Libby Libby Short - McGraw Hill Higher Education

... that results from the net income (or loss) for the period less any distribution of dividends. Other changes that do not affect the operations of the current period are also reported in this statement. McGraw-Hill Ryerson ...

... that results from the net income (or loss) for the period less any distribution of dividends. Other changes that do not affect the operations of the current period are also reported in this statement. McGraw-Hill Ryerson ...

The Role of Accounting in a Society

... conceptual solutions in order to make them function better (Cooper, 2015). A good illustration of this is the concept of fair value measurement. Although the credibility of the efficient market theory as the foundation of a substantial part of accounting theory (including the fair value measurement) ...

... conceptual solutions in order to make them function better (Cooper, 2015). A good illustration of this is the concept of fair value measurement. Although the credibility of the efficient market theory as the foundation of a substantial part of accounting theory (including the fair value measurement) ...

Table of Contents - Ontario Energy Board

... balance), and other specified reporting or filings, the distributor is required to report using the alternative accounting standard, including the accounting procedures or requirements that the Board has stipulated. The terms “regulated” and “rate-regulated” as used in this APH do not imply a specif ...

... balance), and other specified reporting or filings, the distributor is required to report using the alternative accounting standard, including the accounting procedures or requirements that the Board has stipulated. The terms “regulated” and “rate-regulated” as used in this APH do not imply a specif ...

Accounting for Government and Society

... modern economies. The task of such research, however, has been facilitated by the development of well defined models of investor behavior and the widespread availability of large data bases. But capital markets are not ‘society’, and many other needs and concerns may be overlooked with a pursuit of ...

... modern economies. The task of such research, however, has been facilitated by the development of well defined models of investor behavior and the widespread availability of large data bases. But capital markets are not ‘society’, and many other needs and concerns may be overlooked with a pursuit of ...

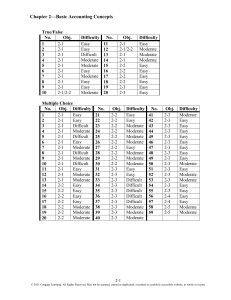

Financial Accounting Chapter 2

... A) increased cash and increased expenses. B) increased cash and decreased expenses. C) decreased cash and increased expenses. D) decreased cash and decreased revenues. Answer: C LO: 2-1 Diff: 1 EOC REF: E2-27 AACSB: Analytical skills AICPA Functional Competencies: Measurement AICPA Business Perspect ...

... A) increased cash and increased expenses. B) increased cash and decreased expenses. C) decreased cash and increased expenses. D) decreased cash and decreased revenues. Answer: C LO: 2-1 Diff: 1 EOC REF: E2-27 AACSB: Analytical skills AICPA Functional Competencies: Measurement AICPA Business Perspect ...

Fraud, Internal Control, and Cash 7

... supermarket is $10 short of the cash rung up on the cash register. If only one person has operated the register, the shift manager can quickly determine responsibility for the shortage. If two or more individuals have worked the register, it may be impossible to determine who is responsible for the ...

... supermarket is $10 short of the cash rung up on the cash register. If only one person has operated the register, the shift manager can quickly determine responsibility for the shortage. If two or more individuals have worked the register, it may be impossible to determine who is responsible for the ...

Fund - McGraw Hill Higher Education - McGraw

... Long-term capital items are not reported on the fund-based balance sheet, but are scheduled and reported in the government-wide financial statements. Reports only those liabilities that have become due and will require current financial resources to liquidate. Long-term debt principal not due within ...

... Long-term capital items are not reported on the fund-based balance sheet, but are scheduled and reported in the government-wide financial statements. Reports only those liabilities that have become due and will require current financial resources to liquidate. Long-term debt principal not due within ...

Internal Control and Cash

... for all of the related activities, the potential for errors and irregularities is increased. Related purchasing activities include ordering merchandise, receiving the goods, and paying (or authorizing payment) for the merchandise. In purchasing, for example, orders could be placed with friends or wi ...

