Chapter 13AB PowerPoint

... A currency exchange service exchanges 1 euro for Japanese yen with the buy rate 135.69, and sell rate 132.08. Cedric wishes to exchange 800 Euros for yen. The service buys yen at 135.69 The service sells yen at 132.08 ...

... A currency exchange service exchanges 1 euro for Japanese yen with the buy rate 135.69, and sell rate 132.08. Cedric wishes to exchange 800 Euros for yen. The service buys yen at 135.69 The service sells yen at 132.08 ...

Commission on Currency Exchange

... _______________________________ of that country. We use an _________________________ __________________ to find out how much your money is worth in the foreign currency, and vice versa. Exchange rates are constantly ________________________________, and so are published daily in newspapers, displaye ...

... _______________________________ of that country. We use an _________________________ __________________ to find out how much your money is worth in the foreign currency, and vice versa. Exchange rates are constantly ________________________________, and so are published daily in newspapers, displaye ...

Exchange rate determination

... therefore p increases An increase in p implies a reduction in m/p and an increase in i i higher than i* implies further expected depreciation ,,,e and p will continue to increase until t+3 when m increases At this point i is below i* therefore expected appreciation, the e must be above its long run ...

... therefore p increases An increase in p implies a reduction in m/p and an increase in i i higher than i* implies further expected depreciation ,,,e and p will continue to increase until t+3 when m increases At this point i is below i* therefore expected appreciation, the e must be above its long run ...

CHAPTER 5 INTERNATIONAL Trade and Exchange Rates Chapter

... Canadian currency. In this case, if the U.S. dollar price of one Canadian dollar changes from $0.71 to $0.69, this is a currency depreciation. 4. Under a system of fixed exchange rates, a devaluation of the currency takes place when the price at which foreign currencies can be bought is increased by ...

... Canadian currency. In this case, if the U.S. dollar price of one Canadian dollar changes from $0.71 to $0.69, this is a currency depreciation. 4. Under a system of fixed exchange rates, a devaluation of the currency takes place when the price at which foreign currencies can be bought is increased by ...

Slides - James Ashley Morrison

... Across history, nations have chosen a wide variety of materials to serve as money. The ancient Greeks used cattle, some Native Americans used wampum, and the early Chinese used cowry shells. Today, most countries use “paper” currency, which is usually made from cotton and/or linen. ...

... Across history, nations have chosen a wide variety of materials to serve as money. The ancient Greeks used cattle, some Native Americans used wampum, and the early Chinese used cowry shells. Today, most countries use “paper” currency, which is usually made from cotton and/or linen. ...

RMB revaluation will serve China`s self

... pegged regime, risks inviting more, not less, hot money inflows into China, thus exacerbating the very macro imbalances that a flexible exchange rate is supposed to solve. A one-time maxi revaluation would take speculative pressures out of the currency all at once, avoiding the risk of inviting a hu ...

... pegged regime, risks inviting more, not less, hot money inflows into China, thus exacerbating the very macro imbalances that a flexible exchange rate is supposed to solve. A one-time maxi revaluation would take speculative pressures out of the currency all at once, avoiding the risk of inviting a hu ...

PRICE AND INCOME EFFECTS OF DEVALUATION

... well from 1870 until the WW1. During the war government financed military expenses by printing money, however, this inevitably led to inflation; and, by the end of the war, price levels were very high everywhere. In an effort to encourage exports and domestic employment, countries started to frequen ...

... well from 1870 until the WW1. During the war government financed military expenses by printing money, however, this inevitably led to inflation; and, by the end of the war, price levels were very high everywhere. In an effort to encourage exports and domestic employment, countries started to frequen ...

Lecture 3

... foreign exchange quotations in one of two ways: the foreign currency price of one dollar, or the dollar price of a unit of foreign currency. ...

... foreign exchange quotations in one of two ways: the foreign currency price of one dollar, or the dollar price of a unit of foreign currency. ...

Linear Regression 1

... absolutely required in order to have a global economy? – 1. Inexpensive transportation & communication – 2. International financial (money) system – 3. Countries that are willing to participate • Removal of legal or regulatory “barriers” ...

... absolutely required in order to have a global economy? – 1. Inexpensive transportation & communication – 2. International financial (money) system – 3. Countries that are willing to participate • Removal of legal or regulatory “barriers” ...

4. What is the Triffin Paradox? Explain.

... Effectively, the EMU means the elimination of sovereignty in monetary matters for member states. To complement the EMU, the heads of state of the EU adopted the Stability and Growth Pact. Essentially, the Pact consists of regulations and financial penalties to ensure budget discipline. The European ...

... Effectively, the EMU means the elimination of sovereignty in monetary matters for member states. To complement the EMU, the heads of state of the EU adopted the Stability and Growth Pact. Essentially, the Pact consists of regulations and financial penalties to ensure budget discipline. The European ...

Chapter 16

... Foreign transactions must be converted into U.S. dollars, even if the receipt or payment was in a foreign currency, to include the transaction in the financial statements. Whenever a transaction involving borrowing or lending occurs between companies using two different currencies, the possibility e ...

