Unit 2 Assets - Georgia CTAE | Home

... Introduce Depreciable Assets: Using the text, help students identify assets that would be classified as Property, Plant, and Equipment. Discuss with students how the cost of the assets is determined. Explain that the Matching Principle requires us to match the expenses to the revenues they helped to ...

... Introduce Depreciable Assets: Using the text, help students identify assets that would be classified as Property, Plant, and Equipment. Discuss with students how the cost of the assets is determined. Explain that the Matching Principle requires us to match the expenses to the revenues they helped to ...

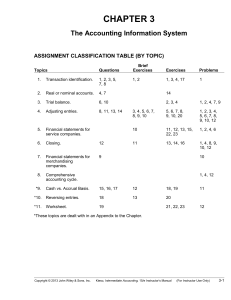

chap.3 - HCC Learning Web

... by credits. Liabilities, stockholders’ equity, and revenues are decreased by debits and increased by credits. 4. In a double-entry system, for every debit there must be a credit and vice-versa. This leads us to the basic accounting equation: Assets = Liabilities + Stockholders’ Equity. The Accountin ...

... by credits. Liabilities, stockholders’ equity, and revenues are decreased by debits and increased by credits. 4. In a double-entry system, for every debit there must be a credit and vice-versa. This leads us to the basic accounting equation: Assets = Liabilities + Stockholders’ Equity. The Accountin ...

2015 Accounting Solutions Higher Finalised Marking

... Based on the contribution per unit divided by the limiting factor (1) which can be: machine hours, labour hours, availability of materials or workers (1 max for example). The product with the highest contribution/limiting factor will be made first in order to maximise profits (1). ...

... Based on the contribution per unit divided by the limiting factor (1) which can be: machine hours, labour hours, availability of materials or workers (1 max for example). The product with the highest contribution/limiting factor will be made first in order to maximise profits (1). ...

LO1 - McGraw-Hill Education Canada

... • The income statement summarizes the financial impact of operating activities undertaken by the company during the accounting period. • Operating activities are the primary source of revenues and expenses. • The time period assumption divides the long life of a company into shorter periods, such as ...

... • The income statement summarizes the financial impact of operating activities undertaken by the company during the accounting period. • Operating activities are the primary source of revenues and expenses. • The time period assumption divides the long life of a company into shorter periods, such as ...

BUS 203 Business Financial Mgt_Spring 2006_1st Part

... General Ledger & Chart of Accounts The General Ledger is a summary book that records all transactions and balances and is organized into 5 distinct categories. For computerized accounting it is essential that these are set-up accurately in your Chart of Accounts ...

... General Ledger & Chart of Accounts The General Ledger is a summary book that records all transactions and balances and is organized into 5 distinct categories. For computerized accounting it is essential that these are set-up accurately in your Chart of Accounts ...

Amortization of Intangible Assets

... 1. Amortization is the systematic allocation of the amortizable amount of an Intangible Asset over its useful life. Amortization expenses the cost of the asset in equal installments (Straight line method of amortization) over the life of the asset, rather than when the asset is paid. 2. Amortization ...

... 1. Amortization is the systematic allocation of the amortizable amount of an Intangible Asset over its useful life. Amortization expenses the cost of the asset in equal installments (Straight line method of amortization) over the life of the asset, rather than when the asset is paid. 2. Amortization ...

secondary school improvement programme (ssip) 2016 grade 12

... Tangible assets are possessions with a relatively long lifespan, which are not purchased for the purpose of resale. Tangible assets, such as vehicles, equipment and buildings are purchased for use by the business However, the business may find that they no longer require a particular asset, e.g. an ...

... Tangible assets are possessions with a relatively long lifespan, which are not purchased for the purpose of resale. Tangible assets, such as vehicles, equipment and buildings are purchased for use by the business However, the business may find that they no longer require a particular asset, e.g. an ...

Certified Hospitality Accountant Executive (CHAE) Review

... Transactions are then “posted” to the appropriate ledger accounts with reference back to the journal. Trial Balance A list of all accounts and the balances (either debit or credit in separate columns) All debit balances are added and all credit balances are added. The totals are compared - s ...

... Transactions are then “posted” to the appropriate ledger accounts with reference back to the journal. Trial Balance A list of all accounts and the balances (either debit or credit in separate columns) All debit balances are added and all credit balances are added. The totals are compared - s ...

Developing a Cost Accounting System for First Government Contract

... to include identifying potential system gaps that the DCAA did not call attention to, and to determine the best methods for correcting DCAA audit deficiencies. Our effort was segregated into three phases. Phase I encompassed an initial risk assessment with a report citing accounting compliance probl ...

... to include identifying potential system gaps that the DCAA did not call attention to, and to determine the best methods for correcting DCAA audit deficiencies. Our effort was segregated into three phases. Phase I encompassed an initial risk assessment with a report citing accounting compliance probl ...

Bad debt - Get Through Guides

... (All items that cause the amount shown by supplier as receivable to be higher than amount shown by us as payable will be added) Add: Items where our credit entries are < compared to debit entries in supplier’s statement Purchases not recorded by us Purchases recorded at a lower amount by us An ...

