China

... Flexibility does not necessarily mean a free float. Initially, China could allow the yuan to move within a wider band, or peg it to a basket of currencies rather than the dollar alone. The authors first knock on the head the notion that the banking system must be cleaned up before allowing the exch ...

... Flexibility does not necessarily mean a free float. Initially, China could allow the yuan to move within a wider band, or peg it to a basket of currencies rather than the dollar alone. The authors first knock on the head the notion that the banking system must be cleaned up before allowing the exch ...

Monetary Policy

... • Equation: MV ≡ PT (or PQ or PY or Nominal GDP) SO will an increase in M increase in P? YES if………………………………………………… MONETARIST view : Money is so “dangerous” that central bank should only allow it to grow at…………………………………………….. ...

... • Equation: MV ≡ PT (or PQ or PY or Nominal GDP) SO will an increase in M increase in P? YES if………………………………………………… MONETARIST view : Money is so “dangerous” that central bank should only allow it to grow at…………………………………………….. ...

Currencies: Should There Be Five or One Hundred and Five?

... move freely across borders, so countries could control both exchange rates and interest rates. Under the influence of economist John Maynard Keynes, monetary policy was thought of as an instrument to dampen cyclical booms and recessions. It was monetary policy as speed control: Interest rates were i ...

... move freely across borders, so countries could control both exchange rates and interest rates. Under the influence of economist John Maynard Keynes, monetary policy was thought of as an instrument to dampen cyclical booms and recessions. It was monetary policy as speed control: Interest rates were i ...

download... - Stewart Financial

... Until the outbreak of the First World War, the values of most major currencies (Canadian, US and Britain for example) were fixed to the price of gold; at any time, paper money could be exchanged for bullion. The exchange rate between currencies under this system was limited to how profitably someone ...

... Until the outbreak of the First World War, the values of most major currencies (Canadian, US and Britain for example) were fixed to the price of gold; at any time, paper money could be exchanged for bullion. The exchange rate between currencies under this system was limited to how profitably someone ...

Chapter 1

... assets The concept of equilibrium Basic supply and demand to explain behavior in financial markets The search for profits An approach to financial structure based on transaction costs and asymmetric ...

... assets The concept of equilibrium Basic supply and demand to explain behavior in financial markets The search for profits An approach to financial structure based on transaction costs and asymmetric ...

Exchange Rates in small open economies

... Reduces transaction costs and exchange rate risks in substantial proportion of economy. Stabilises domestic prices—which react rapidly to nominal exchange rate changes. ...

... Reduces transaction costs and exchange rate risks in substantial proportion of economy. Stabilises domestic prices—which react rapidly to nominal exchange rate changes. ...

M16_KRUG8283_08_IM_C16

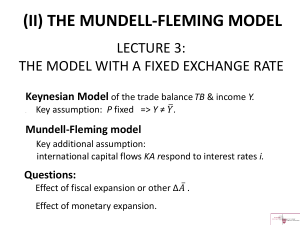

... output determination in an open economy. The model presented is similar in spirit to the classic MundellFleming model, but the discussion goes beyond the standard presentation in its contrast of the effects of temporary versus permanent policies. The distinction between temporary and permanent polic ...

... output determination in an open economy. The model presented is similar in spirit to the classic MundellFleming model, but the discussion goes beyond the standard presentation in its contrast of the effects of temporary versus permanent policies. The distinction between temporary and permanent polic ...

UGBA 178: Introduction to International Business

... The International Fisher Effect states that for any two countries the spot exchange rate should change in an equal amount but in the opposite direction to the difference in nominal interest rates between two countries. In other words: (S1 - S2) / S2 x 100 = i $ - i ¥ ...

... The International Fisher Effect states that for any two countries the spot exchange rate should change in an equal amount but in the opposite direction to the difference in nominal interest rates between two countries. In other words: (S1 - S2) / S2 x 100 = i $ - i ¥ ...

exam review wk 7

... – Stocks of foreign currency (usually U.S. dollars or euros) that they can use to buy their own currency to support its price ...

... – Stocks of foreign currency (usually U.S. dollars or euros) that they can use to buy their own currency to support its price ...

Document in Word format

... ever, heard of a currency crisis in the largest and the smallest monetary systems. For the smallest monetary systems, even in the unlikely event that they have a sophisticated financial infrastructure, there is often a lack of liquidity in financial markets for them to be of significant interest to ...

... ever, heard of a currency crisis in the largest and the smallest monetary systems. For the smallest monetary systems, even in the unlikely event that they have a sophisticated financial infrastructure, there is often a lack of liquidity in financial markets for them to be of significant interest to ...

solution

... output and appreciating the currency. Since the central bank cannot allow exchange rates to change, it must increase the money supply, an action depicted in the diagram as an outward shift in the AA schedule. Corresponding to this monetary expansion is a balance of payments surplus and an equal incr ...