... Foreign transactions must be converted into U.S. dollars, even if the receipt or payment was in a foreign currency, to include the transaction in the financial statements. Whenever a transaction involving borrowing or lending occurs between companies using two different currencies, the possibility e ...

Exchange Rate Regimes

... issuing authority to ensure the fulfillment of its legal obligation. E.g. Hong Kong fixes its exchange rate with the U.S. Domestic currency is issued only against foreign exchange and remains fully backed by foreign assets. Eliminates traditional central bank functions such as monetary control and l ...

... issuing authority to ensure the fulfillment of its legal obligation. E.g. Hong Kong fixes its exchange rate with the U.S. Domestic currency is issued only against foreign exchange and remains fully backed by foreign assets. Eliminates traditional central bank functions such as monetary control and l ...

Chapter 10 File

... Capital account Net changes in a nation’s international financial assets and liabilities; credit entry occurs when residents sell stocks, bonds, or other financial assets to nonresidents. Money flows to resident, while resident’s LT international liabilities (debit entry) increase. a. Direct invest ...

... Capital account Net changes in a nation’s international financial assets and liabilities; credit entry occurs when residents sell stocks, bonds, or other financial assets to nonresidents. Money flows to resident, while resident’s LT international liabilities (debit entry) increase. a. Direct invest ...

fixed exchange rate - McGraw Hill Higher Education

... discuss the advantages and disadvantages of each system 3. Define the real exchange rate and show how it is related to the prices of goods across pairs of countries 4. Understand the law of one price and apply the purchasing power parity theory of exchange rates to long-run equilibrium exchange rate ...

... discuss the advantages and disadvantages of each system 3. Define the real exchange rate and show how it is related to the prices of goods across pairs of countries 4. Understand the law of one price and apply the purchasing power parity theory of exchange rates to long-run equilibrium exchange rate ...

One Market, One Money? Well, Maybe . . . Sometimes

... competitive advantages through a policy of devaluation and wageprice controls. But for all that, the more transborder trade in goods, services, and capital takes place, the greater are the transactions costs and the exchange rate risks to which agents are exposed. Absent the political institutions t ...

... competitive advantages through a policy of devaluation and wageprice controls. But for all that, the more transborder trade in goods, services, and capital takes place, the greater are the transactions costs and the exchange rate risks to which agents are exposed. Absent the political institutions t ...

3.1.4 Loss of competitiveness arising from exchange rate policies

... 3.1.4 Loss of competitiveness arising from exchange rate policies In addition to the factors above, the exchange rate regime adopted by most of the afflicted countries was seen by some as having played a crucial role in the emergence of the crisis in East Asia. Many countries in the region appear to ...

... 3.1.4 Loss of competitiveness arising from exchange rate policies In addition to the factors above, the exchange rate regime adopted by most of the afflicted countries was seen by some as having played a crucial role in the emergence of the crisis in East Asia. Many countries in the region appear to ...

Distinguished Lecture on Economics in Government Exchange rate

... • In the case of shocks, economy can adjust via a change either in exchange rates or domestic prices and wages. The nominal exchange rate adjustment is typically much quicker • Argentina in 2000, currency board arrangements prevented the nominal exchange rate from moving • For a country with a histo ...

... • In the case of shocks, economy can adjust via a change either in exchange rates or domestic prices and wages. The nominal exchange rate adjustment is typically much quicker • Argentina in 2000, currency board arrangements prevented the nominal exchange rate from moving • For a country with a histo ...

Trade and the Exchange Rate

... Our goods are now relatively more expensive therefore we lose our international competitiveness. Australia will demand less of our goods and more of another countries. ...

... Our goods are now relatively more expensive therefore we lose our international competitiveness. Australia will demand less of our goods and more of another countries. ...

Trade and the Exchange Rate

... Our goods are now relatively more expensive therefore we lose our international competitiveness. Australia will demand less of our goods and more of another countries. ...

... Our goods are now relatively more expensive therefore we lose our international competitiveness. Australia will demand less of our goods and more of another countries. ...

The Euro by Carlos Rios

... Bond yield <2% of 3 lowest countries Exchange rate must remain in normal fluctuation bands for the two previous years ...

... Bond yield <2% of 3 lowest countries Exchange rate must remain in normal fluctuation bands for the two previous years ...

higher grade economics - Bannerman High School

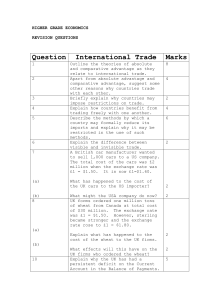

... and comparative advantage as they relate to international trade. Apart from absolute advantage and comparative advantage, suggest some other reasons why countries trade with each other. Briefly explain why countries may impose restrictions on trade. Explain how countries benefit from trading freely ...

... and comparative advantage as they relate to international trade. Apart from absolute advantage and comparative advantage, suggest some other reasons why countries trade with each other. Briefly explain why countries may impose restrictions on trade. Explain how countries benefit from trading freely ...