JOURNAL

... The journal entries that you have learnt so far are simple and affect two accounts only. There can be entries that affect more than two accounts; such entries are called compound or combined entries. A simple journal entry contains only one debit and one credit. But if an entry contains more than on ...

... The journal entries that you have learnt so far are simple and affect two accounts only. There can be entries that affect more than two accounts; such entries are called compound or combined entries. A simple journal entry contains only one debit and one credit. But if an entry contains more than on ...

Homework Disk: Assignment 9

... Owner's additional investment made during the current period c. Net Income d. Salaries expense ...

... Owner's additional investment made during the current period c. Net Income d. Salaries expense ...

accounting revision notes and assessment tasks

... 4. Valuation of assets becomes difficult at the time of sale of business. 5. In adequate for planning and control – accounting information supplied by this system is inadequate for planning and control. 6. Comparative study is difficult – due to incomplete information regarding the business transact ...

... 4. Valuation of assets becomes difficult at the time of sale of business. 5. In adequate for planning and control – accounting information supplied by this system is inadequate for planning and control. 6. Comparative study is difficult – due to incomplete information regarding the business transact ...

Sample Study Guide - McGraw Hill Higher Education

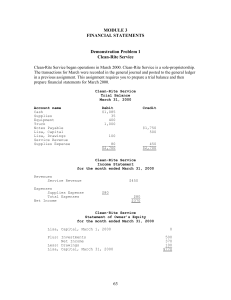

... 2. Statement of Owner’s Equity—explains changes in equity from net income (or loss) and from owner investment and withdrawals over a period of time. 3. Balance Sheet—describes a company’s financial position (types and amounts of assets, liabilities, and equity) at a point in time. 4. Statement of Ca ...

... 2. Statement of Owner’s Equity—explains changes in equity from net income (or loss) and from owner investment and withdrawals over a period of time. 3. Balance Sheet—describes a company’s financial position (types and amounts of assets, liabilities, and equity) at a point in time. 4. Statement of Ca ...

1999 - School of Business and Social Sciences

... answers a, b and c is cited to every question or statement. You should only give one answer to every question. If you for example think that the correct answer to question 3 is option c, then you should clearly state 3c in your paper. Your answer will be considered to be wrong, if there is any doubt ...

... answers a, b and c is cited to every question or statement. You should only give one answer to every question. If you for example think that the correct answer to question 3 is option c, then you should clearly state 3c in your paper. Your answer will be considered to be wrong, if there is any doubt ...

Slide 1

... identify preferred accounting practices to create harmony among accounting practices of different countries. 国际会计准则委员会 McGraw-Hill/Irwin ...

... identify preferred accounting practices to create harmony among accounting practices of different countries. 国际会计准则委员会 McGraw-Hill/Irwin ...

general comments

... cited aims which were too general in nature or reflected the needs of the examination and therefore lacked a focus specific to the project. There were also frequent instances of ...

... cited aims which were too general in nature or reflected the needs of the examination and therefore lacked a focus specific to the project. There were also frequent instances of ...

VT Transaction user guide

... same company at the same time. The main copy of a file should not be held on a floppy disk. Floppy disks are more prone than hard disks to physical damage which can prevent the file being read. The maximum number of companies you can create is limited only by the disk space available. On a modern PC ...

... same company at the same time. The main copy of a file should not be held on a floppy disk. Floppy disks are more prone than hard disks to physical damage which can prevent the file being read. The maximum number of companies you can create is limited only by the disk space available. On a modern PC ...

Chapter 11

... argue that they don't think it is necessary to record depreciation expense on the income statement because it does not involve a cash outlay. In addition, they do not see the necessity for reducing the equipment value on the balance sheet. They wonder whether CM 2 should just stop depreciating its e ...

... argue that they don't think it is necessary to record depreciation expense on the income statement because it does not involve a cash outlay. In addition, they do not see the necessity for reducing the equipment value on the balance sheet. They wonder whether CM 2 should just stop depreciating its e ...

ACG 2021

... a. Note is held until maturity and collected in full at that time. b. Note is dishonored; the amount of the note and its interest are written off as uncollectible. Problem 4: Prepare general journal entries for the following transactions of this company for the current year: Apr 25: Sold $4,500 of m ...

... a. Note is held until maturity and collected in full at that time. b. Note is dishonored; the amount of the note and its interest are written off as uncollectible. Problem 4: Prepare general journal entries for the following transactions of this company for the current year: Apr 25: Sold $4,500 of m ...

MGMT-026 Chapter 05 Slides

... Each sales transaction for a seller of merchandise involves two parts: ...

... Each sales transaction for a seller of merchandise involves two parts: ...

The Accounting Cycle - Kenyatta University Library

... To decide to be an accountant is no more descriptive than deciding to be a doctor. Obviously, there are many specialty areas. Many accountants engage in the practice of “public” accounting, which involves providing audit, tax, and consulting services to the general public. To engage in the practice ...

... To decide to be an accountant is no more descriptive than deciding to be a doctor. Obviously, there are many specialty areas. Many accountants engage in the practice of “public” accounting, which involves providing audit, tax, and consulting services to the general public. To engage in the practice ...

Introduction to Accounting

... • Justified by going concern concept. • Current values are difficult to determine. • Difficult to keep track of up down of the market price. ...

