Slide show

... reliability or accuracy nor accepts any responsibility arising in any other way for errors or omissions. ...

... reliability or accuracy nor accepts any responsibility arising in any other way for errors or omissions. ...

Mount Everest Mineral Water Ltd 531096

... time as other information becomes available to us. This report will be updated if events affecting the report materially change. This research on securities [as defined in clause (h) of Section 2 of the Securities Contracts (Regulation) Act, 1956], such research being referred to for the purpose of ...

... time as other information becomes available to us. This report will be updated if events affecting the report materially change. This research on securities [as defined in clause (h) of Section 2 of the Securities Contracts (Regulation) Act, 1956], such research being referred to for the purpose of ...

Chapter 13

... coupon rate they should Bonds usually have a maturity date (up to 30 years or so) Receive benefits through interest income ...

... coupon rate they should Bonds usually have a maturity date (up to 30 years or so) Receive benefits through interest income ...

Fact Sheet:SPDR DoubleLine Short Duration Total

... Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit spdrs.com for most recent month-end p ...

... Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit spdrs.com for most recent month-end p ...

Cash or liquid asset management

... Principles of Personal Finance Importance of Liquidity Nothing happen it without plan Knowledge is the best protection Protect yourself against major catastrophes Time Dimension of Investing The Agency Problem ...

... Principles of Personal Finance Importance of Liquidity Nothing happen it without plan Knowledge is the best protection Protect yourself against major catastrophes Time Dimension of Investing The Agency Problem ...

Hiding in Plain Sight

... This material is for informational purposes only and is not intended to be an offer or solicitation to purchase or sell any security or to employ a specific investment strategy. It is intended solely for the information of those to whom it is distributed by Fieldpoint Private. No part of this materi ...

... This material is for informational purposes only and is not intended to be an offer or solicitation to purchase or sell any security or to employ a specific investment strategy. It is intended solely for the information of those to whom it is distributed by Fieldpoint Private. No part of this materi ...

Bio: Sharon Pivirotto

... serves a nationwide client base of well recognized brands, providing services that take the headache out of managing and administering their defined benefit plans. A seasoned Project Management Professional® (PMP®) certified by the Project Management Institute (PMI®), Karen has over 18 years of expe ...

... serves a nationwide client base of well recognized brands, providing services that take the headache out of managing and administering their defined benefit plans. A seasoned Project Management Professional® (PMP®) certified by the Project Management Institute (PMI®), Karen has over 18 years of expe ...

Pro athletes must use caution to avoid financial

... without verifying that the financial information provided is accurate. Invest only in deals where the financial statements have been audited by a reputable certified public accounting firm. According to the SEC complaint, Wright mailed investors forged Ameritrade account statements. It is critical t ...

... without verifying that the financial information provided is accurate. Invest only in deals where the financial statements have been audited by a reputable certified public accounting firm. According to the SEC complaint, Wright mailed investors forged Ameritrade account statements. It is critical t ...

MANULIFE HIGH YIELD BOND FUND

... Manulife Funds are managed by Manulife Investments, a division of Manulife Asset Management Limited. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the fund facts as well as the prospectus before investing. The indicate ...

... Manulife Funds are managed by Manulife Investments, a division of Manulife Asset Management Limited. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the fund facts as well as the prospectus before investing. The indicate ...

Guaranteed Capital Fund

... reinvested income. Figures are calculated for single premiums in the currency of the fund and are annualised for terms greater than a year. CPI Measures the increase in the price of the basket of goods an average family would buy over a specific time period ...

... reinvested income. Figures are calculated for single premiums in the currency of the fund and are annualised for terms greater than a year. CPI Measures the increase in the price of the basket of goods an average family would buy over a specific time period ...

incentives to investors in the industry

... a high number of rural communities (about 84% of the population is rurally based). This is an untapped opportunity and should serve as a challenge to telecommunications investors especially now that the new policy encourages the development of 20% of the operator’s network capacity to the rural area ...

... a high number of rural communities (about 84% of the population is rurally based). This is an untapped opportunity and should serve as a challenge to telecommunications investors especially now that the new policy encourages the development of 20% of the operator’s network capacity to the rural area ...

Traduction IR strategy 15avril2008

... and aligned plans (for salaried farm workers and skilled crafts person) as of 2020. In light of this role, the FRR is a long-term investor and an instrument for ensuring intergenerational solidarity. For this reason, when it was first set up in 2003 and in the first decisions made by the Fund’s Supe ...

... and aligned plans (for salaried farm workers and skilled crafts person) as of 2020. In light of this role, the FRR is a long-term investor and an instrument for ensuring intergenerational solidarity. For this reason, when it was first set up in 2003 and in the first decisions made by the Fund’s Supe ...

TIAA-CREF Emerging Markets Debt Fund

... Average Maturity refers to the average time to maturity (the date a principal amount of a security becomes due or payable) of all the debt securities held in a portfolio. Option-Adjusted Duration estimates how much the value of a bond portfolio would be affected by a change in prevailing interest ra ...

... Average Maturity refers to the average time to maturity (the date a principal amount of a security becomes due or payable) of all the debt securities held in a portfolio. Option-Adjusted Duration estimates how much the value of a bond portfolio would be affected by a change in prevailing interest ra ...

