Posting from a General Journal to a General Ledger

... and credit balance, it is often referred to as the balance-ruled account form. The account balance is calculated and recorded as each entry is recorded in the account. Recording information in an account is described later in this chapter. The T account is a useful device for analyzing transactions ...

... and credit balance, it is often referred to as the balance-ruled account form. The account balance is calculated and recorded as each entry is recorded in the account. Recording information in an account is described later in this chapter. The T account is a useful device for analyzing transactions ...

Free Sample

... purchase of supplies on credit, $4,200; receipt of a bill for utilities for the month which is due on the 15th of the next month, $1,200; and, partial payment on the balance due for supplies, $800. What is the balance in the Accounts Payable account at the end of the month assuming a beginning balan ...

... purchase of supplies on credit, $4,200; receipt of a bill for utilities for the month which is due on the 15th of the next month, $1,200; and, partial payment on the balance due for supplies, $800. What is the balance in the Accounts Payable account at the end of the month assuming a beginning balan ...

Preview Sample 1

... purchase of supplies on credit, $4,200; receipt of a bill for utilities for the month which is due on the 15th of the next month, $1,200; and, partial payment on the balance due for supplies, $800. What is the balance in the Accounts Payable account at the end of the month assuming a beginning balan ...

... purchase of supplies on credit, $4,200; receipt of a bill for utilities for the month which is due on the 15th of the next month, $1,200; and, partial payment on the balance due for supplies, $800. What is the balance in the Accounts Payable account at the end of the month assuming a beginning balan ...

Accounting 20 Module 4 Lesson 17 Lesson 17

... fixed asset. At the close of each fiscal period, each fixed asset record is brought up to date. The depreciation expense for that period is recorded and the book value of the asset is figured. Study the two examples on pages 650 to 652 in the textbook. Book value is the original asset cost less accu ...

... fixed asset. At the close of each fiscal period, each fixed asset record is brought up to date. The depreciation expense for that period is recorded and the book value of the asset is figured. Study the two examples on pages 650 to 652 in the textbook. Book value is the original asset cost less accu ...

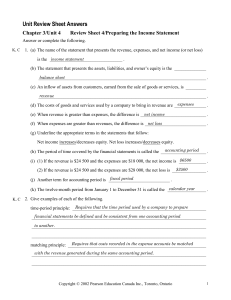

Chapter 3/Unit 4 Review Sheet 4/Preparing the Income Statement

... (g) Underline the appropriate terms in the statements that follow: Net income increases/decreases equity. Net loss increases/decreases equity. accounting period (h) The period of time covered by the financial statements is called the ____________________ ...

... (g) Underline the appropriate terms in the statements that follow: Net income increases/decreases equity. Net loss increases/decreases equity. accounting period (h) The period of time covered by the financial statements is called the ____________________ ...

Equity $10000 Land $84000 Notes Payable $10000

... accounts. • Changes to accounts summarized in the General Journal. – General Journal notes • which accounts are credited and • which accounts are debited. These General Journal entries take the following form: ...

... accounts. • Changes to accounts summarized in the General Journal. – General Journal notes • which accounts are credited and • which accounts are debited. These General Journal entries take the following form: ...

It is recommended that you use a direct internet connection when

... Office Hours: 9:00 to 12:30 Tuesdays and Thursdays Phone: ...

... Office Hours: 9:00 to 12:30 Tuesdays and Thursdays Phone: ...

Fund Financial Statements - Minnesota Board of Water and Soil

... The government reports the general fund as its only major governmental fund. The general fund accounts for all financial resources of the government. The District’s financial statements (general fund) are presented on the modified accrual basis of accounting. Under the modified accrual basis of acco ...

... The government reports the general fund as its only major governmental fund. The general fund accounts for all financial resources of the government. The District’s financial statements (general fund) are presented on the modified accrual basis of accounting. Under the modified accrual basis of acco ...