... • Justified by going concern concept. • Current values are difficult to determine. • Difficult to keep track of up down of the market price. ...

UNIVERSITY OF WATERLOO School of Accounting and Finance

... A) the period of time for which we prepare our financial statements B) the length of time over which our plant and equipment assets are expected to be used by the company in generating revenues C) the time it takes for a company to purchase and pay for goods or services from suppliers, sell those go ...

... A) the period of time for which we prepare our financial statements B) the length of time over which our plant and equipment assets are expected to be used by the company in generating revenues C) the time it takes for a company to purchase and pay for goods or services from suppliers, sell those go ...

A Short Guide to the UK National Accounts

... It should be noted that there are not three different versions of GDP, just three different ways of estimating the same thing. The three approaches will be discussed more in the next three sub-chapters. The published headline figure of GDP is an average of the three approaches. While all three appro ...

... It should be noted that there are not three different versions of GDP, just three different ways of estimating the same thing. The three approaches will be discussed more in the next three sub-chapters. The published headline figure of GDP is an average of the three approaches. While all three appro ...

2011 Financials

... Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with Canadian generally accepted auditing standards. Those standards require that we comply with ethical requirements and plan and perform an audit to obtain reasonable ...

... Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with Canadian generally accepted auditing standards. Those standards require that we comply with ethical requirements and plan and perform an audit to obtain reasonable ...

question bank - SIETK ECE Dept

... 12. The economies in production costs which occur to the firm alone when it expands its output is called (A) External economies ...

... 12. The economies in production costs which occur to the firm alone when it expands its output is called (A) External economies ...

Internal Controls - Trans

... Three Person Segregation: CFO, Accountant, Bookkeeper Bookkeeper: Post accounts receivable Reconcile petty cash Write checks Post general ledger Reconcile bank statements Post credits/debits Give credits and discounts ...

... Three Person Segregation: CFO, Accountant, Bookkeeper Bookkeeper: Post accounts receivable Reconcile petty cash Write checks Post general ledger Reconcile bank statements Post credits/debits Give credits and discounts ...

DOC, 113 Kb

... Vertical analysis - a method of financial statement analysis in which each entry for each of the three major categories of accounts (assets, liabilities and equities) in a balance sheet is represented as a proportion of the total account, alias, it shows the relationship off financial statement item ...

... Vertical analysis - a method of financial statement analysis in which each entry for each of the three major categories of accounts (assets, liabilities and equities) in a balance sheet is represented as a proportion of the total account, alias, it shows the relationship off financial statement item ...

Final Update Report - Biggleswade Town Council

... In examining the Council’s payroll function, we aim to confirm that extant legislation is being appropriately observed as regards adherence to the Employee Rights Act 1998 and the requirements of HM Revenue and Customs (HMRC) in relation to the deduction and payment over of income tax and NI contrib ...

... In examining the Council’s payroll function, we aim to confirm that extant legislation is being appropriately observed as regards adherence to the Employee Rights Act 1998 and the requirements of HM Revenue and Customs (HMRC) in relation to the deduction and payment over of income tax and NI contrib ...

Asset section of the balance sheet

... customers whether or not they have yet been paid for. o Expenses: represent the dollar amount of resources the entity used to earn revenues during the period of time. Expenses reports in one accounting period may actually be paid for in another accounting period. o Net income (or net earnings): the ...

... customers whether or not they have yet been paid for. o Expenses: represent the dollar amount of resources the entity used to earn revenues during the period of time. Expenses reports in one accounting period may actually be paid for in another accounting period. o Net income (or net earnings): the ...

Accounting Brief - Venture Mentors, LLC

... income statement. There are several other statements and management reports that should be created and used, however these two are the basic statements required for taxes and normal business operations. In setting up the accounting system, it is recommended that you have professional help. The owner ...

... income statement. There are several other statements and management reports that should be created and used, however these two are the basic statements required for taxes and normal business operations. In setting up the accounting system, it is recommended that you have professional help. The owner ...

BRIEF EXERCISE 8-1 (a) Other receivables. (b) Notes receivable. (c

... Bad Debts Expense is reported in the income statement as an operating expense (usually a selling expense). Recording the Write-Off Each write-off should be approved in writing by authorized management personnel. Under the allowance method, every bad debt write-off is debited to the allowance a ...

... Bad Debts Expense is reported in the income statement as an operating expense (usually a selling expense). Recording the Write-Off Each write-off should be approved in writing by authorized management personnel. Under the allowance method, every bad debt write-off is debited to the allowance a ...

FREE Sample Here

... 38. In a chart of accounts using three digits for each account, each numeric digit has meaning to users of the AIS. For example, a numeric digit may represent either a major category of accounts, a primary financial subaccount within each category, or a specific account into which transaction data w ...

... 38. In a chart of accounts using three digits for each account, each numeric digit has meaning to users of the AIS. For example, a numeric digit may represent either a major category of accounts, a primary financial subaccount within each category, or a specific account into which transaction data w ...

PSA 510: Initial Engagements * Opening Balances

... consistently applied or changes in accounting policies have been properly accounted for and adequately disclosed. ...

... consistently applied or changes in accounting policies have been properly accounted for and adequately disclosed. ...