The main qualities of an orthodox currency board are

... central bank that equals additional hard foreign exchange reserves in the hands of the central bank. ...

... central bank that equals additional hard foreign exchange reserves in the hands of the central bank. ...

Exchange Rate Topics

... {HK$1000/ S01/01} US dollars. 2. Put {S01/01 × HK$1000} into bank account. After 1 year get US$(1+iF)×{HK$1000/S01/01 } 3. Convert these funds into US at exchange rate prevailing in 1 year. (1 i F ) S12 / 31 HK $1000 S01/ 01 ...

... {HK$1000/ S01/01} US dollars. 2. Put {S01/01 × HK$1000} into bank account. After 1 year get US$(1+iF)×{HK$1000/S01/01 } 3. Convert these funds into US at exchange rate prevailing in 1 year. (1 i F ) S12 / 31 HK $1000 S01/ 01 ...

Slides on Currencies in International Trade (Session 3)

... the government – and a willingness to create pain ◦ Example: Suppose your nation’s economy is very prosperous, but exports are growing only slowly Your people will have money to buy imports Their demand for foreign currencies will put upward pressure on their exchange rates Government has to s ...

... the government – and a willingness to create pain ◦ Example: Suppose your nation’s economy is very prosperous, but exports are growing only slowly Your people will have money to buy imports Their demand for foreign currencies will put upward pressure on their exchange rates Government has to s ...

Foreign Exchange (FX) Market

... Network of financial institutions and brokers in which individuals, businesses, banks, and governments buy and sell the currencies of different countries The liquidity of the market provides businesses with access to international markets for goods and services by providing foreign currency necessar ...

... Network of financial institutions and brokers in which individuals, businesses, banks, and governments buy and sell the currencies of different countries The liquidity of the market provides businesses with access to international markets for goods and services by providing foreign currency necessar ...

Balance of payments - Business-TES

... from the UK – Imports (M) The sale of goods and services to buyers from other countries leading to an inflow of currency to the UK – Exports (X) ...

... from the UK – Imports (M) The sale of goods and services to buyers from other countries leading to an inflow of currency to the UK – Exports (X) ...

chapter 2 international monetary system

... by Prime Minister Tony Blair appears to be in favor of joining the euro club, it is not clear at the moment if that will actually happen. The opposition Tory party is not in favor of adopting the euro and thus giving up monetary sovereignty of the country. The public opinion is also divided on the i ...

... by Prime Minister Tony Blair appears to be in favor of joining the euro club, it is not clear at the moment if that will actually happen. The opposition Tory party is not in favor of adopting the euro and thus giving up monetary sovereignty of the country. The public opinion is also divided on the i ...

chapte r 4

... F. Speculating on Anticipated Exchange Rates Many commercial banks attempt to capitalize on their forecasts of anticipated exchange rate movements in the foreign exchange market ...

... F. Speculating on Anticipated Exchange Rates Many commercial banks attempt to capitalize on their forecasts of anticipated exchange rate movements in the foreign exchange market ...

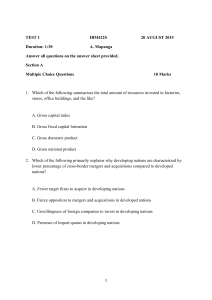

TEST 1 IBM422S 20 AUGUST 2015

... 6. A pair of shoes costs £40 in Britain. An identical pair costs $50 in the United States when the exchange rate is £1 = $1.50. Which of the following is correct? ...

... 6. A pair of shoes costs £40 in Britain. An identical pair costs $50 in the United States when the exchange rate is £1 = $1.50. Which of the following is correct? ...

Measuring Trade

... Trade surplus– a nation exports more than it imports Trade deficit– when a nation imports more than it exports ...

... Trade surplus– a nation exports more than it imports Trade deficit– when a nation imports more than it exports ...

developing countries` choice of exchange rate regime should

... The estimated fall in output for countries with a short-term external debt of around 25% of GDP and a floating exchange rate regime is about two times larger than the response for countries with a fixed exchange rate and the same debt level. But in countries with low foreign currency debt, a flexib ...

... The estimated fall in output for countries with a short-term external debt of around 25% of GDP and a floating exchange rate regime is about two times larger than the response for countries with a fixed exchange rate and the same debt level. But in countries with low foreign currency debt, a flexib ...

Lecture 5 (POWER POINT)

... exchange rate within ±1% of the adopted par value by buying or selling foreign reserves as necessary. • The U.S. was only responsible for maintaining the gold parity. • Under Bretton Woods, the IMF was created. • The Bretton Woods is also known as an adjustable peg system. When facing serious balanc ...

... exchange rate within ±1% of the adopted par value by buying or selling foreign reserves as necessary. • The U.S. was only responsible for maintaining the gold parity. • Under Bretton Woods, the IMF was created. • The Bretton Woods is also known as an adjustable peg system. When facing serious balanc ...

Exchange Rate

... for International Settlements (BIS) ) • Foreign exchange market activity has become ever more concentrated in a handful of global financial centres. The vast majority of global FX trading in 2013 has occurred in five jurisdictions: the United Kingdom (41%), the United States (19%), Singapore (5.7%), ...

