International Payment flows

... Money can store value and act as a unit for accounting. Over time money has made a transition from silver or gold coins that had real ...

... Money can store value and act as a unit for accounting. Over time money has made a transition from silver or gold coins that had real ...

Macro_5.2-_Foreign_Exchange_FOREX

... 3. Changes in Relative Price Level (Resulting in more imports)- ...

... 3. Changes in Relative Price Level (Resulting in more imports)- ...

Chapter 10

... systems within the country collapsed; certain government actions set the stage for a constitutional crisis. ...

... systems within the country collapsed; certain government actions set the stage for a constitutional crisis. ...

Chapter 18

... – Form of buying low and selling high – Opportunities to profit through exchange rate ...

... – Form of buying low and selling high – Opportunities to profit through exchange rate ...

Decrease in demand does not lead to currency depreciation Result

... • Decrease in demand results in overvalued dollar, causing a surplus on world market • Supply of foreign currency available for trade is insufficient • Central bank’s foreign reserves are depleted • Eventually, government must take some action ...

... • Decrease in demand results in overvalued dollar, causing a surplus on world market • Supply of foreign currency available for trade is insufficient • Central bank’s foreign reserves are depleted • Eventually, government must take some action ...

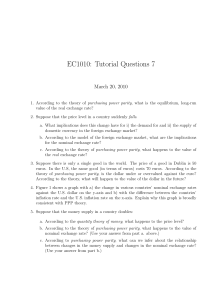

File - Paul Scanlon

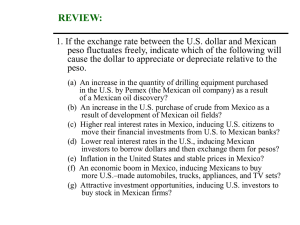

... 2. Suppose that the price level in a country suddenly falls. a. What implications does this change have for i) the demand for and ii) the supply of domestic currency in the foreign exchange market? b. According to the model of the foreign exchange market, what are the implications for the nominal ex ...

... 2. Suppose that the price level in a country suddenly falls. a. What implications does this change have for i) the demand for and ii) the supply of domestic currency in the foreign exchange market? b. According to the model of the foreign exchange market, what are the implications for the nominal ex ...

Exchange Rates Theories

... to have the same inflation rates (why?) People believe that the relative value of currency A to currency B will not change They are indifferent between holding A or B no change in exchange rate ...

... to have the same inflation rates (why?) People believe that the relative value of currency A to currency B will not change They are indifferent between holding A or B no change in exchange rate ...

File

... The Equilibrium Exchange Rate In the currency market, the country that is importing is _________________ their own currency and _________________ another country’s currency. A country that is buying bonds ________________ their own currency and _______________ another country’s currency. When a coun ...

... The Equilibrium Exchange Rate In the currency market, the country that is importing is _________________ their own currency and _________________ another country’s currency. A country that is buying bonds ________________ their own currency and _______________ another country’s currency. When a coun ...

International Monetary Systems

... 2. The US dollar would be designed as a reserve currency, and other nations would maintain their FX reserves in the form of dollars. 3. Each country fixed its ex rate against the dollar and the value of dollar is defined by the official gold price $35 per ounce (Gold Exchange Standard). ...

... 2. The US dollar would be designed as a reserve currency, and other nations would maintain their FX reserves in the form of dollars. 3. Each country fixed its ex rate against the dollar and the value of dollar is defined by the official gold price $35 per ounce (Gold Exchange Standard). ...

3.E Money in the European Union High School Lesson Plan

... To introduce the idea of the lesson, teacher will ask students if any have ever traveled outside of the United States. If so, teacher will ask that student whether they were able to use dollars to buy things in that other country. The student may explain that they were not able to use US dollars, bu ...

... To introduce the idea of the lesson, teacher will ask students if any have ever traveled outside of the United States. If so, teacher will ask that student whether they were able to use dollars to buy things in that other country. The student may explain that they were not able to use US dollars, bu ...

Document

... Ex. a preference for Japanese goods creates an increase in the supply of dollars in the currency exchange market which leads to depreciation of the Dollar and an appreciation of Yen ...

... Ex. a preference for Japanese goods creates an increase in the supply of dollars in the currency exchange market which leads to depreciation of the Dollar and an appreciation of Yen ...

International Trade

... If the U.S. wants to devalue the dollar it will borrow dollars from the IMF and buy other currencies around the world If the U. S. wants to revalue the dollar it will borrow other currencies from the IMF and buy dollars around the world ...

... If the U.S. wants to devalue the dollar it will borrow dollars from the IMF and buy other currencies around the world If the U. S. wants to revalue the dollar it will borrow other currencies from the IMF and buy dollars around the world ...