... (All items that cause the amount shown by supplier as receivable to be higher than amount shown by us as payable will be added) Add: Items where our credit entries are < compared to debit entries in supplier’s statement Purchases not recorded by us Purchases recorded at a lower amount by us An ...

Document

... Relevant = give some meaning by being connected to the transaction it represents Self-checking = validation process to give immediate feedback as to whether the code exists Flexible = allow expansion of the coding system JAN ...

... Relevant = give some meaning by being connected to the transaction it represents Self-checking = validation process to give immediate feedback as to whether the code exists Flexible = allow expansion of the coding system JAN ...

Expenses

... •Attracting and serving customers Not all decreases in stockholders’ equity arise from expenses (Example: Dividends) Copyright © Cengage Learning. All rights reserved. ...

... •Attracting and serving customers Not all decreases in stockholders’ equity arise from expenses (Example: Dividends) Copyright © Cengage Learning. All rights reserved. ...

chapter 2

... Four major financial statements (reports) are designed to allow a “view” of the company from different perspectives. At year end the first financial statement prepared is that of the Income Statement. This view is focused on the results of business transactions with customers. Economic inflow from t ...

... Four major financial statements (reports) are designed to allow a “view” of the company from different perspectives. At year end the first financial statement prepared is that of the Income Statement. This view is focused on the results of business transactions with customers. Economic inflow from t ...

Define - kthsyr12acc

... Presumable he will run it next year and he would have to start the business up again. And what does he do with the money left over from the first festival. ...

... Presumable he will run it next year and he would have to start the business up again. And what does he do with the money left over from the first festival. ...

BASIC CONCEPTS OF FINANCIAL ACCOUNTING

... time and the occurrence of events in that time period. ...

... time and the occurrence of events in that time period. ...

Sales Transaction Assertions

... A. Lapping of Accounts Receivable Lapping is when, to cover a cash theft, an employee defers recording cash receipts from one customer and covers the shortage with receipts from another customer. It can be detected by comparing the name, amount, and dates shown on remittance advices with cash recei ...

... A. Lapping of Accounts Receivable Lapping is when, to cover a cash theft, an employee defers recording cash receipts from one customer and covers the shortage with receipts from another customer. It can be detected by comparing the name, amount, and dates shown on remittance advices with cash recei ...

national curriculum statement

... Discounts: A reduction or a concession given on cash payment (cash discount) and on a large quantity of goods bought on credit (trade discount). Double-entry accounting: In double entry accounting, every transaction has two journal entries: a debit and a credit. Debits must always equal credits. Do ...

... Discounts: A reduction or a concession given on cash payment (cash discount) and on a large quantity of goods bought on credit (trade discount). Double-entry accounting: In double entry accounting, every transaction has two journal entries: a debit and a credit. Debits must always equal credits. Do ...

McGraw-Hill/Irwin

... Statement of Retained Earnings This statement summarizes the increases and decreases in Retained Earnings during the period. •Business ...

... Statement of Retained Earnings This statement summarizes the increases and decreases in Retained Earnings during the period. •Business ...

Free Sample

... 38. In a chart of accounts using three digits for each account, each numeric digit has meaning to users of the AIS. For example, a numeric digit may represent either a major category of accounts, a primary financial subaccount within each category, or a specific account into which transaction data ...

... 38. In a chart of accounts using three digits for each account, each numeric digit has meaning to users of the AIS. For example, a numeric digit may represent either a major category of accounts, a primary financial subaccount within each category, or a specific account into which transaction data ...

accounting process - ICAI Knowledge Gateway

... (i) When there is an increase in the amount of an asset, its account is debited; the account will be credited if there is a reduction in the amount of the asset concerned : Suppose a firm purchases furniture for ` 800, the furniture account will be debited by ` 800 since the asset has increased by ...

... (i) When there is an increase in the amount of an asset, its account is debited; the account will be credited if there is a reduction in the amount of the asset concerned : Suppose a firm purchases furniture for ` 800, the furniture account will be debited by ` 800 since the asset has increased by ...

LESSON 6-3

... Net Income: the difference between total revenue and total expenses when total revenue is greater Net Loss: the difference between total revenue and total expenses when total expenses are greater ...

... Net Income: the difference between total revenue and total expenses when total revenue is greater Net Loss: the difference between total revenue and total expenses when total expenses are greater ...

download

... related expenses in the same period is called the matching concept, or matching principle. ...

... related expenses in the same period is called the matching concept, or matching principle. ...

2174 321 syllabus

... be difficult to follow if you are not prepared. Class time will be used to explain concepts and help with material you found difficult to learn on your own. This requires you to identify areas where you need help, prior to class, and ask for help in class. On the syllabus (q) indicates questions, (b ...

... be difficult to follow if you are not prepared. Class time will be used to explain concepts and help with material you found difficult to learn on your own. This requires you to identify areas where you need help, prior to class, and ask for help in class. On the syllabus (q) indicates questions, (b ...