theme: detecting accounting errors

... This list offers a profile that describes the nature of each error. That’s all well and good but how do you go about finding clues? The first order of business is to make sure to use good technique and organization in the initial preparation of financial statements. For instance, the material requir ...

... This list offers a profile that describes the nature of each error. That’s all well and good but how do you go about finding clues? The first order of business is to make sure to use good technique and organization in the initial preparation of financial statements. For instance, the material requir ...

Chapter Outline Notes

... expense when the related sales are recorded and it reports accounts receivable on the balance sheet at the estimated amount of cash to be collected. 1. Recording bad debts expense. The allowance method estimates bad debts expense at the end of the accounting period and records it with an adjusting e ...

... expense when the related sales are recorded and it reports accounts receivable on the balance sheet at the estimated amount of cash to be collected. 1. Recording bad debts expense. The allowance method estimates bad debts expense at the end of the accounting period and records it with an adjusting e ...

رقم الطالب في كشف الحضور:....... دراسات محاسبية باللغة الإنجليزية عدد

... 5. Goods out on consignment should be included in the inventory of the consignor. 6. The specific identification method of costing inventories tracks the actual physical flow of the goods available for sale. 7. Management may choose any inventory costing method it desires as long as the cost flow as ...

... 5. Goods out on consignment should be included in the inventory of the consignor. 6. The specific identification method of costing inventories tracks the actual physical flow of the goods available for sale. 7. Management may choose any inventory costing method it desires as long as the cost flow as ...

PR 46 - Australian Prudential Regulation Authority

... benefit fund to another approved benefit fund, except in the situation where the asset is ...

... benefit fund to another approved benefit fund, except in the situation where the asset is ...

Liabilities and Shareholders` Equity

... T-ACCOUNTS 3.1. T-account analysis of transactions and preparation of income statement and balance sheet. Refer to the information for Moulton Corporation as of December 31, Year 12, in the problem T-ACCOUNTS 2.1 in web-based “Using T-Accounts to Record Transactions—Extension of Chapter 2”. Moulton ...

... T-ACCOUNTS 3.1. T-account analysis of transactions and preparation of income statement and balance sheet. Refer to the information for Moulton Corporation as of December 31, Year 12, in the problem T-ACCOUNTS 2.1 in web-based “Using T-Accounts to Record Transactions—Extension of Chapter 2”. Moulton ...

BSBFIA401 Prepare financial reports

... Bad debts Bad debts are written off during the year as they occur. However, an organisation may analyse its debtors’ balances at the end of the year to decide whether any further debtors need to be written off. The writing off of debtors at balance day is referred to as ‘additional bad debts’. The a ...

... Bad debts Bad debts are written off during the year as they occur. However, an organisation may analyse its debtors’ balances at the end of the year to decide whether any further debtors need to be written off. The writing off of debtors at balance day is referred to as ‘additional bad debts’. The a ...

Report-to-the-Parliament--Fiscal-Yr-2007

... The amounts that transit in budget are transferred to account 522 in the name of the Fund by means of decrees of variation from income to expenditure, subject to the recording of the Court of Accounts, and by subsequent orders of payment through expense item 9565, within the competence of the depart ...

... The amounts that transit in budget are transferred to account 522 in the name of the Fund by means of decrees of variation from income to expenditure, subject to the recording of the Court of Accounts, and by subsequent orders of payment through expense item 9565, within the competence of the depart ...

Elements of the Income Statement

... BALANCE SHEET – reports the amount of assets, liabilities, and stockholders’ equity of an accounting entity at a point in time. INCOME STATEMENT – reports the revenues less the expenses of the accounting period. STATEMENT OF STOCKHOLDERS’ EQUITY – reports the changes in each of the company’s stockho ...

... BALANCE SHEET – reports the amount of assets, liabilities, and stockholders’ equity of an accounting entity at a point in time. INCOME STATEMENT – reports the revenues less the expenses of the accounting period. STATEMENT OF STOCKHOLDERS’ EQUITY – reports the changes in each of the company’s stockho ...

Q2) sea company had the following transactions :

... 13. ( ) A multiple-step income statement distinguishes between operating and non-operating activities. 14. ( ) The income statement for retailers contains one expense category just like the income statement of a service enterprise. 15. ( ) Sales Returns and Allowances is a contra revenue account to ...

