CHAPTER 02 AA Accounting for Business

... + Equity Cash Accounts Equipment Accounts + Common - Dividends + Revenues - Expenses Receivable Payable Stock ...

... + Equity Cash Accounts Equipment Accounts + Common - Dividends + Revenues - Expenses Receivable Payable Stock ...

[COURSE NAME] [~~~]

... examination booklet by giving the number of your choice. For example, if (1) is the best answer for item (a), write (a)(1) in your examination booklet. If more than one answer is given for an item, that item will not be marked. Incorrect answers will be marked as zero. No account will be taken of an ...

... examination booklet by giving the number of your choice. For example, if (1) is the best answer for item (a), write (a)(1) in your examination booklet. If more than one answer is given for an item, that item will not be marked. Incorrect answers will be marked as zero. No account will be taken of an ...

Week 5 Horngren, Chapter 8, Accounting Information

... people to whom they have given credit. This is done in the Accounts Receivable Subsidiary Ledger. So when entries are made in the sales journal the individual accounts are updated in the subsidiary ledger on a daily basis. Note the posting references and entries in the subsidiary ledger in Exhibit 8 ...

... people to whom they have given credit. This is done in the Accounts Receivable Subsidiary Ledger. So when entries are made in the sales journal the individual accounts are updated in the subsidiary ledger on a daily basis. Note the posting references and entries in the subsidiary ledger in Exhibit 8 ...

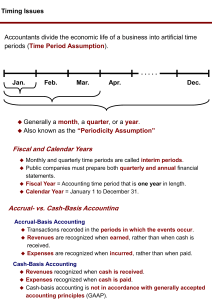

Fiscal and Calendar Years Accrual- vs. Cash

... Transactions recorded in the periods in which the events occur. Revenues are recognized when earned, rather than when cash is received. Expenses are recognized when incurred, rather than when paid. Cash-Basis Accounting Revenues recognized when cash is received. Expenses recognized when ca ...

... Transactions recorded in the periods in which the events occur. Revenues are recognized when earned, rather than when cash is received. Expenses are recognized when incurred, rather than when paid. Cash-Basis Accounting Revenues recognized when cash is received. Expenses recognized when ca ...

Adjusting Accounts

... or of the service being used/consumed (prepaid expenses). Adjusting entries for unearned revenue will be about adjusting for a partially or fully completed amount of a prepaid service during the accounting period. Adjusting entries for prepaid expenses will be about recognizing that a prepaid asset ...

... or of the service being used/consumed (prepaid expenses). Adjusting entries for unearned revenue will be about adjusting for a partially or fully completed amount of a prepaid service during the accounting period. Adjusting entries for prepaid expenses will be about recognizing that a prepaid asset ...

Document

... Owners’ (Stockholders’) Equity: Capital Stock Credit Retained Earnings Credit Income statement accounts: Revenue Credit Expense Debit Dividend accounts: Dividends Debit ...

... Owners’ (Stockholders’) Equity: Capital Stock Credit Retained Earnings Credit Income statement accounts: Revenue Credit Expense Debit Dividend accounts: Dividends Debit ...

Chapter 8 powerpoint

... Used to verify that debits still equal credits in the general ledger accounts after closing entries are made Only accounts with balances are included on this (unlike the Work Sheet which lists ALL accounts) so only assets, liabilities, and capital ...

... Used to verify that debits still equal credits in the general ledger accounts after closing entries are made Only accounts with balances are included on this (unlike the Work Sheet which lists ALL accounts) so only assets, liabilities, and capital ...

Processing Banner Checks - TCSG Intranet

... ran to actually post the check number into the student’s account, provides a check register, gives the totals by type of disbursement, and also creates a check file so that checks can be printed. This process may be ran in Audit Mode as many times as necessary until the check run is correct and in b ...

... ran to actually post the check number into the student’s account, provides a check register, gives the totals by type of disbursement, and also creates a check file so that checks can be printed. This process may be ran in Audit Mode as many times as necessary until the check run is correct and in b ...

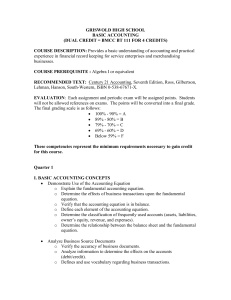

Accounting I - Mr. K`s Pages

... o Verify that the accounting equation is in balance. o Define each element of the accounting equation. o Determine the classification of frequently used accounts (assets, liabilities, owner’s equity, revenue, and expenses). o Determine the relationship between the balance sheet and the fundamental e ...

... o Verify that the accounting equation is in balance. o Define each element of the accounting equation. o Determine the classification of frequently used accounts (assets, liabilities, owner’s equity, revenue, and expenses). o Determine the relationship between the balance sheet and the fundamental e ...

Managing Accounts by Non- Governmental Organisations

... Certified that an amount (s) of Rs...................has/have been sanctioned as Grant in Aid for the year (s) ................ in favour of ....................... for the project titled .................... vide Sanction Order (s) No ...................... dated.......................and out of wh ...

... Certified that an amount (s) of Rs...................has/have been sanctioned as Grant in Aid for the year (s) ................ in favour of ....................... for the project titled .................... vide Sanction Order (s) No ...................... dated.......................and out of wh ...

