CJAR Fundamentalist Perspective on Accounting Jiang

... firms. “Fundamental analysis” involves assessing firm value from an understanding of business fundamentals, but those fundamentals are often observed through accounting numbers like sales, profit margins, balance sheet debt, and so on. Indeed, fundamental analysis is sometimes viewed as the processi ...

... firms. “Fundamental analysis” involves assessing firm value from an understanding of business fundamentals, but those fundamentals are often observed through accounting numbers like sales, profit margins, balance sheet debt, and so on. Indeed, fundamental analysis is sometimes viewed as the processi ...

Movement in Reserves Statement - Pembrokeshire Coast National

... and are offset against the expenditure against those headings to arrive at the net budget. The net budget for each service also includes a “capital charge”. This is based on the assets used by services and is made up of a charge for depreciation (being the value of assets used-up by a service during ...

... and are offset against the expenditure against those headings to arrive at the net budget. The net budget for each service also includes a “capital charge”. This is based on the assets used by services and is made up of a charge for depreciation (being the value of assets used-up by a service during ...

Unit 1 Consignment - ICAI Knowledge Gateway

... cost means not only the cost of the goods as such to the consignor but also all expenses incurred till the goods reach the premises of the consignee. Such expenses include packaging, freight, cartage, insurance in transit, octroi, etc. But expenses incurred after the goods have reached the consignee ...

... cost means not only the cost of the goods as such to the consignor but also all expenses incurred till the goods reach the premises of the consignee. Such expenses include packaging, freight, cartage, insurance in transit, octroi, etc. But expenses incurred after the goods have reached the consignee ...

Chapter 3 - Bellevue College

... and as more courts levy pollution-related fines, it becomes increasingly likely that companies will have to pay large amounts in the future. NO: The amounts still are too difficult to estimate. Putting inaccurate estimates on the financial statements reduces their usefulness. Instead, why not charge ...

... and as more courts levy pollution-related fines, it becomes increasingly likely that companies will have to pay large amounts in the future. NO: The amounts still are too difficult to estimate. Putting inaccurate estimates on the financial statements reduces their usefulness. Instead, why not charge ...

Notification 297/2015 dated 28th December, 2015 - Regarding the Internal Audit Manual (672 KB)

... The Finance Committee shall fix limits for the total recurring and nonrecurring expenditure for the year, based on income and resources of the Institution. No expenditure shall be incurred by the Institution in excess of the limits so fixed. The following proposals shall also be examined by the Fina ...

... The Finance Committee shall fix limits for the total recurring and nonrecurring expenditure for the year, based on income and resources of the Institution. No expenditure shall be incurred by the Institution in excess of the limits so fixed. The following proposals shall also be examined by the Fina ...

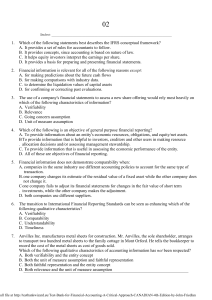

1. Which of the following statements best describes the IFRS

... D. Cash flow statement 21. Which of the following statements best describes the balance sheet? A. It provides information about the financial position of an entity at a specific point in time. B. It measures the economic performance of the entity over a period of time. C. It summarizes only the chan ...

... D. Cash flow statement 21. Which of the following statements best describes the balance sheet? A. It provides information about the financial position of an entity at a specific point in time. B. It measures the economic performance of the entity over a period of time. C. It summarizes only the chan ...

Problem Solutions: Topics 1 and 2 ACCT 60601

... The four main financial statements are: income statement, balance sheet, statement of stockholders’ equity, and statement of cash flows. The income statement provides information relating to the company’s revenues, expenses and profitability over a period of time. The balance sheet lists the company ...

... The four main financial statements are: income statement, balance sheet, statement of stockholders’ equity, and statement of cash flows. The income statement provides information relating to the company’s revenues, expenses and profitability over a period of time. The balance sheet lists the company ...

Using regulatory accounting in developing utility rate

... • GASB 62 (Regulated Operations) is the accounting tool used by public utilities where strictly following GASB does not necessarily meet their business model and the intent of certain accounting transactions that will benefit future periods or be charged against future periods. • All utilities are r ...

... • GASB 62 (Regulated Operations) is the accounting tool used by public utilities where strictly following GASB does not necessarily meet their business model and the intent of certain accounting transactions that will benefit future periods or be charged against future periods. • All utilities are r ...

Report - BidSync

... If by 9:00 am ET WSS has not received the Trade File or been contacted by NRS, then the DCD Operations team will contact NRS Production Assurance at (614) 249-5301. If NRS is unable to send the Trade File by 12:00 pm ET, then they will email the Trade File to the DCD Operations team (“Contingency Mo ...

... If by 9:00 am ET WSS has not received the Trade File or been contacted by NRS, then the DCD Operations team will contact NRS Production Assurance at (614) 249-5301. If NRS is unable to send the Trade File by 12:00 pm ET, then they will email the Trade File to the DCD Operations team (“Contingency Mo ...

A GUIDE TO STATUTORY AUDIT PROCEDURES ON EXPECTED

... With reference to French professional standard NEP-540 (appendix 5).06, “accounting estimates relating to transactions that are unusual due to their amount and their nature, or that are based on strong assumptions where the management’s judgement plays a significant role may result in a high risk of ...

... With reference to French professional standard NEP-540 (appendix 5).06, “accounting estimates relating to transactions that are unusual due to their amount and their nature, or that are based on strong assumptions where the management’s judgement plays a significant role may result in a high risk of ...

ReportBody_Layout 1 - Caherdavin Credit Union

... Volunteers who represent you the members. On your behalf, I would like to thank them for the hours and hours of service they volunteer on your behalf, attending meetings, undertaking training and countless other hours invested in the credit union. The introduction of a new financial reporting standa ...

