c19

... 13) Countries with floating exchange rates have certain characteristics. Indicate the one that does not apply to those countries. A) closed economy B) small economy C) diversified trade D) divergent inflation rates Answer: B 14) Of the following exchange rate arrangements, in which does the exchang ...

... 13) Countries with floating exchange rates have certain characteristics. Indicate the one that does not apply to those countries. A) closed economy B) small economy C) diversified trade D) divergent inflation rates Answer: B 14) Of the following exchange rate arrangements, in which does the exchang ...

New logo in yellow - Queen`s Economics Department

... against foreign shocks. But fixed rates can handle shocks too. Regional adjustment Assume that Ontario is in equilibrium with US Great Lakes states, Alberta is cost competitive with the Texas Gulf, BC is on-side with the Pacific Northwest, etc. Now comes a price shock, say an increase in raw m ...

... against foreign shocks. But fixed rates can handle shocks too. Regional adjustment Assume that Ontario is in equilibrium with US Great Lakes states, Alberta is cost competitive with the Texas Gulf, BC is on-side with the Pacific Northwest, etc. Now comes a price shock, say an increase in raw m ...

Tight monetary policy and financial stability

... interest rates last year by a total of 1½ percentage points, which contributed to a 2.8% appreciation of the króna. Without these actions, the inflation rate would have been even higher. However, the Bank’s interest rate rises hardly sufficed to match greater inflationary expectations during the fin ...

... interest rates last year by a total of 1½ percentage points, which contributed to a 2.8% appreciation of the króna. Without these actions, the inflation rate would have been even higher. However, the Bank’s interest rate rises hardly sufficed to match greater inflationary expectations during the fin ...

Document

... “People worry today that the economic and financial union might lead to the loss of French sovereignty and independence. In fact, at a time when capital moves about in mere seconds, thanks to the computer, from one financial location to another, one notices that speculative movements are completely ...

... “People worry today that the economic and financial union might lead to the loss of French sovereignty and independence. In fact, at a time when capital moves about in mere seconds, thanks to the computer, from one financial location to another, one notices that speculative movements are completely ...

Why Not a Global Currency?

... national price levels. Nothing could be further from the truth, and as virtually everyone knows by now, exchange rates fluctuate wildly in comparison with goods prices. Early in the flexiblerate experience, theorists offered what appeared to be an attractive answer to this observation: currency is a ...

... national price levels. Nothing could be further from the truth, and as virtually everyone knows by now, exchange rates fluctuate wildly in comparison with goods prices. Early in the flexiblerate experience, theorists offered what appeared to be an attractive answer to this observation: currency is a ...

1 - contentextra

... The reason other countries must copy the Fed’s monetary policies has to do with exchange rates, which many countries try to peg to varying degrees to the value of the dollar. One of the determinants of exchange rates is relative interest rates between countries. If the US lowers interest rates, and ...

... The reason other countries must copy the Fed’s monetary policies has to do with exchange rates, which many countries try to peg to varying degrees to the value of the dollar. One of the determinants of exchange rates is relative interest rates between countries. If the US lowers interest rates, and ...

overvalued exchange rate

... • Under a fixed exchange rate regime, is an effective tool for adjusting domestic output in the Keynesian short run. • In the classical model P and e increase immediately in response to the fiscal expansion and NX is immediately crowded ...

... • Under a fixed exchange rate regime, is an effective tool for adjusting domestic output in the Keynesian short run. • In the classical model P and e increase immediately in response to the fiscal expansion and NX is immediately crowded ...

Answer Key - University of Colorado Boulder

... demand for money to rise. C. A rise in the average value of transactions carried out by a household or a firm causes its demand for money to rise. D. A rise in the average value of transactions carried out by a household or a firm causes its demand for nominal money to rise. E. A rise in the average ...

... demand for money to rise. C. A rise in the average value of transactions carried out by a household or a firm causes its demand for money to rise. D. A rise in the average value of transactions carried out by a household or a firm causes its demand for nominal money to rise. E. A rise in the average ...

International Money and the International Monetary System

... IMF members can 'use' SDRs by presenting it to another member, who is required to provide a foreign currency from their own reserves. Interest are charged/paid on difference of SDR holdings against allocations (i.e. net use) As a rule, only IMF member countries can hold SDR accounts with the IMF. ...

... IMF members can 'use' SDRs by presenting it to another member, who is required to provide a foreign currency from their own reserves. Interest are charged/paid on difference of SDR holdings against allocations (i.e. net use) As a rule, only IMF member countries can hold SDR accounts with the IMF. ...

China`s Currency Moves

... global equity markets. All this attention certainly demonstrates how important China has become within the global economy at large. Devaluation—or a Market-Driven Move? Once pegged to the US dollar, the renminbi exchange rate has been allowed to float since 2006 within a specified range around a fix ...

... global equity markets. All this attention certainly demonstrates how important China has become within the global economy at large. Devaluation—or a Market-Driven Move? Once pegged to the US dollar, the renminbi exchange rate has been allowed to float since 2006 within a specified range around a fix ...

Class 7: Economic Globalization

... Krugman reading: “Chinese New Year” • Unlike the dollar, the euro or the yen, whose values fluctuate freely, China’s currency is pegged by official policy at about 6.8 yuan to the dollar. At this exchange rate, Chinese manufacturing has a large cost advantage over its rivals, leading to huge trade ...