Double-Entry Accounting

... be conceptualized in much the same way as the scale in The Accounting Formula. Within each of the three major components of The Accounting Formula, accountants create individual T accounts to clarify the financial standing of the business. Some of these accounts include: Depreciation is a method o ...

... be conceptualized in much the same way as the scale in The Accounting Formula. Within each of the three major components of The Accounting Formula, accountants create individual T accounts to clarify the financial standing of the business. Some of these accounts include: Depreciation is a method o ...

Basic Accounting

... The daily operation of a business includes many kinds of transactions — sales, purchases, payment for expenses, receipt of cash, etc. These transactions that affect the financial profile of the business are recorded in journal entries. The recording of each transaction includes what accounts (items) ...

... The daily operation of a business includes many kinds of transactions — sales, purchases, payment for expenses, receipt of cash, etc. These transactions that affect the financial profile of the business are recorded in journal entries. The recording of each transaction includes what accounts (items) ...

Streamline - mirrorsa.co.za

... to complete the transaction, would be a receivable against the debtor account, also against the clearing account. Another example would be where you need to transfer an amount between say two creditor accounts. It would require two payable transactions, one with a negative amount, and the other with ...

... to complete the transaction, would be a receivable against the debtor account, also against the clearing account. Another example would be where you need to transfer an amount between say two creditor accounts. It would require two payable transactions, one with a negative amount, and the other with ...

Syllabus - Institute of Credit Management

... course. Learners are required to prepare and recognise ledger accounts in this format in the examination and there will be no need for them to undertake the balancing off of accounts. Tutors might like to refer to the Study Text for this unit which has been written using the continuous running balan ...

... course. Learners are required to prepare and recognise ledger accounts in this format in the examination and there will be no need for them to undertake the balancing off of accounts. Tutors might like to refer to the Study Text for this unit which has been written using the continuous running balan ...

English Glossary

... First-in, first-out inventory costing method using the price of merchandise purchased first to calculate the cost of merchandise sold first. (p. 569) Fiscal period the length of time for which a business summarizes and reports financial information. (p. 152) G Gain on plant assets (p. 548) ...

... First-in, first-out inventory costing method using the price of merchandise purchased first to calculate the cost of merchandise sold first. (p. 569) Fiscal period the length of time for which a business summarizes and reports financial information. (p. 152) G Gain on plant assets (p. 548) ...

sample final exam MBA_607___final_exam_APRIL 2012 (1)

... B) Retained earnings has a debit balance for a profitable corporation. C) Retained earnings represents the future dividend liability of the company. D) Retained earnings represents the income that has been earned by the company, less any dividends declared since the first day of operations. ...

... B) Retained earnings has a debit balance for a profitable corporation. C) Retained earnings represents the future dividend liability of the company. D) Retained earnings represents the income that has been earned by the company, less any dividends declared since the first day of operations. ...

bookkeeping: flow of information

... The trial balance is a listing of all the ledger accounts, with debits in the left column and credits in the right column. At this point no adjusting entries have been made. The Trial Balance uses the information from the General Ledger to summarise the data to use for preparing the Financial Statem ...

... The trial balance is a listing of all the ledger accounts, with debits in the left column and credits in the right column. At this point no adjusting entries have been made. The Trial Balance uses the information from the General Ledger to summarise the data to use for preparing the Financial Statem ...

Principles-of-Financial-Accounting-11th-Edition

... OBJECTIVE 2: Explain the double-entry system and the usefulness of T accounts in analyzing business transactions. Summary Statement The double-entry system of accounting requires that each transaction be recorded with at least one debit and one credit, and that the total dollar amount of the debits ...

... OBJECTIVE 2: Explain the double-entry system and the usefulness of T accounts in analyzing business transactions. Summary Statement The double-entry system of accounting requires that each transaction be recorded with at least one debit and one credit, and that the total dollar amount of the debits ...

Preview Sample 3

... A private organization which establishes broad accounting principles as well as specific accounting rules is the a. Securities and Exchange Commission. b. Internal Revenue Service. c. Financial Accounting Standards Board. d. Corporate Board of Directors. ...

... A private organization which establishes broad accounting principles as well as specific accounting rules is the a. Securities and Exchange Commission. b. Internal Revenue Service. c. Financial Accounting Standards Board. d. Corporate Board of Directors. ...

Chapter 4 Instructor

... Credit (cr) - means an entry to the right hand side of an account. Note that a debit or credit, per se, does not indicate increase or decrease. To decide the effect of a debit or credit, the type of account must be considered. ...

... Credit (cr) - means an entry to the right hand side of an account. Note that a debit or credit, per se, does not indicate increase or decrease. To decide the effect of a debit or credit, the type of account must be considered. ...

Special Journals and Vouchers

... financial statements (using a work sheet or from the adjusted individual accounts), close the nominal accounts, and prepare a post-closing trial balance. This process of recording, classifying, summarizing, and reporting of accounting data is based on an old and universally accepted system called do ...

... financial statements (using a work sheet or from the adjusted individual accounts), close the nominal accounts, and prepare a post-closing trial balance. This process of recording, classifying, summarizing, and reporting of accounting data is based on an old and universally accepted system called do ...

Chapter 2 - UNI Business

... ©2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. ...

... ©2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. ...

![[COURSE NAME] [~~~]](http://s1.studyres.com/store/data/016690036_1-a0e3386a320b08f14eef7bebe0343d5c-300x300.png)