Chapter 7 - Business Accounting

... You will learn ……………. • What is meant by “accounts” • Why businesses need to keep accounting records and use financial documents • Who uses these accounting records • What final accounts of a company contain – Profit and Loss Account – Balance Sheet ...

... You will learn ……………. • What is meant by “accounts” • Why businesses need to keep accounting records and use financial documents • Who uses these accounting records • What final accounts of a company contain – Profit and Loss Account – Balance Sheet ...

Step 1: Determine what the current account

... Income Statement For Year Ended December 31, 2015 ...

... Income Statement For Year Ended December 31, 2015 ...

LEDGER

... total of credits of an account. If debit side total is more than the credit side, the account shows a debit balance. Similarly, the balance will be credit if the credit side total of an account is more than the debit side total. This process of ascertaining and writing the balance of each account in ...

... total of credits of an account. If debit side total is more than the credit side, the account shows a debit balance. Similarly, the balance will be credit if the credit side total of an account is more than the debit side total. This process of ascertaining and writing the balance of each account in ...

Chapter 7 short version

... Entities should assess at each statement of financial position date whether there is objective evidence that an account receivable may be impaired, and determine the amount of allowance that should be estimated based on the net realizable value or the discounted cash flow from such receivable TAX- w ...

... Entities should assess at each statement of financial position date whether there is objective evidence that an account receivable may be impaired, and determine the amount of allowance that should be estimated based on the net realizable value or the discounted cash flow from such receivable TAX- w ...

Appendix B - College of the Redwoods

... reduction by valuation allowances, “book value” refers to cost or stated value less any appropriate allowance. A distinction is sometimes made between “gross book value” and “net book value,” the former designating value before allowances and the latter after their deduction. In the absence of any m ...

... reduction by valuation allowances, “book value” refers to cost or stated value less any appropriate allowance. A distinction is sometimes made between “gross book value” and “net book value,” the former designating value before allowances and the latter after their deduction. In the absence of any m ...

Year 12 accounting term 2 internal controls

... the transactions (goods sold on credit, cash received and so on) that have occurred and is in the same form as a three-column ledger. Statements of account also help to ensure that the business’s records are correct, as most people receiving an incorrect statement will contact the firm. This, in con ...

... the transactions (goods sold on credit, cash received and so on) that have occurred and is in the same form as a three-column ledger. Statements of account also help to ensure that the business’s records are correct, as most people receiving an incorrect statement will contact the firm. This, in con ...

DATA LABEL: PUBLIC The Peoples Development Trust Legacy Hub

... producing accounts and management reports Experience of preparing draft financial accounts Experience of liaising with auditors, banks and other financial institutes Experience of using Sage Line 50 Experience of liaising with Inland Revenue Experience of producing financial reports, budge ...

... producing accounts and management reports Experience of preparing draft financial accounts Experience of liaising with auditors, banks and other financial institutes Experience of using Sage Line 50 Experience of liaising with Inland Revenue Experience of producing financial reports, budge ...

1. Paid rent for the next three months. 2. Paid property taxes that

... Below is a list of accounts in no particular order. Assume that all accounts have normal balances. Required: In column A, indicate whether a debit will: 1. Increase the account balance, or 2. Decrease the account balance. In column B, classify each account according to the following scheme. For con ...

... Below is a list of accounts in no particular order. Assume that all accounts have normal balances. Required: In column A, indicate whether a debit will: 1. Increase the account balance, or 2. Decrease the account balance. In column B, classify each account according to the following scheme. For con ...

www.studyguide.pk

... On 1 April the business rents out part of its warehouse for an annual rent of $6000 receivable in equal instalments on 1 April, 1 July, 1 October and 1 January. At 31 October what would the final accounts show? Profit and Loss Account ...

... On 1 April the business rents out part of its warehouse for an annual rent of $6000 receivable in equal instalments on 1 April, 1 July, 1 October and 1 January. At 31 October what would the final accounts show? Profit and Loss Account ...