... output and appreciating the currency. Since the central bank cannot allow exchange rates to change, it must increase the money supply, an action depicted in the diagram as an outward shift in the AA schedule. Corresponding to this monetary expansion is a balance of payments surplus and an equal incr ...

Source

... To examine how financial markets such as bond, stock and foreign exchange markets work ...

... To examine how financial markets such as bond, stock and foreign exchange markets work ...

The International Use of Currencies: The U.S. Dollar and the Euro

... lead to a gradual increase in the euro’s use as a unit of account in the denomination of trade flows, particularly in transactions between the euro area and developing and transition countries. Moreover, if all 15 EU countries eventually join the euro area, then more than 60 percent of their current ...

... lead to a gradual increase in the euro’s use as a unit of account in the denomination of trade flows, particularly in transactions between the euro area and developing and transition countries. Moreover, if all 15 EU countries eventually join the euro area, then more than 60 percent of their current ...

The Case for Exchange Rate Flexibility: The Chilean Experience

... • The real exchange rate has fluctuated according to international environment and domestic policies has not been able to change this trend. • During the 90s the most appreciated real exchange rate occurred in the presence of a managed exchange rate and capital controls. ...

... • The real exchange rate has fluctuated according to international environment and domestic policies has not been able to change this trend. • During the 90s the most appreciated real exchange rate occurred in the presence of a managed exchange rate and capital controls. ...

Currency Crisis Models - Kellogg School of Management

... 1996). This maximization problem dictates if and when the government will abandon the fixed exchange rate regime. Second-generation models generally exhibit multiple equilibria so that speculative attacks can occur because of self-fulfilling expectations. In Obstfeld’s models (1994; 1996) the centra ...

... 1996). This maximization problem dictates if and when the government will abandon the fixed exchange rate regime. Second-generation models generally exhibit multiple equilibria so that speculative attacks can occur because of self-fulfilling expectations. In Obstfeld’s models (1994; 1996) the centra ...

Answers to Textbook Problems

... output and appreciating the currency. Since the central bank cannot allow exchange rates to change, it must increase the money supply, an action depicted in the diagram as an outward shift in the AA schedule. Corresponding to this monetary expansion is a balance of payments surplus and an equal incr ...

... output and appreciating the currency. Since the central bank cannot allow exchange rates to change, it must increase the money supply, an action depicted in the diagram as an outward shift in the AA schedule. Corresponding to this monetary expansion is a balance of payments surplus and an equal incr ...

Trade, Exchange Rates, and Public Policy

... constraints even though it continues to use its own pound sterling instead of the euro. When asked about these statements, finance ministers and central bankers in Denmark and Sweden indicate that they, too, will seek to restrain government spending and hold back on tax cuts. In addition, they state ...

... constraints even though it continues to use its own pound sterling instead of the euro. When asked about these statements, finance ministers and central bankers in Denmark and Sweden indicate that they, too, will seek to restrain government spending and hold back on tax cuts. In addition, they state ...

Problem_Set8 - Homework Minutes

... In the 3-sector model, analyzing the effect of an economic shock is most complex in the Foreign Exchange sector because 3 variables must be analyzed separately and then sometimes jointly. A change in the RDGP primarily affects imports whereas a change in PI mostly affects exports. A change in R infl ...

... In the 3-sector model, analyzing the effect of an economic shock is most complex in the Foreign Exchange sector because 3 variables must be analyzed separately and then sometimes jointly. A change in the RDGP primarily affects imports whereas a change in PI mostly affects exports. A change in R infl ...

Global Economy and the Future of Capitalism File

... The Shadow of the Great Depression 44 states allied against the Axis powers met in Bretton Woods in 1944. Their purpose was to devise new rules and institutions to govern international trade and monetary relations after the fighting ended. The US played the leading role. Its proposals shaped by t ...

... The Shadow of the Great Depression 44 states allied against the Axis powers met in Bretton Woods in 1944. Their purpose was to devise new rules and institutions to govern international trade and monetary relations after the fighting ended. The US played the leading role. Its proposals shaped by t ...

14.02 Principles of Macroeconomics Problem Set 6 Fall 2005 ***Solutions***

... NX = NX (Y , Y *, E ) . An expansionary monetary policy leads to an increase in output Y and a depreciation of E (from the interest parity condition). The first effect decreases next exports, while the second effect increases NX, given that the Marshall-Lerner condition holds. The overall effect is ...

... NX = NX (Y , Y *, E ) . An expansionary monetary policy leads to an increase in output Y and a depreciation of E (from the interest parity condition). The first effect decreases next exports, while the second effect increases NX, given that the Marshall-Lerner condition holds. The overall effect is ...

Exchange Rate Regimes: Issues & Policy Options

... Types of ER regimes Advantages and disadvantages of fixing/floating Choice of ER regime Empirical Evidence on Exchange Regimes ...

... Types of ER regimes Advantages and disadvantages of fixing/floating Choice of ER regime Empirical Evidence on Exchange Regimes ...