Appendix 1 Job Description

... Process invoices and staff / volunteer expenses into the accounting system, ensuring coding and level of detail is in line with agreed principles Ensure VAT exemptions are in place where appropriate and manage refunds with suppliers as appropriate; Organise payment of all invoices and expenses in a ...

... Process invoices and staff / volunteer expenses into the accounting system, ensuring coding and level of detail is in line with agreed principles Ensure VAT exemptions are in place where appropriate and manage refunds with suppliers as appropriate; Organise payment of all invoices and expenses in a ...

Glosarry of Business Terms

... due date, and interest rate. Book value ‐‐ total assets minus total liabilities. (See also net worth.) Book value also means the value of an asset as recorded on the company's books or financial reports. Book value is often different than true value. It may be more or less. Breakeven point ‐‐ the am ...

... due date, and interest rate. Book value ‐‐ total assets minus total liabilities. (See also net worth.) Book value also means the value of an asset as recorded on the company's books or financial reports. Book value is often different than true value. It may be more or less. Breakeven point ‐‐ the am ...

Chapter Outline Notes

... Adjusting accounts is a 3-step process: (1) Determine the current account balance, (2) Determine what the current account balance should be, and (3) Record adjusting entry to get from step 1to step 2. A. Framework for Adjustments Adjustments are necessary for transactions and events that extend over ...

... Adjusting accounts is a 3-step process: (1) Determine the current account balance, (2) Determine what the current account balance should be, and (3) Record adjusting entry to get from step 1to step 2. A. Framework for Adjustments Adjustments are necessary for transactions and events that extend over ...

Debits and Credits: Analyzing and Recording Business Transactions

... Step 1 Which accounts are affected? The law firm receives its cash and office equipment, so three accounts are involved: Cash, Office Equipment, and Mia Wong, Capital. These account titles come from the chart of accounts. Step 2 Which categories do these accounts belong to? Cash and Office Equipment ...

... Step 1 Which accounts are affected? The law firm receives its cash and office equipment, so three accounts are involved: Cash, Office Equipment, and Mia Wong, Capital. These account titles come from the chart of accounts. Step 2 Which categories do these accounts belong to? Cash and Office Equipment ...

chapter 24 uncollectible ar

... When it becomes clear that the charge customer will not pay, amount owned is removed from accounting records ...

... When it becomes clear that the charge customer will not pay, amount owned is removed from accounting records ...

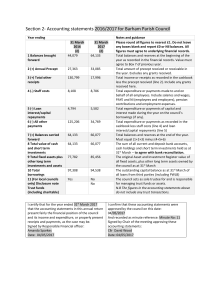

section 2 Accounts - Barham Parish Council

... PAYE and NI (employees and employers), pension contributions and employment expenses. Total expenditure or payments of capital and interest made during the year on the council’s borrowings (if any). Total expenditure or payments as recorded in the cashbook less staff costs (line 4) and loan interest ...

... PAYE and NI (employees and employers), pension contributions and employment expenses. Total expenditure or payments of capital and interest made during the year on the council’s borrowings (if any). Total expenditure or payments as recorded in the cashbook less staff costs (line 4) and loan interest ...

A Assets Owners Equity - Duplin County Schools

... ON ACCOUNT FROM DAVIS SUPPLY STORE, would result in which journal entry? A. Debit Accounts Payable/Davis Supply Store and credit Supplies B. Debit Supplies and credit Accounts ...

... ON ACCOUNT FROM DAVIS SUPPLY STORE, would result in which journal entry? A. Debit Accounts Payable/Davis Supply Store and credit Supplies B. Debit Supplies and credit Accounts ...

Paper Bookkeeping - Navajo Business, Navajo Nation

... Books, daybooks, and ledgers are the mainstay of manual entry bookkeeping. The picture of a person leaning over a big leather bound ledger, with an ink quill pen in their hand, portrays the historical image of the bookkeeper performing their bookkeeping entries. The painstaking accuracy required to ...

... Books, daybooks, and ledgers are the mainstay of manual entry bookkeeping. The picture of a person leaning over a big leather bound ledger, with an ink quill pen in their hand, portrays the historical image of the bookkeeper performing their bookkeeping entries. The painstaking accuracy required to ...

Financial Statements Basics - Duke`s Fuqua School of Business

... decrease in a liability or equity account. A credit implies the opposite: a decrease to an asset account and an increase in a liability or equity account. So, for example, if you debit Cash and credit Bank borrowings, what does this mean you did? Journal entry: Cash (Dr) Bank borrowings (Cr) ...

... decrease in a liability or equity account. A credit implies the opposite: a decrease to an asset account and an increase in a liability or equity account. So, for example, if you debit Cash and credit Bank borrowings, what does this mean you did? Journal entry: Cash (Dr) Bank borrowings (Cr) ...

Accounting II - davis.k12.ut.us

... d. Explain the purposes of each financial statement and describe the way the statements articulate with each other. e. Use percentages and ratios to analyze financial statement data. STANDARD 7 Students will prepare closing entries and a Post-Closing Trial Balance. Objective 1: Prepare closing entri ...

... d. Explain the purposes of each financial statement and describe the way the statements articulate with each other. e. Use percentages and ratios to analyze financial statement data. STANDARD 7 Students will prepare closing entries and a Post-Closing Trial Balance. Objective 1: Prepare closing entri ...

Transaction Analysis

... - Fair Value Principle – Indicates that assets and liabilities should be reported at fair value (the price received to sell an asset or settle a liability). -Certain investments are reported at fair value ...

