UNIVERSITY OF THE EAST – CALOOCAN CAMPUS

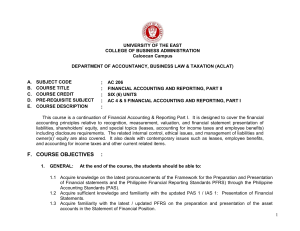

... This course is a continuation of Financial Accounting & Reporting Part I. It is designed to cover the financial accounting principles relative to recognition, measurement, valuation, and financial statement presentation of liabilities, shareholders’ equity, and special topics (leases, accounting for ...

... This course is a continuation of Financial Accounting & Reporting Part I. It is designed to cover the financial accounting principles relative to recognition, measurement, valuation, and financial statement presentation of liabilities, shareholders’ equity, and special topics (leases, accounting for ...

After posting this adjusting entry, the ledger accounts would look like

... Recall that the Prepaid Insurance of $3,600 was for 12 months of insurance. So, during September, we used 1/12 of the insurance, or $300. ...

... Recall that the Prepaid Insurance of $3,600 was for 12 months of insurance. So, during September, we used 1/12 of the insurance, or $300. ...

Do 3 - Together We Pass

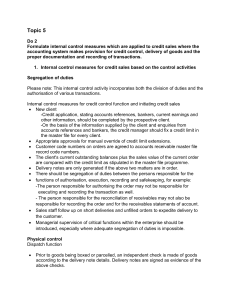

... Formulate internal control measures which are applied to credit sales where the accounting system makes provision for credit control, delivery of goods and the proper documentation and recording of transactions. 1. Internal control measures for credit sales based on the control activities Segregatio ...

... Formulate internal control measures which are applied to credit sales where the accounting system makes provision for credit control, delivery of goods and the proper documentation and recording of transactions. 1. Internal control measures for credit sales based on the control activities Segregatio ...

Environmental Account Framing Workbook

... The perspective of the account framer (economic, human cultural, living, or physical Earth perspective) will influence choices and outcomes throughout the account-framing process. For example, the purpose and motivation for producing the account will depend on the perspective. If the account is inte ...

... The perspective of the account framer (economic, human cultural, living, or physical Earth perspective) will influence choices and outcomes throughout the account-framing process. For example, the purpose and motivation for producing the account will depend on the perspective. If the account is inte ...

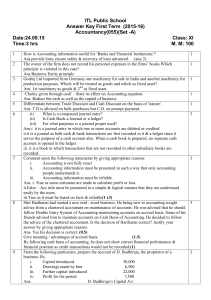

Ans key First term Acc XI

... What is a compound journal entry? (ii) Is Cash Book a Journal or a ledger? (iii) For what purposes is a journal proper used? Ans.i. it is a journal entry in which one or more accounts are debited or credited ii.it is a journal as both cash & bank transactions are first recorded in it & a ledger sinc ...

... What is a compound journal entry? (ii) Is Cash Book a Journal or a ledger? (iii) For what purposes is a journal proper used? Ans.i. it is a journal entry in which one or more accounts are debited or credited ii.it is a journal as both cash & bank transactions are first recorded in it & a ledger sinc ...

MF477 - KSRE Bookstore - Kansas State University

... accounting period for items that will be used in a future period to realize income. Total Operating Expenses (GFI): The sum of cash and noncash expenses plus or minus accrual and expense inventory adjustments. Includes cost of purchased feed, but does not include purchases of items purchased for res ...

... accounting period for items that will be used in a future period to realize income. Total Operating Expenses (GFI): The sum of cash and noncash expenses plus or minus accrual and expense inventory adjustments. Includes cost of purchased feed, but does not include purchases of items purchased for res ...

Internal Control Systems

... of procedures and records established to start, record, process and report entity transactions and maintain accountability for the related assets, liabilities and equity. What are Control Activities? Control activities are those policies and procedures that help ensure that management directives are ...

... of procedures and records established to start, record, process and report entity transactions and maintain accountability for the related assets, liabilities and equity. What are Control Activities? Control activities are those policies and procedures that help ensure that management directives are ...

