Economic and Financial

... of a government or central bank buying/selling foreign currency in exchange for their own. This is often used as a way to manipulate the exchange rate. This also tends to strengthen a State’s currency. Background: In 1944, the United Nations Monetary and Financial conference was held in Bretton Wood ...

... of a government or central bank buying/selling foreign currency in exchange for their own. This is often used as a way to manipulate the exchange rate. This also tends to strengthen a State’s currency. Background: In 1944, the United Nations Monetary and Financial conference was held in Bretton Wood ...

Chapter 7 Power Point Presentation

... direction of exchange rate movement. A high interest rate will increase the demand for the home currency, thus enhancing its exchange value. A high level of inflation is too much money chasing too few goods and would cause currency to depreciate. The exchange rate is very sensitive to changes in ...

... direction of exchange rate movement. A high interest rate will increase the demand for the home currency, thus enhancing its exchange value. A high level of inflation is too much money chasing too few goods and would cause currency to depreciate. The exchange rate is very sensitive to changes in ...

When Does Integration Pay?

... Prestige of achieving the closer union of European economies. As a step toward political union? That is the dream. ...

... Prestige of achieving the closer union of European economies. As a step toward political union? That is the dream. ...

Foreign Exchange

... When G or T , then government develops a budget surplus This leads to a decrease in the demand for loanable funds or an increase in the supply of loanable funds, which results in r % . This change in r % leads to IG . In addition, the decrease in r% causes D$ and/or S$ as investors seek higher retur ...

... When G or T , then government develops a budget surplus This leads to a decrease in the demand for loanable funds or an increase in the supply of loanable funds, which results in r % . This change in r % leads to IG . In addition, the decrease in r% causes D$ and/or S$ as investors seek higher retur ...

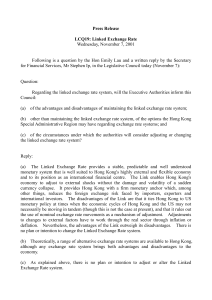

LCQ19: Linked Exchange Rate (7

... monetary system that is well suited to Hong Kong's highly external and flexible economy and to its position as an international financial centre. The Link enables Hong Kong's economy to adjust to external shocks without the damage and volatility of a sudden currency collapse. It provides Hong Kong w ...

... monetary system that is well suited to Hong Kong's highly external and flexible economy and to its position as an international financial centre. The Link enables Hong Kong's economy to adjust to external shocks without the damage and volatility of a sudden currency collapse. It provides Hong Kong w ...

Euro Region Debt Crisis and Exchange Rate Dynamics in EU Accession Countries

... in the light of the latest global recession. This paper argues in favor of policies that will help increase flexibility of prices and reduce the monopoly powers in the private as well as public sectors, thereby contributing toward more complete endogenous adjustment of the real exchange rates. Achie ...

... in the light of the latest global recession. This paper argues in favor of policies that will help increase flexibility of prices and reduce the monopoly powers in the private as well as public sectors, thereby contributing toward more complete endogenous adjustment of the real exchange rates. Achie ...

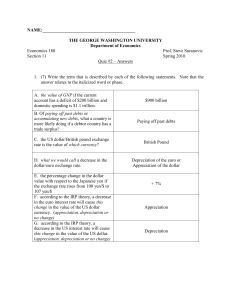

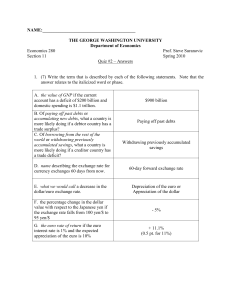

THE GEORGE WASHINGTON UNIVERSITY

... 1. (7) Write the term that is described by each of the following statements. Note that the answer relates to the italicized word or phase. A. the value of GNP if the current account has a deficit of $200 billion and domestic spending is $1.1 trillion. ...

... 1. (7) Write the term that is described by each of the following statements. Note that the answer relates to the italicized word or phase. A. the value of GNP if the current account has a deficit of $200 billion and domestic spending is $1.1 trillion. ...

Exchange Rate

... RATE SYSTEM: – is when the government does not intervene in the foreign exchange markets, but simply allows the exchange rate to be freely determined by demand and supply in the market. ...

... RATE SYSTEM: – is when the government does not intervene in the foreign exchange markets, but simply allows the exchange rate to be freely determined by demand and supply in the market. ...

foreign exchange investment

... market for trading currencies. Financial centers around the world function as anchors of trading between a wide range of different types of buyers and sellers around the clock, with the exception of weekends. The foreign exchange market determines the relative values of different currencies. ...

... market for trading currencies. Financial centers around the world function as anchors of trading between a wide range of different types of buyers and sellers around the clock, with the exception of weekends. The foreign exchange market determines the relative values of different currencies. ...

