exchange arets

... The Exchange Rate o Bi-lateral Exchange Rate - the rate at which one currency can be traded against another. Examples include: o Sterling/US Dollar, $/YEN or Sterling/Euro o Effective Exchange Rate Index (EER) - a weighted index of sterling's value against a basket of international currencies the w ...

... The Exchange Rate o Bi-lateral Exchange Rate - the rate at which one currency can be traded against another. Examples include: o Sterling/US Dollar, $/YEN or Sterling/Euro o Effective Exchange Rate Index (EER) - a weighted index of sterling's value against a basket of international currencies the w ...

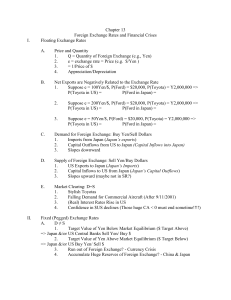

Chapter 13 - Montana State University

... May conflict with attempts to stimulate the Domestic Economy a. England: 1992 b. Countries hit with currency/financial crisis (Asia, 1997): IMF c. Generally, if a country uses monetary policy to defend exchange rate, it can’t use it for domestic stabilization Market rates rise with risk of default ...

... May conflict with attempts to stimulate the Domestic Economy a. England: 1992 b. Countries hit with currency/financial crisis (Asia, 1997): IMF c. Generally, if a country uses monetary policy to defend exchange rate, it can’t use it for domestic stabilization Market rates rise with risk of default ...

Source

... domestic real interest rates raise, the domestic currency appreciates. When domestic interest rates rise due to an expected increase in inflation, the domestic currency depreciates. ...

... domestic real interest rates raise, the domestic currency appreciates. When domestic interest rates rise due to an expected increase in inflation, the domestic currency depreciates. ...

MACROECONOMICS

... Bank wants it to be: $1=€1.50 but the Fed wants it to be $1= €1. The Fed enters the FX market and keeps on buying euros with dollars. Money supply increases until the fixed exchange rate is reached. Of course, higher demand for euros appreciates € and depreciates $. How easy is this for CB? ...

... Bank wants it to be: $1=€1.50 but the Fed wants it to be $1= €1. The Fed enters the FX market and keeps on buying euros with dollars. Money supply increases until the fixed exchange rate is reached. Of course, higher demand for euros appreciates € and depreciates $. How easy is this for CB? ...

Tension and new alliances - the currency wars

... devaluations. To be sure, an underlying demand for protectionist measures has never been muted, as globalization represents a threat for monopolistic rents, and inevitably increased with the crisis. Not surprisingly, during the crisis, 17 of the G20 countries introduced protectionist measures, desp ...

... devaluations. To be sure, an underlying demand for protectionist measures has never been muted, as globalization represents a threat for monopolistic rents, and inevitably increased with the crisis. Not surprisingly, during the crisis, 17 of the G20 countries introduced protectionist measures, desp ...

China’s Exchange Rate System after WTO Accession

... Capital brought in from abroad must be deposited in special accounts in designated banks. Any repayments and remittances from these accounts are also subject to SAFE approval. Foreign investment in the Chinese stock market is limited to B shares. Inbound foreign capital must get SAFE approval to con ...

... Capital brought in from abroad must be deposited in special accounts in designated banks. Any repayments and remittances from these accounts are also subject to SAFE approval. Foreign investment in the Chinese stock market is limited to B shares. Inbound foreign capital must get SAFE approval to con ...

Fetters of gold and paper

... “The point is that an exchange-rate system is a system, in which countries on both sides of the exchange-rate relationship have a responsibility for contributing to its stability and smooth ...

... “The point is that an exchange-rate system is a system, in which countries on both sides of the exchange-rate relationship have a responsibility for contributing to its stability and smooth ...

Ch 29 notes - Solon City Schools

... • If a traveler has any foreign currency left over on their return home, may want to sell it, which they may do at their local bank or money changer. • The exchange rate as well as fees and charges can vary significantly on each of these transactions, and the exchange rate can vary from one day to ...

... • If a traveler has any foreign currency left over on their return home, may want to sell it, which they may do at their local bank or money changer. • The exchange rate as well as fees and charges can vary significantly on each of these transactions, and the exchange rate can vary from one day to ...