Module Exchange Rates and Macroeconomic Policy

... adoption of a common currency. • British economists who favored adoption of the euro argued that if Britain used the same currency as its neighbors, the country’s international trade would expand and its economy would become more productive. But, other economists pointed out that adopting the euro w ...

... adoption of a common currency. • British economists who favored adoption of the euro argued that if Britain used the same currency as its neighbors, the country’s international trade would expand and its economy would become more productive. But, other economists pointed out that adopting the euro w ...

lecture 5.slides - Lancaster University

... • economic policy will be constrained by fixed ER - chronic BP deficit requires deflationary policy - conflict between full employment and BP equilibrium • sudden ‘shocks’ cannot be absorbed by ER adjustment - shocks affect ‘real’ economy if prices are fixed • fixed ER encourages ‘protectionism’ - d ...

... • economic policy will be constrained by fixed ER - chronic BP deficit requires deflationary policy - conflict between full employment and BP equilibrium • sudden ‘shocks’ cannot be absorbed by ER adjustment - shocks affect ‘real’ economy if prices are fixed • fixed ER encourages ‘protectionism’ - d ...

International Finance and the Foreign Exchange

... An unanticipated shift to a more expansionary monetary policy (buying bonds) will: 1. lowers interest rates 2. lowers the outflow of capital 3. causes currency depreciation and a trade surplus ...

... An unanticipated shift to a more expansionary monetary policy (buying bonds) will: 1. lowers interest rates 2. lowers the outflow of capital 3. causes currency depreciation and a trade surplus ...

ch15

... central bank permits the exchange rates to vary. If the exchange rate approaches the upper band SU, then the central bank sells foreign exchange reserves in sufficient quantities to prevent additional depreciation of its nation’s currency. In contrast, if the exchange rate approaches the lower band ...

... central bank permits the exchange rates to vary. If the exchange rate approaches the upper band SU, then the central bank sells foreign exchange reserves in sufficient quantities to prevent additional depreciation of its nation’s currency. In contrast, if the exchange rate approaches the lower band ...

Floating exchange rates

... • In an adjustable peg regime, exchange rates are normally fixed, but countries are occasionally allowed to alter their exchange rate. • Under the Bretton Woods system, each country announced a par value for their currency in terms of US dollars – the dollar standard. ...

... • In an adjustable peg regime, exchange rates are normally fixed, but countries are occasionally allowed to alter their exchange rate. • Under the Bretton Woods system, each country announced a par value for their currency in terms of US dollars – the dollar standard. ...

ECONOMIC DEVELOPMENT & INTERNATIONAL POLITICS

... Brazilian exports getting crushed by currency appreciation ...

... Brazilian exports getting crushed by currency appreciation ...

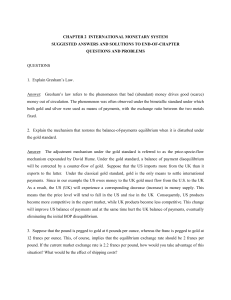

suggested answers and solutions to

... average of currencies of EU member countries. The ECU works as the accounting unit of EMS and plays an important role in the workings of the ERM. The ERM is the procedure by which EMS member countries manage their exchange rates. The ERM is based on a parity grid system, with parity grids first comp ...

... average of currencies of EU member countries. The ECU works as the accounting unit of EMS and plays an important role in the workings of the ERM. The ERM is the procedure by which EMS member countries manage their exchange rates. The ERM is based on a parity grid system, with parity grids first comp ...

Sheila Blair and Nina Smilow

... the economy. As imports become more expensive and exports cheaper, a country slowly slips into a trade deficit. Bolivia believes that devaluation means inflation. Devaluation only favors those who are very rich, and who have the majority of their capital in banks overseas, and those foreign companie ...

... the economy. As imports become more expensive and exports cheaper, a country slowly slips into a trade deficit. Bolivia believes that devaluation means inflation. Devaluation only favors those who are very rich, and who have the majority of their capital in banks overseas, and those foreign companie ...

The Globalization of International Relations

... The shows instability (invades Iraq, budget deficit)… ...

... The shows instability (invades Iraq, budget deficit)… ...

Chapt12

... • Depreciation raises price of imported goods and the price level • Central Bank may try to avoid depreciation by tightening monetary policy • Increase in risk premium may directly cause money demand to rise as people seek “safe” asset ...

... • Depreciation raises price of imported goods and the price level • Central Bank may try to avoid depreciation by tightening monetary policy • Increase in risk premium may directly cause money demand to rise as people seek “safe” asset ...