KAPP Edge Solutions

... The balance sheet has two sides – Assets side and the Liabilities side. Assets are shown on the right hand side and the liabilities are shown on the left hand side of the Balance Sheet. (in traditional way, its changed now) The balance sheet is based on the equation that what an entity owns on ...

... The balance sheet has two sides – Assets side and the Liabilities side. Assets are shown on the right hand side and the liabilities are shown on the left hand side of the Balance Sheet. (in traditional way, its changed now) The balance sheet is based on the equation that what an entity owns on ...

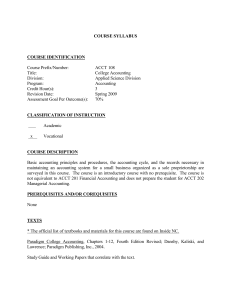

ACCT 108 Title: College Accounting Division

... Study Guide and Working Papers that correlate with the text. ...

... Study Guide and Working Papers that correlate with the text. ...

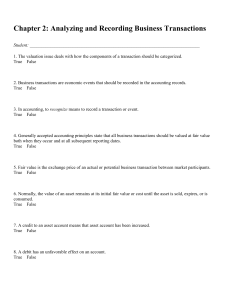

ch03

... ADJUSTING ENTRIES FOR PREPAYMENTS Adjusting entries for prepayments are required to record the portion of the prepayment representing: 1 the expense incurred, or 2 the revenue earned in the current period. The adjusting entry results in a debit to an expense account and a credit to an asset account. ...

... ADJUSTING ENTRIES FOR PREPAYMENTS Adjusting entries for prepayments are required to record the portion of the prepayment representing: 1 the expense incurred, or 2 the revenue earned in the current period. The adjusting entry results in a debit to an expense account and a credit to an asset account. ...

Model og layout of project accounting (text)

... cash receipts and payments for the project [Project-name] in accordance with the guidelines for presentation of accounts for the utilisation of grants allocated by the Danish Ministry of Foreign Affairs and the accounting policies for cash receipts and payments, described on page 5. The figures from ...

... cash receipts and payments for the project [Project-name] in accordance with the guidelines for presentation of accounts for the utilisation of grants allocated by the Danish Ministry of Foreign Affairs and the accounting policies for cash receipts and payments, described on page 5. The figures from ...

Understanding Cooperative Bookkeeping and Financial Statements

... December and pays for the supplies in January, the revenue from this sale would be included on the yearend income statement of the cooperative. The uncollected cash payment would be included in accounts receivable on the year-end balance sheet. Accrual basis accounting is important when analyzing th ...

... December and pays for the supplies in January, the revenue from this sale would be included on the yearend income statement of the cooperative. The uncollected cash payment would be included in accounts receivable on the year-end balance sheet. Accrual basis accounting is important when analyzing th ...

FA2 Module 1. Financial reporting/accounting concepts

... • Expenses/losses: decreases in economic resources resulting from income-generating activities of entity • Other comprehensive income: increases and decreases in net assets that are excluded from income by IFRS and do not reflect transactions with owners in their capacity as owners ...

... • Expenses/losses: decreases in economic resources resulting from income-generating activities of entity • Other comprehensive income: increases and decreases in net assets that are excluded from income by IFRS and do not reflect transactions with owners in their capacity as owners ...

Jonathan Heller ED 605 Unit Plan PATHWAY: Financial

... Set up should take about twenty minutes. This is to set out the board, choose the game piece, and receive the money. The banker should set up the money and the county clerk should set out the title cards during this 20 minutes. Transactions: The first 10 rolls will be for the month of Oct. The first ...

... Set up should take about twenty minutes. This is to set out the board, choose the game piece, and receive the money. The banker should set up the money and the county clerk should set out the title cards during this 20 minutes. Transactions: The first 10 rolls will be for the month of Oct. The first ...