幻灯片 1

... domestic goals without carrying out their international responsibilities��on the other hand,they cannot pursue different domestic and international objectives at the same time. They may either fail to adequately meet the demand of a growing global economy for liquidity as they try to ease inflation ...

... domestic goals without carrying out their international responsibilities��on the other hand,they cannot pursue different domestic and international objectives at the same time. They may either fail to adequately meet the demand of a growing global economy for liquidity as they try to ease inflation ...

Document

... exchange rate are equal to 1; domestic (Mexican) and foreign interest rates are equal to 5% so that RP = 0.05 and R$ = 0.05; and there is no risk premium on domestic assets so that RP=0. Would the spot exchange rate change over time if nothing else changes? b) Starting from the initial equilibrium, ...

... exchange rate are equal to 1; domestic (Mexican) and foreign interest rates are equal to 5% so that RP = 0.05 and R$ = 0.05; and there is no risk premium on domestic assets so that RP=0. Would the spot exchange rate change over time if nothing else changes? b) Starting from the initial equilibrium, ...

International Economics Imports Exports Net Exports Balance of

... Considering opportunity cost, when will countries choose to trade? ...

... Considering opportunity cost, when will countries choose to trade? ...

Chapter 6 - FacStaff Home Page for CBU

... because it forces the local currency to be replaced by the U.S. dollar. c. Although dollarization and a currency board both attempt to peg the local currency’s value, the currency board does not replace the local currency with dollars. ...

... because it forces the local currency to be replaced by the U.S. dollar. c. Although dollarization and a currency board both attempt to peg the local currency’s value, the currency board does not replace the local currency with dollars. ...

GDP and Economic Policy

... E.g. when imports go up, more USDs are needed to pay for imports, i.e. the demand for domestic currency relative to USDs declines (depreciation). ...

... E.g. when imports go up, more USDs are needed to pay for imports, i.e. the demand for domestic currency relative to USDs declines (depreciation). ...

IPEII File - CSUN Moodle

... of 1971 that was no longer a tenable approach. There were runs on US gold stocks and the supply was dwindling. August 15, 1971 suspended the convertibility of the dollar into gold and ...

... of 1971 that was no longer a tenable approach. There were runs on US gold stocks and the supply was dwindling. August 15, 1971 suspended the convertibility of the dollar into gold and ...

Real Exchange Rate

... identical good, if the good is tradable, if there is free trade and there are no transactions /transportation costs, then the price should be the same in both countries. In the shirt example, U.S consumers would buy Indian shirts, buy more rupees, causing an appreciation of the Indian rupee and maki ...

... identical good, if the good is tradable, if there is free trade and there are no transactions /transportation costs, then the price should be the same in both countries. In the shirt example, U.S consumers would buy Indian shirts, buy more rupees, causing an appreciation of the Indian rupee and maki ...

13-3

... 3. Public deficit no more than 3 percent of the country’s GDP 4. Public debt below 60 percent of its GDP ...

... 3. Public deficit no more than 3 percent of the country’s GDP 4. Public debt below 60 percent of its GDP ...

AP MACRO UNIT 8 MR. LIPMAN

... - U.S. citizens have more disposable income - Americans import more - Net exports (Xn) decrease The current account balance decreases and moves toward a deficit. 2. If the U.S. dollar depreciates relative to other countries does the BOP move to a deficit or a surplus? - US exports are desirable - Am ...

... - U.S. citizens have more disposable income - Americans import more - Net exports (Xn) decrease The current account balance decreases and moves toward a deficit. 2. If the U.S. dollar depreciates relative to other countries does the BOP move to a deficit or a surplus? - US exports are desirable - Am ...

Gold Standard

... Fixed and Flexible Exchange Rate System Interest rate differences could influence capital flows: If interest rates in the domestic economy are higher that that of the economy of the anchor currency, it could lead to huge capital flows from the foreign economy to the domestic economy, creating exc ...

... Fixed and Flexible Exchange Rate System Interest rate differences could influence capital flows: If interest rates in the domestic economy are higher that that of the economy of the anchor currency, it could lead to huge capital flows from the foreign economy to the domestic economy, creating exc ...