ECN 104 sec003 Notes Foreign Exchange Market –A market in

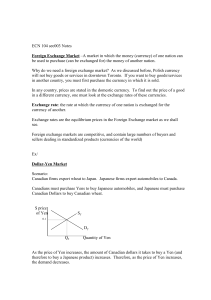

... Foreign Exchange Market –A market in which the money (currency) of one nation can be used to purchase (can be exchanged for) the money of another nation. Why do we need a foreign exchange market? As we discussed before, Polish currency will not buy goods or services in downtown Toronto. If you want ...

... Foreign Exchange Market –A market in which the money (currency) of one nation can be used to purchase (can be exchanged for) the money of another nation. Why do we need a foreign exchange market? As we discussed before, Polish currency will not buy goods or services in downtown Toronto. If you want ...

Gold In A `Sweet Spot` As Central Banks Pursue Aggressive Easing

... Although the Fed is on the sidelines for now, Stoeferle said that there is a paradigm shift in Europe after the European Central Bank (ECB) President Mario Draghi “over-delivered” at the January monetary policy meeting and introduced a €60 billion monthly asset-purchase program. Unlike the Fed, the ...

... Although the Fed is on the sidelines for now, Stoeferle said that there is a paradigm shift in Europe after the European Central Bank (ECB) President Mario Draghi “over-delivered” at the January monetary policy meeting and introduced a €60 billion monthly asset-purchase program. Unlike the Fed, the ...

Exchange Rate Regimes

... • Suppose the foreign interest rate increases. – The expression above shows that the home country’s central bank must decrease its money supply. Why? – If the i* > i, then investors will seek out foreign deposits, causing an excess demand for foreign exchange – CB has to sell foreign exchange to pre ...

... • Suppose the foreign interest rate increases. – The expression above shows that the home country’s central bank must decrease its money supply. Why? – If the i* > i, then investors will seek out foreign deposits, causing an excess demand for foreign exchange – CB has to sell foreign exchange to pre ...

International Markets

... • Some forward-forward swaps are also being used (both transactions are forward) • Frequently used between banks (including Central Banks) • Consider two banks: Citibank (US) and Lloyds (UK) – If Citibank needs pounds, it can agree to exchange dollars for pounds with Lloyds today and also agree to a ...

... • Some forward-forward swaps are also being used (both transactions are forward) • Frequently used between banks (including Central Banks) • Consider two banks: Citibank (US) and Lloyds (UK) – If Citibank needs pounds, it can agree to exchange dollars for pounds with Lloyds today and also agree to a ...

Open-Economy Macroeconomics

... rates. Purchasing-power parity is a theory of exchange rates whereby a unit of any given currency should be able to buy the same quantity of goods in all countries. According to the purchasing-power parity theory, a unit of any given currency should be able to buy the same quantity of goods in a ...

... rates. Purchasing-power parity is a theory of exchange rates whereby a unit of any given currency should be able to buy the same quantity of goods in all countries. According to the purchasing-power parity theory, a unit of any given currency should be able to buy the same quantity of goods in a ...

Document

... – CB should reinforce the decline in the money supply by increasing the interest rate (i) – i is the rediscount rate. The rate at which a central bank exchanges cash for securities. – This can also be done with open market operations – When i increases two things should happen 1. Y & PL ↓ → IM ↓ & E ...

... – CB should reinforce the decline in the money supply by increasing the interest rate (i) – i is the rediscount rate. The rate at which a central bank exchanges cash for securities. – This can also be done with open market operations – When i increases two things should happen 1. Y & PL ↓ → IM ↓ & E ...

4.Flexible vs Fixed Exchange Rate Systems

... Result: Monetary policy is effective in the short run while fiscal policy is not effective. ...

... Result: Monetary policy is effective in the short run while fiscal policy is not effective. ...

Foreign exchange rate

... • S-I has moved in the opposite direction of (T-G) • No strong relationship between NX and the other two balances individually. ...

... • S-I has moved in the opposite direction of (T-G) • No strong relationship between NX and the other two balances individually. ...

here

... transactions. B) have a reserve of foreign currency, which it can print. C) allow the money supply to adjust to whatever level will ensure that the equilibrium exchange rate equals the announced exchange rate. D) follow a rule specifying a constant growth rate for the money supply. 15. Compared to a ...

... transactions. B) have a reserve of foreign currency, which it can print. C) allow the money supply to adjust to whatever level will ensure that the equilibrium exchange rate equals the announced exchange rate. D) follow a rule specifying a constant growth rate for the money supply. 15. Compared to a ...

Econ 371: Answer Key to Problem Set 4 (Chapter 16-17)

... 3. (2 points) Describe the effects of an unexpected devaluation of a currency on the central bank’s balance sheet, output and the balance of payments account. ANSWER: The immediate effect of an unexpected devaluation is that it raises foreign demand for the domestic goods, and reduces domestic deman ...

... 3. (2 points) Describe the effects of an unexpected devaluation of a currency on the central bank’s balance sheet, output and the balance of payments account. ANSWER: The immediate effect of an unexpected devaluation is that it raises foreign demand for the domestic goods, and reduces domestic deman ...