... Volunteers who represent you the members. On your behalf, I would like to thank them for the hours and hours of service they volunteer on your behalf, attending meetings, undertaking training and countless other hours invested in the credit union. The introduction of a new financial reporting standa ...

APPTICATION OF THE AUDIT PROCESS TO OTHER CYCTES

... transactions for the acquisition and payment cycle receive a considerable amount of attention, especially when the client has effective internal controls. Tests of controls and substantive tests of transactions for the acquisition and payment cycle are divided into two broad areas: 1. Tests of acqui ...

... transactions for the acquisition and payment cycle receive a considerable amount of attention, especially when the client has effective internal controls. Tests of controls and substantive tests of transactions for the acquisition and payment cycle are divided into two broad areas: 1. Tests of acqui ...

Financial Statements of a Company

... Recorded Facts: Financial statements are prepared on the basis of facts in the form of cost data recorded in accounting books. The original cost or historical cost is the basis of recording transactions. The figures of various accounts such as cash in hand, cash at bank, trade receivables, fixed ass ...

... Recorded Facts: Financial statements are prepared on the basis of facts in the form of cost data recorded in accounting books. The original cost or historical cost is the basis of recording transactions. The figures of various accounts such as cash in hand, cash at bank, trade receivables, fixed ass ...

Merchandising Business

... was assessed gross profit? at a value of $98,000 for property tax purposes. On December 4, Gallatin Repair Service was offered $160,000 for the land by a Follow Myretail Example 6-1what value should the land be recorded national chain. At in Gallatin Repair Service’s records? ...

... was assessed gross profit? at a value of $98,000 for property tax purposes. On December 4, Gallatin Repair Service was offered $160,000 for the land by a Follow Myretail Example 6-1what value should the land be recorded national chain. At in Gallatin Repair Service’s records? ...

RAILROAD ACCOUNTING: ITS PROBLEMS AND THEIR EFFECT

... than ties, rail and other track materials on certain railroads as compared with the valuation determined by the Interstate Commerce Commission, which is the basis for computing book depreciation, there are certain material amounts carried in "depreciable properties" as defined in the Uniform System ...

... than ties, rail and other track materials on certain railroads as compared with the valuation determined by the Interstate Commerce Commission, which is the basis for computing book depreciation, there are certain material amounts carried in "depreciable properties" as defined in the Uniform System ...

Accounts Receivable

... The Missing Control Segregation of duties. The foundation should not have allowed an accounts receivable clerk, whose job was to record receivables, to also handle cash, record cash, make deposits, and especially prepare the bank reconciliation. Independent internal verification. The controller was ...

... The Missing Control Segregation of duties. The foundation should not have allowed an accounts receivable clerk, whose job was to record receivables, to also handle cash, record cash, make deposits, and especially prepare the bank reconciliation. Independent internal verification. The controller was ...

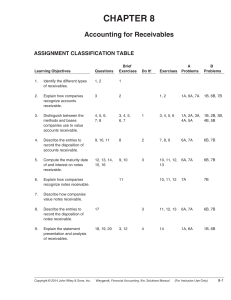

Accounting for Receivables

... Tasanee was the accounts receivable clerk for a large non-profit foundation that provided performance and exhibition space for the performing and visual arts. Her responsibilities included activities normally assigned to an accounts receivable clerk, such as recording revenues from various sources t ...

... Tasanee was the accounts receivable clerk for a large non-profit foundation that provided performance and exhibition space for the performing and visual arts. Her responsibilities included activities normally assigned to an accounts receivable clerk, such as recording revenues from various sources t ...

CHAPTER 8 Accounting for Receivables

... When Jana Company has dishonored a note, the ledger can set up a receivable equal to the face amount of the note plus the interest due. It will then try to collect the balance due, or as much as possible. If there is no hope of collection it will write-off the receivable. ...

... When Jana Company has dishonored a note, the ledger can set up a receivable equal to the face amount of the note plus the interest due. It will then try to collect the balance due, or as much as possible. If there is no hope of collection it will write-off the receivable. ...

The System of Macroeconomic Accounts Statistics

... other international agencies, each statistical standard has been recognized as the international standard for the sector. Although the standards have been harmonized with the 1993 SNA, each is also oriented toward important policy variables not covered by the national accounts, such as measures of t ...

... other international agencies, each statistical standard has been recognized as the international standard for the sector. Although the standards have been harmonized with the 1993 SNA, each is also oriented toward important policy variables not covered by the national accounts, such as measures of t ...

Financial Accounting and Accounting Standards

... Segregate restricted cash from “regular” cash. Current assets or non-current assets Examples, restricted for: (1) plant expansion, (2) retirement of long-term debt, and (3) compensating balances. ...

... Segregate restricted cash from “regular” cash. Current assets or non-current assets Examples, restricted for: (1) plant expansion, (2) retirement of long-term debt, and (3) compensating balances. ...

Project Costing Business Unit

... Any of the ctcLink Finance Team: Emmett Folk – Team Lead Christyanna Dawson ...

... Any of the ctcLink Finance Team: Emmett Folk – Team Lead Christyanna Dawson ...

Financial Accounting Standards Board (FASB)

... been evaluated, the Board meets as many times as necessary to resolve the issues. 5. From these meetings, the Board develops an Exposure Draft of a statement that includes specific recommendations for financial accounting and reporting. 6. After 60 days or longer, if the topic is a major one, all co ...

... been evaluated, the Board meets as many times as necessary to resolve the issues. 5. From these meetings, the Board develops an Exposure Draft of a statement that includes specific recommendations for financial accounting and reporting. 6. After 60 days or longer, if the topic is a major one, all co ...