... for all of the related activities, the potential for errors and irregularities is increased. Related purchasing activities include ordering merchandise, receiving the goods, and paying (or authorizing payment) for the merchandise. In purchasing, for example, orders could be placed with friends or wi ...

Chapter 2: Financial Statements and the Annual

... 34. Venture Corp. increased its dollar amount of working capital over the past several years. To further evaluate the company's short-run liquidity, which one of the following measures should be used? A. The current ratio B. An analysis of the company’s long-term debt C. An analysis of the return o ...

... 34. Venture Corp. increased its dollar amount of working capital over the past several years. To further evaluate the company's short-run liquidity, which one of the following measures should be used? A. The current ratio B. An analysis of the company’s long-term debt C. An analysis of the return o ...

PUBLIC SECTOR ACCOUNTING REFORM Tatjana Jovanović

... The global economic crisis has underscored the importance of accountable and transparent use of public funds, in particular in light of deteriorating fiscal position and rising public debts. There is now a growing consensus that good information on government activities matters. It can help policy ...

... The global economic crisis has underscored the importance of accountable and transparent use of public funds, in particular in light of deteriorating fiscal position and rising public debts. There is now a growing consensus that good information on government activities matters. It can help policy ...

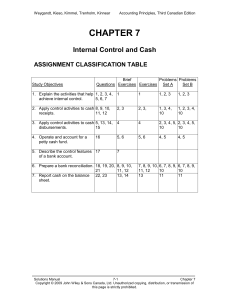

assignment classification table (by topic)

... development (new products that are being developed but which are not yet marketable), the value of the “intellectual capital” of its workforce (the ability of the companies’ employees to come up with new ideas and products in the fast changing technology industry), and the value of the company reput ...

... development (new products that are being developed but which are not yet marketable), the value of the “intellectual capital” of its workforce (the ability of the companies’ employees to come up with new ideas and products in the fast changing technology industry), and the value of the company reput ...

Chapter 1 - Faculty of Business and Economics Courses

... Balance: To keep the accounting equation in balance, each transaction must be recorded in two separate accounts Classification: All business transactions are classified as either assets, liabilities, or owner’s equity Break Down: Assets broken down into cash, inventory and equipment; Liabiliti ...

... Balance: To keep the accounting equation in balance, each transaction must be recorded in two separate accounts Classification: All business transactions are classified as either assets, liabilities, or owner’s equity Break Down: Assets broken down into cash, inventory and equipment; Liabiliti ...

Principles before standards | Information for Better

... In considering how best to tackle current problems it can be useful to look back and see what solutions were adopted in the past. This can both open our eyes to different ways of looking at things and help us to understand how we got to where we are now. Most accountants now active in business life ...

... In considering how best to tackle current problems it can be useful to look back and see what solutions were adopted in the past. This can both open our eyes to different ways of looking at things and help us to understand how we got to where we are now. Most accountants now active in business life ...

chapter 4 solutions version 1

... Retained Earnings + Net Income - Dividends Declared) 6. Adjusting entries have no effect on cash. For unearned revenues and prepayments, cash was received or paid at some point in the past. For accruals, cash will be received or paid in a future accounting period. At the time of the adjusting entry, ...

... Retained Earnings + Net Income - Dividends Declared) 6. Adjusting entries have no effect on cash. For unearned revenues and prepayments, cash was received or paid at some point in the past. For accruals, cash will be received or paid in a future accounting period. At the time of the adjusting entry, ...

Auditing for Fraud Detection - Professional Education Services

... instrument of perpetration is financial statements. Sometimes management fraud is called "fraudulent financial reporting.'' Fraudulent financial reporting was defined by the National Commission on Fraudulent Financial Reporting (1987) as intentional or reckless conduct, whether by act or omission, t ...

... instrument of perpetration is financial statements. Sometimes management fraud is called "fraudulent financial reporting.'' Fraudulent financial reporting was defined by the National Commission on Fraudulent Financial Reporting (1987) as intentional or reckless conduct, whether by act or omission, t ...

