* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Addendum - Canara Robeco

Structured investment vehicle wikipedia , lookup

Initial public offering wikipedia , lookup

Asset-backed security wikipedia , lookup

Private equity wikipedia , lookup

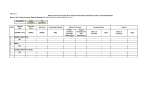

Private equity in the 1980s wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

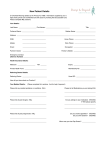

Private equity secondary market wikipedia , lookup

Early history of private equity wikipedia , lookup

Mutual fund wikipedia , lookup

Socially responsible investing wikipedia , lookup

PRESS – RELEASE ADDENDUM This Addendum is dated 30.12.2004 and sets out changes that have taken place from the date of issuance of last Addendum on various aspects of working of the Fund. (1) Sri. P. V. Maiya, has ceased to be the Chairman, Board of Trustees, Canbank Mutual Fund w.e.f. 22.06.2004 upon his resignation. (2) Sri H. N. Sinor has been inducted as Chairman on the Board of Canbank Mutual Fund w.e.f 23.08.2004 Name Current Directorships SHRI H. N. SINOR 764 – F, Sarosh Court, Tilak Road, Dadar, Mumbai 400 014 Chairman : ICICI Infotech Ltd. Director : 1. ICICI Lombard General Insurance Co. Ltd. 2. National Commodity and Derivatives Exchange Ltd. 3. Themis Healthcare Ltd. 4. CRISIL Ltd. (3) The following key personnel joined Canbank Investment Management Services Ltd. on 15.10.2004 and he is on deputation from Canara Bank (Sponsor). Shri. S. Santhanam Asst. General Manager 51 B.Sc., CAIIB 32 years : 22 years in Commercial Banking and 10 years in Investment Banking (4) The following changes have been effected in Fund Management consequent to the merger of Canbonus, Canglobal and Canpep95 Schemes with CanEquity Diversified Scheme, effective from 30.12.2004. Shri. U. P. Bhat M. Com., LLB, CAIIB Experience : Nine years experience in Commercial Banking & nearly 14 years experience in Fund Management and Operations. Fund Manager for Canpremium, Canequity Tax Saver, Canequity Diversified Schemes. :2: Shr J. Venkatesan, M. Com., I. C.W.A, CAIIB, Experience : Seven years experience in Commercial Banking & nearly 13 years experience in Primary Market / Debt market / Money Market / Equity Market Operations and Fund Management. Fund Manager for Cantriple, Cancigo, CanIndex, Canganga and Canexpo Schemes The AMC will have the discretion to change the Fund Manager depending on the operational requirement (5) Change of address Shri B. Ramani Raj, (Trustee, Canbank Mutual Fund) Chief General Manager (Retd.), Department of Government & Bank Accounts, Reserve Bank of India ,Central Office, Mumbai. Dr. Jauhari Lal Gupta, (Director, Canbank Investment Management Services Ltd.) G 27, Sai Vihar Residency, Sus Road, Pashan, Pune 411 021 Vice Chancellor’s Bungalow, G. G. University Campus, Koni, Bilaspur, Chhattisgarh 495 009 (6) Canbank Mutual Fund has revised the load structure in respect of the following schemes : Category Equity CanEquity Diversified Canexpo CanEquity Tax Saver Canpremium Canganga Cantriple Entry Load % 2.25 Nil 2.25 Nil 2.00 Nil 2.00 2.00 2.00 Limit For Investments less than Rs. 200 Lacs Rs. 200 Lacs and above For Investments less than Rs. 200 Lacs Rs. 200 Lacs and above For Investments less than Rs. 200 Lacs Rs. 200 Lacs and above Exit Load % Nil Nil Nil Nil Nil Nil 0.25, Upto 6 mths 0.25, Upto 6 mths 0.25, Upto 6 mths The revision in load is effective from 01.01.2005. This forms as an integral part of offer document of the respective schemes. :3: NOTICE (7) SEBI (Central Database of Market Participants) Regulations 2003 : SEBI vide its Circular No. MRD/DOP/MAPIN/CIR-26/2004 dated 16.08.2004 and MAPIN/CIR-37/2004 dated 27.10.2004 has made it mandatory for the following class of investors to obtain Unique Identification Number (UIN) under MAPIN Regulations. a) Bodies corporate (their promoters and directors ) who buy, sell or deal or subscribe to units of the various Schemes of the Fund , have to obtain a UIN before 31.12.2004. b) Resident investors not being bodies corporate who buy, sell or deal or subscribe to units of the various Schemes of the Fund of the value of Rs. 100000 or more have to obtain a UIN before 31.03.2005. c) Foreign Institutional Investors, sub accounts and foreign venture capital investors who buy, sell or deal or subscribe to units of the various Schemes of the Fund, have to obtain a UIN by 31.03.2005. SEBI has authorized National Securities Depositories Limited (NSDL) to maintain the database and NSDL designated Point of Service (POS) at various centres for providing registrations under the regulations. The detailed notifications and application form are available in the websites www.sebi.gov.in; www.mapin.nsdl.com Investors who qualify for obtaining UIN as above are required to furnish their UIN in the application form. SYSTEMATIC INVESTMENT PLAN (SIP) 8) We are happy to introduce revised Systematic Investment Plans facility for investors of all our existing schemes . Revised Features of the Systematic Investment Plan are as under: Eligibility : Minimum Amount of first subscription : No. of Instalments a) Minimum b) Maximum Minimum amount of SIP instalments : Minimum Period of investment : : All class of investors provided in the Offer Document Rs. 1000.00 irrespective of the minimum currently prescribed under the respective Schemes. ` Six Months No Limit Rs. 1000.00 and thereafter in multiples of Rs. 1000.00 Six Months, No maximum Period :4: Periodicity : Monthly/Quarterly Dates of post dated Cheques : 5th of every month /quarter (In case, the fixed date happenes to be holiday, the cheques shall be deposited on the next business day. Applicable NAV and Cut-off time : Entry Load : Applicable NAV and cut-off time as prescribed under the Regulation shall be applicable. Nil Exit Load : Notice Period : The exit load shall be applicable, if the amount is withdrawn by the investor within 12 months from the date of respective investment. The exit load will be equivalent to the entry load applicable to investments other than SIP in the respective scheme. Investors may be given option to discontinue SIP by giving 15 days notice prior to the due date of the instalment. This forms as an integral part of offer document of all our open ended schemes. (9) Change of address of Canbank Computer Services Ltd., Registrar and Transfer Agents of CanEquity Diversified, CanExpo, CanEquity Tax Saver, CanIndex, CanPremium, CanTriple, Cancigo and Canganga Schemes : Canbank Computer Services Ltd. Naveen Complex, IV Floor 14, M. G. Road, Bangalore – 560 001 Tel No. (080) 2532 0541/42/43 Fax : 2532 0544 Fax : [email protected];[email protected] The above addendum is issued as an integral part of Offer Documents of all the open ended schemes. Risk Factors All investments in Mutual Funds and Securities are subject to market risks and the NAV of scheme may go up or down depending upon the factors and forces affecting securities market. The investors are advised to read the detailed Offer Document before investing in any scheme.