Assumptions - Absa Investment Account 28 Aug 14

... and is used simply for illustration purposes. You are encouraged to obtain your independent investment, financial, legal, regulatory, tax, accounting, actuarial and other advice relating to the Investment Account. The Calculator projects your investment growth based on your contributions, investment ...

... and is used simply for illustration purposes. You are encouraged to obtain your independent investment, financial, legal, regulatory, tax, accounting, actuarial and other advice relating to the Investment Account. The Calculator projects your investment growth based on your contributions, investment ...

Weekly Commentary 04-27-15 PAA

... This is a remarkable expectation. Second, it’s not achievable without taking considerable risk and the vast majority of investors surveyed said, if they had to choose, they would opt for safety of principal over performance potential. In other words, they wouldn’t take the risk necessary to earn suc ...

... This is a remarkable expectation. Second, it’s not achievable without taking considerable risk and the vast majority of investors surveyed said, if they had to choose, they would opt for safety of principal over performance potential. In other words, they wouldn’t take the risk necessary to earn suc ...

The Role of Theory in Research BHV 390

... Logical Connections from PIT • Human males only have to make a minimal parental investment to obtain reproductive success (a few sperm) • Female humans must make an enormous parental investment to obtain reproductive success (+/- 5 years) • Male humans have reproductive potential limited only by th ...

... Logical Connections from PIT • Human males only have to make a minimal parental investment to obtain reproductive success (a few sperm) • Female humans must make an enormous parental investment to obtain reproductive success (+/- 5 years) • Male humans have reproductive potential limited only by th ...

portfolio objective

... This portfolio targets to achieve long term capital appreciation with a “conservative” positioning. Suitable for ...

... This portfolio targets to achieve long term capital appreciation with a “conservative” positioning. Suitable for ...

download

... • Historically, small company stocks have generated the highest returns. But the volatility of returns have been the highest too • Inflation and taxes have a major impact on returns • Returns on Treasury Bills have barely kept pace ...

... • Historically, small company stocks have generated the highest returns. But the volatility of returns have been the highest too • Inflation and taxes have a major impact on returns • Returns on Treasury Bills have barely kept pace ...

Power and instability of the financial sphere Hersel ESU2008

... • The gap between investment seeking money and profitable real invest widens, because lack of demand • Investment seeking money goes into the secondary market and derivatives of the existing stock of real capital (I.e. profitable corporations, real estate etc.) ...

... • The gap between investment seeking money and profitable real invest widens, because lack of demand • Investment seeking money goes into the secondary market and derivatives of the existing stock of real capital (I.e. profitable corporations, real estate etc.) ...

Chris Diaz Commentary - Snowden Lane Partners

... change, and no forecasts can be guaranteed. The comments may not be relied upon as recommendations, investment advice or an indication of trading intent. Janus makes no representation as to whether any illustration/example mentioned in this document is now or was ever held in any Janus portfolio. Il ...

... change, and no forecasts can be guaranteed. The comments may not be relied upon as recommendations, investment advice or an indication of trading intent. Janus makes no representation as to whether any illustration/example mentioned in this document is now or was ever held in any Janus portfolio. Il ...

On the Significance of the Investment Chapter of the Energy Charter

... 14.Cementownia "Nowa Huta" S.A. (Poland) v. Republic of Turkey 15.Europe Cement Investment and Trade S.A. (Poland) v. Republic of Turkey 16.Liman Caspian Oil B.V. (the Netherlands) and NCL Dutch Investment B.V. (the Netherlands) v. Republic of Kazakhstan 17.Electrabel S.A. v. Republic of Hungary 18. ...

... 14.Cementownia "Nowa Huta" S.A. (Poland) v. Republic of Turkey 15.Europe Cement Investment and Trade S.A. (Poland) v. Republic of Turkey 16.Liman Caspian Oil B.V. (the Netherlands) and NCL Dutch Investment B.V. (the Netherlands) v. Republic of Kazakhstan 17.Electrabel S.A. v. Republic of Hungary 18. ...

Biodiversity Fund: Investing in Tasmania*sNative

... BIODIVERSITY FUND: INVESTING IN TASMANIA’S NATIVE FORESTS 2013–14 The Biodiversity Fund’s targeted investment approach provides an opportunity to focus on environments that are rich in biodiversity but which are facing increasing pressures. Such pressures include loss of habitat connectivity through ...

... BIODIVERSITY FUND: INVESTING IN TASMANIA’S NATIVE FORESTS 2013–14 The Biodiversity Fund’s targeted investment approach provides an opportunity to focus on environments that are rich in biodiversity but which are facing increasing pressures. Such pressures include loss of habitat connectivity through ...

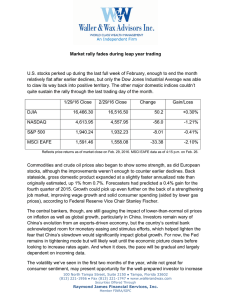

Market rally fades during leap year trading U.S. stocks perked up

... The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and ...

... The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and ...

Information and Registration

... The World Investment Report 2010 presents the latest data on foreign direct investment (FDI) around the world. It also traces global and regional trends in investment and international production by transnational corporations (TNCs). This year’s World Investment Report puts a special focus on climat ...

... The World Investment Report 2010 presents the latest data on foreign direct investment (FDI) around the world. It also traces global and regional trends in investment and international production by transnational corporations (TNCs). This year’s World Investment Report puts a special focus on climat ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.