Accounting Codes - University of California | Office of The President

... code and identifies the campus. Location 2 may be either the numeral 1 (local campus) or the numeral 2 (systemwide or UCOP). The three-digit UC location code is required on all financial data submitted by the campuses to CFS. Campuses may, at local discretion, use a one-digit location code for campu ...

... code and identifies the campus. Location 2 may be either the numeral 1 (local campus) or the numeral 2 (systemwide or UCOP). The three-digit UC location code is required on all financial data submitted by the campuses to CFS. Campuses may, at local discretion, use a one-digit location code for campu ...

download

... However, they too must be able to read and analyze their own balance sheets to determine items such as the current financial balances of cash, accounts receivable, inventories, and accounts payable, and other accounts that have a direct impact on operations. ...

... However, they too must be able to read and analyze their own balance sheets to determine items such as the current financial balances of cash, accounts receivable, inventories, and accounts payable, and other accounts that have a direct impact on operations. ...

What is Accounting? - masif-emba-fais-s12

... Common expenses are: salaries expense, rent expense, utilities expense, tax expense, etc. ...

... Common expenses are: salaries expense, rent expense, utilities expense, tax expense, etc. ...

Chapter 7

... a. Cash cannot be combined with cash equivelants. b. Restricted cash funds may be combined with Cash. c. Cash is listed first in the current assets. d. Restricted cash funds cannot be reported as a ...

... a. Cash cannot be combined with cash equivelants. b. Restricted cash funds may be combined with Cash. c. Cash is listed first in the current assets. d. Restricted cash funds cannot be reported as a ...

General Ledger Overview

... You can create journal entries from existing standard journals or posted journals, and create multiple standard journals for each source journal. You can also allocate an amount from one account to another based on a predefined allocation. Any journal entered, but not yet updated, can be displayed a ...

... You can create journal entries from existing standard journals or posted journals, and create multiple standard journals for each source journal. You can also allocate an amount from one account to another based on a predefined allocation. Any journal entered, but not yet updated, can be displayed a ...

Accounting Theory Defined

... the summarized accounting data: 1 A balance sheet reports the assets, liabilities, and owner’s equity at a specific date. 2 An income statement presents the revenues and expenses and resulting net income or net loss for a specific period of time. 3 A statement of cash flows summarizes information ab ...

... the summarized accounting data: 1 A balance sheet reports the assets, liabilities, and owner’s equity at a specific date. 2 An income statement presents the revenues and expenses and resulting net income or net loss for a specific period of time. 3 A statement of cash flows summarizes information ab ...

Cost Of Goods Sold - McGraw Hill Higher Education

... customs and duties (add) cash discounts (deduction) returns (deduction) to determine the Recorded when title passes to the firm. acquisition cost ...

... customs and duties (add) cash discounts (deduction) returns (deduction) to determine the Recorded when title passes to the firm. acquisition cost ...

Financial Management Policy - Six Nations Of The Grand River

... XXVIII. "Signing Authority" is a person designated and approved by the Six Nations of the Grand River Council to have signing authority for the Six Nations of the Grand River. ...

... XXVIII. "Signing Authority" is a person designated and approved by the Six Nations of the Grand River Council to have signing authority for the Six Nations of the Grand River. ...

Chapter 2--Analyzing Transactions: The Accounting Equation

... 7. Consists of the three basic accounting elements: assets = liabilities + owner's equity. 8. The concept that nonbusiness assets and liabilities are not included in the business' accounting records. 9. An economic event that has a direct impact on the business. 10. An unwritten promise to pay a sup ...

... 7. Consists of the three basic accounting elements: assets = liabilities + owner's equity. 8. The concept that nonbusiness assets and liabilities are not included in the business' accounting records. 9. An economic event that has a direct impact on the business. 10. An unwritten promise to pay a sup ...

SMS203 - National Open University of Nigeria

... As discussed above, you should also note that, in the same way as businesses buy goods or services on credit, because it is convenient to them, they frequently sell goods or services on credit to suit the convenience of their customers. And in the same way explained above, it is equally essential to ...