Contents of the course - Solvay Brussels School of

... let the FX rate depreciate and restore competitiveness, leading to a rise in X and a reduction in M (if FX rates are floating) reduce the stock of money by direct intervention : buy domestic currencies against foreign currencies held in monetary reserves (if FX rates are fixed) reduce the stock o ...

... let the FX rate depreciate and restore competitiveness, leading to a rise in X and a reduction in M (if FX rates are floating) reduce the stock of money by direct intervention : buy domestic currencies against foreign currencies held in monetary reserves (if FX rates are fixed) reduce the stock o ...

Answers - University of California, Berkeley

... foreign investors into buying US assets) or depreciation of the dollar. Question 4 (a) Since Italy effectively had to maintain a fixed exchange rate with the DM, its monetary policy had to be dedicated to this aim only and thus could not be used for output stabilization. Therefore, Italy had only th ...

... foreign investors into buying US assets) or depreciation of the dollar. Question 4 (a) Since Italy effectively had to maintain a fixed exchange rate with the DM, its monetary policy had to be dedicated to this aim only and thus could not be used for output stabilization. Therefore, Italy had only th ...

Nature of Money

... System, but not principles, brought to an end in 1971 when US went off gold standard ...

... System, but not principles, brought to an end in 1971 when US went off gold standard ...

the international monetary and financial environment

... ■ Each nation’s currency floats independently, according to market forces without government intervention. ■ Examples- Canadian dollar, the British pound, the euro, the U.S. dollar, and the Japanese yen—float independently on world exchange markets- exchange rates are determined daily by supply and ...

... ■ Each nation’s currency floats independently, according to market forces without government intervention. ■ Examples- Canadian dollar, the British pound, the euro, the U.S. dollar, and the Japanese yen—float independently on world exchange markets- exchange rates are determined daily by supply and ...

PART I: PARSIFAL SCHEDULING

... works best at improving a country’s trade balance when demand elasticities are high (i.e., the sum of the domestic demand elasticity for imports plus the foreign demand elasticity for exports exceeds one). Empirical studies suggest that demand elasticities for most countries are quite high. 4. The J ...

... works best at improving a country’s trade balance when demand elasticities are high (i.e., the sum of the domestic demand elasticity for imports plus the foreign demand elasticity for exports exceeds one). Empirical studies suggest that demand elasticities for most countries are quite high. 4. The J ...

Bretton Woods System - Wharton Finance Department

... will be accompanied by a net flow of gold from France to Great Britain. • This flow of gold will lead to a lower price level in France and, at the same time, a higher price level in ...

... will be accompanied by a net flow of gold from France to Great Britain. • This flow of gold will lead to a lower price level in France and, at the same time, a higher price level in ...

28. Exchange Rates.#F1545B

... things changed. Europe and Japan rebuilt their productive capacities. Germany had an “economic miracle.” We were investing abroad and also demanding more and more foreign imports. The new situation looked like this. There was now an excess of dollars supplied in relation to the demand for dollars at ...

... things changed. Europe and Japan rebuilt their productive capacities. Germany had an “economic miracle.” We were investing abroad and also demanding more and more foreign imports. The new situation looked like this. There was now an excess of dollars supplied in relation to the demand for dollars at ...

Globalization and the Washington Consensus

... – By 1880 most countries were on the gold standard – Achieves balance of trade equilibrium for all countries (value of exports equals value of imports); flow of gold was used to make up differences – Abandoned in 1914; attempt to resume after WWI failed with Great Depression ...

... – By 1880 most countries were on the gold standard – Achieves balance of trade equilibrium for all countries (value of exports equals value of imports); flow of gold was used to make up differences – Abandoned in 1914; attempt to resume after WWI failed with Great Depression ...

Gordon Chapter 6 International Trade, Exchange Rates, and

... How can a higher demand for a country’s assets that leads to an “asset bubble” eventually cause foreigners to run for the exits by withdrawing their funds and converting capital inflows to capital outflows? Why can’t central banks reverse the capital outflow through the use of reserves? Why would ce ...

... How can a higher demand for a country’s assets that leads to an “asset bubble” eventually cause foreigners to run for the exits by withdrawing their funds and converting capital inflows to capital outflows? Why can’t central banks reverse the capital outflow through the use of reserves? Why would ce ...

doc Conference 1

... value and ranking over this time period informative? Relative to the range of HDI from top to bottom, these two countries are relatively close. If you were to suggest a unique development policy to each country to improve the HDI ranking for next year, what would ...

... value and ranking over this time period informative? Relative to the range of HDI from top to bottom, these two countries are relatively close. If you were to suggest a unique development policy to each country to improve the HDI ranking for next year, what would ...

INTERNATIONAL FINANCIAL CRISES:

... while the pegged nominal exchange rate was fixed, the real exchange rate appreciated with growing capital inflows. Widening of the current-account deficit typically accompanied an appreciation of the real exchange rate, which made imports cheap and exports expensive. As the current-account deficit m ...

... while the pegged nominal exchange rate was fixed, the real exchange rate appreciated with growing capital inflows. Widening of the current-account deficit typically accompanied an appreciation of the real exchange rate, which made imports cheap and exports expensive. As the current-account deficit m ...

The IMF-World Bank Past, Present, and Future

... significance under the new conditions of increased private capital mobility. ...

... significance under the new conditions of increased private capital mobility. ...