... Krugman reading: “Chinese New Year” • Unlike the dollar, the euro or the yen, whose values fluctuate freely, China’s currency is pegged by official policy at about 6.8 yuan to the dollar. At this exchange rate, Chinese manufacturing has a large cost advantage over its rivals, leading to huge trade ...

Paraguay_en.pdf

... point the yield curve of the benchmark interest rate for the sale of monetary regulation instruments and establishing a credit line for local financial entities in the form of a facility for short-term liquidity through the repurchase of monetary regulation instruments (FLIR). On 14 November the cen ...

... point the yield curve of the benchmark interest rate for the sale of monetary regulation instruments and establishing a credit line for local financial entities in the form of a facility for short-term liquidity through the repurchase of monetary regulation instruments (FLIR). On 14 November the cen ...

The Open Economy Terminology

... Arbitrage implies that the domestic interest rate must be (approximately) equal to the foreign interest rate plus the expected depreciation rate of the domestic currency. ...

... Arbitrage implies that the domestic interest rate must be (approximately) equal to the foreign interest rate plus the expected depreciation rate of the domestic currency. ...

Int Fin Sys - Glendale Community College

... • Under the Bretton Woods system, the U.S. dollar was pegged to gold at $35 per ounce and other currencies were pegged to the U.S. dollar. • Each country was responsible for maintaining its exchange rate within ±1% of the adopted par value by buying or selling foreign reserves as necessary. • The Br ...

... • Under the Bretton Woods system, the U.S. dollar was pegged to gold at $35 per ounce and other currencies were pegged to the U.S. dollar. • Each country was responsible for maintaining its exchange rate within ±1% of the adopted par value by buying or selling foreign reserves as necessary. • The Br ...

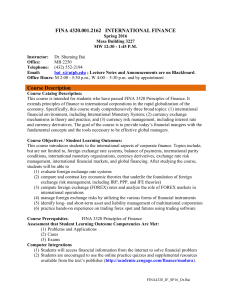

Introduction to International Finance

... growth lies precisely in its ability to increase efficiency."1 Development of efficient financial markets in developing countries has been severely constrained by the neglect of institution building in both private and public sectors. Efficient financial markets require a certain threshold in both ...

... growth lies precisely in its ability to increase efficiency."1 Development of efficient financial markets in developing countries has been severely constrained by the neglect of institution building in both private and public sectors. Efficient financial markets require a certain threshold in both ...

Exchange rate - Philippine Institute of Development Studies

... P54-$1. An appreciation of the peso is a rise in the value relative to the dollar, i.e., from P52-$1 to P50-$1. From the example above, one can conclude that an appreciation (depreciation) of the peso makes imported products cheaper (more expensive) in the Philippines. Conversely, a depreciation fav ...

... P54-$1. An appreciation of the peso is a rise in the value relative to the dollar, i.e., from P52-$1 to P50-$1. From the example above, one can conclude that an appreciation (depreciation) of the peso makes imported products cheaper (more expensive) in the Philippines. Conversely, a depreciation fav ...

Exam 3 with answers

... B) Equals trade-weighted sum of all bilateral real exchange rate % changes C) Equals the % change in import and export price ratios D) None of the above 14. The “Home bias” in equities A) Relates to the observation that countries hold much larger shares of their home equities in their asset portfoli ...

... B) Equals trade-weighted sum of all bilateral real exchange rate % changes C) Equals the % change in import and export price ratios D) None of the above 14. The “Home bias” in equities A) Relates to the observation that countries hold much larger shares of their home equities in their asset portfoli ...

Contents of the course - Solvay Brussels School

... should undertake a deflationary policy. Problem : prices and wages are sticky. A surplus country (too many exports - too high domestic currency) : should reflate. Problem : less pressure for adjustment. Tempted to build up their reserve of foreign currencies (selling domestic currencies) and steril ...

... should undertake a deflationary policy. Problem : prices and wages are sticky. A surplus country (too many exports - too high domestic currency) : should reflate. Problem : less pressure for adjustment. Tempted to build up their reserve of foreign currencies (selling domestic currencies) and steril ...

Contents of the course - Solvay Brussels School of

... Pre-World War I : « classical gold standard » Inter-War period : « managed gold standard » Not worked as in theory : currencies more considered as international money; manipulation of interest rates by central banks, sterilisation policies ; positive correlation of prices and wages accross countr ...

... Pre-World War I : « classical gold standard » Inter-War period : « managed gold standard » Not worked as in theory : currencies more considered as international money; manipulation of interest rates by central banks, sterilisation policies ; positive correlation of prices and wages accross countr ...

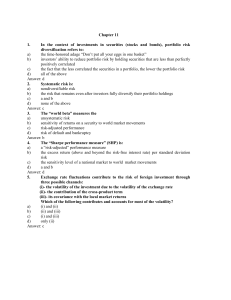

TEST BANK

... The realized dollar returns for a U.S. resident investing in a foreign market will depend on the return in the foreign market as well as on the exchange rate fluctuations between the dollar and the foreign currency. Calculate the variance of the monthly rate of return in dollar terms, if the varianc ...

... The realized dollar returns for a U.S. resident investing in a foreign market will depend on the return in the foreign market as well as on the exchange rate fluctuations between the dollar and the foreign currency. Calculate the variance of the monthly rate of return in dollar terms, if the varianc ...

Deutsche Bank’s View of the US Economy and the Fed

... heavily in fx reserves to channel domestic saving through ...

... heavily in fx reserves to channel domestic saving through ...