... As discussed above, you should also note that, in the same way as businesses buy goods or services on credit, because it is convenient to them, they frequently sell goods or services on credit to suit the convenience of their customers. And in the same way explained above, it is equally essential to ...

Slide 1 - Cengage

... Click and study the concept of Business Entity, then read the example below. Example: The company’s financial records should not include information about the owner’s personal belongings, such as a house or a personal car. The owner should also have his or her own bank account separate from the comp ...

... Click and study the concept of Business Entity, then read the example below. Example: The company’s financial records should not include information about the owner’s personal belongings, such as a house or a personal car. The owner should also have his or her own bank account separate from the comp ...

Norwood Office Supplies (NOS) Case AC 432 – DeZoort Fall 2004

... 30, 2003. No changes were made to the inventory or customer standing data after that date. Norwood started using the PCAC system for the month of December. b. You have been provided transactions for the month of December, 2003. Assume that these are all the transactions for the year and that you are ...

... 30, 2003. No changes were made to the inventory or customer standing data after that date. Norwood started using the PCAC system for the month of December. b. You have been provided transactions for the month of December, 2003. Assume that these are all the transactions for the year and that you are ...

chapter 6 solutions version 1

... deposits that have been made by the company but not yet entered on the bank statement. Another cause of the difference is outstanding checks, that is, checks that have been written and recorded in the accounts of the company that have not cleared the bank, hence they have not been deducted from the ...

... deposits that have been made by the company but not yet entered on the bank statement. Another cause of the difference is outstanding checks, that is, checks that have been written and recorded in the accounts of the company that have not cleared the bank, hence they have not been deducted from the ...

preference shares - LPS Business Department

... Share premium • Therefore as shares are each given a NOMINAL value, e.g. a value at which they are worth as part of the company ownership. However because the stock market buyers may be willing to pay a higher price than this, the company can increase the selling price above the shares value, there ...

... Share premium • Therefore as shares are each given a NOMINAL value, e.g. a value at which they are worth as part of the company ownership. However because the stock market buyers may be willing to pay a higher price than this, the company can increase the selling price above the shares value, there ...

chapter 11 powerpoint - Immaculateheartacademy.org

... A bank statement contains an itemized record of all transactions in a depositor’s account. A bank returns the canceled checks, usually as imaged checks, with the bank statement. When these are received, the statement is compared to the checkbook, called reconciling the bank statement or bank reconci ...

... A bank statement contains an itemized record of all transactions in a depositor’s account. A bank returns the canceled checks, usually as imaged checks, with the bank statement. When these are received, the statement is compared to the checkbook, called reconciling the bank statement or bank reconci ...

Top of Form Week 2: The Accounting Information System and

... Cash basis accounting is represented exactly how one would imagine given its name. Transactions are recorded are recorded when cash is either received or cash is paid out. Although often it may be a more simplistic form of accounting, it is not supported by GAAP and may cause misleading information ...

... Cash basis accounting is represented exactly how one would imagine given its name. Transactions are recorded are recorded when cash is either received or cash is paid out. Although often it may be a more simplistic form of accounting, it is not supported by GAAP and may cause misleading information ...

Controlling Cash

... because it is easily concealed. • B. Cash is not readily identifiable and this makes it a likely target for thieves. • C. Cash may be more desirable than other company assets because it can be quickly spent to acquire other things of value. ...

... because it is easily concealed. • B. Cash is not readily identifiable and this makes it a likely target for thieves. • C. Cash may be more desirable than other company assets because it can be quickly spent to acquire other things of value. ...

Unit F011 - Accounting principles - Scheme of work and

... The Scheme of Work and sample Lesson plans provide examples of how to teach this unit and the teaching hours are suggestions only. Some or all of it may be applicable to your teaching. The Specification is the document on which assessment is based and specifies what content and skills need to be cov ...

... The Scheme of Work and sample Lesson plans provide examples of how to teach this unit and the teaching hours are suggestions only. Some or all of it may be applicable to your teaching. The Specification is the document on which assessment is based and specifies what content and skills need to be cov ...