Free Sample

... 50. Volunteer, Inc. is in the process of liquidating and going out of business. The firm has $69,820 in cash, inventory totaling $214,000, accounts receivable of $144,000, plant and equipment with a $384,000 book value, and total liabilities of $614,000. It is estimated that the inventory can be di ...

... 50. Volunteer, Inc. is in the process of liquidating and going out of business. The firm has $69,820 in cash, inventory totaling $214,000, accounts receivable of $144,000, plant and equipment with a $384,000 book value, and total liabilities of $614,000. It is estimated that the inventory can be di ...

A Closer Look

... Internal records indicate that depreciation on manufacturing facilities totaled $500 and on selling and administrative facilities totaled $200 during the year. The firm included these amounts in cost of goods sold and selling and administrative expenses respectively in the income statement in Exhibi ...

... Internal records indicate that depreciation on manufacturing facilities totaled $500 and on selling and administrative facilities totaled $200 during the year. The firm included these amounts in cost of goods sold and selling and administrative expenses respectively in the income statement in Exhibi ...

6 Keeping Score: Bases of

... The balance sheet presented lacks both feedback value and predictive value. McCumber owns a vehicle, has inventory, is owed money by its customers, and owes amounts in addition to the note payable. All of these items resulted from activities during January, but none of them are reported on the bala ...

... The balance sheet presented lacks both feedback value and predictive value. McCumber owns a vehicle, has inventory, is owed money by its customers, and owes amounts in addition to the note payable. All of these items resulted from activities during January, but none of them are reported on the bala ...

FINANCIAL ACCOUNTING : MEANING, NATURE AND ROLE OF

... record her receipts of money on one page of her "household diary" while payments for different items such as milk, food, clothing, house, education etc. on some other page or pages of her diary in a chronological order. Such a record will help her in knowing about : (i) ...

... record her receipts of money on one page of her "household diary" while payments for different items such as milk, food, clothing, house, education etc. on some other page or pages of her diary in a chronological order. Such a record will help her in knowing about : (i) ...

Chapter 1 - Accounting Information and Decision Making

... We measure resources owned by a company as assets. Recall that with the start-up funds of $10,000, your computerrepair business bought a truck ($6,000) and equipment ($3,000). You will measure the $9,000 as assets. Other assets typical of most businesses include such items as cash, inventories, supp ...

... We measure resources owned by a company as assets. Recall that with the start-up funds of $10,000, your computerrepair business bought a truck ($6,000) and equipment ($3,000). You will measure the $9,000 as assets. Other assets typical of most businesses include such items as cash, inventories, supp ...

File

... transactions to retailers. Banks usually charge the retailer a transaction fee for each debit card and a fee that averages 3.5% of the credit card sale. In both types of transaction the retailer’s bank will wait until the end of the day and make a deposit for the full day’s transactions. Fees for ba ...

... transactions to retailers. Banks usually charge the retailer a transaction fee for each debit card and a fee that averages 3.5% of the credit card sale. In both types of transaction the retailer’s bank will wait until the end of the day and make a deposit for the full day’s transactions. Fees for ba ...

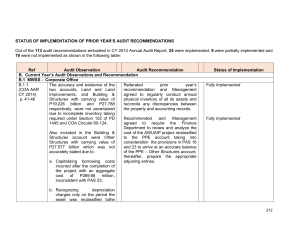

MWSS2015_Part3-Status_of_PY`s_Recomm

... was not accurately reported due to (a) Income pertaining to CY 2013 with an aggregate total of P229.229 million was recognized as revenue during the year and (b) income received in CY 2014 totaling P235.205 million was not recognized as current year’s income. Also, no accrual of income from debt ser ...

... was not accurately reported due to (a) Income pertaining to CY 2013 with an aggregate total of P229.229 million was recognized as revenue during the year and (b) income received in CY 2014 totaling P235.205 million was not recognized as current year’s income. Also, no accrual of income from debt ser ...