... 13. ( ) A multiple-step income statement distinguishes between operating and non-operating activities. 14. ( ) The income statement for retailers contains one expense category just like the income statement of a service enterprise. 15. ( ) Sales Returns and Allowances is a contra revenue account to ...

Chapter 3 - McGraw Hill Higher Education

... Assets = Liabilities + Stockholders’ Equity Contributed Capital Retained Earnings Change = Cash from Operating Activities in + Cash from Investing Activities Cash + Cash from Financing Activities ...

... Assets = Liabilities + Stockholders’ Equity Contributed Capital Retained Earnings Change = Cash from Operating Activities in + Cash from Investing Activities Cash + Cash from Financing Activities ...

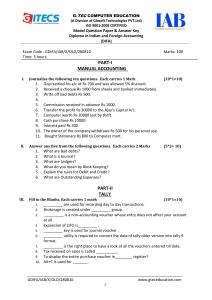

tally - gitecs

... chronological order. A record of a single business transaction is called journal entry. 3. Ledger-A ledger is the book in which all the accounts are maintained. The chart of accounts of the business shows the categorization and grouping of its accounts. 4. Book-keeping is an art of recording busines ...

... chronological order. A record of a single business transaction is called journal entry. 3. Ledger-A ledger is the book in which all the accounts are maintained. The chart of accounts of the business shows the categorization and grouping of its accounts. 4. Book-keeping is an art of recording busines ...

Basic Accounting - University of Calicut

... (c) convention of full disclosure (d) convention of materiality. 7. Revenue is generally recognized as being earned at the point of time (a) sale is made and ownership of goods transferred (b) cash is received (c) production is completed (d) sales are effected or cash is received, whichever is earli ...

... (c) convention of full disclosure (d) convention of materiality. 7. Revenue is generally recognized as being earned at the point of time (a) sale is made and ownership of goods transferred (b) cash is received (c) production is completed (d) sales are effected or cash is received, whichever is earli ...

Chapter 2 Review of the Accounting Process

... Elements of the accounting equation are represented by accounts that are contained in a general ledger. Each general ledger account can be classified as either permanent or temporary. Permanent accounts represent assets, liabilities, and shareholders’ equity at a point in time. For a corporation, sh ...

... Elements of the accounting equation are represented by accounts that are contained in a general ledger. Each general ledger account can be classified as either permanent or temporary. Permanent accounts represent assets, liabilities, and shareholders’ equity at a point in time. For a corporation, sh ...

Journal Entries - University of South Florida

... The Product or Initiative may be incorrect Be careful to correctly choose either letter O or digit 0 ...

... The Product or Initiative may be incorrect Be careful to correctly choose either letter O or digit 0 ...

Chapter 3 Using Accrual Accounting to Measure Income

... The time-period concept ensures that accounting information is reported at regular intervals. Basic accounting period is 1 year A fiscal year ends on a date other than December 31. Interim financial statements are usually prepared for periods such as a month, a quarter, or semiannual period. ...

... The time-period concept ensures that accounting information is reported at regular intervals. Basic accounting period is 1 year A fiscal year ends on a date other than December 31. Interim financial statements are usually prepared for periods such as a month, a quarter, or semiannual period. ...

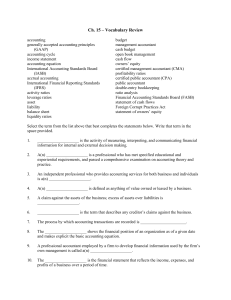

Ch. 15 – Vocabulary Review accounting generally accepted

... A(n) ____________________ is a professional who has met specified educational and experiential requirements, and passed a comprehensive examination on accounting theory and ...

... A(n) ____________________ is a professional who has met specified educational and experiential requirements, and passed a comprehensive examination on accounting theory and ...

TRUE/FALSE. Write `T` if the statement is true and `F` if the statement

... FOB shipping point with terms of 2/10 net/30. The seller prepays $100 of transportation costs for the company. Which of the following entries would be made to record full payment to the seller the payment is made within 10 days? A) The accounting entry would be a $2,060 debit to Accounts Payable, a ...

... FOB shipping point with terms of 2/10 net/30. The seller prepays $100 of transportation costs for the company. Which of the following entries would be made to record full payment to the seller the payment is made within 10 days? A) The accounting entry would be a $2,060 debit to Accounts Payable, a ...

