margin requirements of any applicable regulatory authority. I will pay to RBC Direct Investing, on demand, any and all indebted ...

... a) reduce or cancel any margin facility made available to me or refuse to grant any additional margin facility to me; or b) require that I provide margin in addition to the margin requirements of any applicable regulatory authority. I will pay to RBC Direct Investing, on demand, any and all indebted ...

structured return for all market conditions

... on membership in the European Union was a good example of how the strategy can deliver in unsettled conditions. “We had to restructure some of our positions, but we made money on others, which is the point of having both types.” ...

... on membership in the European Union was a good example of how the strategy can deliver in unsettled conditions. “We had to restructure some of our positions, but we made money on others, which is the point of having both types.” ...

lessons learnt in Lao - Land Info Working Group

... Some companies started to think and apply wider concept about CSR. Page 15 ...

... Some companies started to think and apply wider concept about CSR. Page 15 ...

BAE Systems Pension Scheme Additional Voluntary Contributions

... *The Standard Life Money Market The Standard Life Money Market Fund (formerly called the Standard Life Sterling Fund) and With Profits Funds are not available to new contributors. They remain available only to members who were paying regular contributions prior to 1 February 2011. ...

... *The Standard Life Money Market The Standard Life Money Market Fund (formerly called the Standard Life Sterling Fund) and With Profits Funds are not available to new contributors. They remain available only to members who were paying regular contributions prior to 1 February 2011. ...

Investment in Financial Capital

... • Summarize reasons why people invest, what is required before beginning, how returns are earned, and some ways to obtain funds to invest. • Determine your own investment philosophy. • Recognize the variety of investments available. • Identify the major factors that affect the return on investment. ...

... • Summarize reasons why people invest, what is required before beginning, how returns are earned, and some ways to obtain funds to invest. • Determine your own investment philosophy. • Recognize the variety of investments available. • Identify the major factors that affect the return on investment. ...

Understanding private equity.

... also impact the willingness of banks and investors to provide financing. Quality of the management team Cash flow consistency Defensible market position Operational leverage for growth Feasibility of a solid exit strategy Stability during economic downturns Presence of larger, well-cap ...

... also impact the willingness of banks and investors to provide financing. Quality of the management team Cash flow consistency Defensible market position Operational leverage for growth Feasibility of a solid exit strategy Stability during economic downturns Presence of larger, well-cap ...

File

... Keywords: asianinvestor | awards | investment performance | hedge funds | hedge fund awards | alternatives AsianInvestor is pleased to announce the 2010 winners for institutional funds management. We conclude the awards announcements today by recognising the best in hedge funds and alternatives hous ...

... Keywords: asianinvestor | awards | investment performance | hedge funds | hedge fund awards | alternatives AsianInvestor is pleased to announce the 2010 winners for institutional funds management. We conclude the awards announcements today by recognising the best in hedge funds and alternatives hous ...

daily review 2016-07-20

... Readership: This document is intended solely for the addressee(s). Its content may be legally privileged and/or confidential. This material is only valid if distributed in the Philippines. Opinions: Any opinions expressed in this document may be subject to change without notice and is not intended t ...

... Readership: This document is intended solely for the addressee(s). Its content may be legally privileged and/or confidential. This material is only valid if distributed in the Philippines. Opinions: Any opinions expressed in this document may be subject to change without notice and is not intended t ...

Information Technology Investment Proposal - IT Governance

... Note – This form is to be submitted for the review of IT investment proposals where the direct cost is greater than $10,000 and less than $50,000 (not including staff time) and the solution requirements are Low Complexity (refer to the IT Governance Web site, Forms, Complexity Calculation Worksheet. ...

... Note – This form is to be submitted for the review of IT investment proposals where the direct cost is greater than $10,000 and less than $50,000 (not including staff time) and the solution requirements are Low Complexity (refer to the IT Governance Web site, Forms, Complexity Calculation Worksheet. ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.