... - Fair Value Principle – Indicates that assets and liabilities should be reported at fair value (the price received to sell an asset or settle a liability). -Certain investments are reported at fair value ...

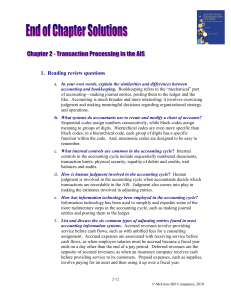

Opening vignette

... ends on a day other than the end of a pay period. Deferred revenues are the opposite of accrued revenues; as when an insurance company receives cash before providing service to its customers. Prepaid expenses, such as supplies, involve paying for an asset and then using it up over a fiscal year. ...

... ends on a day other than the end of a pay period. Deferred revenues are the opposite of accrued revenues; as when an insurance company receives cash before providing service to its customers. Prepaid expenses, such as supplies, involve paying for an asset and then using it up over a fiscal year. ...

Financial Accounting, Second Canadian Edition

... • Adjusted trial balance proves the equity of total debit balances and total credit balances after the adjusting entries have been made • Financial statements can be easily prepared from the adjusted trial balance ...

... • Adjusted trial balance proves the equity of total debit balances and total credit balances after the adjusting entries have been made • Financial statements can be easily prepared from the adjusted trial balance ...

Accounting I

... a. Understand the accounting equation: Assets = Liabilities + Owner’s Equity b. Explain mathematically why the accounting equation must be in balance. c. Manipulate the accounting equation to find the missing variable. Objective 2: Classify accounts as assets, liabilities, or owner’s equity. STANDAR ...

... a. Understand the accounting equation: Assets = Liabilities + Owner’s Equity b. Explain mathematically why the accounting equation must be in balance. c. Manipulate the accounting equation to find the missing variable. Objective 2: Classify accounts as assets, liabilities, or owner’s equity. STANDAR ...

Unit 3 – Journals and Ledgers, Keeping track of it all

... Updated Trial Balance Recording transactions results in changes to the ledger accounts. Once these changes have been recorded in the appropriate accounts, the previous trial balance and financial statements (income statement and balance sheet) become outdated. This provides the need for an updated o ...

... Updated Trial Balance Recording transactions results in changes to the ledger accounts. Once these changes have been recorded in the appropriate accounts, the previous trial balance and financial statements (income statement and balance sheet) become outdated. This provides the need for an updated o ...

ACCOUNTING is primarily a system of

... donations. Also called contributed capital. 67. PREPAID EXPENSE is when you paid the cash “up-front” but haven’t received the goods or services yet. This is an asset. 68. PROFIT AND LOSS STATEMENT (P&L) is also known as an income statement. It shows your business revenue and expenses for a specific ...

... donations. Also called contributed capital. 67. PREPAID EXPENSE is when you paid the cash “up-front” but haven’t received the goods or services yet. This is an asset. 68. PROFIT AND LOSS STATEMENT (P&L) is also known as an income statement. It shows your business revenue and expenses for a specific ...

Test 1 Answers

... Multiple Choice (1 point each) Identify the letter of the choice that best completes the statement or answers the question. _D_ ...

... Multiple Choice (1 point each) Identify the letter of the choice that best completes the statement or answers the question. _D_ ...

Chapter 3

... Explain what a journal is and how it helps in the recording process. Explain what a ledger is and how it helps in the recording process. Explain what posting is and how it helps in the recording process. Explain the purposes of a trial balance. ...

... Explain what a journal is and how it helps in the recording process. Explain what a ledger is and how it helps in the recording process. Explain what posting is and how it helps in the recording process. Explain the purposes of a trial balance. ...

CHAPTER 7

... notes and the adjusting entries related to interest on December 31, 2001 for each note. These are not normal trade terms for Shaw. (a) Shaw sold inventory with a normal sales price of $500,000 in return for a non-interest-bearing note. The note was dated May 1, 2001, matures in 3 years and has a fac ...

... notes and the adjusting entries related to interest on December 31, 2001 for each note. These are not normal trade terms for Shaw. (a) Shaw sold inventory with a normal sales price of $500,000 in return for a non-interest-bearing note. The note was dated May 1, 2001, matures in 3 years and has a fac ...

Solution: AQ#3 (Chp 4, 5, 6)

... c. Advertising expense. d. Salary for the company president. Use the following information for question #2: BG Supply Co. uses accrual-basis accounting. The company purchased inventory costing $5,000 with payment terms of 2/10, n/30. The inventory was delivered under terms FOB destination and freigh ...

... c. Advertising expense. d. Salary for the company president. Use the following information for question #2: BG Supply Co. uses accrual-basis accounting. The company purchased inventory costing $5,000 with payment terms of 2/10, n/30. The inventory was delivered under terms FOB destination and freigh ...

CHAPTER 4 Outline

... An adjusting entry for prepaid expenses will result in an increase or a debit to an expense account and a decrease or a credit to an asset account. An adjusting entry for unearned revenues will result in a decrease or a debit to a liability account and an increase or a credit to a revenue accoun ...

... An adjusting entry for prepaid expenses will result in an increase or a debit to an expense account and a decrease or a credit to an asset account. An adjusting entry for unearned revenues will result in a decrease or a debit to a liability account and an increase or a credit to a revenue accoun ...

ch_1_intro_to_accoun..

... that each business maintains its own accounts, & that these accounts are separate from other interests of the owners ...

... that each business maintains its own accounts, & that these accounts are separate from other interests of the owners ...