Downloable-Solution-Manual-for-Accounting-Tools-for

... b. Obligations expected to be paid after one year are classified as expenses. c. Current assets are assets that a company expect to convert to cash or use up within the longer of one year or its operating cycle. d. Property, plant, and equipment are assets with relatively long useful lives that are ...

... b. Obligations expected to be paid after one year are classified as expenses. c. Current assets are assets that a company expect to convert to cash or use up within the longer of one year or its operating cycle. d. Property, plant, and equipment are assets with relatively long useful lives that are ...

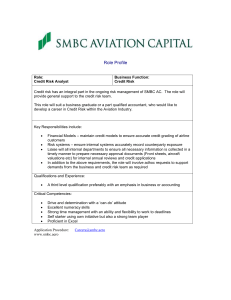

Credit Risk Financial Analyst

... Liaise will all internal departments to ensure all necessary information is collected in a timely manner to prepare necessary approval documents (Front sheets, aircraft valuations etc) for internal annual reviews and credit applications In addition to the above requirements, the role will involve ad ...

... Liaise will all internal departments to ensure all necessary information is collected in a timely manner to prepare necessary approval documents (Front sheets, aircraft valuations etc) for internal annual reviews and credit applications In addition to the above requirements, the role will involve ad ...

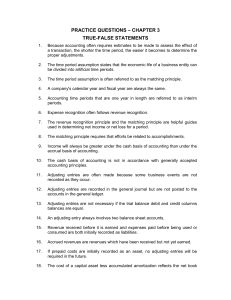

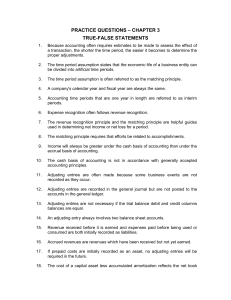

Chapter #3 Practice Q`s

... The matching principle states that expenses should be matched with revenues. Another way of stating the principle is to say that a. assets should be matched with liabilities. b. efforts should be matched with accomplishments. c. owner withdrawals should be matched with owner contributions. d. cash p ...

... The matching principle states that expenses should be matched with revenues. Another way of stating the principle is to say that a. assets should be matched with liabilities. b. efforts should be matched with accomplishments. c. owner withdrawals should be matched with owner contributions. d. cash p ...

practiceqs_chapter3

... The matching principle states that expenses should be matched with revenues. Another way of stating the principle is to say that a. assets should be matched with liabilities. b. efforts should be matched with accomplishments. c. owner withdrawals should be matched with owner contributions. d. cash p ...

... The matching principle states that expenses should be matched with revenues. Another way of stating the principle is to say that a. assets should be matched with liabilities. b. efforts should be matched with accomplishments. c. owner withdrawals should be matched with owner contributions. d. cash p ...

Chapter 16, TEST 16B

... 3. Gross sales plus sales returns and allowances is called net sales. _____ _____ 4. Gross profit less operating expenses produces the income from operations. _____ _____ 5. A formal statement of the changes in owner's equity during an accounting period is called a statement of owner's equity. _____ ...

... 3. Gross sales plus sales returns and allowances is called net sales. _____ _____ 4. Gross profit less operating expenses produces the income from operations. _____ _____ 5. A formal statement of the changes in owner's equity during an accounting period is called a statement of owner's equity. _____ ...

Audit Committee 18 September 2012

... Since the production of the draft accounts by 30 June 2012 they have been subject to external audit review for which the auditors report (ISA 260) is included as a separate item on this agenda. ...

... Since the production of the draft accounts by 30 June 2012 they have been subject to external audit review for which the auditors report (ISA 260) is included as a separate item on this agenda. ...

chapter_1-guidedoutlinestud

... 11. On November 1 of the current year, the assets and liabilities of TSU are as follows: Cash, $ 10,000; Accounts Receivable, $ 8,200; Supplies, $ 1,050; Land, $ 25,000; Accounts Payable, $ 6,530. What is the amount of stockholder’s equity as of November 1 of the current year? a. $ 37,720 b. $ 44,43 ...

... 11. On November 1 of the current year, the assets and liabilities of TSU are as follows: Cash, $ 10,000; Accounts Receivable, $ 8,200; Supplies, $ 1,050; Land, $ 25,000; Accounts Payable, $ 6,530. What is the amount of stockholder’s equity as of November 1 of the current year? a. $ 37,720 b. $ 44,43 ...