... for International Settlements (BIS) ) • Foreign exchange market activity has become ever more concentrated in a handful of global financial centres. The vast majority of global FX trading in 2013 has occurred in five jurisdictions: the United Kingdom (41%), the United States (19%), Singapore (5.7%), ...

The Difference Between Currency Manipulation and Monetary Policy

... First, it is important to note that the real (i.e., inflationBank of China (PBC, the central bank of China) has preadjusted) exchange rate matters for international trade, not vented rapid appreciation of the renminbi (RMB) by purthe nominal exchange rate. Manipulation of real exchange chasing U.S. ...

... First, it is important to note that the real (i.e., inflationBank of China (PBC, the central bank of China) has preadjusted) exchange rate matters for international trade, not vented rapid appreciation of the renminbi (RMB) by purthe nominal exchange rate. Manipulation of real exchange chasing U.S. ...

Chapter15 - University of San Diego Home Pages

... determined by the forces of D and S. There is no intervention by the Central Bank Fixed Exchange Rate System – a system where central banks intervene to maintain or stabilize exchange rates at a fixed value Managed Float – A system where central banks intervene in the foreign exchange markets to mai ...

... determined by the forces of D and S. There is no intervention by the Central Bank Fixed Exchange Rate System – a system where central banks intervene to maintain or stabilize exchange rates at a fixed value Managed Float – A system where central banks intervene in the foreign exchange markets to mai ...

The United Kingdom & the EU (the Single Currency)

... • The country, like other outsiders, will be very much affected by the policies adopted by the EMU members. • All decisions which relate to monetary and exchange rate policy will be to reflect primarily the interests of the EMU participants. • Its trading partners would dominate decision-making in k ...

... • The country, like other outsiders, will be very much affected by the policies adopted by the EMU members. • All decisions which relate to monetary and exchange rate policy will be to reflect primarily the interests of the EMU participants. • Its trading partners would dominate decision-making in k ...

Exchange Rate Regimes

... In the short run, under fixed exchange rates, a country gives up its control of the interest rate and the exchange rate. Also, anticipation that a country may be about to devalue its currency may lead investors to ask for very high interest rates. An argument against flexible exchange rates is that ...

... In the short run, under fixed exchange rates, a country gives up its control of the interest rate and the exchange rate. Also, anticipation that a country may be about to devalue its currency may lead investors to ask for very high interest rates. An argument against flexible exchange rates is that ...

Money and Banking - Holy Family University

... Use managed float: the central bank allows market forces to determine second-to-second (day-to-day) fluctuations in exchange rates but intervenes if the currency grows too weak or too strong. ...

... Use managed float: the central bank allows market forces to determine second-to-second (day-to-day) fluctuations in exchange rates but intervenes if the currency grows too weak or too strong. ...

Interwar instability

... real estate assets->another currency ends the crisis, supported by US capital inflows • 1929: US inflows end->higher interest rates are useless following Fed’s higher interest rates->collapse of foreign reserves->austerity ...

... real estate assets->another currency ends the crisis, supported by US capital inflows • 1929: US inflows end->higher interest rates are useless following Fed’s higher interest rates->collapse of foreign reserves->austerity ...

Purchasing Power Parity

... differed in two markets would necessarily converge. • According to the theory of purchasingpower parity, a currency must have the same purchasing power in all countries and exchange rates move to ensure that. ...

... differed in two markets would necessarily converge. • According to the theory of purchasingpower parity, a currency must have the same purchasing power in all countries and exchange rates move to ensure that. ...

The Euro`s Fundamental Flaws

... Until recently, the bond markets treated all euro sovereign debts as virtually equal, not raising interest rates on high-debt countries until the possibility of default became clear. The need for massive fiscal adjustment without any offsetting currency devaluation will now drive Greece and perhaps ...

... Until recently, the bond markets treated all euro sovereign debts as virtually equal, not raising interest rates on high-debt countries until the possibility of default became clear. The need for massive fiscal adjustment without any offsetting currency devaluation will now drive Greece and perhaps ...

Exchange Rates

... Suppose there is an increase in demand for British Sterling= D1 to D2, thus increasing exchange rate. British authorities will then tap into their currency reserves and sell more sterling, thus increasing supply from S1 to S2, and maintaining fixed exchange rate. ...

... Suppose there is an increase in demand for British Sterling= D1 to D2, thus increasing exchange rate. British authorities will then tap into their currency reserves and sell more sterling, thus increasing supply from S1 to S2, and maintaining fixed exchange rate. ...

Exchange Rates Teacher

... when its value rises against other currencies, whereas a depreciation occurs when a currencies’ value falls against other currencies. ...

... when its value rises against other currencies, whereas a depreciation occurs when a currencies’ value falls against other currencies. ...

Fig. 1: Annual* Inflation and Depreciation in Israel, 1958

... Portfolios of U.S. and Foreign Mutual Funds ...

... Portfolios of U.S. and Foreign Mutual Funds ...