Banking System in Saudi Arabia

... exchanged. As a store of value, it means that money is capable of holding its value over time. Therefore, people can store it for some time and yet it will not lose its value in exchange. Money is a means of exchange and therefore it facilitates transactions (p. 233). This means that in order to rec ...

... exchanged. As a store of value, it means that money is capable of holding its value over time. Therefore, people can store it for some time and yet it will not lose its value in exchange. Money is a means of exchange and therefore it facilitates transactions (p. 233). This means that in order to rec ...

Exchange-Rate Systems and Currency Crises

... • IMF principles for member nations: • No manipulation to prevent effective balance-ofpayments adjustments or unfair competitive gains • Act to counter short-term exchange market disorders • When members intervene in markets, they should take into account the interests of other members. • Exchange-r ...

... • IMF principles for member nations: • No manipulation to prevent effective balance-ofpayments adjustments or unfair competitive gains • Act to counter short-term exchange market disorders • When members intervene in markets, they should take into account the interests of other members. • Exchange-r ...

exchange rate

... Bimetallism was a “double standard” in the sense that both gold and silver were used as money. Some countries were on the gold standard, some on the silver standard, and some on both. Both gold and silver were used as an international means of payment, and the exchange rates among currencies w ...

... Bimetallism was a “double standard” in the sense that both gold and silver were used as money. Some countries were on the gold standard, some on the silver standard, and some on both. Both gold and silver were used as an international means of payment, and the exchange rates among currencies w ...

Public Investment Programme of BiH

... Decision of the BH Presidency that the Currency Board will continue, which was stated in the PRSP, which has been endorsed by all levels of government The Currency Board produced major economic and social benefits It achieved the main objective – the financial stability through a consistent ap ...

... Decision of the BH Presidency that the Currency Board will continue, which was stated in the PRSP, which has been endorsed by all levels of government The Currency Board produced major economic and social benefits It achieved the main objective – the financial stability through a consistent ap ...

Determine RMB Real Equilibrium Exchange Rate

... Exchange rate is at the heart of international finance, and also remains a central issue in many disputes of international trade. Mainstream theories study exchange rate based on the purchasing power parity and a common sense which assume wage level equals labor productivity. Unfortunately, this ass ...

... Exchange rate is at the heart of international finance, and also remains a central issue in many disputes of international trade. Mainstream theories study exchange rate based on the purchasing power parity and a common sense which assume wage level equals labor productivity. Unfortunately, this ass ...

Strengthening of the Financial Sector

... Decision of the BH Presidency that the Currency Board will continue, which was stated in the PRSP, which has been endorsed by all levels of government The Currency Board produced major economic and social benefits It achieved the main objective – the financial stability through a consistent ap ...

... Decision of the BH Presidency that the Currency Board will continue, which was stated in the PRSP, which has been endorsed by all levels of government The Currency Board produced major economic and social benefits It achieved the main objective – the financial stability through a consistent ap ...

Document

... foreign goods to be relatively cheaper thus reducing exports and increasing imports Depreciation of the dollar causes American goods to be relatively cheaper and foreign goods to be relatively more expensive thus increasing exports and reducing imports ...

... foreign goods to be relatively cheaper thus reducing exports and increasing imports Depreciation of the dollar causes American goods to be relatively cheaper and foreign goods to be relatively more expensive thus increasing exports and reducing imports ...

SECTION8

... – Provides a measure of the amount of goods your money will buy in another country. ...

... – Provides a measure of the amount of goods your money will buy in another country. ...

Appreciation

... •The Case for Fixed Exchange Rates • Facilitates trade by creating certainty about the exchange rate ...

... •The Case for Fixed Exchange Rates • Facilitates trade by creating certainty about the exchange rate ...

A Model of US Import Flows (1974-1988) Dominick Answini

... (US), one must be able to turns one's currency into US currency. This caused an increase in the demand for dollars and an appreciation of their value relative to other currencies. In terms of international trade theory, we see that Americans now held dollars with inflated value and this made imports ...

... (US), one must be able to turns one's currency into US currency. This caused an increase in the demand for dollars and an appreciation of their value relative to other currencies. In terms of international trade theory, we see that Americans now held dollars with inflated value and this made imports ...

2015-05-22 17:00:39.740 GMT (Adds Kelimbetov

... (Bloomberg) -- Kazakhstan’s central bank plans to cut the cost of cash it lends to banks after the ruble’s recovery eased devaluation pressures, Governor Kairat Kelimbetov said. The rate charged on foreign-currency swaps and repurchase operations may be reduced by 1 percent in June, Kelimbetov said ...

... (Bloomberg) -- Kazakhstan’s central bank plans to cut the cost of cash it lends to banks after the ruble’s recovery eased devaluation pressures, Governor Kairat Kelimbetov said. The rate charged on foreign-currency swaps and repurchase operations may be reduced by 1 percent in June, Kelimbetov said ...